Category Archive: 9a) Buy and Hold

Kinder haften für ihre Eltern! #altersvorsorge

Kinder haften für ihre Eltern! ?? #altersvorsorge

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung...

Read More »

Read More »

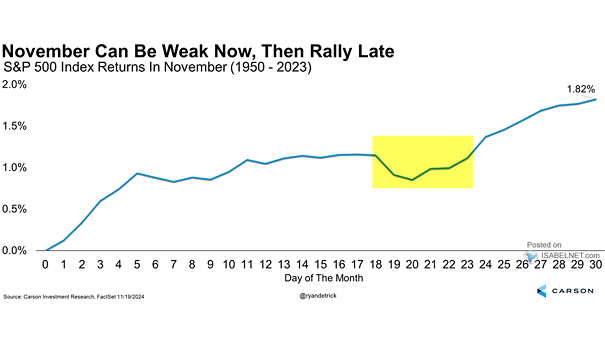

Market Forecasts Are Very Bullish

Inside This Week's Bull Bear Report A Holiday Rally Is Likely Last week, we discussed the impact of the Trump Presidency on the financial markets based on expectations of tax cuts, tariffs, and deregulation. Since then, the "Trump Trade" went into full swing, pushing the markets higher; however, as we noted, that the trading had gotten a …

Read More »

Read More »

Die Mogelpackung des Monats

Wenn Du wissten willst, welches Produkt im November um 150% teurer geworden ist, dann schau Dir dieses Video an. Tina krönt hier den Sieger der Mogelpackung des Monats.

#Finanztip

Read More »

Read More »

Eastern vs. Western Medicine: Can Your Inner Dialogue Make or Break Your Health Journey?

In this episode of Ultra Healthy Now, Dr. Radha Gopalan and host Dr. Nicole Srednicki discuss the integration of Eastern and Western medical philosophies. They emphasize the importance of addressing both physical and mental health, particularly in relation to memory loss and overall well-being.

Read More »

Read More »

Schuldenbremse, Produktivität, Banken und Inflation

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Linke Politiker aller Parteien fordern die Aufhebung der #Schuldenbremse. Doch was das für unsere Volkswirtschaft bedeutet, ist den meisten nicht bewusst. Zusätzliche #Staatsschulden führen immer zu Inflation. Anders ist es mit Schulden von Unternehmen. Die...

Read More »

Read More »

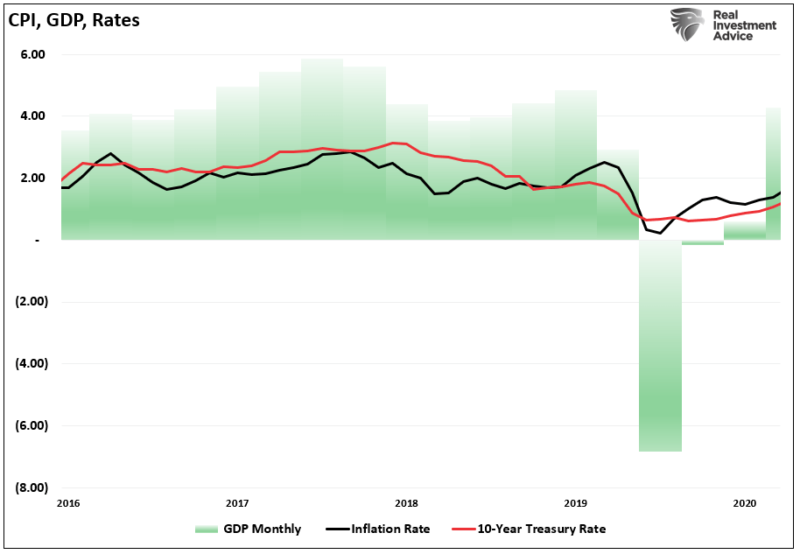

“Trumpflation” Risks Likely Overstated

With the re-election of President Donald Trump, the worries about tariffs and pro-business policies sparked concerns of "Trumpflation." Inflation has been a top concern for policymakers, businesses, and everyday consumers, especially following the sharp price increases experienced over the past few years. However, growing evidence shows inflationary pressures continue to ease significantly, paving the way …

Read More »

Read More »

