Category Archive: 9a.) Real Investment Advice

8-6-25 The Risks of Over-reliance on Index Funds

"Just buy the VOO (S&P 500) and chill..." is NOT good advice. Investors made NO money on VOO between 1999 and 2013. Outcomes from buying when valuations are low is very different from buying when valuations are at record highs.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:...

Read More »

Read More »

8-6-25 How to Build a Winning Investment Portfolio | What to Buy & What to Avoid in 2025

Are you building an investment portfolio but unsure what assets belong—and which ones to avoid? Lance Roberts & Danny Ratliff demonstrate how to build a diversified portfolio, the critical assets every investor should consider (stocks, bonds, ETFs), and the common portfolio mistakes that could hurt your long-term returns. Whether you're a beginner investor or refining your financial strategy, these portfolio construction tips will help you...

Read More »

Read More »

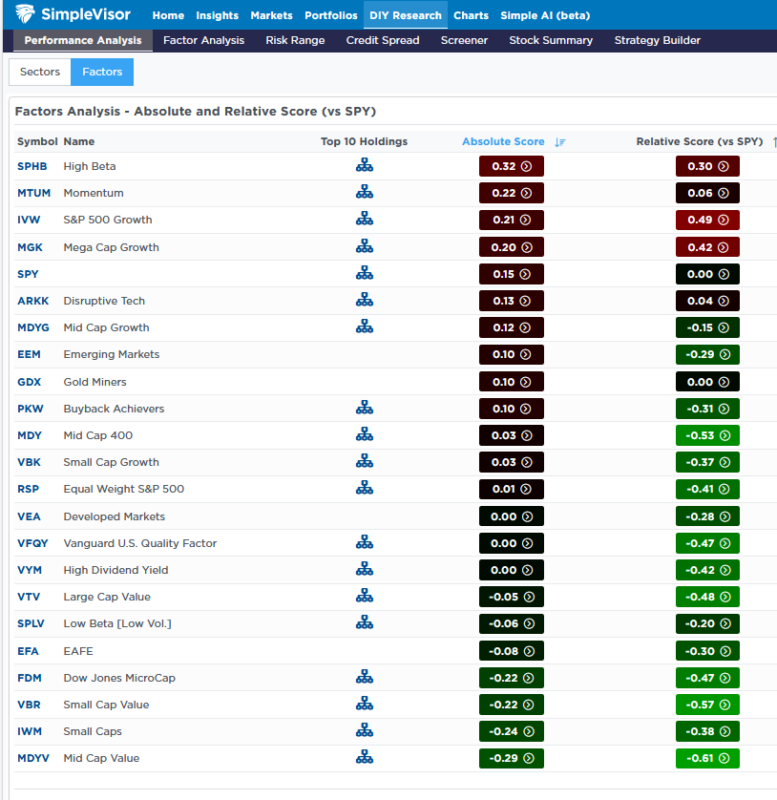

The Low Beta Boom: Sidestepping The Dotcom Bust

Following the release of our article The High Beta Melt Up- Echoes of 1999, we received a few emails complaining that we left our readers hanging. They wanted to know how investors could have shifted their holdings from high beta and momentum stocks to sidestep massive losses when the dot-com bubble burst. In the first …

Read More »

Read More »

Utilities And Industrials Carry The Market

The race to build and power AI data centers is creating an interesting anomaly in the stock market. Despite the S&P 500 being up over 7% on the year, and the higher-beta stocks seemingly leading the way, utilities and industrials are the best-performing sectors. The surging demand for power drives utilities, while industrials benefit from …

Read More »

Read More »

8-5-25 Retirement is Boring

Humans need to DO something. The notion of retirement as sleeping-in, playing video games, doing what ever you want when...it's not healthy, and the guy that created the Financial Independence, Retire Early movement...went back to work.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:...

Read More »

Read More »

8-5-25 Where Do Millennials Get Financial Advice? | Two Dads on Money Talk Smart Money Moves

IIn this episode of Two Dads on Money, Lance Roberts & Jonathan Penn dive into how Millennials find financial advice in today’s digital world. From TikTok influencers to YouTube financial experts, and from Reddit forums to traditional financial planners, where should Millennials really turn for smart money guidance?

Lance reviews Monday's Market action, Eurozone vs U.S. economic growth expectations, and Palantir's earnings report. Millennials...

