Category Archive: 9a) Buy and Hold

Friedensangst in Europa – Blogger, Journalisten und Propaganda – und etwas Philosophie

Die #Angst vor Frieden geht im politischen #Europa um. #Medien, Politik und #Rüstung sehen ihre Einkommensquellen schwinden. Ich erkläre an meinem Beispiel, wie sich Blogger, Journalisten und Propagandisten voneinander unterscheiden.

-

✘ Werbung:

Mein Buch Politik für Wähler ► https://amazon.de/dp/B0F92V8BDW/

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch...

Read More »

Read More »

12-2-25 LIVE Q&A: Ask Us Anything About Markets & Money

Welcome to our LIVE Q&A session!

Lance Roberts is taking your questions directly from the YouTube live chat—covering markets, investing, retirement planning, inflation, interest rates, the Federal Reserve, portfolio strategy, risk management, and your personal finance questions.

No scripts, no agenda—just real-time answers based on data, history, and risk-focused investing principles.

We’ll break down what’s moving the markets, how to think...

Read More »

Read More »

Sollen Kapitalerträge jetzt besteuert werden?

Sollen Kapitalerträge jetzt besteuert werden? 🤔 Was haltet ihr von den aktuellen Rentenplänen?

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit...

Read More »

Read More »

How to Reduce Taxes on Investment Gains: Advanced Strategies for High Net Worth Investors

Building wealth requires more than market awareness; it requires keeping as much of your earnings as possible. High net worth investors face steeper tax exposure, wider reporting thresholds, and more complex investment structures. Learning how to reduce taxes on investment income is one of the most effective ways to strengthen long‑term performance. Below are the …

Read More »

Read More »

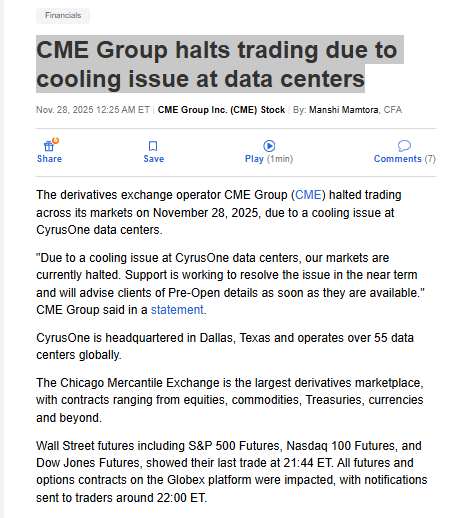

Overheating Financial Markets Highlight Data Centers Handicap

The Chicago Mercantile Exchange (CME) trading platforms were shut down for approximately 4 hours due to overheating after its cooling system at its Illinois data center failed. The outage began around 10:00 p.m. ET on November 27, halting about 90% of global derivatives volume on the Globex platform across futures and options for equities, bonds, …

Read More »

Read More »

Mindestlohn hoch, Minijob zieht mit

📈 Der Mindestlohn steigt – und die Minijob-Grenze gleich mit!

💰 2024 lag der Mindestlohn noch bei 12,50 € – bis 2027 soll er auf 14,60 € steigen. Das bringt spürbar mehr Netto für viele Arbeitnehmer:innen.

🧾 Die Minijob-Grenze wird daran angepasst: Von 538 € (2024) auf 633 € (2027). Bedeutet: Du darfst mehr verdienen, ohne Deinen Status als Minijobber:in zu verlieren.

💡 Gerade für Studis, Rentner:innen oder alle mit Nebenjob lohnt sich das....

Read More »

Read More »

12-1-25 A Perfect Year-End Rally Setup But With One Big Warning

Markets $SPX $NDX followed classic seasonality with a November dip that set up a potential year-end rally. But after six straight monthly gains, the odds of a pullback are rising.

In this short video, I explain why seasonality supports upside, but this streak makes risk management more important than ever.

Read More »

Read More »

Das 5. Geschlecht wird dich nicht reich machen

⚡ Work-Life-Balance, 5 Geschlechter, Klimakleber, Selbstfindung…

Alles Themen, die gerade ins Extreme ausschlagen.

