Category Archive: 9a) Buy and Hold

Investieren wie Milliardäre! Mit solchen Sprüchen versuchen einige Anbieter, ELTIFs zu bewerben.?

Investieren wie Milliardäre! - Mit solchen Sprüchen versuchen einige Anbieter, ELTIFs zu bewerben. ? #eltifs

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in...

Read More »

Read More »

Die beste Kamera für Foto und Video – Was nutze ich? – Geschichte + Technik

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

#Fotografieren ist seit meiner Studentenzeit ein großes #Hobby von mir. Mit der Zeit und YouTube kamen dann auch Videos hinzu, mit denen ich auch Geld verdiene. Zuerst gibt es etwas Geschichte und #Technik und schließlich erzähle ich, welche vier Kameras ich...

Read More »

Read More »

Meister-Ausbildung für 100.000€: Lohnt sie sich trotzdem?

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_RjJnAlvmfjk

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_RjJnAlvmfjk

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_RjJnAlvmfjk

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_RjJnAlvmfjk

Justtrade

Traders Place* ►...

Read More »

Read More »

Avoid Sleepless Nights_Financial Crisis Insights

Let's stay positive and focus on being okay. Self-fulfilling prophecies are real! Remember the crashes in 2008 and 2000? Stay strong ? #positivity #financialadvice #recession

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

#523 Trotz Krise: Werden ETFs ewig steigen? #etf

#523 Trotz Krise: Werden ETFs ewig steigen? ?? #etf

Wird der Aktienmarkt für immer steigen? Und hat dieses Wachstum vielleicht irgendwann auch mal eine Grenze? Wenn wir langfristig investieren, gehen wir davon aus, dass der Aktienmarkt steigen wird. In dieser Folge erklären wir dir, wieso wir eigentlich davon ausgehen und weshalb du dir keine Sorgen vor einer ETF-Blase machen musst.

Read More »

Read More »

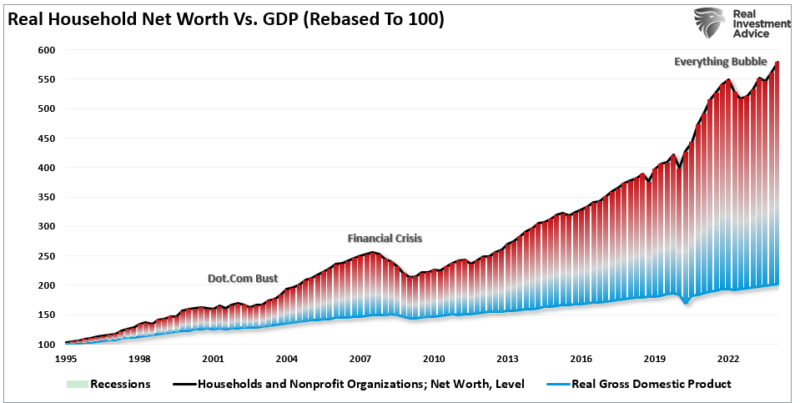

Economic Growth Myth & Why Socialism Is Rising

I was recently asked about the seemingly strong “economic growth” rate as the Federal Reserve prepares to start cutting rates.

“If economic growth is so strong, as noted by the recent GDP report, then why would the Federal Reserve cut rates?”

It’s a good question that got me thinking about the trend of economic growth, the debt, and where we will likely be.

Since the end of the financial crisis, economists, analysts, and the Federal...

Read More »

Read More »

Ist dein Stundenlohn illegal?

Verdienst Du so wenig Geld, dass es eigentlich illegal ist? Wie hoch der aktuelle Mindestlohn ist und wie Du dir deinen Stundenlohn ganz einfach selbst ausrechnen kannst, das erfährst Du hier von Leo.

