Category Archive: 9a) Buy and Hold

Understanding Volatility: The Fear and Greed Index Explained

? Exploring market volatility with Michael! ? Understand the fear greed index and implied volatility. Stay informed! #Finance101

Watch the entire show here: https://cstu.io/a3ab0e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Steigende Inflation macht es den Deutschen schwer, privat vorzusorgen. #ruhestand

Die steigende Inflation macht es vielen Deutschen schwer, privat für den Ruhestand vorzusorgen. #ruhestand

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den...

Read More »

Read More »

“Trump Trade” Sends Investors Into Overdrive

Inside This Week's Bull Bear Report A Pause That Refreshes? Last week, we discussed that with the election over and the Federal Reserve cutting interest rates, many market headwinds were put behind us. To wit; "As a result, the market surged higher, hitting our year-end target of 6000 on Friday. Furthermore, since election day, the …

Read More »

Read More »

Früherer Tod mit weniger Geld?

Sterben wir früher, wenn wir weniger Geld haben? Ob das stimmt und woran das liegen könnte, das erfährst Du hier im Video.

#Finanztip

Read More »

Read More »

Dieser Betrag sprengte Überweisung

Ein Staatsfonds mit 24 Milliarden zur Atommüllentsorgung – aber wie startet man solch ein Projekt? ?

Read More »

Read More »

Geheime Gründe für Trumps Wahlerfolg | Mail eines Zusehers

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Ein Freund aus Kanada hat mir die beiden #Kerngründe genannt, warum #Trump so deutlich gewinnen konnte. Und überraschend erfahren wir in unseren #Medien nichts davon, obwohl es mit geringer #Recherche den Journalisten auffallen sollte. Und diese

-...

Read More »

Read More »

Can Lifestyle Changes Really Reduce Your Risk of Alzheimer’s? – Dr. Nicole Srednicki

In this episode of Ultra Healthy Now podcast, host Dr. Nicole Srednicki, a specialist in high-performance health,explores how diet, exercise, and lifestyle modifications can significantly impact brain health and cognitive function. Dr. Srednicki shares a personal story of a patient taking proactive steps to fight Alzheimer’s and highlights the importance of early detection, reducing inflammation, and managing stress. The discussion also covers the...

Read More »

Read More »

Understanding Market Patterns: Why Analog Trends Can Be Misleading

An important reminder about market analogs ? Things may seem similar to the past, but every situation is unique! #MarketTrends #FinanceTips

Watch the entire show here: https://cstu.io/d6f878

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

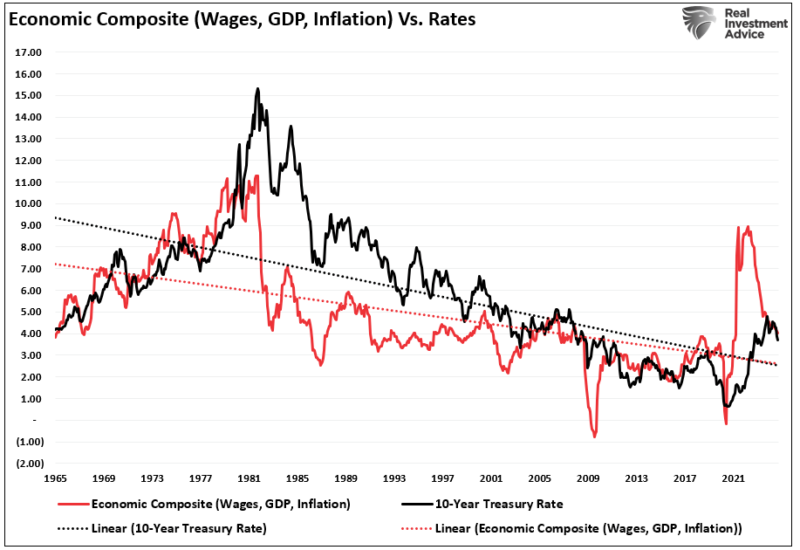

Paul Tudor Jones: I Won’t Own Fixed Income

Paul Tudor Jones recently voiced concerns that rising U.S. deficits and debt and increasing interest rates could lead to a fiscal crisis. His perspective reflects the long-standing fear that sustained borrowing will trigger inflation, raise interest rates, and eventually overwhelm the government’s ability to manage its debt obligations. In short, his thesis is that interest …

