Category Archive: 9a.) Real Investment Advice

Fueling AI Data Centers: Behind The Meter Solutions- Part 1

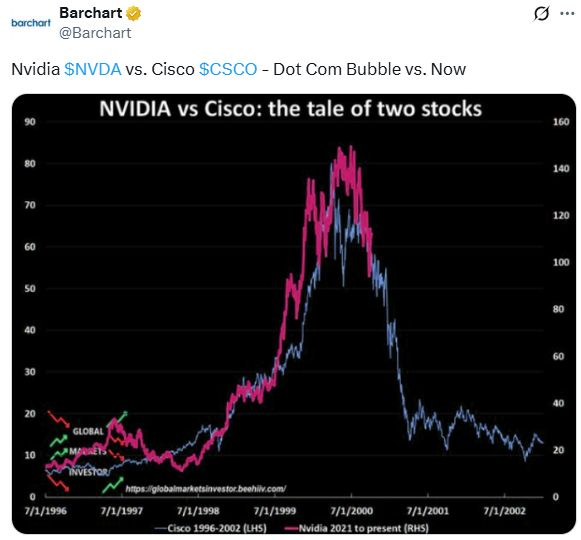

“AI is big business” is a gross understatement. The IEA estimates that “the market capitalization of AI-related firms in the S&P 500 has grown by around USD 12 trillion since 2022.” For perspective, the chart below shows that only the […] The post Fueling AI Data Centers: Behind The Meter Solutions- Part 1 appeared first …

Read More »

Read More »

6-24-25 How Much Risk Do You Think You Can Handle?

Each incremental increase in the rate of return you want from your portfolio requires a geometric increase in risk to achieve.

What do you want your portfolio to do for you?

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

6-24-25 Is WW III Off the Table?

Is the threat of World War III finally off the table?

Lance Roberts breaks down the latest developments in global conflict and what they mean for financial markets. From oil prices and defense stocks to safe-haven assets like gold and Treasuries, we’ll unpack how investors should think about geopolitical risk now. Are markets too complacent—or is the worst truly behind us? Is Apple dead? Lance addresses a YouTube Chatroom query with analysis of...

Read More »

Read More »

The Role of Behavioral Finance in Protecting Your Wealth

Behavioral finance is a powerful lens through which we can better understand the relationship between human psychology and financial decision-making. While numbers and logic drive traditional investing models, real-world choices are often heavily influenced by emotions like fear, greed, and […] The post The Role of Behavioral Finance in Protecting Your Wealth appeared first on …

Read More »

Read More »

Strait Of Hormuz Closure: Why It Hurts Iran Too

Closing the Strait of Hormuz would have severe implications for global trade, most importantly oil. As the graphic below, courtesy of the EIA, shows, about 14 million barrels of oil and condensate flow through the Strait daily. That equates to […] The post Strait Of Hormuz Closure: Why It Hurts Iran Too appeared first on …

Read More »

Read More »

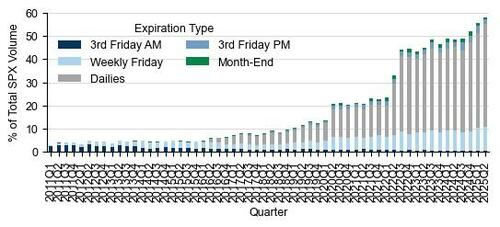

6-23-25 Investing Tactically, Not Emotionally

Lance Roberts shares the process of logical evaluation and portfolio risk management when markets experience turmoil: What matters most to investors? What do these attacks mean for earnings?

How might geopolitics affect EOQ activity?

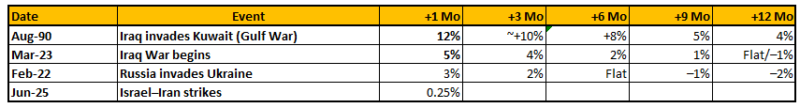

Comparing the Japanese Carry Trade blow up vs the most recent Iran Bombings: There is not the same sense of urgency this time; markets have already moved-on.

How will the Israel-Iran conflict play out?

Likely...

Read More »

Read More »

6-23-25 This, too, Shall Pass

Historically speaking, events such as the bombing of the Iranian nuclear sites tend to be short-lived. This is most likely NOT the start of WW-3, but expect retaliations from Iran, and expect market volatility. But don't over-think it.

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen...

