Category Archive: 9a) Buy and Hold

Strafzölle – Die deutsche Autoindustrie auf der Kippe

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Die heimische #Automobilindustrie steht am Scheideweg. Man hat sich Jahrzehnte auf den Lorbeeren ausgeruht und dabei die #Zukunft verschlafen. Jetzt versucht die EU mit #Strafzöllen den Siegeszug #Chinas zu verhindern. Bei Stereoanlagen, Videorecordern,...

Read More »

Read More »

So viele Überstunden machen Menschen in DE

Überstunden wirken sich nicht nur auf die Produktivität und Gesundheit aus, sondern auch auf Deinen Geldbeutel. Wie viele Überstunden wir in Deutschland durchschnittlich machen und was Du bei unbezahlten Überstunden tun kannst, erfährst Du hier von Leo.

#Finanztip

Read More »

Read More »

Trade Republic reagiert auf Finanztip

Die irische Einlagensicherung bei Trade Republic: Ein Detail, das wir bei Finanztip kritisieren. Jetzt hat der Neobroker darauf reagiert und eine wichtige Neuerung präsentiert.

Read More »

Read More »

7-19-24 Have Economic Concerns Put Your Retirement Plans on Hold?

A recent survey reveals 50+ aged Americans are either delaying their retirement or considering re-entering the workforce. Generation X stands out as particularly anxious about retirement. Concerns about not having enough money (49%), inflation (47%), and the desire for more financial options (42%) were among the top reasons cited for delaying retirement.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial...

Read More »

Read More »

How Delta Hedging and Beta Weighting Can Protect Your Portfolio #stockmarketforbeginners

Https://www.richdad.com/

Facebook: @RobertKiyosaki

https://www.facebook.com/RobertKiyosaki/

Twitter: @TheRealKiyosaki

https://twitter.com/theRealKiyosaki

Instagram: @TheRealKiyosaki

https://www.instagram.com/therealkiyosaki/

-----

Disclaimer: The information provided in this video is for educational and informational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any financial instrument or...

Read More »

Read More »

Why You Need a Financial Advisor

RIA Advisors' Chief Investment Strategist recounts how you can tell you need a financial advisor, and why the group of advisors at RIA can best fill your needs.

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Upcoming personal finance free online events:...

Read More »

Read More »

4 Dinge, die Du bei der Steuererklärung vergisst

Die Steuererklärung wird jedes Jahr aufs Neue fällig. Und egal wie oft Du sie machst, es gibt wahrscheinlich jedes Jahr ein paar Punkte, die Du übersiehst. Welche das sind, das erklärt Dir Leo in diesem Video.

#Finanztip

Read More »

Read More »

Erfüllt dein aktuelles Konto diese vier Punkte? ️ #girokonto

Erfüllt dein aktuelles Konto diese vier Punkte? ?️ #girokonto

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Mit dieser Karte lauert Stress im Urlaub

Der Urlaub steht an und Du willst ein Hotel oder einen Mietwagen buchen? Xenia erklärt dir, welche Karte Du dafür lieber nicht nutzen solltest und warum.

#Finanztip

Read More »

Read More »

Relationship Between Fed Rate Cuts and Treasury Yields Explained

During a rate cutting environment, treasury bonds tend to do well. Fed funds cuts lead to falling ten year treasury yields due to Fed control over the short end of the curve. #investing #economy

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

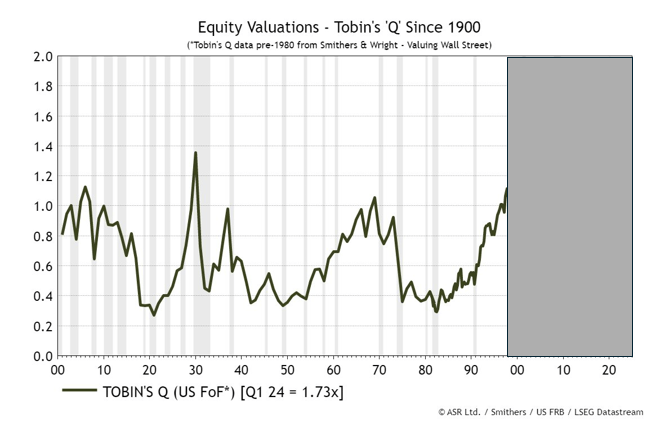

7-18-24 Irrational Exuberance Then And Now

Walking the tightrope between irrational exuberance and reality is complex. Therefore, appreciate the market for what it is. This bull market has no known expiration date. Active management, using technical and fundamental analysis along with macroeconomic forecasting, is crucial to managing the potential risks and rewards that lie ahead. What if we are experiencing rational exuberance and AI is an economic game changer? What if current valuations...