Ja, das Pendel wird sich wieder beruhigen, aber jetzt ist deine Chance:

Während alle ab Donnerstag ins lange Wochenende verschwinden, kannst du arbeiten, Leistung bringen und Geld verdienen. 💸

Geld, das du heute clever investierst, baut dir Immobilien, Cashflow und Freiheit für morgen auf. 🏠

#mindset

#finanziellefreiheit...

Read More »

Read More »

12-1-25 Bear Markets Are a Good Thing

Bear markets aren’t the enemy—they’re the reset that creates future returns.

Lance Roberts breaks down why market downturns are a normal, necessary, and even healthy part of a full market cycle. We explore how bear markets cleanse excess speculation, reset valuations, restore forward returns, and give disciplined investors long-term opportunities to improve financial outcomes.

We’ll discuss why drawdowns feel worse than they are, why expectations...

Read More »

Read More »

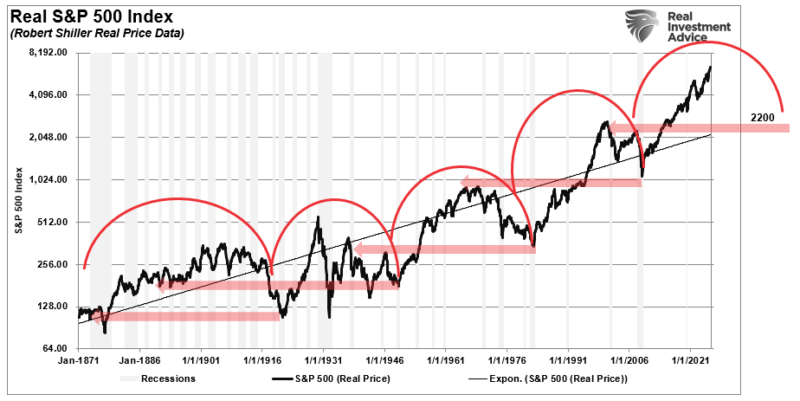

A Bear Market Is A Good Thing.

One of my favorite writers for the WSJ is Spencer Jakab, who recently penned an article explaining why a bear market is not necessarily a bad thing. He starts with a quote from "The Godfather." "“These things gotta happen every five years or so, ten years. Helps to get rid of the bad blood…been ten … Continue reading »

Read More »

Read More »

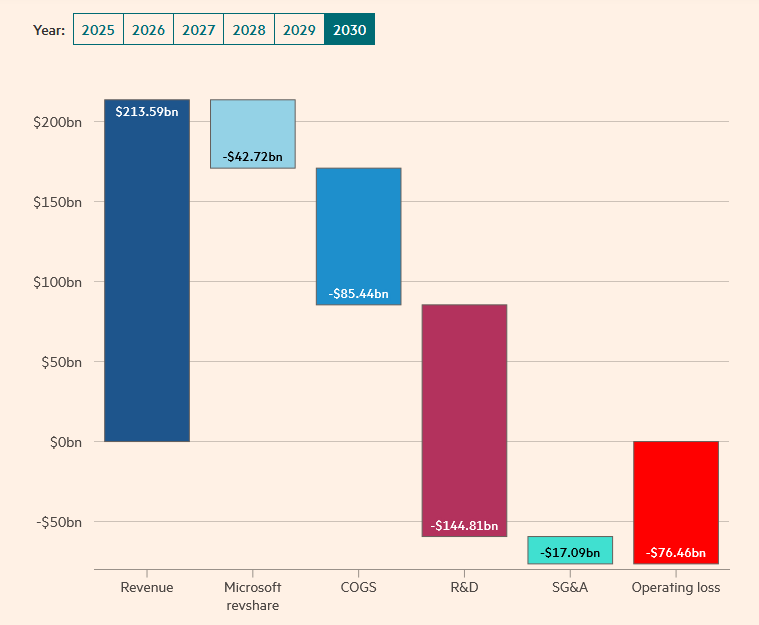

HSBC Casts Doubt On OpenAI’s Future

Per the Financial Times (LINK), HSBC has serious doubts about OpenAI's financial wherewithal. The following bullet points outline HSBC's assumptions, which highlight the challenging financial path OpenAI faces. The graphic below from the article shows that HSBC expects OpenAI to run a massive operating loss in the year 2030. Accordingly, they have serious concerns about …

Read More »

Read More »

Was haben WWM und Elterngeld gemeinsam?

