Category Archive: 9a) Buy and Hold

Krankenkasse wird für viele teurer. Was jetzt? | Geld ganz einfach

Krankenkassenvergleich 2024: Die besten Krankenkassen

HKK* ► https://www.finanztip.de/link/hkk-gkv-yt/yt_lMH1A6BWVhs

TK

Audi BKK* ► https://www.finanztip.de/link/audibkk-gkv-yt/yt_lMH1A6BWVhs

HEK

Energie-BKK* ► https://www.finanztip.de/link/energiebkk-gkv-yt/yt_lMH1A6BWVhs

Big direkt gesund* ► https://www.finanztip.de/link/bigdirekt-gkv-yt/yt_lMH1A6BWVhs

(Stand: 18.01.24)

? Jetzt Finanztip Unterstützer werden:...

Read More »

Read More »

Top 15 Exportnationen 1975-2023

Die Top 15 Exportnationen nach Waren- & Dienstleistungsexporten

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=811&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Vermögen tracken mit Finanzfluss Copilot: ►► https://www.finanzfluss.de/copilot/ ?

ℹ️ Weitere Infos zum Video:

Was sind eigentlich die größten Exportnationen der Welt? Wir haben...

Read More »

Read More »

Wie du dir ohne Kapital mit strategischen Beteiligungen ein Vermögen aufbaust! (Work for Equity)

? https://dealmakingtraining.de/geb-webinar-yt5 - Jetzt kostenlos zum Webinar am 24.10.2024 anmelden!

? Lerne, wie du dir mit strategischen Beteiligungen ein Vermögen aufbaust - auch ohne Eigenkapital!

In diesem Video zeigt dir Gerald Hörhan, wie du ohne eigenes Kapital an Unternehmensbeteiligungen oder Immobilienanteile kommen kannst – durch das sogenannte Work for Equity.

Er erklärt, wie du durch deine Arbeitsleistung oder spezifische...

Read More »

Read More »

How to Use Taxes and Debt to Build Wealth – Robert Kiyosaki

In this episode of Rich Dad Radio Show, hosts Robert Kiyosaki and Kim Kiyosaki are joined by financial experts Tom Wheelwright and Jason Hartman to discuss the critical importance of tax strategies and smart investments in today’s unpredictable financial environment. If you’re serious about protecting and growing your wealth, this episode delivers actionable insights into leveraging tax incentives and making strategic investment decisions that...

Read More »

Read More »

10-23-24 Technical Analysis Techniques

As promised, a show about that voodoo that we do!

(Actually, it's not voodoo, and Lance Roberts will explain why and how).

Markets sold off on Tuesday to break even. following six straight weeks of gains; still, markets have no fear of recession. Lance shares his personal strategy for Bonds (using his own money, not clients') When everyone is hating on Bonds is the time to buy. After the Election, the focus will return to Yields and Interest...

Read More »

Read More »

How Gen Z is Redefining Work-Life Balance and Challenging Hustle Culture

? Time to prioritize self-care and work-life balance! Gen Z leading the way in changing the hustle culture mindset. #selfcare #balance #genz ?♂️?

Watch the entire show here: https://cstu.io/c9ce2b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Top 15 OECD Länder mit dem höchsten Durchschnittsgehalt! ?

Top 15 OECD Länder mit dem höchsten Durchschnittsgehalt! ?

? Das sind die Top 15 Länder nach höchstem durchschnittlichen Jahreseinkommen in US-Dollar.

Die Werte sind kaufkraft- und inflationsbereinigt.

Quelle: https://stats.oecd.org/Index.aspx?DatasetCode=AV_AN_WAGE

(Die Daten der OECD Webseite wurden im Mai 2024 abgerufen. Seither hat sich die URL geändert und die Tabelle auf der dieses Video basiert, ist womöglich nicht mehr dort abrufbar)

#️⃣...

Read More »

Read More »

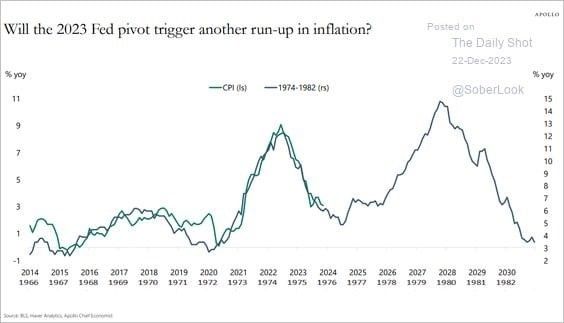

Memory Inflation Warps Bond Yields

The Mayo Clinic defines Post Traumatic Stress Disorder, or PTSD, as “a mental health condition that’s caused by an extremely stressful or terrifying event — either being part of it or witnessing it.” Within the field of PTSD research is a concept called “memory inflation.” Memory inflation occurs when memories of traumatic events become more intense over time.