Read More »

Read More »

How to Use Charitable Giving to Reduce Taxes and Maximize Impact

Charitable giving can be a powerful component of your long-term financial plan. With the right strategy, giving can help you support the causes you care about while simultaneously reducing your tax burden and enhancing your legacy. Whether you’re considering a donor-advised fund, establishing a charitable trust, or exploring private foundations, integrating philanthropy into your broader …

Read More »

Read More »

Palantir Thrives On Trump Presidency

Shares of Palantir rose about 20% the day President Trump was elected president. The stock hasn't looked back, more than tripling since election day. Palantir has been a big winner under the Trump administration. This past weekend, the Washington Post highlighted some of the big government contract wins for Palantir as shown below: Palantir's sales …

Read More »

Read More »

8-4-25 Corrections are Better Opportunities for a Better Price

Market weakness is not a bad thing. We don't like corrections, but corrections are an opportunity to put capital to work at a better price.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube...

Read More »

Read More »

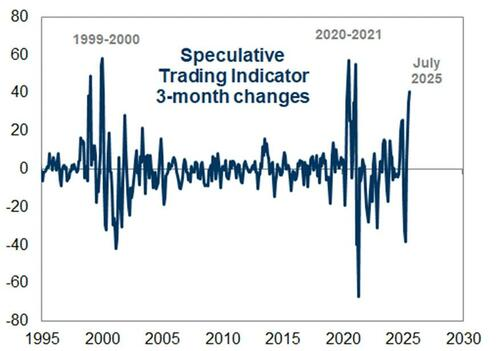

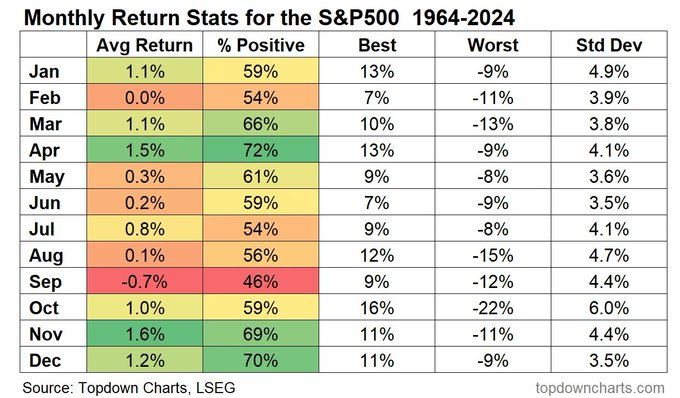

8-4-25 Bull Streak Ends As August Begins

The historic stock market bull streak has finally come to an end as August kicks off, raising concerns about seasonal weakness, rising volatility, and technical breakdowns. Lance Roberts breaks down what triggered the reversal, how meme stock speculation is adding risk, and what the August-September period historically means for investors.

We’ll analyze key technical indicators on the S&P 500, NASDAQ, and Dow Jones, discuss the latest earnings...

Read More »

Read More »

Bull Streak Ends As August Begins

As the turn of the calendar occurred on Friday, the bull streak for the market since the April lows ended. Such was not unexpected, and the correction has been a topic of discussion in our #DailyMarketCommentary over the last two weeks. To wit: "While the overall backdrop remains bullish, including stable economic growth and earnings, …

Read More »

Read More »

Does Trump Have A Valid Point About Rate Cuts?

President Trump has been incessantly pressuring Jerome Powell to cut rates ever since he took office. To wit, check out Trump's latest post on Truth Social below. The Fed cut rates in late 2024 but stopped when Trump took office. Some claim the pause is political. Conversely, the Fed primarily supports its case with fears …

Read More »

Read More »

Analysts Grow Bullish With Earnings Forecasts

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

8-1-25 Don’t Let the Point Spread Fool You

The financial media started in early with headlines about "sweeping" new tariffs and markets tumbling 485-points...only, consider, with the Dow at 43,832, that's only about 1%. So don't let yourself be swayed by sensationalistic headlines.

Hosted by RIA Advisors Senior Financial Advisor, Jonathan Penn, CFP

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's...

Read More »

Read More »

8-1-25 Herd Mentality Could Be Costing You Big

Why do investors so often buy high and sell low? Jonathan Penn & Matt Doyle expose the dangers of herd mentality in the stock market, how FOMO (fear of missing out) drives bad decisions, and what behavioral finance teaches us about avoiding costly investing mistakes. Learn how to recognize crowd behavior—and how to protect your portfolio from emotional traps. Jon & Matt also cover market response to new tariffs, and whether markets will...