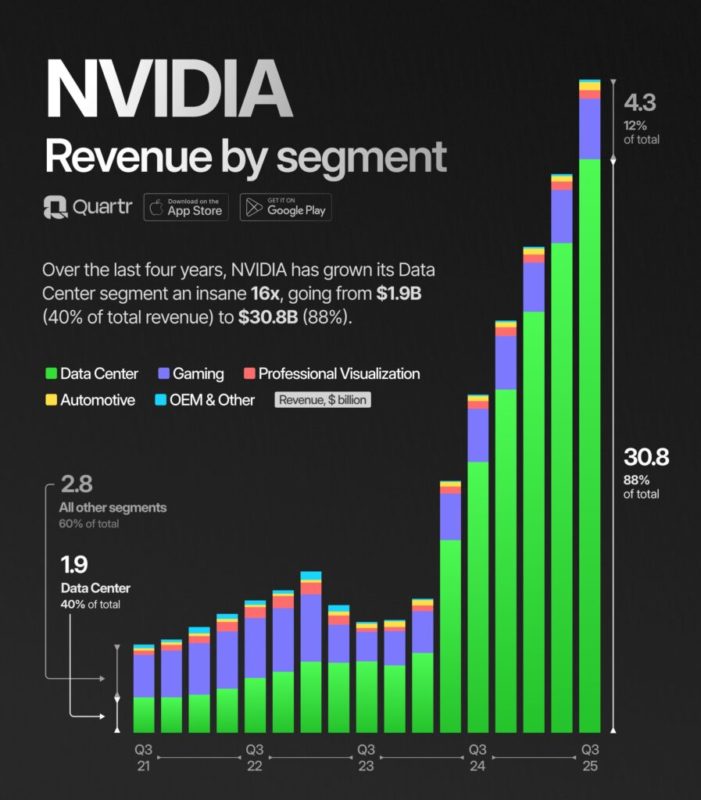

AI Is Steaming To Nvidia’s Benefit

Wall Street's poster child for AI is Nvidia. With an overwhelming market share in AI chip design, Nvidia is up over 200% year to date and a whopping 2680% over the last five years. Driving the price surge are incredible earnings, revenue growth, massive profit margins, and promising outlooks. Since 2020, Nvidia's sales have increased …

Read More »

Read More »

Dein Paket ist nicht angekommen? #shorts

Du hast etwas bestellt aber Dein Paket ist verschwunden? Dann at Tina hier ein paar Tipps für Dich, was Du jetzt tun kannst.

#Finanztip

Read More »

Read More »

How AI and Fed Policies Are Shaping the Market

In this episode of the Cashflow Academy podcast, host Andy Tanner is joined by investing experts Noah Davidson and Corey Halliday. They dive into broad market trends, discuss Fed policies, and analyze current market sentiment. The episode also covers topics such as the impact of AI on jobs, the role of consumer confidence, and the significance of hedging in today's financial landscape. Whether you're a seasoned investor or just getting started,...

Read More »

Read More »

The Impact of AI on Employment and Demographics Explained

AI advancements are changing the job market. Demographics show a decline in birth rates. What will the future workforce look like? ? #AI #FutureOfWork

Watch the entire show here: https://cstu.io/9f7cb1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Plötzlich ist der ETF aus dem Depot verschwunden – einfach so? #fusion

Plötzlich ist der ETF aus dem Depot verschwunden – einfach so? #fusion ?

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

How to Run a Successful Airbnb: Mastering Short-Term Rentals – Jaren Sustar, Michael Elefante

Get Your FREE Copy of "How to Buy Your First Investment Property": https://bit.ly/3NJLquO

Join Jaren Sustar in this exciting episode as he interviews Michael Elefante, a renowned real estate investor and entrepreneur who achieved financial freedom at the age of 27. Michael shares his journey from working at Dunkin' Donuts to owning eight short-term rental properties that generate over $1.5 million in gross rental income annually. The...

Read More »

Read More »

11-21-24 Will Trump Tariffs be Inflationary?

A preview of risks on the horizon, including Trump Tariffs, interest rates, and how debt and deficits are economic drivers. What are the effects on corporate profitability?Will valuations be problematic next year? Lance revews Nvidia's stellar quarterly report and analysts' expectations for 2025. Bitcoin is tracking WITH the US Dollar, not against it as a de-dollarization asset. CNBC completely misses "first man in space" trivia question...

Read More »

Read More »

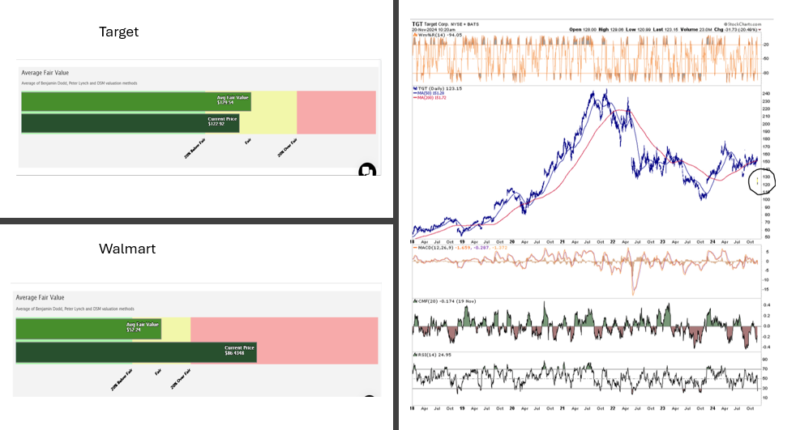

Target And Walmart: Same Business But Different Trends

Yesterday's Commentary shared Walmart's outstanding earnings report and reviewed its surging share price from a technical basis. Despite being a head-to-head competitor of Walmart, Target is heading down a completely different path. Walmart beat EPS and revenue expectations easily, while Target was short. Target reported EPS of $1.85, well below estimates of $2.30. Unlike Walmart, …

Read More »

Read More »

Diese Marken stecken hinter No-Name-Produkten | Teil 3

Hättest Du gedacht, dass es so viele Discounter-Produkte gibt, die von bekannten Marlen hergestellt werden? Leo stellt Dir hier mal wieder ein paar davon vor.

#Finanztip

Read More »

Read More »