Category Archive: 9a) Buy and Hold

Was kostet es zu sterben? | Finanzfluss

Wieviel kostet eine Beerdigung? Bestattungskosten erklärt! Kostenloses Depot inkl. 20€ Prämie: ►► https://www.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=314&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *? In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Financial Fitness Friday (8/28/20)

Market Analysis & Commentary from RIA Advisors Director of Financial Planning, Richard Rosso, CFP w Senior Advisor, Danny Ratliff, CFP

Read More »

Read More »

Zuseherkommentar über Mythen und Verschwörungen

✘ Werbung: https://www.Whisky.de/shop/ Es ist schon krass, wie manche Menschen an #Weltverschwörungen glauben. Ich nehme eine E-Mail zum Anlass, um aus einigen #Gedankenblasen mal die Luft abzulassen. Es geht um Glauben, Gold, Parteien und Vieles mehr. Parlamentarischer Rat ► https://www.historisches-lexikon-bayerns.de/Lexikon/Verfassungskonvent_von_Herrenchiemsee,_10.-23._August_1948 BIP Wikipedia ►...

Read More »

Read More »

The Waffle House Index & Post-Election Planning / Financial Fitness Friday (8/28/20)

SEG-1: It's Jerome Powell's World (We just live in it)

SEG-2: Fed-sparked Inflation: Will it Float?

SEG-3: Moonjars and ROTH Conversions

SEG-4: The Waffle House Index & Post-election Planning

--------

RIA Advisors Director of Financial Planning, Richard Rosso, CFP w Senior Advisor Danny Ratliff, CFP

--------

Articles mentioned in this podcast:

https://realinvestmentadvice.com/the-first-trillion-is-always-the-hardest-analyzing-apple-mania/...

Read More »

Read More »

The Best of The Real Investment Show for Week Ending 8/28/20

President Trump's Executive Orders: Truth & Consequences

If I Were King (of the Post Office)

The Expiry of Federal Stimulus

0% Interest Rates' Negative Effects on Economic Growth

The Fed's "New" Tool

RIA Advisors Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA, from this week's episodes of The Real Investment Show.

--------

Articles mentioned in this podcast:...

Read More »

Read More »

0% Interest Rates’ Negative Effect on Economic Growth (8/27/20)

If you think lower and lower interest rates are great for consumers and the economy...think again. Chief Investment Strategist Lance Roberts w w Portfolio Manager, Michael Lebowitz, CFA

--------

Articles mentioned in this podcast:

https://realinvestmentadvice.com/the-first-trillion-is-always-the-hardest-analyzing-apple-mania/

https://realinvestmentadvice.com/technically-speaking-why-this-isnt-1920-valuations-returns/...

Read More »

Read More »

The Fed Preview (Full Show EDIT) 8/27/20

SEG-1: The Masked Weatherman; The Jackson Hole Meeting

SEG-2: The Fed's New Tool!

SEG-3: The Negative Effect of Interest Rates on Economic Growth

SEG-4: Apple vs Amazon

--------

Chief Investment Strategist Lance Roberts w w Portfolio Manager, Michael Lebowitz, CFA

--------

Articles mentioned in this podcast:

https://realinvestmentadvice.com/the-first-trillion-is-always-the-hardest-analyzing-apple-mania/...

Read More »

Read More »

The Perception of Risk vs Reality / Three Minutes on Markets & Money (8/27/20)

Why are traders no longer hedging--no perception of risk? Expectations of economic recovery vs what yield spreads are telling us. Unemployment benefits affecting consumer confidence, which is not reflective of markets'

Chief Investment Strategist Lance Roberts

--------

Get more info & commentary:

https://realinvestmentadvice.com/newsletter/

--------

SUBSCRIBE to The Real Investment Show here: https://www.youtube.com/c/TheLanceRobertsShow...

Read More »

Read More »

(8/26/20) The Pre-Hurricane Episode

Market Analysis & Commentary from RIA Advisors Chief Investment Strategist, Lance Roberts w Senior Advisor, Danny Ratliff, CFP

Read More »

Read More »

(8/26/20) The Pre-Hurricane Episode

Market Analysis & Commentary from RIA Advisors Chief Investment Strategist, Lance Roberts w Senior Advisor, Danny Ratliff, CFP

Read More »

Read More »

The Expiry of Federal Stimulus (8/26/20)

The reality of the March rally is it was based on a temporary infusion of funds to households; the next round of federal stimulus will be smaller...and the subsequent "boost" to the economy will be proportionately less.

Chief Investment Strategist Lance Roberts w Senior Advisor Danny Ratliff, CFP

--------

Register for the next Candid Coffee:

https://register.gotowebinar.com/rt/1959782027202558734?source=Ria+Website%22

--------

Get more...