Read More »

Read More »

6-23-25 U.S. Strikes Iran: How to Invest When Geopolitics Explode”

Over the weekend, the U.S. launched strikes against Iran’s nuclear facilities. Of course, for Americans and the financial markets, the response from not only Iran but also Iran’s allies will be critical. Lance Roberts describes a process of logical evaluation and portfolio risk management when markets experience turmoil: What matters most to investors? What do these attacks mean for earnings? How might geopolitics affect EOQ activity? [NOTE: Lance...

Read More »

Read More »

Behind The Meter Solutions: The Gas Powering AI

As the building of AI and cloud data centers expands rapidly, the demand for energy to power these data centers grows. The problem, however, is that the existing power grid can’t keep up with the rapidly increasing demand. Furthermore, improving and expanding the power grid takes longer than building data centers.

Read More »

Read More »

Iran Stuck By U.S.: Markets, Risk, and Rational Investing

Over the weekend, the U.S. launched strikes against Iran's nuclear facilities. Currently, I only have the details reported by major mainstream outlets. However, given that stock market futures are trading sharply lower on Sunday, I wanted to get something in print before the market opens relating to navigating this event over the next few days.

Read More »

Read More »

Oil Price Rise, Not Tariffs, Will Cause CPI To Tick Up

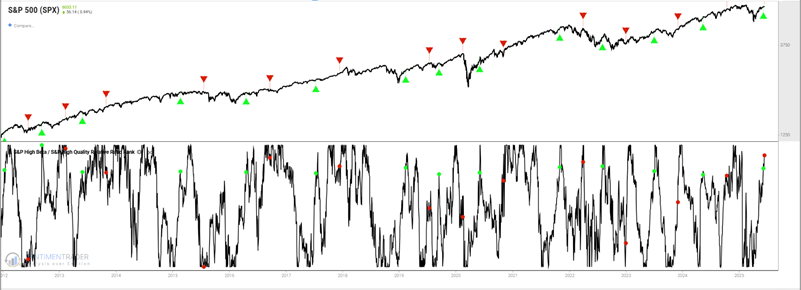

Inside This Week's Bull Bear Report Back To Extreme Optimism Last week, we discussed that the bull rally continues despite all of the negative narratives lately, from tariffs to the deficit to the potential onset of WWIII. "The market's bullish trend continued this week, and it is rapidly approaching all-time highs.

Read More »

Read More »

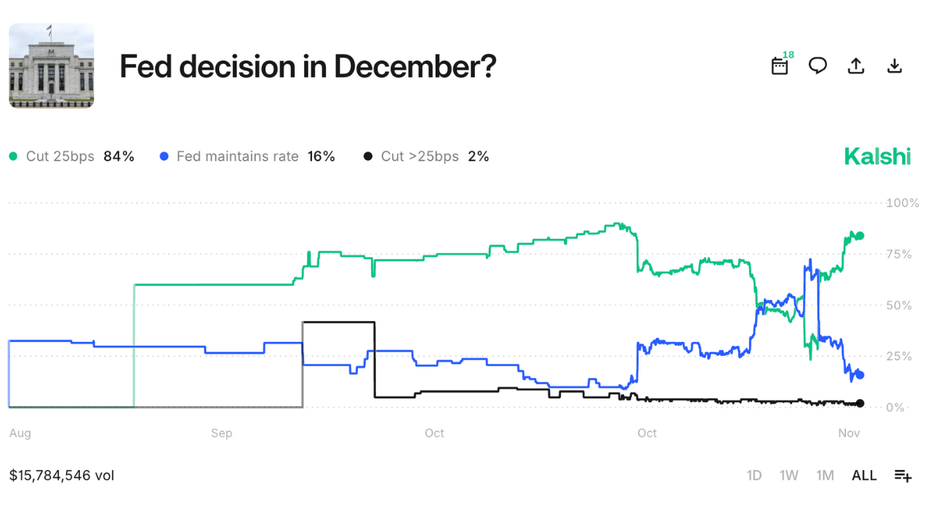

Fed Left Rates Unchanged Amid Elevated Uncertainty

The Fed left rates and the pace of QT unchanged as expected in Wednesday’s meeting. Powell’s opening statement was updated to reflect that uncertainty about the economic outlook has “diminished but remains elevated.” Powell emphasized that the Fed would maintain a data-dependent approach and isn’t in a hurry to cut rates, but left the door …

Read More »

Read More »

The Dollar’s Death Is Greatly Exaggerated

The narrative surrounding the "dollar's death" as the world's reserve currency has been on the rise recently. However, this happens whenever the dollar declines relative to other currencies. We previously wrote about the false claims of the "dollar's death" in 2023 (see here, here, and here). The recent decline in the dollar relative to other currencies is well within historical norms.