Memory inflation of past events amplifies one’s emotions and behaviors. As we will...

Read More »

Read More »

Wohin mit einer großen Summe Geld?

Du bist gerade zu einer größeren Summe an Geld gekommen und weißt nicht, wie Du es am besten anlegen sollst? Saidi hilft Dir dabei in diesem Video.

#Finanztip

Read More »

Read More »

Finfluencer: Gibt es Grenzen? ?

Finfluencer: Ein spannender Blick auf die Trends der Finanzwelt. Doch wie bei allem im Leben, lohnt es sich, kritisch hinzuschauen. Was steckt hinter den Empfehlungen? Prüfe selbst, ob es zu dir passt! ?

Read More »

Read More »

Planning Retirement: Why Counting on 10% Annual Growth Could Be Risky

Are you saving enough for retirement? ? Don't wait too long to start investing! #financialplanning #retirementgoals ?

Watch the entire show here: https://cstu.io/0e9840

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

El secreto de Alejandro Cardona para hacerte RICO en 2024

? https://realmentor.net/rd ? ENTRA AQUÍ ¡No dejes pasar esta oportunidad de transformar tu visión empresarial en realidad ? ¿Cómo es posible que, a pesar de tener éxito en algunas áreas de tu vida, no logres alcanzar una verdadera libertad financiera? En este nuevo episodio, tenemos el honor de contar con un amigo de la casa, Alejandro Cardona, fundador del Seminario Creando Riqueza, quien nos comparte su inspiradora historia de transformación y...

Read More »

Read More »

Die sicheren 7% Rendite, von denen viele sprechen, sind gar nicht so sicher. #msciworld

Die sicheren 7% Rendite, von denen viele sprechen, sind gar nicht so sicher. ? #msciworld

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen?...

Read More »

Read More »

Zuseher: Generationengerechtigkeit, Wohlstand, Auswanderung und MINT

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Ein junger Zuseher kommentiert das aktuelle politische Geschehen und macht aus meiner Sicht dabei ein paar #Fehler, die ich gerne kommentiere. Besonders seine Vorstellung von #Rente und 'gelobtem Land' zum #Auswandern treffen nicht meine Zustimmung

-...

Read More »

Read More »

10-22-24 Is the Stock Market Party Over?

The era of double-digit growth in the stock market may be coming to an end...or is it?

Goldman Sachs strategist David Kostin estimates that the S&P 500 index will deliver an annualized return of 3% over the next decade — well below the 13% returns in the last 10 years, and the long-term average of 11%. Lance Roberts & Jonathan Penn discuss the potential for a market correction in 2024. Would a stock market downturn result from the end of...

Read More »

Read More »

How Lower Interest Rates Are Impacting the Real Estate Market

? Low home sales have created a sudden boom with lower interest rates! Time to refinance and pick up some extras! ? #RealEstate #FinanceTips

Watch the entire show here: https://cstu.io/c52e83

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

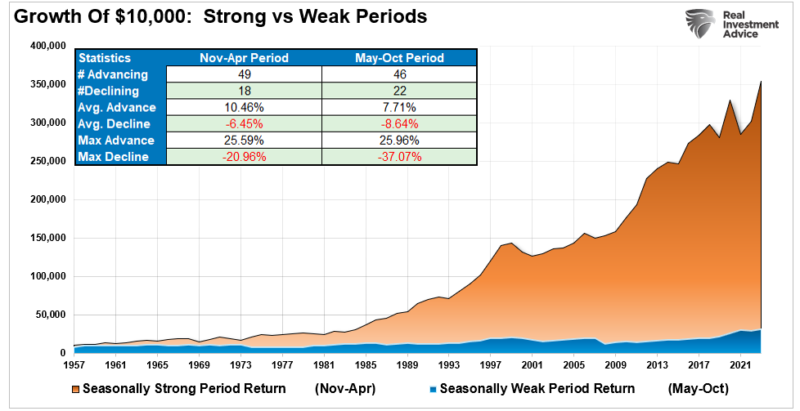

Seasonality: Buy Signal And Investing Outcomes

Seasonality has long influenced stock market trends, offering insights into predictable cycles of strength and weakness throughout the year. Yale Hirsch, the creator of the Stock Trader’s Almanac, is one of the most well-known contributors to studying these patterns. His research has highlighted that certain periods of the year consistently present better opportunities for investors to generate returns, while other times warrant caution.

The...

Read More »

Read More »