Category Archive: 9a) Buy and Hold

Immos wieder erschwinglicher? | Geld ganz einfach

Baufinanzierung: Mit Bestzins zur Traumimmobilie

Interhyp* ► https://www.finanztip.de/link/interhyp-baufi-text-youtube/yt_cvdYk1UsttM

Baufi24* ► https://www.finanztip.de/link/baufi24-baufi-text-youtube/yt_cvdYk1UsttM

Dr. Klein* ► https://www.finanztip.de/link/drklein-baufi-text-youtube/yt_cvdYk1UsttM

Hüttig & Rompf

Hypofriend* ► https://www.finanztip.de/link/hypofriend-baufi-text-youtube/yt_cvdYk1UsttM

🧡 Finanztip ist gemeinnützig. Jetzt...

Read More »

Read More »

How to Use Advanced Tax Planning to Maximize Long-Term Wealth

Tax planning is often viewed through the narrow lens of annual deductions and April deadlines. But for high-income earners and business owners, advanced tax planning strategies can be one of the most powerful tools for building and preserving long-term wealth. Strategic, forward-looking tax planning isn't just about minimizing what you owe today. Instead, it's about …

Read More »

Read More »

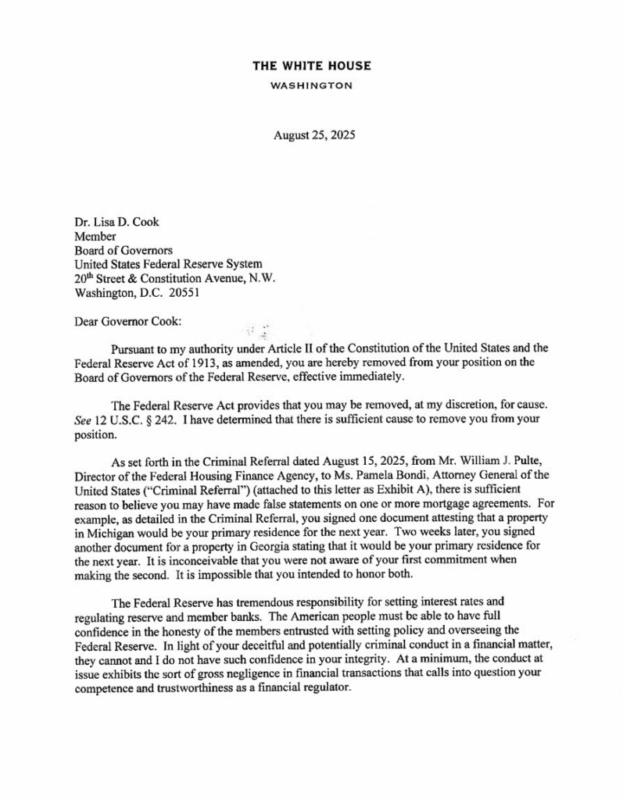

As The Fed Turns: The Soap Opera Grows More Intriguing

President Trump fired Fed Governor Lisa Cook for cause. The President claims, There is sufficient reason to believe you may have made false statements on one or more mortgage agreements. This is the first time in the 112-year history of the Fed that a President has fired a Fed Governor. Cook is fighting the dismissal, …

Read More »

Read More »

Finanzfluss Lexikon Bingo: TTWROR & Interner Zinsfuß #bingo #ttwror #izf

Finanzfluss Lexikon Bingo: TTWROR & Interner Zinsfuß 🎰 #bingo #ttwror #izf

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen...

Read More »

Read More »

ChatGPT & Co. im Preisvergleich

Nutzt Du KI-Chatbots, wenn ja wofür?

KI-Chatbots sind längst mehr als nur Spielerei – sie schreiben Texte, beantworten Fragen, programmieren Code, recherchieren Informationen und helfen sogar bei kreativen Projekten.

Dabei gilts wie bei anderen Abos Kosten zu vergleichen und zu schauen, welcher Anbieter für Dich den meisten Mehrwert bietet. Vergleichen lohnt sich ✅

Read More »

Read More »

8-23-25 Savvy Social Security Planning

Will Social Security be there for you when you’re ready to retire?

Richard Rosso and Jonathan Penn host Candid Coffee on Savvy Social Security Planning, sharing the in's and out's of the Social Security system, answering questions like when you should apply for Social Security—and how much should you expect to receive?

INTRO/Genesis of Candid Coffee

4:30 Teaser questions

5:15 Claiming Options & Costly Decisions about Social Security

9:40...

Read More »

Read More »

8-27-25 The Taylor Swift Influence on Markets

Can Taylor Swift move markets?

Signet saw a 3% bump as a result of the pop star's engagement ring presentation by Travis Kelce.

RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

-------

➢ Listen...

Read More »

Read More »

How to Survive and Thrive in the Greatest Wealth Reset – Robert Kiyosaki

Right now, we’re witnessing one of the greatest wealth shifts in history — and millions of people are being wiped out financially. In this powerful episode, Robert Kiyosaki explains why markets are collapsing, pensions are failing, and why traditional “safe” investments are no longer safe.

Robert breaks down the five key lessons you must learn to protect yourself, including the difference between assets and liabilities, why financial education is...

Read More »

Read More »

Spare nicht an sozialen Kontakten! #sparen

Spare nicht an sozialen Kontakten! 📉 #sparen

9 Anzeichen, dass du ZU VIEL sparst!:

?feature=shared

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff...

