Category Archive: 9a.) Real Investment Advice

Understanding the Benefits and Risks of Annuities for Retirement Income

When planning for retirement, securing a reliable income stream is a top priority. Many retirees turn to annuities for retirement income as a way to guarantee financial stability. Guaranteed income strategies help retirees maintain cash flow throughout their lives, reducing the risk of outliving their savings. However, while annuities offer security and predictability, they also …

Read More »

Read More »

A Rare Zweig Breadth Thrust Provides Optimism

The Zweig Breadth Thrust, a rare technical indicator, triggered a bullish signal on Friday. The signal indicates rapid and significant changes in momentum. The calculation is based on the 10-day moving average of the percentage of stocks that were positive on a daily basis. The Zweig Breadth Thrust signal occurs when the moving average rises …

Read More »

Read More »

4-28-25 Focus on What You Can Control

A review of a bell curve of event probabilities places financial armageddon at the extreme end of the scale of events likely to occur. Best to focus energies (and investments) over those area which we can control.

Hosted by RIA Advisors Chief Investment Strategist, lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen...

Read More »

Read More »

4-28-25 Correction Continues: How Risk Management Protects Your Portfolio

The market correction continues, and understanding the value of risk management is more critical than ever. Lance Roberts breaks down why market volatility is a normal part of investing, how risk management strategies protect your portfolio, and practical steps you can take today to stay disciplined. Learn how to navigate downturns, control emotions, and plan for long-term success.

Key Topics:

• Market correction insights

• Importance of managing...

Read More »

Read More »

Banks Are Now Free To Trade Crypto

The Fed removed its handcuffs on banks, allowing them greater flexibility to trade and hold crypto assets. Before Thursday's action, banks were asked to seek advance approval from the regulators before participating in crypto-related activities. Further, the Fed removed guidance that banks exercise caution with crypto due to its volatility, liquidity, and legal uncertainty. The …

Read More »

Read More »

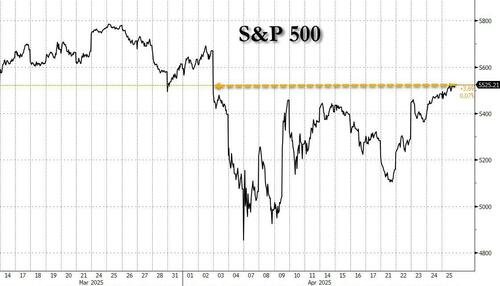

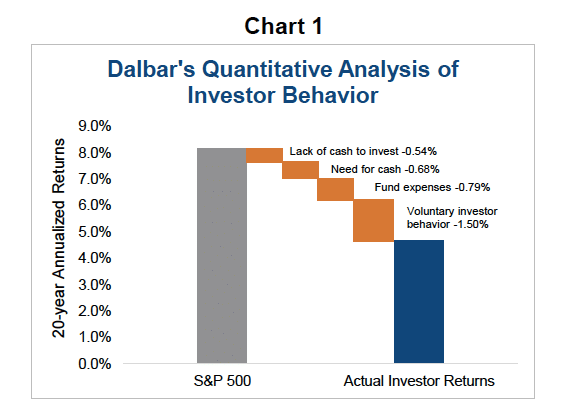

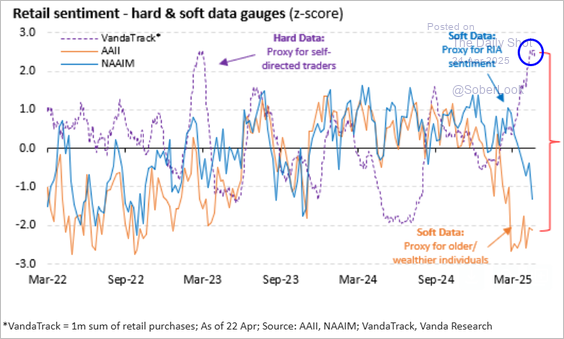

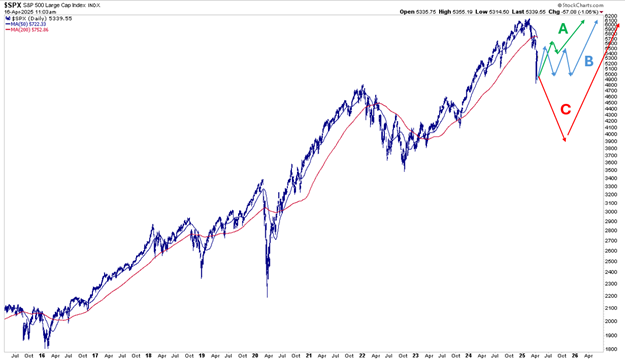

Correction Continues – The Value Of Risk Management

Despite the recent rally, the correction continues. While wanting to "buy the dip" is tempting, there has been enough technical damage to warrant remaining cautious in the near term. As we have discussed, managing risk requires discipline and the emotional ability to navigate more volatile markets until a more straightforward path for risk-taking emerges. The …

Read More »

Read More »

Spock And The Logic Based Approach To Volatility

Inside This Week's Bull Bear Report Market Finds Some Hope Last week, we discussed the issue with the spat between President Trump and the Federal Reserve chairman, Jerome Powell. As noted then: "While the markets await the next Federal Reserve meeting, the uncertainty over monetary policy weighs on markets as much as the uncertainty about tariffs.

