Category Archive: 9a) Buy and Hold

Mit diesem Verdienst gehört man der unteren Mittelschicht an #mittelschicht

Mit diesem Verdienst gehört man der Mittelschicht an 💶 #mittelschicht

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

Jetzt Balkonkraftwerk kaufen? 4 Gründe | Geld ganz einfach

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_hChQQ2c5lkE

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_hChQQ2c5lkE

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_hChQQ2c5lkE

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_hChQQ2c5lkE

Justtrade* ►...

Read More »

Read More »

Why the Rich Are Rushing Into GOLD – Robert Kiyosaki, Marin Katusa

Gold is up over 27% this year, and Wall Street is still pushing paper ETFs. But those are just IOUs. When the system cracks, paper gold won’t save you. Real gold—the kind you can hold—is the asset smart investors are turning to now.

The FREE Rich Dad Gold Forecast Guide shows how physical gold could keep rising—and how to move part of your IRA or 401(k) into gold tax- and penalty-free (U.S. Residents Only).

📘 Claim Your Free Guide:...

Read More »

Read More »

6-4-25 Will There Be a Summer Swoon?

Is a summer swoon looming in the stock market for 2025?

Lance Roberts & Danny Ratliff explore the historical performance of the S&P 500 and major sectors during the summer months—June through August, and examine whether investors should brace for a seasonal pullback, looking at historical June-to-August returns and volatility trends, what typically drives a summer slowdown in stocks, and sector-by-sector analysis: What holds up best in...

Read More »

Read More »

Wie sinnvoll sind Covered Call ETFs? #coveredcalletf

Wie sinnvoll sind Covered Call ETFs? 📊 #coveredcalletf

🎥 12% Rendite erzielen mit diesem ETF? Monatliche Einnahmen mit Covered Call ETFs erklärt!:

-BY6nRjDc?si=ZpeBJpUaQpxvYXku

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

Sellers Outnumber Buyers In The Housing Market

The following commentary is from Redfin "There are 34% more sellers in the market than buyers. At no other point in records dating back to 2013 have sellers outnumbered buyers this much. In other words, it’s a buyer’s market. Redfin expects home prices to drop 1% by the end of the year as a result. … Continue reading...

Read More »

Read More »

Stablecoins To The Treasury’s Rescue

Digital Money was the title of TBAC’s April 30, 2025, presentation to the U.S. Treasury Department, and an important topic worth discussing. TBAC, short for the Treasury Borrowing Advisory Committee, is comprised of senior investment professionals from the largest banks, brokers, hedge funds, and insurance companies. Most often, the committee informs the Treasury staff on …

Read More »

Read More »

6-3-25 THe Multiplier Effect of AI Spending

For every $1-Billion spent on developing AI, it creates $3-Billion in economic growth.

It's called the multiplier effect, and if the Administration has $1.8-Trillion in commitments to spend on AI. Do the math: Multiply by three. That's where economic growth is coming from.

Hosted by Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

Trumps Rache: Harvard im Kreuzfeuer

Donald Trump entzieht Harvard die Förderungen, kippt die Steuerfreiheit – und will internationale Studenten rauswerfen.

Harvard-Absolvent und Multimillionär Gerald Hörhan zeigt, warum das keine Einzelaktion ist, sondern ein ideologischer Krieg gegen Amerikas wichtigste Bildungseinrichtung.

Ist genau jetzt der Moment, in dem Amerikas leistungsfähigstes Bildungssystem irreparablen Schaden nimmt – und dadurch der gesamte wirtschaftliche Motor ins...

Read More »

Read More »

6-3-25 Reports of the Death of American Exceptionalism Are Greatly Exaggerated

Is America’s global leadership really fading?

Lance Roberts & Jonathan Penn reveal the truth behind the “decline of American exceptionalism” narrative, and why the U.S. continues to lead in economic strength, innovation, and global influence. Today's show also features several bonus elements, including a recap of Mrs. Robert's trip to the Vegas Bitcoin Expo and convention robots; an exposition on the alleged death of American Exceptionalism,...

Read More »

Read More »

Vor- und Nachteile von Covered Call ETFs #coveredcalletf

Vor- und Nachteile von Covered Call ETFs 📊#coveredcalletf

🎥 12% Rendite erzielen mit diesem ETF? Monatliche Einnahmen mit Covered Call ETFs erklärt!:

-BY6nRjDc?si=ZpeBJpUaQpxvYXku

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

How Long $2 Million in Retirement Savings Lasts in Every U.S. State

For many Americans, accumulating $2 million in retirement savings is a significant milestone. However, the longevity of these savings can vary greatly depending on the state in which you choose to retire. Factors such as cost of living, taxes, healthcare expenses, and lifestyle choices all play a role in determining how far your retirement funds …

Read More »

Read More »

