Category Archive: 9a) Buy and Hold

6-28-25 Candid Coffee TEASER

Register for our next live webinar, "Financial Independence Candid Coffee," June 28, 2025:

https://streamyard.com/watch/BUr4UuRVt6Uj

Read More »

Read More »

Neue US-Steuer: Dein Geld ist in Gefahr!

Dein Geld ist in Gefahr – und du merkst es vielleicht nicht mal.

Die USA planen eine neue Steuer, die deine US-Investments empfindlich treffen könnte – zusätzlich droht eine neue Inflationswelle durch die Notenpresse.

Gerald erklärt, wie die USA durch massive Budgetdefizite unter Druck geraten, warum Anleger künftig deutlich höhere Steuern auf US-Aktien und -Anleihen zahlen könnten und welche Kettenreaktionen das weltweit auslösen kann.

Erfahre,...

Read More »

Read More »

Eine absolute Leseempfehlung von Thomas: Nexus 🤖 #nexus

Eine absolute Leseempfehlung von Thomas: Nexus 🤖 #nexus

🎥 5 Bücher, die du 2025 unbedingt lesen solltest!:

?si=JXONX7eWoeIWB1PW

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine...

Read More »

Read More »

„Zölle“ auf US-Aktien? | Geld ganz einfach

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_4yVh0xBSEyY

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_4yVh0xBSEyY

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_4yVh0xBSEyY

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_4yVh0xBSEyY

Justtrade* ►...

Read More »

Read More »

6-1 1-25 CPI Day: Will Inflation Hold Steady?

Today is CPI Day, and all eyes are on the Consumer Price Index report for May. What will today’s CPI data mean for the Federal Reserve’s interest rate path and future market volatility?

Lance Roberts & Danny Ratliff examine the implications for stocks, bonds, and consumer sentiment.

Tune in for an investor-focused look at inflation trends, historical context, and what may come next.

#MayCPI #InflationWatch #CPI2025

Read More »

Read More »

6-10-25 Is Making Private Equity Public a Good Idea?

The SEC is considering dropping "accredited investor" designation so as to enable retail investors to participate in private equity opportunities; but is removing the scarcity aspect of private investing a sound proposition?

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

The Google AI Buildout In Plain English

On May 20th, Google CEO Sundar Pichai updated the public on the company's progress on its AI development as follows: We are now processing 480 trillion monthly tokens, a nearly 50X increase in just one. Over 7 million developers are now building with the Gemini API, a 5x growth since last I.O., and our enterprise … Continue reading...

Read More »

Read More »

Deficits And The Tradeoffs Required To Fix Them

By falling significantly short of its intended savings goals, the DOGE program underscores the substantial challenges that hinder efforts to reduce federal spending and cut the deficit. Furthermore, its failure suggests that a more expedient way to reduce the deficit might be to increase federal revenue. Thus, we pose the simple hypothetical question: What if …

Read More »

Read More »

Schwacher Dollar: Lohnt sich ein Hedged ETF?

Klar, ein schwacher Dollar hat negative Auswirkungen auf die Rendite von Aktien-ETFs. Im MSCI World sind beispielsweise mehr als 70% an Wert in US-Aktien enthalten, die erstmal in US-Dollar notieren. Fällt der Dollar-Wert, bekommst Du für Deine Aktien weniger Euros.

Hedged-ETFs, also währungsgesicherte ETFs, sichern gegen solche Wechselkursschwankungen ab. Denn: Sie nutzen zusätzliche Finanzinstrumente, wie zum Beispiel Derivate,

um die...

Read More »

Read More »

Neues aus der Kryptoszene #cryptoking

Big Beautiful Bill 📜 #bbb

Marktgeflüster Podcast #151: TRUMP vs MUSK + THOMAS vs META 🔥🥊

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit...

Read More »

Read More »

6-10-25 Private Equity is Coming for Your Money

Lance Roberts & Jonathan Penn uncover how private equity investments are no longer just for the ultra-wealthy...but is that the best plan? With Wall Street's latest push, retail investors are now being targeted as the next frontier for capital. From alternative investments in 2025 to the growing trend of private equity entering 401(k) plans, we break down what you need to know about the risks of private equity, the lack of transparency compared...

Read More »

Read More »

Messerangriffe und Amokläufe – Wie schützt man sich? Run.Hide.Fight

Die Gefahr durch #Messerangriffe und #Amokläufe hat in der Öffentlichkeit massiv zugenommen. Der Ex-Bundeswehrsoldat Alexander T. Schneider hat einen Leitfaden zum Überleben in kritischen Situationen wie Amokläufen und Terroranschlägen geschrieben. Mit diesem kleinen Büchlein steigt Ihre #Überlebenswahrscheinlichkeit um ein Vielfaches. Jeder kann es lernen - man muss kein Kämpfer sein, um zu den Überlebenden zu gehören.

Buch: RUN.HIDE.FIGHT -...

Read More »

Read More »

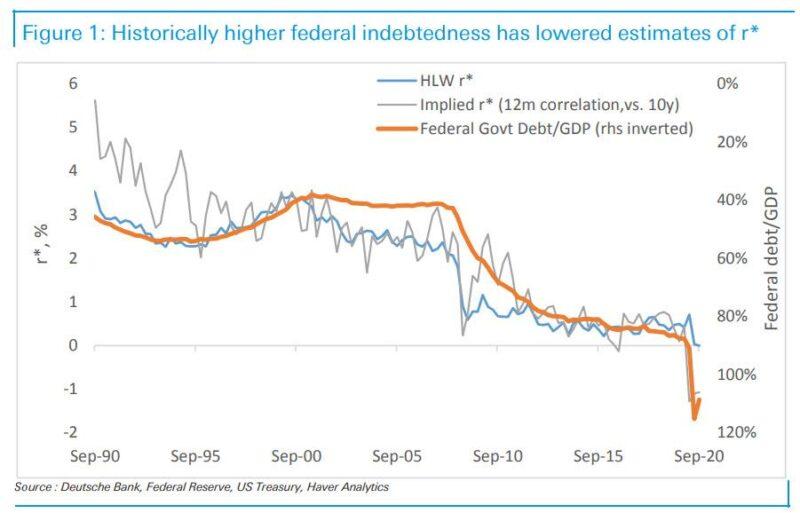

The Economy Is The Real Deficit Problem

The deficit fearmongers are out in full force, warning that massive debt payments will further exacerbate the deficit and ultimately bankrupt the country. While we agree that steadily increasing deficits are a significant problem, we believe it's not for the reasons most people give. To that end, a recent Tweet by George Gammon succinctly makes …

Read More »

Read More »

Top 5 Mistakes High Net Worth Individuals Make Without a Financial Plan

When you’ve worked hard to build wealth, protecting it becomes just as important as growing it. However, even high net worth individuals (HNWIs) often fall into avoidable traps, especially when navigating wealth without a formal financial plan. Without a clear strategy, even sophisticated investors may overlook important details, leading to costly consequences over time. In …

Read More »

Read More »

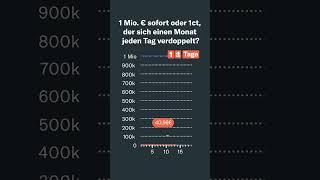

1 Million € – oder 1 Cent, der sich jeden Tag verdoppelt?

Grundsätzlich klingt die Million erstmal super – so viel Geld auf einmal ist bestimmt nicht verkehrt., oder?

Finanziell gesehen macht allerdings der Cent mehr Sinn: Verdoppelt sich der Betrag täglich, erreichst Du bereits am 28. Tag die Million. Und nach 31 Tagen hättest Du dann schon 10,7 Millionen Euro.

Das liegt am sog. Zinseszinseffekt: Sparst Du kontinuierlich, wächst der Wert Deines Geldes langfristig überproportional an.

Hättest Du den...

Read More »

Read More »

6-9-25 Buying the Dip is Not an Easy Thing

The time when you are most fearful of buying into the market is exactly when you should; it's counter-intuitive: We look at all the bearish sentiment, and add our own bias, and talk ourselves out of it.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on...

Read More »

Read More »

Mit diesem Verdienst gehört man zur Oberschicht #oberschicht

Mit diesem Verdienst gehört man zur Oberschicht 🎩 #oberschicht

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

6-9-25 How to Buy the Dip–Technically Speaking

Are you waiting for the perfect moment to "buy the dip" but unsure how to spot it?

Lance Roberts reveals how to identify smart entry points using technical analysis. From recognizing key support levels and reversal patterns, to understanding what oversold indicators are really telling you, we’ll walk you through the tools, charts, and signals that professional investors rely on.

Whether you're a seasoned trader or a long-term investor...

Read More »

Read More »

Bond Yield Chasing: Tomorrow’s Narrative?

Numerous bond narratives are driving long-term bond yields higher. “Crippling deficits” and a tariff-induced inflation sit at the top the list. We have repeatedly poked holes in these narratives. Instead of dwelling further on them, let's consider what tomorrow's narratives might be. When the bond market changes direction and yields fall, the two narratives we …

Read More »

Read More »