Category Archive: 9a) Buy and Hold

The True Essence of Wealth: It’s Not Just About Money

Money isn't the measure of wealth. Your health, purpose, and family matter most. True wealth goes beyond monetary value. ? #LifeLessons

Watch the entire show here: https://cstu.io/8592a7

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The MACD: A Guide To This Powerful Momentum Gauge

When we discuss technical analysis in our articles and podcasts, we often examine the moving average convergence divergence indicator, better known as the MACD, or colloquially the Mac D. The MACD is one of our favored technical indicators to help forecast prices and manage risk. Accordingly, let's learn more about the MACD to see how …

Read More »

Read More »

Seeking Beta

While the "Trump rally" appears to have just begun, one of its initial hallmarks is that investors want beta. Beta is a measure of the volatility of a stock versus the broader market, most often the S&P 500. For instance, a stock with a beta of 1.50 implies that based on prior trading, investors should … Continue reading...

Read More »

Read More »

Unsere Finanz-Fails 2024 | Geld ganz einfach

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_wOHkiwfwECU

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-yt/yt_wOHkiwfwECU

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_wOHkiwfwECU

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_wOHkiwfwECU

Trade Republic

Justtrade

Flatex* ►...

Read More »

Read More »

11-13-24 Annuities: Good, Bad, & Ugly

It's Inflation Day: Expectations are for a .3% print for October (the Bureau of Labor Statistics reported CPI rising.2%, and up 2.6% over the past 12-months). Remember, it's only a guess; why inflation is destined to rise. Stocks remain over-bought; watch for pre-Thanksgiving volatility; more than half in our Twitter poll sees the S&P at 6,200 by EOY. Why are investors expecting more rate cuts in 2025? Lance & Danny present an Annuity...

Read More »

Read More »

Why Your 401k Might Not Save You! – Robert Kiyosaki, John MacGregor

Robert Kiyosaki, host of The Rich Dad Radio Show, is joined by John MacGregor, author of 'The 10 Top Reasons Why Rich People Go Broke.' They discuss the severe financial challenges many people, particularly those relying on 401k and IRA plans, might face due to systemic flaws and lack of financial education. The episode emphasizes the importance of being proactive, educating oneself, and understanding how to manage personal finances independently...

Read More »

Read More »

Geld zu verschenken? Steuersätze bei Vermögensübertragungen #erbe

Geld zu verschenken? Steuersätze bei Vermögensübertragungen ? #erbe

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

Kündige Deinen Internetvertrag #shorts

Wie lange hast Du schon Deinen Internetvertrag? Kann es sein, dass Du eigentlich zu viel für Deine Leistungen zahlst? Leo erklärt Dir hier, wie oft Du Deinen Vertrag regelmäßig prüfen solltest und warum.

#Finanztip

Read More »

Read More »

How to Secure Profits and Avoid Margin Calls in Investments

Trade wisely, secure your profits. Avoid being wiped out by margin calls. Secure your family's legacy. #InvestingTips #FinancialAdvice

Watch the entire show here: https://cstu.io/494659

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Hackea tu mente en 3 pasos: aprende a salir de la bancarrota y crear riqueza con Luis Luzardo

? https://realmentor.net/rd ? ENTRA AQUÍ ¡Descubre Cómo Alcanzar La LIBERTAD FINANCIERA y Crear INGRESOS PASIVOS Usando El Sistema Que Me Convirtió En Millonario!

=================================

? ¿Te sientes atrapado en un ciclo de fracasos y bloqueos? Descubre cómo cada adversidad puede ser la clave para desbloquear tu verdadero potencial. En este episodio, tenemos a Luis Luzardo, experto en ventas y liderazgo, quien ayuda a líderes y...

Read More »

Read More »

7 % Rendite mit US-Anteilen sichern?

? Die CAPE-Ratio zeigt uns, wie der US-Markt bewertet ist – und aktuell liegt sie bei 36! Aber was bedeutet das für zukünftige Renditen? ? Historisch gesehen könnten wir damit in den nächsten Jahren mit geringeren Renditen rechnen. Sollte man jetzt sein Portfolio anpassen oder einfach abwarten? Erfahre mehr dazu im Video ?

Read More »

Read More »

Crypto Soars

On the campaign trail, Donald Trump favored the crypto industry, including appointing "crypto-friendly" regulators. Moreover, one of the plans he mentioned several times was the creation of a federal strategic reserve of crypto assets. Trump's decisive victory, along with the Republican sweep of Congress, makes it even more likely the crypto industry and related cryptocurrencies …

Read More »

Read More »

Ist es sinnvoll den ETF zu wechseln, wenn ein günstigerer ETF auf den Markt kommt? ? #etfwechsel

Ist es sinnvoll den ETF zu wechseln, wenn ein günstigerer ETF auf den Markt kommt? ? #etfwechsel

? Finanzfluss Copilot: Dein Gesamtvermögen im Überblick! Verbinde all deine Konten und Depots in wenigen Klicks.

Verschaffe dir finanzielle Klarheit und Gelassenheit, indem du den Überblick über deine Investments, Kontostände und Transaktionen behältst.

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen...

