Category Archive: 9a) Buy and Hold

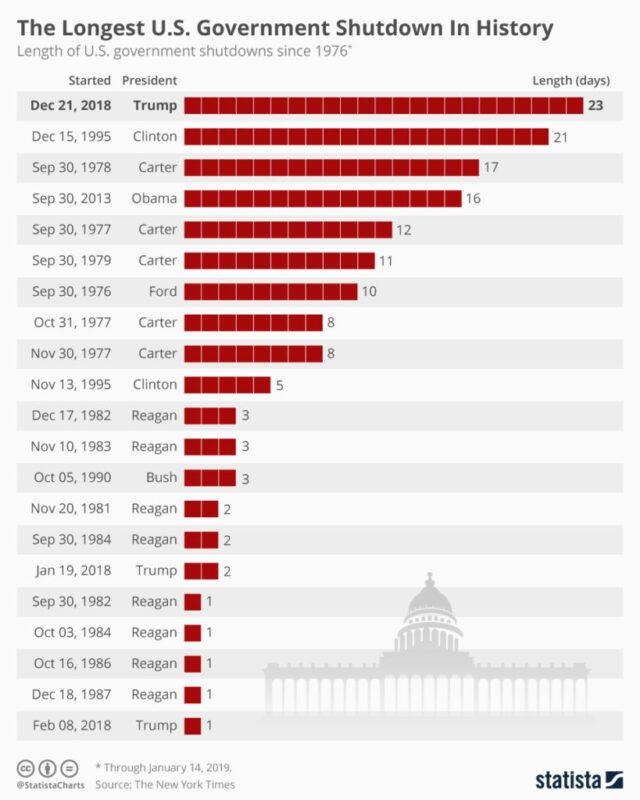

10-1-25 Government Shutdown Begins: What It Means for Markets & Investors {REVISED*]

The U.S. government shutdown has officially started. What does this mean for the economy, markets, and your investments? Lance Roberts covers the immediate fallout from the shutdown on federal spending, workers, and services ; how markets have historically reacted during shutdowns—and what to expect this time; the risk to GDP, delayed economic data releases, and consumer confidence.

This shutdown is more than politics—it’s a real test for the...

Read More »

Read More »

Neue Budget-Funktionen im Finanzfluss Copilot ️ #budget

Neue Budget-Funktionen im Finanzfluss Copilot 👨✈️ #budget

NEU! Haushaltsbuch, Budgets & mehr im Finanzfluss Copilot | App & Web Tutorial

?feature=shared

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum...

Read More »

Read More »

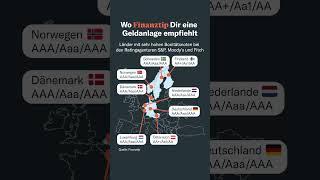

Verschwörungstheorien: Welche wirklich wahr sind!

Angst ist das Geschäftsmodell der Verschwörungstheoretiker.

Egal ob Euro-Crash, Lastenausgleich, Vermögensregister oder Auswanderungs-Panik – ständig wird dir erzählt, dass Deutschland und Österreich untergehen.

Die Wahrheit ist:

Ja, es gibt echte Risiken. Inflation, De-Globalisierung, Überschuldung der Staaten, politische Radikalisierung.

Aber die ganzen Untergangspropheten verdienen Geld damit, dich in Panik zu versetzen – und dich in schlechte...

Read More »

Read More »

Sind aktive ETFs besser? | Geld ganz einfach

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_xuOnpNPqqn4

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_xuOnpNPqqn4

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_xuOnpNPqqn4

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_xuOnpNPqqn4

Trade...

Read More »

Read More »

“Dividenden sind ökonomisch Blödsinn” Prof. Martin Weber erklärt, wie man vom Vermögen lebt!

Die richtige Entnahme-Strategie um später vom Vermögen zu leben!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=876&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

Finanzfluss Copilot: App für dein Vermögen ►► https://link.finanzfluss.de/r/copilot-app-yt 📱

ℹ️ Weitere Infos zum Video:

Markus hat mit Professor Dr. Martin Weber über Entnahme-Strategien...

Read More »

Read More »

The Greater Depression Is Here – Robert Kiyosaki, Doug Casey

Economists call it “The Greater Depression”—and according to Robert Kiyosaki and Doug Casey, it’s already here. The U.S. dollar is losing trust, debt is skyrocketing, and millions of people are completely unprepared for what comes next.

In this urgent conversation, Robert and Doug explain why the financial system is broken and what ordinary people can do to protect themselves.

You’ll learn:

-Why government debt and money printing guarantee...

Read More »

Read More »

Heizperiode beginnt! #oktober

Heizperiode beginnt! 🔟 #oktober

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen und...