👶💰 Was haben Elterngeld und „Wer wird Millionär?“ gemeinsam?

💡 Beide wurden seit ihrer Einführung nicht erhöht – und verlieren durch die Inflation massiv an Wert.

📺 Bei „Wer wird Millionär?“ gibt’s seit 2002 1 Mio. € zu gewinnen. Heute bräuchte es etwa 1,5 Mio. €, um denselben Wert zu haben.

👨👩👧👦 Das Elterngeld gibt’s seit 2007 – maximal 1.800 € im Monat. Heute wären eigentlich 2.600 € nötig, um dieselbe Kaufkraft zu haben.

📉 Bedeutet:...

Read More »

Read More »

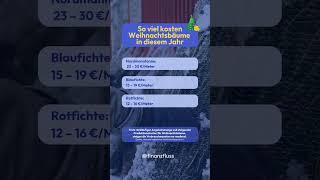

So viel kosten Weihnachtsbäume 2025

So viel kosten Weihnachtsbäume 2025 🎄

Hast du schon einen Baum gekauft? Wie teuer war er?

#Weihnachtsbaum #Weihnachten #Weihnachten2025 #Tannenbaum

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔...

Read More »

Read More »

Die Sozialisten hassen es!

Die Sozialisten hassen es:

💥 Erfolgsbeteiligung.

Weil das bedeuten würde, dass sich Leistung lohnt.

Genau darauf basiert die amerikanische Wirtschaft:

Finde Menschen, die sich einsetzen, Verantwortung übernehmen

und am Gewinn beteiligt sind.

So wachsen sie und du gleich mit. 🚀

#leistungmusswiedersichtlohnen

#unternehmertum

#mindset

#erfolg

Read More »

Read More »

In weniger als 10 Jahren in Rente gehen? #fire

In weniger als 10 Jahren in Rente gehen? 🔥 #fire

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung...

Read More »

Read More »

Investieren, wenn die Blase platzt: Crash-Anlage vs. Sparplan

Buy the Dip vs. Sparplan: Crash-Strategien getestet!

Black Week: -44% auf Finanzfluss Copilot PLUS bis 1.12. ►► https://link.finanzfluss.de/r/black-week-youtube-ff 📱*

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=891&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

ℹ️ Weitere Infos zum Video:

Viele Anleger halten Cash zurück und warten auf den nächsten...

Read More »

Read More »

Düstere Prognose: USA kurz vor dem Crash?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_MSgmj6ax3VU

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_MSgmj6ax3VU

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_MSgmj6ax3VU

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_MSgmj6ax3VU

Trade...

Read More »

Read More »

Finanzbildung? Große Lücken bei jungen Menschen

📚 Finanzbildung? Bei jungen Menschen gibt’s noch ordentlich Nachholbedarf!

💡 Laut Finanztip-Umfrage schätzen viele 18- bis 29-Jährige ihr Wissen zu wichtigen Finanzthemen als (sehr) schlecht ein – vor allem bei:

🏗️ Bauen (60 %),

📈 Börse (50 %),

💳 Kredit & Steuern (je 47 %),

⚖️ Recht (46 %),

👵 Altersvorsorge (40 %).

🏠 Besser sieht’s bei Miete und Versicherungen aus – aber auch hier sagt jede:r Dritte: „Ich hab keinen Plan.“

💥 Das ist nicht...

Read More »

Read More »

Was soll der digitale Euro eigentlich bringen? 🤔

Was soll der digitale Euro eigentlich bringen? 🤔

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung...

Read More »

Read More »