Read More »

Read More »

Top 10 AI Stocks

Join host Andy Tanner and his guests, Noah Davidson and Corey Halliday, on the Cashflow Academy podcast as they discuss the top 10 AI stocks as determined by AI.

They dive into the role of AI in the financial sector, personal anecdotes about early tech adoption, and provide insights into how AI can be leveraged in stock trading and investing. Plus, they explore the exciting and sometimes frightening implications of AI advancing past human...

Read More »

Read More »

Immobilien Kongress LEAK: Warum Profi-Investoren jetzt zuschlagen

? https://betongoldwebinar.com/yt ?Jetzt Gratis Immobilien-Webinar ansehen!

Auch wenn die Zinsen heute höher sind, ist genau jetzt der beste Zeitpunkt, um in #Immobilien zu investieren. Der Markt zeigt gerade eine besonders gute Kombination auf, die es so schnell nicht mehr geben wird. Doch welche sind das und wieso ist es jetzt so einfach, mit Immobilien #reich zu werden?

Wie das geht und wieso sich dabei hässliche kleine Löcher besonders...

Read More »

Read More »

Probier mal diese 7 Steuertricks | Geld ganz einfach

Steuerprogramm & App: Wiso, Taxfix, Smartsteuer

Wiso Steuer 2024* ► https://www.finanztip.de/link/buhlwisosteuer-steuersoftware-yt/yt_Ys6TeZT750w

Steuersparerklärung (Steuerjahr 2023)* ► https://www.finanztip.de/link/wolterssteuersparerklaerung-steuersoftware-yt/yt_Ys6TeZT750w

Tax 2024* ► https://www.finanztip.de/link/buhltax-steuersoftware-yt/yt_Ys6TeZT750w

Steuerbot* ► https://www.finanztip.de/link/steuerbot-steuersoftware-yt/yt_Ys6TeZT750w...

Read More »

Read More »

Mastering Hurdle Rates: How to Achieve Financial Success

Ever wonder about hurdle rates in your financial plan? It's the key return needed for success. Patience is key in investing. No shortcuts! ? #FinanceTips

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-17-24 Avoiding the Sexy Stock Plays

With a slowing economy, what's the best play for investors? The market has been sustained essentially by seven large-cap stocks, but that dynamic appears to be shifting, and the appeal of making big money quickly may blind you to the realities in the market.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

Articles mentioned...

Read More »

Read More »

EM Einnahmenhistorie ️ #euro

EM Einnahmenhistorie ⚽️? #euro

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen und...

Read More »

Read More »

Irrational Exuberance Then And Now

On December 5, 1996, Chairman of the Fed Alan Greenspan offered that stock prices may be too high, thus risking a correction that could result in an economic fallout. He wondered out loud if the market had reached a state of “irrational exuberance.”

Read More »

Read More »

Listen to why inflation can lead to bad political decisions that hurt everyone. #monetarypolicy

Https://www.richdad.com/

Facebook: @RobertKiyosaki

https://www.facebook.com/RobertKiyosaki/

Twitter: @TheRealKiyosaki

https://twitter.com/theRealKiyosaki

Instagram: @TheRealKiyosaki

https://www.instagram.com/therealkiyosaki/

-----

Disclaimer: The information provided in this video is for educational and informational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any financial instrument or...

Read More »

Read More »

Automate Your Wealth: Strategies for Financial Growth – Jaren Sustar, Brennan Schlagbaum

In this episode of The Rich Dad Radio Show, host Jaren Sustar fills in for Robert Kiyosaki and interviews Brennan Schlagbaum, a bestselling author and founder of Budget Dog. They discuss practical steps for achieving financial freedom through automation, simplification, and focusing on the fundamentals of finance. Brennan shares his personal journey of overcoming debt, building wealth, and why financial transparency is crucial. The episode also...

Read More »

Read More »