Category Archive: 9a.) Real Investment Advice

The Coming Era of QT

(6/2/22) Markets took to heart a quasi-retraction from Fed Gov. Bostic on possible halt to Fed tightening later this Summer, pulling back to previous lows. Regardless, markets are still in a buying mood, and this will be the wash-rinse-repeat pattern for the next several weeks; too many investors are predicting a bear market for it to occur. Queen Elizabeth-II marks her 70th year on the throne; can the monarchy last? The Fed's method of...

Read More »

Read More »

Could Markets Rally All the Way into Summer? | 3:00 on Markets & Money

(6/1/22) We're seeing signs of a much stronger rally as we head into Summer months: There has not been a negative June in the markets since 2015; July also tends to be a stronger month in the Summer. Things are more dicey in August and September, but with markets under so much pressure the past two months, it would not be a surprise to see markets take off in the next two months. Markets tend to do the opposite of what everyone expects: With over...

Read More »

Read More »

The Great Resignation has shifted to The Great Re-hiring

(6/1/22) Summer Markets could provide opportunity for investors; 25% of Americans are delaying retirement because of inflation--meaning, they weren't ready to retire in the first place. How Biden/Powell are fighting inflation; the solution for high gasoline prices is more oil. California lifeguards earning 6-figure incomes; how The Great Resignation has shifted to The Great Re-hiring; how we're handling inflation & the Savings Paradox; Bearish...

Read More »

Read More »

Student Loan Forgiveness is a Nightmare!

(5/31/22) Iran's "secret" tunnels; The new Delorean; Why Student Loan Forgiveness is a fundamentally flawed concept.

[NOTE: The last segment of today's show (5/31/22) was dropped from the live feed to YouTube; it is preserved in this recording.]

0:00 - The Flawed Reasoning Behind Forgiving Student Loans

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO

--------

Our Latest "Three Minutes on Markets & Money:...

Read More »

Read More »

Can the Rally Last? | 3:00 on Markets & Money

(5/31/22) Markets are ending the month of May with a nice rally in the previous week--but can it last? There are still a lot of companies that are offsides in market allocations in terms of equities as well as in bonds--anyone with a 60/40 allocation is out of whack. Much of the remaining rebalancing will have to be accomplished in the final month of the quarter: June. Volatility, however, has not been suggesting the recent rally can stand. What...

Read More »

Read More »

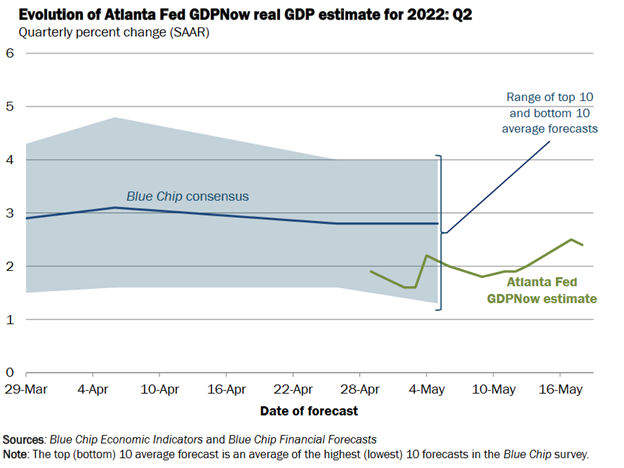

What Markets are Trying to Tell the Fed

(5/31/22) Markets prepare to wrap up May, and enter the final month of the Second Quarter, and how investors can take advantage; why inflationary pressures remain; how Washington's idiocy made inflation worse...and some Senators want to repeat the process. Oil Company margins are no better now, thanks to inflation of labor and materials, and higher costs of extraction. How trapped-longs can finally get out; why the Fed is behind the curve in...

Read More »

Read More »

High Inflation May Already Be Behind Us

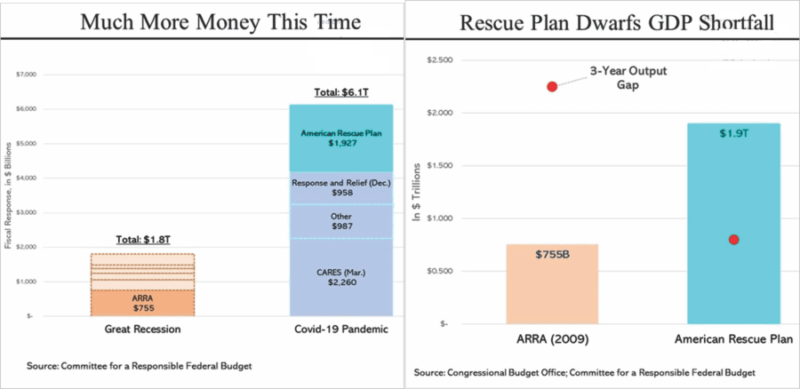

High inflation has captured the headlines as of late particularly as CPI recently hit the highest levels since 1981. Some are even suggesting we will face hyperinflation. However, while inflation is certainly present, the question to be answered is whether it will remain that way, or if the worst may already be behind us?

Read More »

Read More »

Target Date Funds: The Rule of Dumb

(5/27/22) (5/27/22) Will the Memorial Day weekend see lots of "revenge travel?" Never under-estimate the ability of a bear market to suck you in one more time; a reflexive rally is not an all-clear sign for investors. Listen to screeching sound of a dead-cat bounce; how are companies responding; how long can a reflexive rally last? ESG funds are just S&P funds in a green skirt. Target Date Funds: The Rule of Dumb. Why Target Date Fund...

Read More »

Read More »

Snap Goes The Economy

“…the macro environment has deteriorated further and faster than we anticipated when we issued our quarterly guidance last month.” -Snap CEO Evan Spiegel

Read More »

Read More »

Investing So Easy a Monkey Can Do It…until the bubble bursts.

(5/30/22) As the markets go, so goes the year: The way we look at financial markets is very different from the way the Fed looks at financial markets. Keep in mind where we've come from, and where we are today: How inflation was created, and the mistake everyone made was that growth in the economy was organic...but in reality was fueled by all the liquidity that had been injected into the economy; the problem of not having an investing strategy....

Read More »

Read More »

How Much Room Does the Market Have? | 3:00 on Markets & Money

(5/26/22) Good news for markets as they try to establish a bottom and set up for a counter-trend rally. Stock prices peaked in March, and since then have had a tough time. The MACD signal has been in a downward trend, applying downward pressure to pricing at the same time. Wednesday's rally triggered a MADC Buy-signal for the first time in 8-weeks. Markets have been stabilizing and forming consistent bottom levels. With the MACD signal in place,...

Read More »

Read More »

The Federal Reserve: Two Hikes & Done?

(5/26/22) 2022 is turning out to be one of the roughest years ever for market investors; where investors are most likely to make mistakes; How aggressive will the Fed be on interest rates? No one is surprised at Meta's fraud issues; the question of blockchain integrity; software security will be an ongoing business & investing opportunity; what will the Fed's next action mean for markets? The Fed looks at markets differently than do investors;...

Read More »

Read More »

Bonds Are Turning a Corner | 3:00 on Markets & Money

(5/25/22) Bonds have started to turn a corner in recent weeks, picking up their non-correlation relative to equity prices--exactly what you want if you're using bonds as a hedge against a stock sell-off. Taking a look at interest rates for hints of where rates are heading reveals much about the economy, and where it's heading, as well. As slowing in April of the rate of growth of inflation allowed interest rates to rise, so did May's reports of...

Read More »

Read More »

Unintended Consequences of Taxing the Rich

(5/25/22) Selling pressures continue in the markets, stringing together the most losing weeks since 1928, underscoring the importance of bonds as markets shift from inflation to growth priorities. Correlations and Causations of the Uvalde Shootings: coincidence of increased violence with growth in social media; the velocity of information makes it too easy to react & respond. Why catfish live longer; the rich who want to raise taxes...and the...

Read More »

Read More »

Will Markets Give Up All of Monday’s Gains? | 3:00 on Markets & Money

(5/24/22) Markets were able to hold support at last week's lows--and important test of the bottom, and a set up for a double-bottom. Unfortunately, markets are pointing lower following Snapchat's poor report, which is weighing on FAANG stocks, which in turn are placing a drag on the S&P. A commonality of recent weeks has been a rally that gets sold-into, which has been the heart of the negative pressure on the 20-DMA. Price declines are also...

Read More »

Read More »

Dealing with Negative News in a Positive Way

(5/24/22) Thanks to Snapchat and Mega, and their impact on FAAG stocks, markets sold off last week's gains. Price action remains negative; is relief on the horizon? LA Port activity smoothing out. Bad geopolitical news further weighs on markets, investors, and advisors: How to handle negative news in making investing decisions. At Davos 2022, Ray Daleo says "cash is trash;" why does the Dollar continue to strengthen" We're the...

Read More »

Read More »

Why a 20% Correction Does Not a Bear Market Make | 3:00 on Markets & Money

(5/23/22) Breaking through the markets' 20% barrier does not a bear market make, regardless of breathless media commentary. 20% off today's S&P is merely a correction, thanks to the lone-term bullish trend of rising prices remains well intact. On Friday, buying came in in the late afternoon, holding onto support established earlier last week. Markets are looking to move higher this morning--an indication that the bottom could hold, and the...

Read More »

Read More »

Why the Recession Will Be Here Later than Expected

(5/23/22) The Dow is now stringing together 8-weeks of losses--its worst performance since the 1920's. Contrary to media claims of a bear market, the 20% drop is but a correction on the road to Bubblization: This will be The Most Forecasted Recession in history. Graduation Weekend at the Roberts' house; Davos 2022 = Pinky & The Brain. When all the experts agree, something else is bound to happen; why buy & hold doesn't work at the wrong end...

Read More »

Read More »

Dealing with Healthcare Costs in Retirement

(5/20/22) Waiting for the Bounce: Some people just aren't cut out to invest in stocks; Richard Rosso's Investing Opera; Why does Elon Musk want Twitter? Musk says ESG is a scam; ORFN--the anti-woke fund; the truth about Bitcoin; the positives of a Bear Markets: needed cleansing. How we're managing against inflation. Why you shouldn't benchmark to the top. Gasoline prices & biking in Houston; Healthcare costs in Retirement; using HSA's as a...

Read More »

Read More »

Warnings from Target Sink Stocks: What’s Next? REV | 3:00 on Markets & Money

(5/19/22) Target and Walmart's warnings about future earnings pulled the rug out from under stocks Wednesday, essentially reversing all of the previous gains, going back to last week. The data suggests a recession is near, if not already here. (We raised cash in anticipation of the worst.) The current level of resistance will be important for markets to break above in order to get the rally back on track. Negative money flows have improved,...

Read More »

Read More »