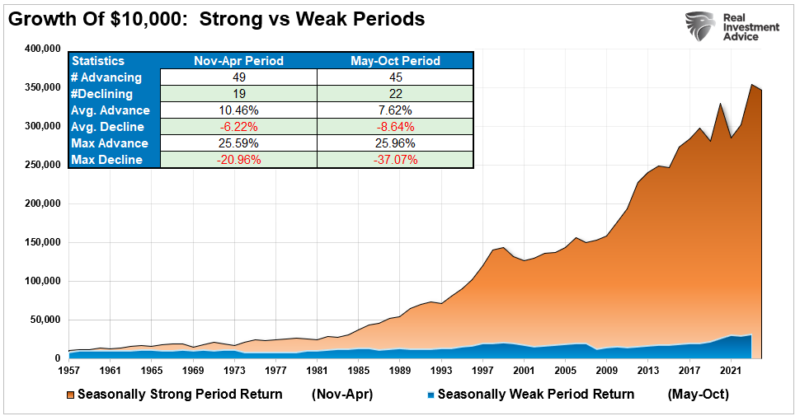

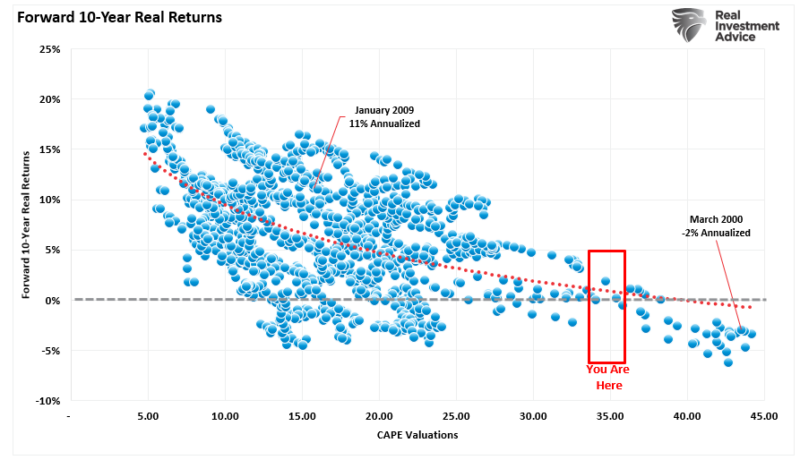

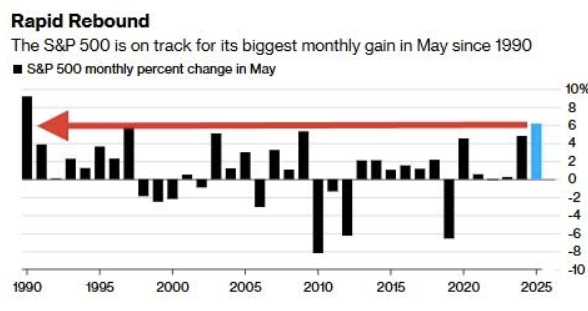

Sell In May And Go Away?

An old Wall Street adage advises investors to sell in May and go away. Given that we have just turned the calendar to June, it's worth assessing whether selling stocks and holding cash for the next seven months makes sense. The graph and data below are based on two trading strategies, both starting in January … Continue reading »

Read More »

Read More »

6-2-25 You Can Always Rationalize a Reason Not to Buy Stocks

We can always rationalize why we shouldn't buy stocks. Lance Roberts shares one of The Most Stupid Excuses he's heard yet.

Hosted by Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

Neues aus der Kryptoszene #cryptoking

Neues aus der Kryptoszene 🔑 #cryptoking

Marktgeflüster Podcast #150: 3.4 Mrd. VERLUST durch grauen Kapitalmarkt 🔥

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als...

Read More »

Read More »

Why Schools Never Taught You THIS About Money – Andy Tanner, Del Denney

🎯 Ready to take control of your financial future? Visit https://bit.ly/3JsRdmj for access to FREE investing tools, including Andy’s “Power of 6” ebook.

Most people were taught how to earn money… but not how to keep it, grow it, or use it to buy freedom. In this episode of Rich Dad StockCast, host Del Denney and Rich Dad expert Andy Tanner break down what financial literacy really means — and why most of us never learned it in school.

👉 Why aren’t...

Read More »

Read More »

Ab wie viel Geld müssen andere nie wieder arbeiten? | Livestream

Die besten Tagesgeld-Angebote 04/25: https://www.finanztip.de/tagesgeld/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=2-FUxW5G63U

Die besten Festgeld-Angebote 04/25: https://www.finanztip.de/festgeld/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=2-FUxW5G63U

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_2-FUxW5G63U

Traders Place* ►...

Read More »

Read More »

6-2-25 Why Buying Stocks is Always Hard

Why does the stock market test our patience and nerve?

Lance Roberts looks at the psychology of investing, how to master long-term strategies, and ways to navigate market volatility with confidence! Today is National Leave Work Early day...but before you do, make sure to tackle Lance's Monday Mandatory Reading list (links are provided below); Lance shares another tender moment from the Roberts' kitchen, and his essay on why buying stocks is hard...

Read More »

Read More »

Mehr oder weniger Rendite: Covered Call ETFs #coveredcalletf

Mehr oder weniger Rendite: Covered Call ETFs 📊#coveredcalletf

🎥 12% Rendite erzielen mit diesem ETF? Monatliche Einnahmen mit Covered Call ETFs erklärt!:

-BY6nRjDc?si=ZpeBJpUaQpxvYXku

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im...

Read More »

Read More »

Bond Market Paradigm Shift?

Some bearish bond investors in Japan and the US appear to believe that a paradigm shift is underway in the sovereign bond markets. To wit, consider the following statement from Jim Bianco on Thoughtful Money: “If these deficits are really going to kick in and cause problems, these rates are going to go much higher than … Continue...

Read More »

Read More »