#Finanztip

Read More »

Read More »

Understanding Recession Risks During Market Decline and Fed Rate Hikes

? Worried about recession risks and market declines? ? Stay informed about the Fed's rate hikes and market trends to make wise investment decisions! #FinanceTips #MarketInsights

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Auch nach dem Tod sind Steuererklärungen fällig ? #steuern

Auch nach dem Tod sind Steuererklärungen fällig ? #steuern

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

Supply Chain Disruption – Tom Wheelwright, Peter Goodman

Join Tom Wheelwright as he discovers how small business owners can gain resilience, forecast the future of the supply chain, and build a disruption-proof strategy with his guest, American economics journalist and author, Peter S. Goodman.

Peter S. Goodman is the global economic correspondent for The New York Times, based in New York. He appears regularly on The Daily podcast, as well as major broadcast outlets like CBS News, CNN, the BBC, and...

Read More »

Read More »

8-15-24 How to Buy a Dividend Stock

July CPI clocks-on on-target for the Federal Reserve to cut rates, as it indicate inflation is trending downward. This would set-up the Fed for up to four rate cuts by the end of the year, but not so great for stocks. Watch for seasonal adjustments to Retail Sales reports. Markets will challenge 50-DMA, and could end its correction today. Your personal experience with inflation is not the same as Government calculations, which is what markets look...

Read More »

Read More »

Discover the peace of mind a living trust can bring! #TrustPlanning #SecureYourAssets

-----

Disclaimer: The information provided in this video is for educational and informational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any financial instrument or engage in any financial activity.

The content presented here is based on the speaker's personal opinions and research, which may not always be accurate or up-to-date. Financial markets and investments carry inherent risks, and...

Read More »

Read More »

Heiraten = neue Steuerklasse? #shorts

Steuerklasse 3, 4 oder 5? Welche Steuerklasse ist nach der Hochzeit am sinnvollsten? Saidi erklärt Dir in diesem Video kurz, wie sich das auf deine Steuererklärung auswirkt.

#Finanztip

Read More »

Read More »

Investment Opportunities and Strategies to Protect Your Portfolio

In this episode, host Andy Tanner is joined by Corey Halliday and Noah Davidson for a deep dive into current market trends, investment opportunities, and strategies to protect your portfolio during turbulent times. This episode is packed with valuable insights on the Federal Reserve's actions, consumer behavior shifts, and the impact of inflation on the economy.

Understanding Market Shifts

Andy and his guests kick off the discussion with an...

Read More »

Read More »

Moving Beyond the Dollar with Gold and Silver – Robert Kiyosaki, Andy Schectman

In the latest episode of the Rich Dad Radio Show, Robert Kiyosaki teams up with Andy Schectman, president and founder of Miles Franklin Precious Metals, to tackle the pressing issues facing the global financial system today. This episode is a must-listen for anyone concerned about the stability of their investments in an increasingly volatile world.

This episode is essential for anyone who wants to safeguard their financial future in a rapidly...

Read More »

Read More »

Monopoly offenbart Egoismus bei Reichen!

Monopoly offenbart Egoismus bei Reichen! ?

? Jeder weiß, dass sich beim Monopoly das wahre Gesicht einer Person zeigt! Das haben sich Forscher zunutze gemacht. In der Studie wurde ein Monopoly-Spiel manipuliert, indem Spieler von Anfang an mehr Geld und Vorteile erhielten.

#️⃣ #monopoly #studie #experiment

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als...

Read More »

Read More »

Boost Your Portfolio with Collectible Coins

Owning gold coins with collector's value can outperform gold price over time! Understand what you own and why. #InvestingTips #GoldCoins

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-14-24 Looking for Rate Cut Clues in CPI Data

The PPI number came in weaker than expected with lower input prices. Today's CPI report (a 0.2% monthly increase = 3.2% annual rate) weakness could spur the Fed to lower rates, although to what extent remains unknown. The upcoming Jackson Hole Economic Summit could also provide impetus for the Fed's action in September. Meanwhile, markets on Tuesday cleared the 100-DMA, and are looking for confirmation at the 50-DMA. Will he or won't he? Danny's...

Read More »

Read More »

Top 10 der wertvollsten Unicorns ? #unicorn

Top 10 der wertvollsten Unicorns ? #unicorn

Quelle: CB Insights, 2024

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »