Category Archive: 9a) Buy and Hold

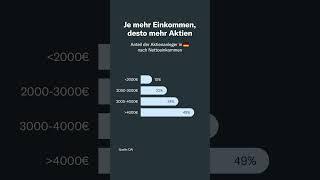

Je höher das Einkommen, desto mehr Aktien

Der Aktienbesitz in Deutschland ist stark vom Einkommen abhängig

Jeder Zweite mit einem Netto-Einkommen von mehr als 4.000€ pro Monat ist im Besitz von Aktien, Aktienfonds und ETF's – Tendenz steigend.

Bei Menschen mit einem Einkommen von weniger als 2.000€ ist nur jeder Zehnte am Aktienmarkt aktiv. Ein Grund dafür könnten gestiegene Preise nach Inflationsphasen sein.

#Finanztip

Read More »

Read More »

5-29-25 Narratives or Fundamentals: What Matters Most?

Narratives DO matter: When the Fed issues a statement, markets respond; but that narrative will change very quickly. Over the long-haul, the fundamentals of earnings growth, forward expectations of earnings growth, rates, and valuations; those are what matter over the long-term.

Hosted by Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube...

Read More »

Read More »

Trump’s Tariff War: Economic Genius or Global Gamble? – Tom Wheelwright, Dr. Adam Ozimek

👉 https://bit.ly/41d3Kmy 👈 CLICK HERE Ready to change your financial future? Join Tom Wheelwright, Robert Kiyosaki's CPA, and apply to the WealthAbility Accelerator today!

Join Tom Wheelwright as he explores if Trump’s tariffs are actually going to do what he says they are going to do, and if so - how will they affect small business owners with his guest and economist, Dr. Adam Ozimek.

Dr. Adam Ozimek is Chief Economist at EIG, where he serves...

Read More »

Read More »

5-29-29 Nvidia Earnings: The Lost Segment

We encountered technical issues getting this morning's live-stream up and running. Consequently, many of you missed the start of the show, including Lance Roberts' summary of Nvidia's earnings report last night, and potential market reaction today. Fortunately, we were independently recording the show, and are pleased to post "The Lost Segment" from Thursday's show:

0:18 - Trump Tariffs vs Trade Court

4:26 - Premarket Commentary: Nvidia...

Read More »

Read More »

Trumps Zölle stiften auch bei Finanzfluss Chaos #chaos

Basic Capital: Mit Leverage investieren🏋️♀️ #leverage

Marktgeflüster Podcast #149: US Downgrade = Thomas & Holger GONE

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen....

Read More »

Read More »

5-29-25 The Death of Narratives

President Trump's tariffs are being negated by Trade Courts, and markets feel inspired. Nvidia reports earnings, and is poised for a 6% gain today; we're still on the cusp of all that AI can do. Lance and Michael discuss the importance of recognizing and shutting out the narratives that distract investors; why we all seem to need a reason "why" things are as they are. Commentary on Nvidia's technology "moat;" comparisons to...

Read More »

Read More »

Der Broker ist egal #einfachmachen

Der Broker ist egal 📱 #einfachmachen

🎥 Untypische Lektionen, die ich in 10 Jahren Börse gelernt habe:

?si=v9m5cD1mE_WxiDaS

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen...

Read More »

Read More »

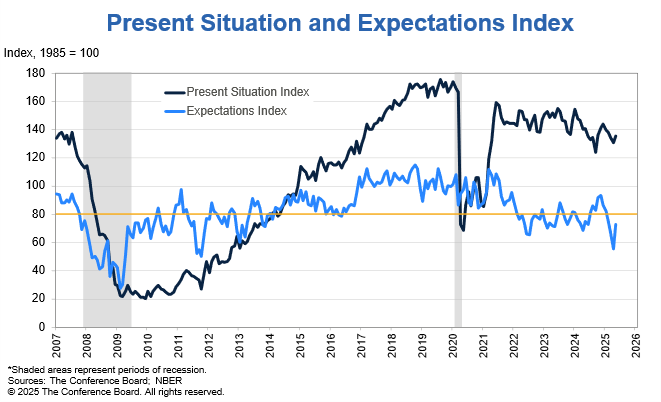

Consumers Are Not As Gloomy

The Conference Board’s consumer confidence index surged from 85.7 to 98.0. Such was the largest one-month increase since 2009! Clearly, progress on trade deals and the delay in implementing tariffs spurred the increase. Moreover, the recovering stock market also boosted consumer confidence. However, bear in mind that the index is coming off its lowest level …

Read More »

Read More »

Wie viele 100.000€ reichen für Frührente oder Immobilie? | Saidis Senf

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_SFFCIHN49M4

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_SFFCIHN49M4

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_SFFCIHN49M4

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_SFFCIHN49M4

Justtrade* ►...

Read More »

Read More »

Vorsicht vor Finanztip Fake-Accounts auf Instagram!

🚨 Auf Instagram gibt es gerade leider ziemlich viele Fake-Accounts von Finanztip. Bitte folgt denen nicht, geht auf deren Anfragen nicht ein und joined auch nicht deren WhatsApp Gruppen.

Von Finanztip gibt es zunächst mal diesen offiziellen Hauptaccount hier. Und dann gibt es noch unseren Female-Finance-Account @aufgeldreise. Von dem gibt es so einige Fake-Profile, von denen einige von Euch auch direkt kontaktiert wurden.

Weder Hermann Josef...

Read More »

Read More »

5-28-25 What If AI Factories Re-Define Our Industries

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757AI data centers are not the way to go; AI Factories are. AI Factories can exponentially increase computing power and thereby increase productivity. AI has the potential to be the next leg of the Industrial Revolution.

Hosted by Chief Investment Strategist, Lance Roberts, CIO w Senior Financial Advisor, Danny Ratliff, CFP

Produced...

Read More »

Read More »

Wall Street Insider Reveals What’s REALLY Coming Next (You’re Not Ready) – Andy Tanner, Scott Bok

👉 See How Savvy Investors Are Using "The Power of 6" to Generate New Streams of Cash Flow: https://bit.ly/3U3HAPY

Wall Street isn't what it used to be—and in this episode, you'll find out why. Andy Tanner sits down with Scott Bok, author of "Surviving Wall Street: A Tale of Triumph, Tragedy, and Timing," to unpack the hidden lessons behind the biggest financial crises of our time—from long-term capital collapse to the COVID...

Read More »

Read More »

Unter diesem Verdienst wird man als arm eingestuft #armutsgrenze

Unter diesem Verdienst wird man als arm eingestuft 💶 #armutsgrenze

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

The Financial Collapse Has Begun – Robert Kiyosaki

👉 Silver is still 50% below its all-time high—but that window may be closing fast. As demand surges across solar, EVs, AI, and even medicine, governments are quietly stockpiling silver… and supply is shrinking. Rich Dad believes silver could hit $70 this year—and smart investors are getting in before the next breakout. Priority Gold’s FREE Rich Dad Silver Forecast Guide reveals why silver is poised to 2x—and how to move part of your IRA or 401(k)...

Read More »

Read More »

5-28-25 Nvidia Day!

It's “Nvidia Day!” The Big Dog in the Tall Grass for AI reports earnings after the closing bell today. Lance Roberts & Danny Ratliff delve into the anticipation surrounding Nvidia's upcoming earnings report, set to be released after today's market close. We'll explore market expectations, potential impacts on NVDA stock, and the broader implications for the AI and semiconductor sectors. Also a discussion about the inimitable Mrs. Roberts, and...

Read More »

Read More »

Kritisiere deine eigene Strategie 🤔 #meineoderkeine

Kritisiere deine eigene Strategie 🤔 #meineoderkeine

🎥 Untypische Lektionen, die ich in 10 Jahren Börse gelernt habe:

?si=v9m5cD1mE_WxiDaS

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du...

Read More »

Read More »

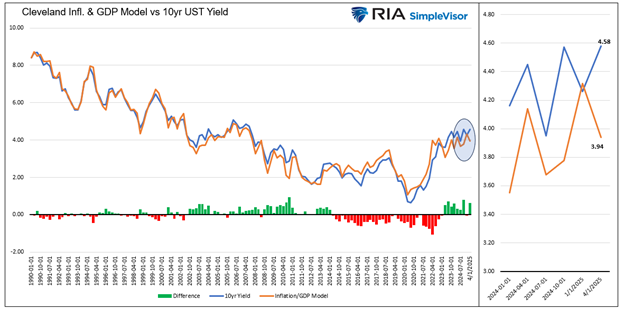

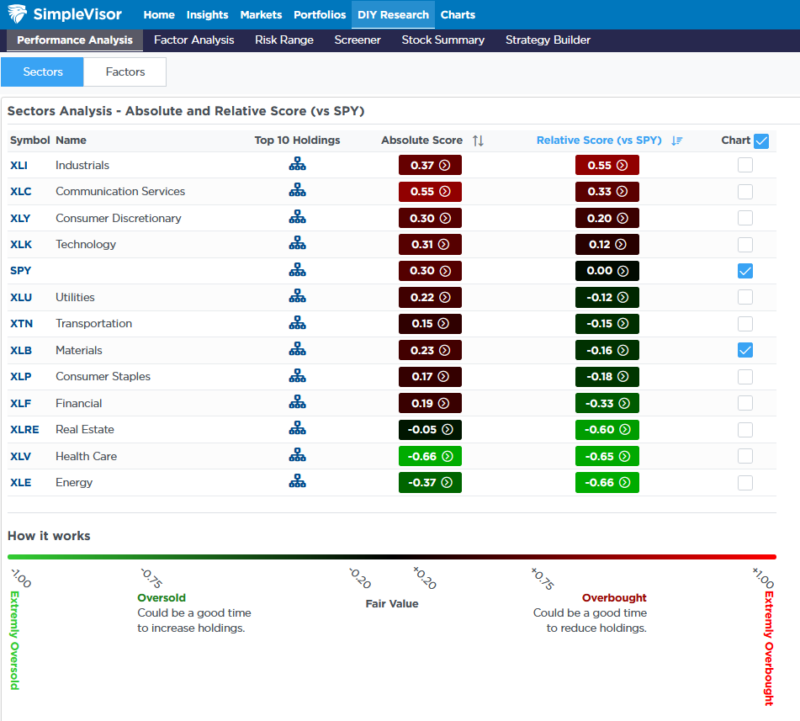

Narratives vs. Fundamentals: Battle In The Bond Market

On January 8, 2025, we answered many of your questions with an article entitled Why Are Bond Yields Rising? Since then, bond yields initially fell but have recently risen back to early January levels. Unsurprisingly, our email boxes are again filled with the same questions we got in early January. This article presents a different …

Read More »

Read More »

Assessing Credit Spreads After The USA Downgrade

A reader of our Daily Commentary asked how we measure corporate credit spreads in light of the Moody's downgrade of the USA credit rating. Specifically, "Without having a AAA benchmark to calculate the credit spread of corporate bonds against, what other measure can help me assessing stress in the corporate bond market." First its important …

Read More »

Read More »

5-27-25 More Money is Lost Trying to Avoid Corrections than In Corrections

Our goal is to grow money in the markets that are presented to us today and adjust in the future. Peter Lynch is credited for noting that more money is lost avoiding correction than that is lost during correction. Corrections are never as bad as expected, and the really bad ones that are so feared rarely ever occur.

Hosted by Chief Investment Strategist, Lance Roberts, CIO w Senior Financial Advisor, Jonathan Penn, CFP

Produced by Brent Clanton,...

Read More »

Read More »