Read More »

Read More »

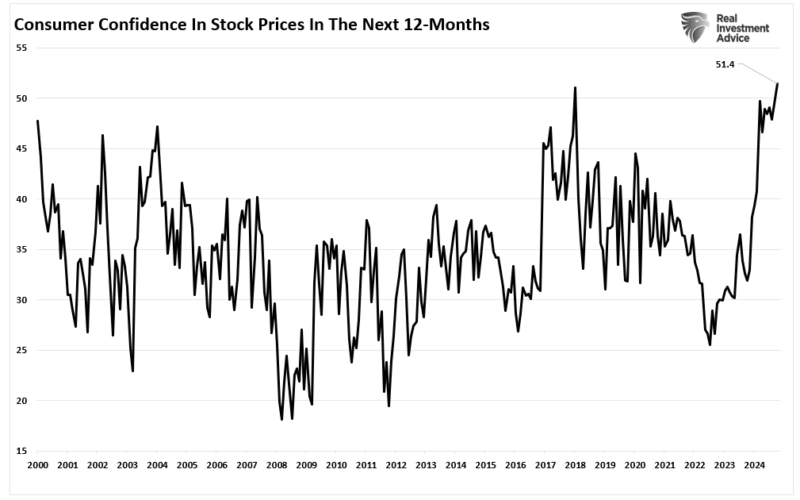

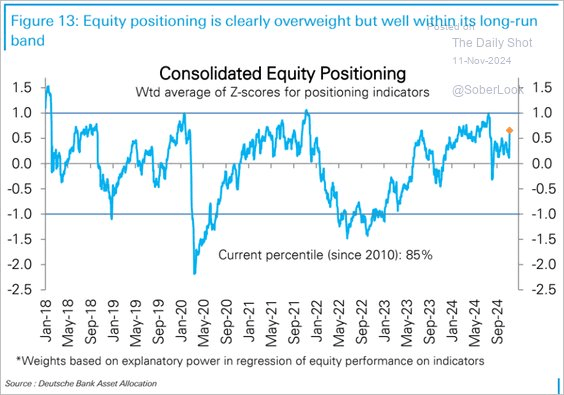

Exuberance – Investors Have Rarely Been So Optimistic

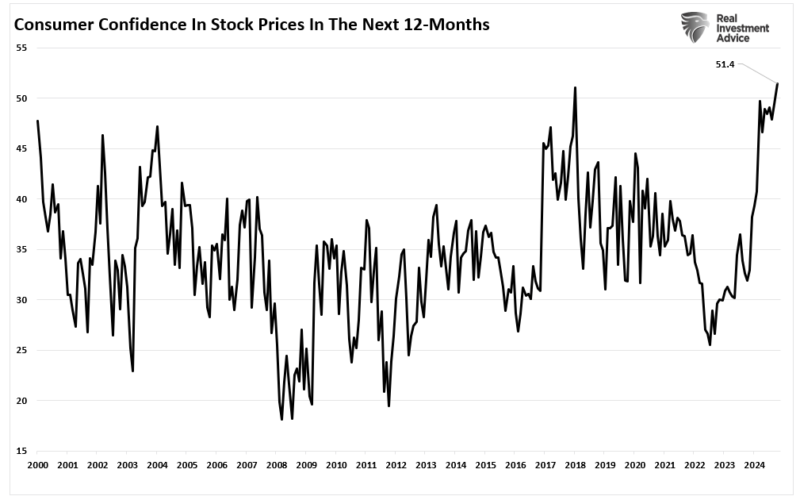

Investor exuberance has rarely been so optimistic. In a recent post, we discussed investor expectations of returns over the next year, according to the Conference Board's Sentiment Index. To wit: "Consumer confidence in higher stock prices in the next year remains at the highest since 2018, following the 2017 “Trump” tax cuts." (Note: this survey was …

Read More »

Read More »

Neuwahlen jetzt? Erklärungen und Gründe, die dagegen sprechen.

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Nach dem Ende der #Ampel am 6.11.2024 sieht es so aus, dass sich die Reste der #Regierung bis deutlich in kommende Jahr 2025 hineinschleppen will. Ich finde wirklich viele Gründe, warum alles für einen verspäteten #Wahltermin im März 2025 sprechen. Die...

Read More »

Read More »

11-12-24 Irrational Exuberance…Again?

Earnings Season is winding up, and The Next Big Report to come will be from NVIDIA on 11/20. Markets are on fire for now; what will the Fed do next? We're expecting one more rate cut in December, and then a pause. This week's inflation print could be higher due to YOY comparisons. Mutual Fund Distributions are coming in December; do not be alarmed! The post-election market is on a tear: invesetors are more exuberant than ever. Everybody is betting...

Read More »

Read More »

Exuberance – Investors Have Rarely Been So Optimistic

Investor exuberance has rarely been so optimistic. In a recent post, we discussed investor expectations of returns over the next year, according to the Conference Board’s Sentiment Index. To wit:

“Consumer confidence in higher stock prices in the next year remains at the highest since 2018, following the 2017 “Trump” tax cuts.“ (Note: this survey was completed before the Presidential Election.)

We also discussed households’ allocations...

Read More »

Read More »

Das ändert sich bei Payback zum Jahreswechsel

Auch bei Payback ändern sich ab 2025 ein paar Dinge. Wer kommt neu dazu und welche Unternehmen steigen zum Jahreswechsel bei Payback Pay aus? Leo hat hier die wichtigsten News, die dann ab Anfang nächsten Jahres gelten.

#Finanztip

Read More »

Read More »