Read More »

Read More »

8/27/25 Is the Taylor Swift Engagement a Market Event?

Taylor Swift’s engagement has captured global attention—but does it matter for investors? Lance Roberts & Danny Ratliff examine why celebrity headlines dominate financial chatter, what it says about investor psychology, and why distraction often shows up near the peak of speculative markets.

✅ How celebrity news becomes a market “story”

✅ Why investors chase hype instead of fundamentals

✅ The risks of distraction during late-stage bull...

Read More »

Read More »

Momentum Strategies And Physics: Mass And Velocity Matter

In his 1687 book, Philosophiae Naturalis Principia Mathematica, Sir Isaac Newton defined momentum as the product of mass and velocity, or p = m * v. The reason we begin with a physics lesson is that momentum strategies are very popular, and Isaac Newton's famous formula can teach us a lot about financial asset momentum. …

Read More »

Read More »

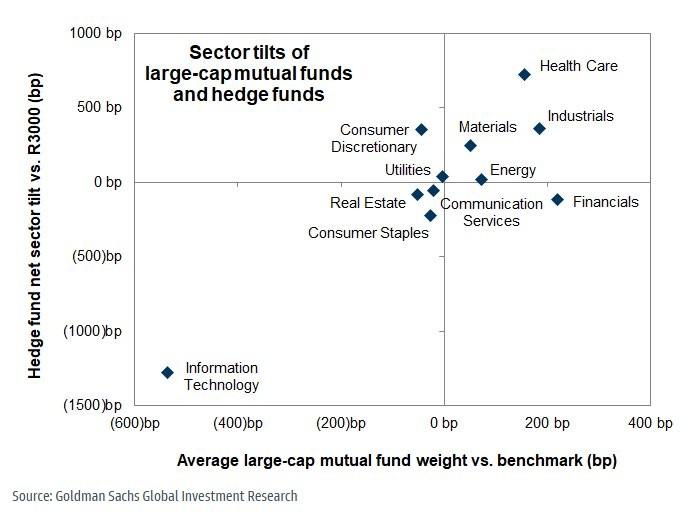

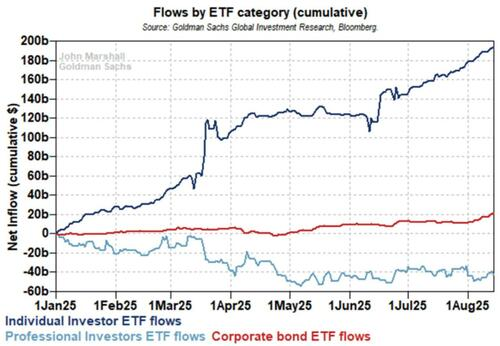

Smart Money Loves Healthcare: But Are They Now Dumb?

We have written a few Commentaries over the last year describing how retail, not institutional, investors are driving markets higher. To wit, there is ample evidence that with each market dip, retail investors are not selling, instead buying unrelentingly. In May, we wrote the following: Typically, institutional investors are right; however, over the last few …

Read More »

Read More »

Zur Reichensteuer… 🤴 #spitzensteuersatz

Zur Reichensteuer... 🤴 #spitzensteuersatz

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

8-26-25 The Importance of Saving First

There is no substitute for starting to save early, and paying yourself first.

RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

-------

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

Convierte Tu Negocio En Una Máquina De Riqueza – Alejandro Cardona & Fernando – Rich Dad Latino

👉 https://realmentor.net/rd 👈 ENTRA AQUÍ ¡Descubre el SISTEMA de PADRE RICO que me hizo MILLONARIO! Construye INGRESOS PASIVOS y alcanza la LIBERTAD FINANCIERA con Fernando González-Ganoza, mentor de habla hispana y representante oficial de Robert Kiyosaki por más de 30 años.

👉 https://www.seminariocreandoriqueza.com/richdad 👈 Aprende a invertir y generar ingresos en la bolsa de valores con el Economista Alejandro Cardona.

¿De verdad eres dueño...

Read More »

Read More »

8/26/25 Are Robo Advisors All They’re Cracked Up to Be?

New invesors ofen believe ha higher risk equals higher reward—bu ha’s no always he case.

Lance Robers & Jonahan Penn explore why newbie invesors ake on more risk han experienced ones, he common invesing misakes beginners make, and how risk managemen sraegies can proec long-erm wealh.

From porfolio allocaion o invesor psychology, we’ll compare how experienced vs. beginner invesors approach risk and why discipline maers more han luck. If you’re...

Read More »

Read More »

Gold Miners Are Benefitting From The Speculative Boom

As we noted in a recent article entitled The High Beta Melt Up: Echoes of 1999, there has been a notable change in investor preferences since the April lows. To wit: "What we do know is that, starting from the April lows, the market’s attitude toward riskier, more speculative activities has become much more intense." …

Read More »

Read More »

How to Build a Wealth Management Plan That Adapts to Life Changes

Most of us start financial planning with a basic idea: save, invest, and retire comfortably. But what happens when life throws something big your way, good or bad? Maybe you will sell your business sooner than expected. Maybe you receive an inheritance. Maybe life takes a sharp left turn through divorce, or you decide to …

Read More »

Read More »