Read More »

Read More »

Kimonos For Bitcoin: 150 Year Old Company Goes Crypto

In a bold and unusual pivot, a traditional Japanese manufacturer of Kimonos is transitioning to a cryptocurrency treasury company. Marusho Hotta, which has been manufacturing kimonos since 1861, will rebrand as the Bitcoin Japan Corporation. The transformation stems from a June acquisition by Bakkt Holdings (BKKT), which took a controlling stake in the company to …

Read More »

Read More »

Diese Länder produzieren am meisten Bier #oktoberfest

Diese Länder produzieren am meisten Bier 🍻 #oktoberfest

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

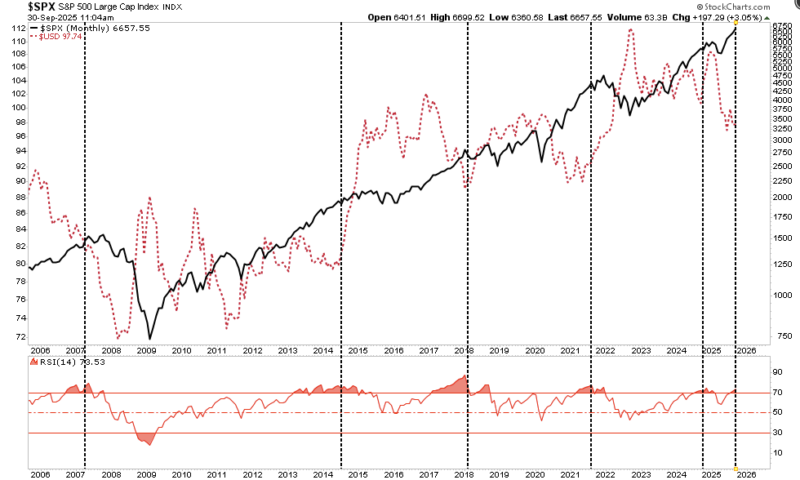

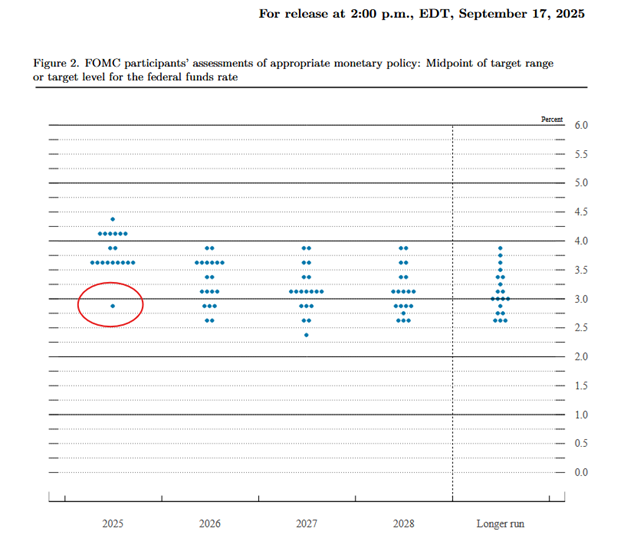

Miran Says Rates Are Too High: Politics Or Reality?

Stephen Miran, Donald Trump's recent addition to the Fed, joined the Federal Reserve the day before the last meeting. At that meeting, he was the only dissenting vote, supporting a 50-basis-point rate cut. All other members voted for a 25-basis-point cut. Additionally, Miran is likely the FOMC participant who thinks the Fed Funds rate should …

Read More »

Read More »

9/30/25 The Truth About Government Shutdowns

A government shutdown is likely but not catastrophic, as the media portrays it.

In this Short video, I break down what actually happens when the government shuts down.

Full episode: https://www.youtube.com/live/OAZFiVQoJYU?si=tD3sA1GaxNZdAMrp

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

e

Read More »

Read More »

La Jugada Maestra de Hernán Barcos: Invertir Su Dinero (Fernando González & Hernán Barcos)

👉 https://realmentor.net/rd 👈 ¡ENTRA AQUÍ y descubre cómo incluso la fama y el dinero no garantizan libertad financiera! Aprende a construir ingresos pasivos y asegurar tu futuro con la filosofía de Padre Rico y la experiencia de Fernando González, representante oficial de Robert Kiyosaki por más de 28 años.

⚽ En este episodio exclusivo grabado en Lima, Perú, Hernán Barcos ( https://www.instagram.com/barcos/ ) —jugador histórico de Alianza Lima—...

Read More »

Read More »

Änderungen rund um dein Girokonto #oktober

Änderungen rund um dein Girokonto 🔟 #oktober

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu...

Read More »

Read More »

9-30-25 Why Do We Invest? 10 Powerful Reasons Explained

Why do we invest? The answer goes far beyond just making money. Lance Roberts & Jonathan Penn, Two Dads on Money, break down the most important reasons people put their money to work in the markets.

Lance and Jon also show why investing is not just for Wall Street professionals—it’s for everyone.

Whether you’re just starting out or refining your long-term strategy, this episode will give you a clear framework for why investing is essential...

Read More »

Read More »

The Government Is Shutting Down Again: Who Cares?

If Congress can’t come to a budget resolution in the next 24 hours, the government will shut down. Sound familiar? We have become numb to the prospect of a government shutdown because it occurs so frequently. Most often, continuing resolution bills are agreed upon before a shutdown, thus enabling the government to continue operating. In …

Read More »

Read More »

The future is now 🤖 #quantencomputer

The future is now 🤖 #quantencomputer

Marktgeflüster Podcast #167: Was ne scheiß Woche

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit...

Read More »

Read More »

9/26/25 2026 Growth Expectations Are Ahead of Reality

Wall Street expects a broad earnings rebound (beyond MAG7) in 2026, but the data says otherwise.

In this short video, I discuss why hopes for strong economic growth—without stimulus, with weakening leading indicators, and with the yield curve still inverted—are ahead of reality.

Read More »

Read More »