Read More »

Read More »

2% CPI Is Here

2% CPI is a headline you won't find in today's Wall Street Journal. The reason is that official inflation gauges, such as CPI, are in the mid to upper 2% range. Last Wednesday, for instance, the year-over-year CPI rate clocked in at 2.6%. We claim inflation is at 2% because we know that 40% of … Continue reading »

Read More »

Read More »

Risks and Rewards of Doing Business in China: Insights from Patrick Jenevein & Andy Tanner

Join host Andy Tanner on the Castle Academy podcast as he welcomes author Patrick Jenevein to discuss his book 'Dancing with the Dragon: Cautionary Tales of the New China from an Old China Hand.' Jenevein shares his personal experiences and insights into the complexities of doing business in China, highlighting the political and economic risks, and lessons learned from his time in the energy industry and entrepreneurship in the Chinese market. Tune...

Read More »

Read More »

Understanding Debt: The Good, the Bad, and the Misused

Debt can be a powerful tool if used wisely. Let's start making better financial decisions from the beginning! ? #financialadvice #moneymanagement

Watch the entire show here: https://cstu.io/2f3b14

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Robert Kiyosaki Almost Died Buying Gold…

It was 1972, and I was a Marine Corps pilot stationed off the coast of Vietnam, flying Huey gunships into combat zones. As the U.S. dollar lost its gold backing and inflation soared, I received a warning from my Rich Dad: the world was about to change. Eager to protect my wealth, I took a risky mission with my copilot—flying behind enemy lines to buy gold directly from a Vietnamese villager.

This journey taught me some unforgettable lessons about...

Read More »

Read More »

Luxus auf Kredit? Die Wahrheit über Konsumschulden!

Luxus auf den ersten Blick – doch was steckt dahinter? Viele Autos und Designerstücke werden nicht aus Ersparnissen, sondern per Kredit finanziert. Ist es das wirklich wert? ?

Read More »

Read More »

Viele Deutsche zahlen über 100 Euro pro Jahr nur für ihr Bankkonto. #girokonto

Viele Deutsche zahlen über 100 Euro pro Jahr nur für ihr Bankkonto. ? #girokonto

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen...

Read More »

Read More »

The Real Estate Blueprint for Freedom – Jaren Sustar, Brian Luebben

? Get "How to Buy Your First Investment Property" - it's FREE!: https://bit.ly/3NJLquO

In this episode, host Jaren Sustar sits down with Brian Luebben, a successful entrepreneur, real estate investor, and coach who left corporate America to chase his dreams—and succeeded by age 30! Brian reveals how he escaped the "9 to 5," started his journey in real estate, and built a thriving life full of freedom and adventure.

Listen in...

Read More »

Read More »

5 Gründe, warum ETFs die genialste Geldanlage sind

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_vzC8DVRR8m0

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-yt/yt_vzC8DVRR8m0

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_vzC8DVRR8m0

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_vzC8DVRR8m0

Trade Republic

Justtrade

Flatex* ►...

Read More »

Read More »

Bitcoin jetzt besser als ETF? Was das Hoch für Deine Anlagestrategie bedeutet

Was geht eigentlich gerade beim Bitcoin ab - und was heißt das für Deine Anlagestrategie? Ist der Bitcoin jetzt endlich erwachsen geworden und potentiell ein richtig gutes Investment? Saidi und Leo analysieren die Lage mit aktuellen Daten, beantworten Eure Fragen und diskutieren mit Euch.

Wie handhabt Ihr es mit Bitcoin? Nehmt an unserer Umfrage teil, erzählt uns Eure Meinung und stellt vorab Eure Fragen:

?...

Read More »

Read More »

11-14-24 The Math Behind the MACD

Just ahead of the Christmas Retail Shopping Season, credit card debt is piling up; consumers are under stress. Survey: What to do when an item is too expensive? What will be the actual effect of tariffs? What economists think vs how consumers react. Meanwhile, markets sold off Wednesday, then rallied back for a positive close: Participants are unwilling to sell, expecting markets to continue to rise; Bitcoin is melting up, Gold is getting beaten...

Read More »

Read More »