Read More »

Read More »

The Pre-Hurricane Episode (Full Show EDIT) 8/26/20)

SEG-1: Market Momentum Doesn't Translate into Economic Growth

SEG-2: Bump Music; Politics & Promising the Moon

SEG-3: The Expiry of Federal Stimulus

SEG-4: Allowing Inflation to "Run Hot"

--------

Market exuberance over new, all-time highs can sometimes cloud the view from such altitudes, obscuring lessons to be learned from past peaks and subsequent falls.

Chief Investment Strategist Lance Roberts w Senior Advisor Danny Ratliff,...

Read More »

Read More »

Wie riskant sind High Yield Bonds von Wirecard, Carnival & Co. | Interview mit Philipp Degenhard

Wie riskant sind High Yield Bonds? Kostenloses Depot inkl. 20€ Prämie: ►► https://www.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=310&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *? In 4 Wochen zum souveränen Investor: ►► https://www.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=310&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ? ℹ️ Weitere Infos zum...

Read More »

Read More »

Lasst die Innenstädte doch zum Disneyland verkommen! Blogbeitrag von Nils Seebach digitalkaufmann.de

✘ Werbung: https://www.Whisky.de/shop/ Sätze wie „Kaufhäuser sind unverzichtbare #Magnete der #Innenstädte und Frequenzbringer!“ und „Die Fußgängerzone wird ohne einen starken Anker wie Kaleriahof aussterben“ bilden seit Jahren das obligatorische Begleitgeplänkel zu jedem neuen Kapitel in der jähen #Krisengeschichte der #Kaufhäuser. Nur: Allein durch stetige Wiederholung wird eine steile, jeder faktischen Grundlage entbehrenden Behauptung nicht...

Read More »

Read More »

Markets’ All Time Highs – We’ve Been Here Before / Three Minutes on Markets & Money (8/26/20)

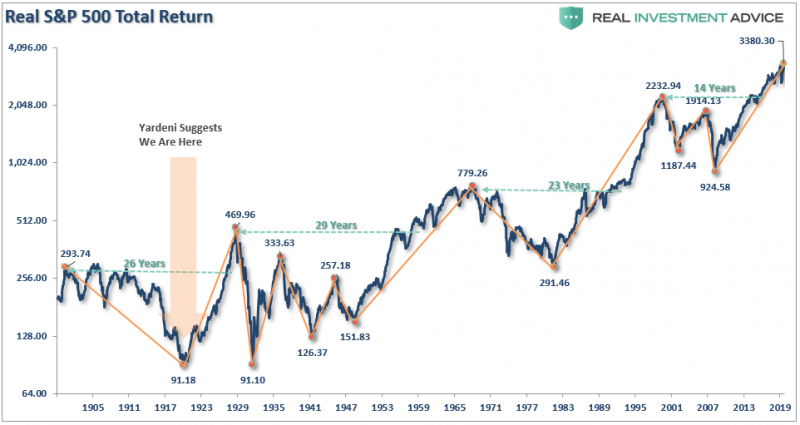

Market exuberance over new, all-time highs can sometimes cloud the view from such altitudes, obscuring lessons to be learned from past peaks and subsequent falls.

Chief Investment Strategist Lance Roberts

--------

Get more info & commentary:

https://realinvestmentadvice.com/newsletter/

--------

SUBSCRIBE to The Real Investment Show here: https://www.youtube.com/c/TheLanceRobertsShow

--------

Visit our Site: www.realinvestmentadvice.com...

Read More »

Read More »

Technically Speaking: Why This Isn’t 1920. Valuations & Returns

Why this isn’t 1920 has everything to starting valuations and future returns. While, generally, I’m not too fond of comparisons between today’s markets and the past, Ed Yardeni made a comparison too bombastic to disregard in his blog.

Read More »

Read More »

(8/25/20) Technically Speaking Tuesday

Market Analysis & Commentary from RIA Advisors Chief Investment Strategist, Lance Roberts

Read More »

Read More »

The Root of Wealth Insecurity [8/25/20]

The political and social turmoil that now grips the nation has it's seed in a very fundamental place.

Chief Investment Strategist, Lance Roberts

--------

Articles mentioned in this podcast:

https://realinvestmentadvice.com/technically-speaking-why-this-isnt-1920-valuations-returns/

--------

Register for the next Candid Coffee:

https://register.gotowebinar.com/rt/1959782027202558734?source=Ria+Website%22

Get more info & commentary:...

Read More »

Read More »

This is Not the Roaring ’20’s | Technically Speaking Tuesday – FULL SHOW [8/25/20]

SEG-1: Transformation of Dow Index from "Industrials"

SEG-2: Hurricane Preparedness & HEB; Changes in the Dow

SEG-2: The Root of Wealth Insecurity

SEG-4: 1920 vs 2020: Valuation & What We Pay

Chief Investment Strategist, Lance Roberts

--------

Articles mentioned in this podcast:

https://realinvestmentadvice.com/technically-speaking-why-this-isnt-1920-valuations-returns/...

Read More »

Read More »