Read More »

Read More »

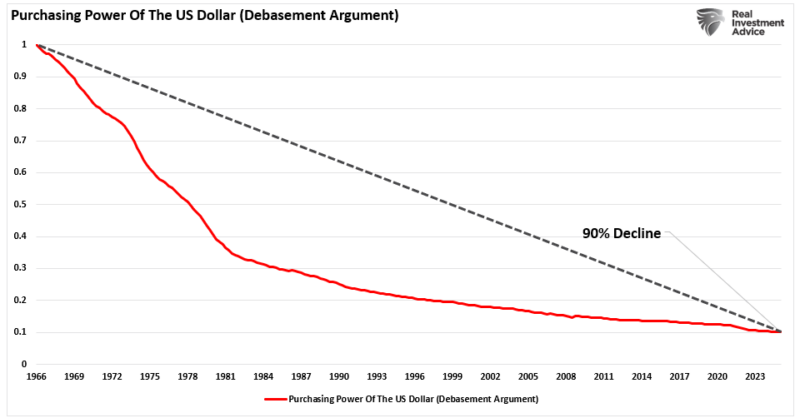

Debasement: What It Is And Isn’t.

Over the past year, financial headlines continue to flood investors with doomsday predictions about the U.S. dollar. Whether it's social media influencers waving "dollar collapse" charts or YouTube personalities warning about debasement, the noise has become deafening. The narrative is seductive: inflation is out of control, the government is printing money, and the dollar is on its last legs.

Read More »

Read More »

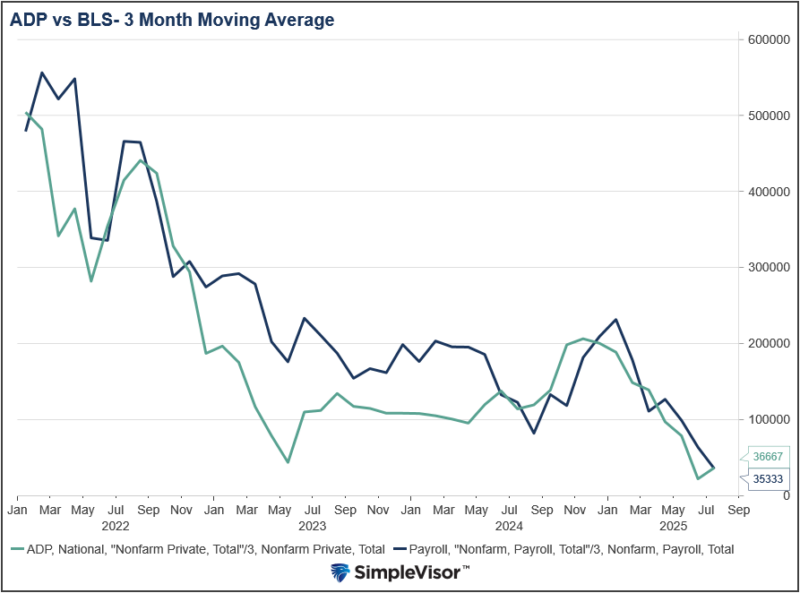

GDP Is Meh: The Bullish And Bearish Headlines Are Misleading

The BEA reported that real GDP grew by 3.0% in the second quarter. Such is almost a percent better than the longer run trend growth rate, and is a cause for optimism for some. However, first quarter GDP was -0.5%, well below trend growth, and worthy of pessimism. The problem with being optimistic about the second quarter or pessimistic about the first quarter is that the threat of tariffs and actual tariffs abnormally impacted the data.

Read More »

Read More »

7-31-25 How High Interest Rates Impact the Housing Market

He housing market is like a pyramid: Younger buyers purchase homes from the generation ahead of them so those buyers can move up. Higher rates are making those houses unaffordable and the pyramid ceases to work.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA.

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's...

Read More »

Read More »

7-31-25 The Fed Holds Firm

The Federal Reserve holds interest rates steady in its latest policy meeting, signaling a firm stance amid inflation concerns, and despite unchecked market bullishness. Lance Roberts & Michael Lebowitz break down what the Fed's decision means for investors, the economy, and your portfolio. AI datacenter buildouts are showing up in economic data...but, the 3% GDP print has a more dire undertone: Strip out the build outs, and the economy is...

Read More »

Read More »

Dissent In The Fed Ranks

December 2024 marked the second-to-last time there was a dissent by an FOMC voting member. The dissent, at the time, was a sole vote by Jefferey Schmid against cutting rates. The last dissent was yesterday. While the Fed voted to maintain the Fed Funds rate at 4.25-4.50%, Michelle Bowman and Christopher Wallace cast dissenting votes in favor of reducing rates.

Read More »

Read More »