Read More »

Read More »

4-25-25 You’re Going to Leave a Legacy

Roth "evangelism" is taking hold across the country as more and more discover the wisdom of converting traditional 401k and IRA's to "Roth's," paying taxes now so that funds accrue tax free.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisor, Jonathan McCarty

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

4-25-25 Wouldn’t You Rather Roth?

Are you contemplating a Roth IRA conversion in 2025?

With potential tax rate increases on the horizon, now might be the optimal time to act. Richard Rosso and Jonathan McCarty delve into:

* The benefits of converting to a Roth IRA before 2026

* Strategies to minimize taxes during conversion

* How Roth conversions can impact your retirement planning

* The role of Roth IRAs in estate planning

Rich and Jonathan explore how a Roth IRA can offer...

Read More »

Read More »

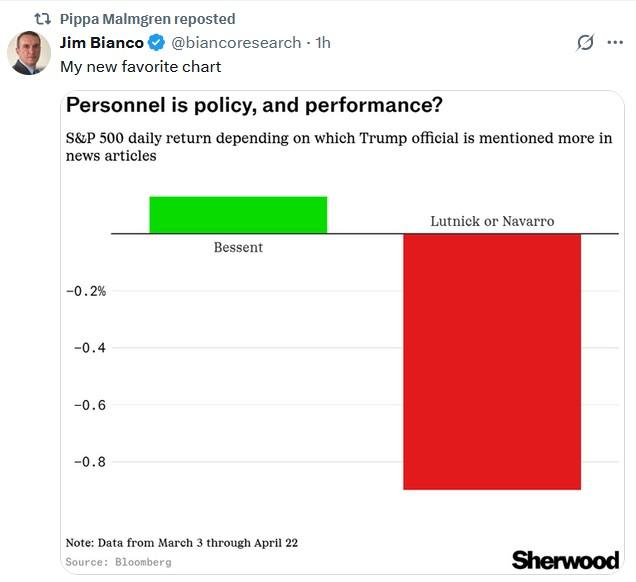

Scott Bessent Affirms The Dollar Is Not Dying

Despite a growing chorus of pundits claiming the "death of the dollar" is imminent, Treasury Secretary Scott Bessent said the dollar will remain the world's reserve currency. The following clip from Bloomberg was based on a speech Scott Bessent gave Thursday morning to the IMF and World Bank: More broadly, the Treasury secretary reinforced backing for the central role of the US and its dollar in the global financial system.

Read More »

Read More »

Speculator Or Investor? 10-Rules From Legendary Investors

Are you a "speculator" or an "investor"? This is an essential question that every individual deploying capital into the financial markets must answer. The reason is that how you answer that question determines how you should behave during market cycles.

Read More »

Read More »

4-24-25 Manage Risk and Volatility rather than manage for Gains

There is no certainty on where we go from here. Don't forget to take profits, don't forget to hold cash so that you can redeploy when prices are lower.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

4-24-25 The Path Ahead: Soar, Stall, Or Plummet?

Will the market soar to new heights, stall in uncertainty, or plummet into correction?

Lance Roberts & Michael Lebowitz break down the key drivers that will shape the economy and stock market in the months ahead. From Federal Reserve policy shifts to earnings forecasts, geopolitical risks to liquidity conditions—this is your investor’s guide to what's next. Whether you're managing a portfolio or planning your financial future, this episode...

Read More »

Read More »

The Powell Relief Rally

Monday's Commentary started: On Truth Social, President Trump stated, “Powell’s Termination Can’t Come Fast Enough!” The stock and bond markets fell as investors feared President Trump might try to remove Powell from his role as the Chairman of the Federal Reserve.

Read More »

Read More »

How to Build an Emergency Fund That Protects Your Retirement Savings

An emergency fund is often associated with working individuals preparing for job loss or unexpected expenses, but it is just as crucial for retirees. Having a dedicated emergency fund for retirees helps cover unforeseen costs without dipping into long-term investments, particularly during market downturns.Protecting retirement savings requires a financial cushion that prevents unnecessary withdrawals from …

Read More »

Read More »

4-23-25 Don’t Focus on Exact Market Lows

Too many investors wait until too late to buy into the market at a specific number or price. You don't need to know the address, so long as you're in the right neighborhood.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

4-23-25 Trump vs. Powell: Should the Fed Chair Be Fired?