Read More »

Read More »

Why High Net Worth Investors Need a Different Wealth Management Strategy

High-net-worth individuals (HNWIs) face financial challenges and opportunities that go far beyond the scope of traditional investment advice. While most investors may focus on growing their nest egg, HNWIs must balance growth with preservation, manage complex tax situations, and prepare for legacy and philanthropic goals.

Read More »

Read More »

6-18-25 $1-Million Doesn’t Go as Far as It Did in 1980

$1-million in 1980 would generate a pretty good income against a comparatively small cost of living back then. Times have changed, ans thanks to inflation and other factors, $1-Million today will not keep up with most Americans' living expenses.

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢...

Read More »

Read More »

6-18-25 Fed Day Preview: Will They or Won’t They?

It’s Fed Day!

Will the Federal Reserve finally cut rates—or kick the can again? Lance Roberts & Danny Ratliff break down what’s at stake, what markets are pricing in, and what it means for your money. Thursday is Juneteenth, markets are closed, and so are we. Lance reviews the track for crude oil prices and the likely effect on inflation as the Iran-Israel conflict continues. What will Jerome Powell say following today's Fed meeting? Fed...

Read More »

Read More »

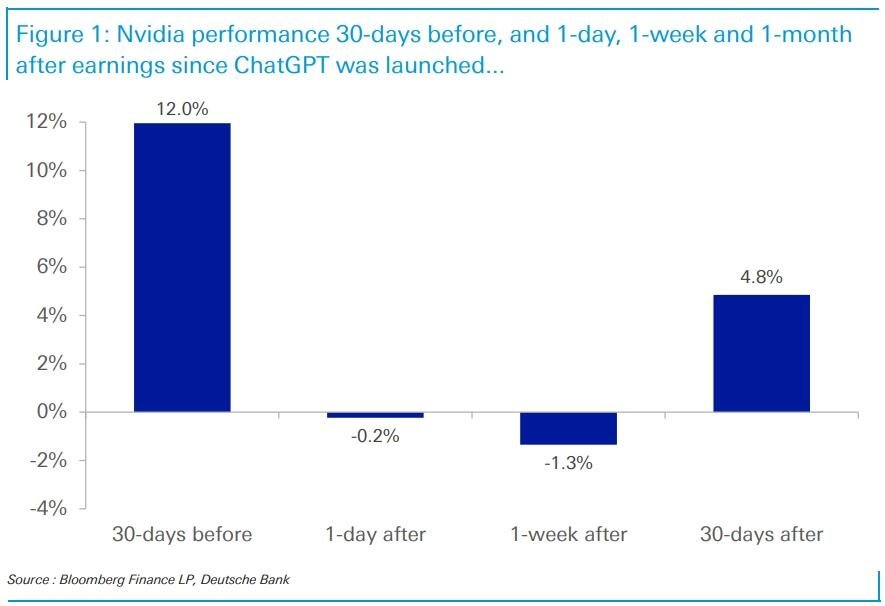

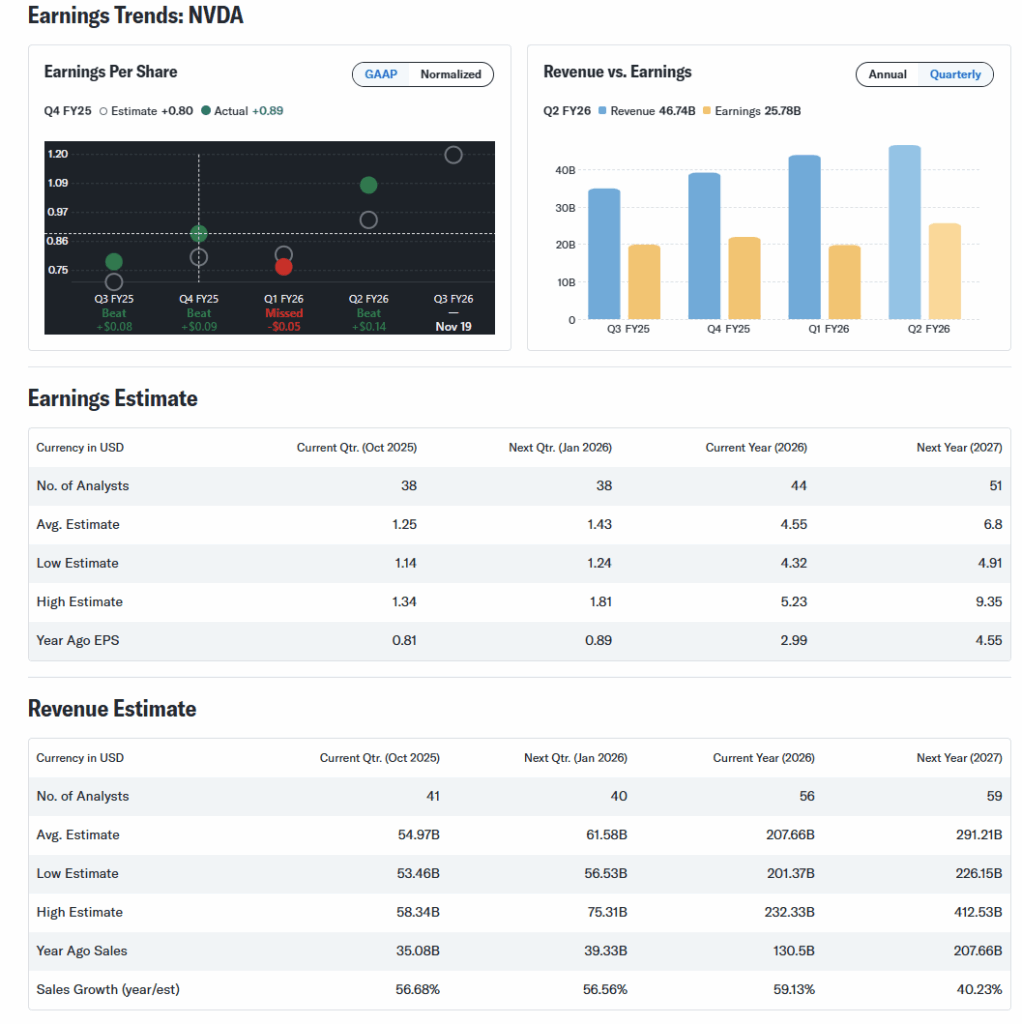

The Tech Bubble Analogy For Nvidia Falls Short

One of the most common parallels for AI stocks’ booming performance is the tech bubble of the 1990s. Both periods were and are being driven by transformative secular developments. On the surface, the remarkable growth, market performance, and high valuations of AI stocks resemble dot-com stocks from the years that created the tech bubble. We’ve …

Read More »

Read More »

6-17-25 Manage Risk & Volatility Rather Than Manage for Gains

A junk bond may pay more, but it's doing so for a reason: There's more risk. Similarly, if you have a company paying a dividend beyond what the 10-year Treasury is paying, there is risk you need to be aware of: What happens in a down market when you've lost 50% and the company cuts its dividend to zero?

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our...

Read More »

Read More »

6-17-25 What’s the Difference Between Fixed Income and “Stable” Income?

What's the difference between fixed income and "stable" income?

Lance Roberts & Jonathan Penn break down the key differences between Dividend Stocks vs fixed income investments like bonds and annuities, and other strategies often labeled as stable income; how each performs in various market environments, the risks you may not see, and what every retiree or income-focused investor should consider. Lance and Jon also address the #1...

Read More »

Read More »

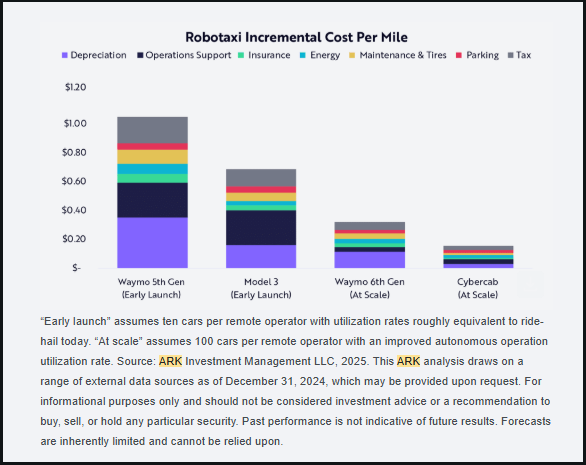

Robotaxi Race: Tesla is Behind the Curve

Tesla’s robotaxi service, tentatively set to launch June 22, 2025, lags behind Waymo’s established operations, which deliver 250,000 weekly rides across multiple U.S. cities. Elon Musk’s cautious approach, driven by safety concerns, has delayed the rollout of Tesla's robotaxi service. However, Tesla’s long-term strategy could position it to overtake competitors. Waymo, backed by Alphabet’s $5 …

Read More »

Read More »