On today's show, Lance Roberts & Danny Ratliff dig into the growing tensions between Donald Trump and Fed Chair Jerome Powell. Should Trump fire Powell? What would it mean for interest rates, inflation, and market stability? Join me as we explore the politics behind the Fed, the potential fallout for investors, and what history tells us about presidential pressure on the central bank.

Hosted by RIA Advisors Chief Investment Strategist Lance...

Read More »

Read More »

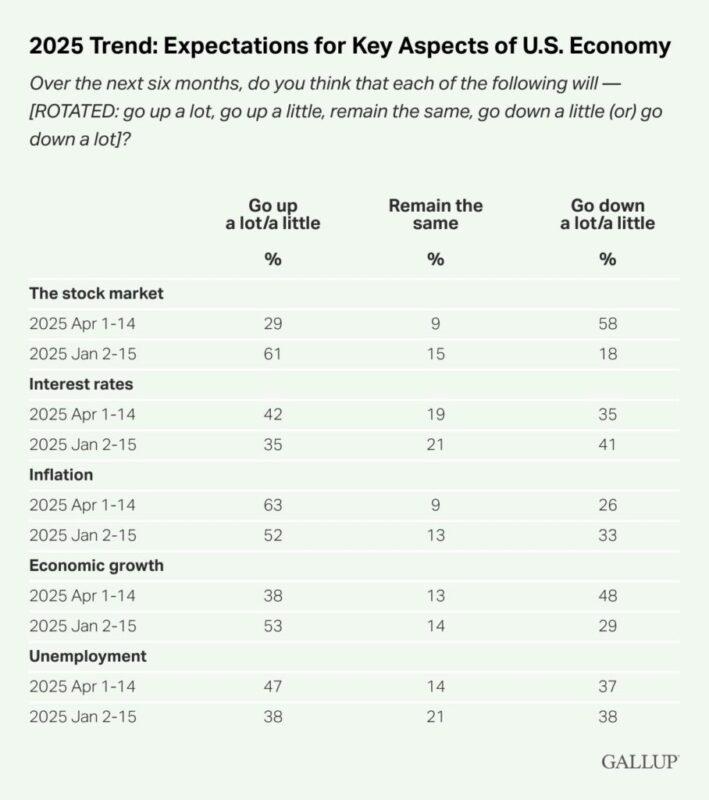

The Path Ahead: Soar, Stall, Or Plummet

We have good and bad news for investors who want to know whether the stock market will soar, stall, or plummet. First, the good news. This article presents the market path for what lies ahead.

Read More »

Read More »

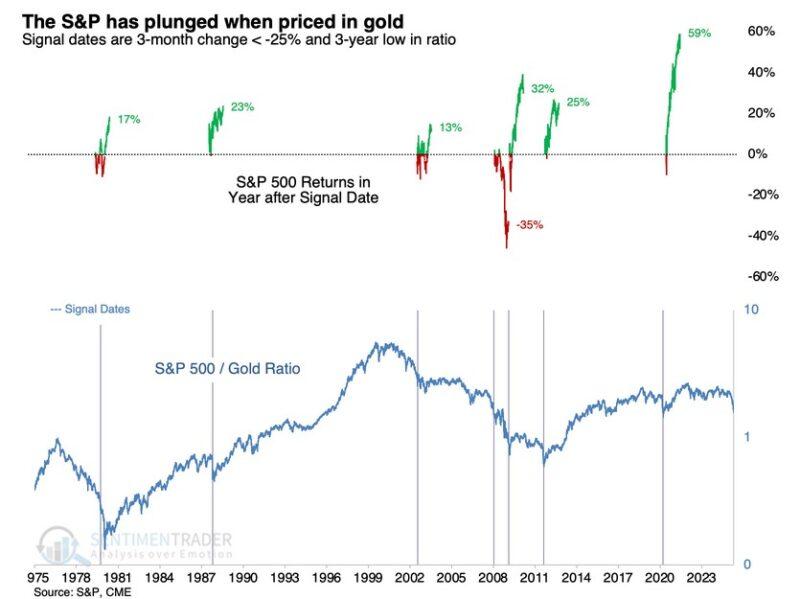

The Gold Stock Relationship

Since the start of the year, the S&P 500 is down over 10% and nearly 20% from its January peak. At the same time, gold is up almost 30%. The stark return differential is excellent news for gold investors, but the clock may be ticking on gold's outperformance versus stocks.

Read More »

Read More »

4-22-25 Know What You Own

Do you know what's in your portfolio? Lance Roberts explains the beauty of mortgage-backed bonds, which most investors do not understand, underscoring the importance of knowing (and understanding) what all are in your holdings.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisor, Jonathan Penn, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube...

Read More »

Read More »