Category Archive: 9a) Buy and Hold

Kaufen statt Mieten – lohnt sich das wirklich?

Rasant steigende Mieten: Ist ein Kauf die bessere Option zur Absicherung? Für viele Mieter kann ein Kauf eine sinnvolle Versicherung gegen Preissteigerungen sein. Aber welche Risiken und Möglichkeiten sind dabei zu beachten? ?

Read More »

Read More »

Dividend Investing for Long-Term Wealth Building – Andy Tanner, Del Denney

? FREE Training with Andy Tanner: https://bit.ly/3JsRdmj

In this episode of Rich Dad's StockCast, host Del Denney and guest Andy Tanner reveal the often overlooked strategy of dividend investing. They discuss the basics of dividends, the significance of consistent income, and why this method can be a game-changer for long-term wealth building.

The conversation covers the emotional intelligence needed for investing, practical steps to get...

Read More »

Read More »

Assessing Investment Risks: How to Protect Your Money When Things Go Wrong

?? Don't speed through investments! Just like driving fast, taking too much risk can lead to trouble. Remember, it's about minimizing losses! #InvestWisely ?

Watch the entire show here: https://cstu.io/d6282c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

New Economic Policies Impacting Your Wallet – John MacGregor

In this episode of Full Disclosure, host John McGregor reveals the latest news shaping the political and financial landscape. From election updates and new mind-blowing regulations to the increasing popularity of gold as an investment and the rise of millionaires in trades like plumbing and HVAC, this stacked episode covers a wide array of topics crucial for your financial future. John also discusses his cash flow wealth building system, offers his...

Read More »

Read More »

Renditen richtig prognostizieren

Renditeprognosen selbst erstellen? ?? Klingt kompliziert, muss es aber nicht sein! Mit ein paar einfachen Methoden und einem Blick auf die richtigen Kennzahlen kannst du besser einschätzen, was deine Investments in Zukunft bringen könnten. Erfahre, wie du deine eigenen Prognosen machst und dabei ein Gefühl für die Märkte entwickelst ?

Read More »

Read More »

Market Polls To Help Handicap The Election

With election eve upon us, we thought it would be helpful to share market based presidential election polls along with Greg Valliere's final thoughts. The graph on the top left shows the price of Trump Media & Technology Group (DJT), which runs Truth Social Media. Truth will be a clear beneficiary if Trump wins and …

Read More »

Read More »

Lohnt es sich gehebelt in ETFs zu investieren? #hebeln

Lohnt es sich gehebelt in ETFs zu investieren? ? #hebeln

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen,...

Read More »

Read More »

11-4-24 The Presidential Election Cometh

It's 2024 Election-eve: Hedge funds are long on a presumed outcome; watch for a pick up in volatility. The Fed meets on the day after the election; there are still about 100 S&P Companies left to report. Reference Lance's weekend article on buy backs, Wolf in Sheep's Clothing: Apple spent $100-B on stock buy backs, when they could have purchased Intel for $99-B and produced their own chips. But, no. investors should do nothing on this day...

Read More »

Read More »

I am $1.2 Billion in Debt, Here’s What Banks Don’t Want You To Know About Money

In this video I share why understanding and using debt strategically can be the ultimate financial game changer. This isn’t about reckless borrowing—it’s about leveraging debt as a tool to generate wealth.

We start by going back to 1971, when President Nixon took the U.S. dollar off the gold standard, transforming money as we knew it. Today, every currency—whether the U.S. dollar, peso, yen, or euro—is debt. Yet, mainstream financial advice often...

Read More »

Read More »

Why Investors Are Overpaying for Assets in Today’s Market

Are we overpaying for assets? ?? Investors, beware! With the current market trends, we might be paying more than it's worth. #InvestingTips

Watch the entire show here: https://cstu.io/019b45

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Ubisoft vs. Roblox #marketcap

Ubisoft vs. Roblox ? #marketcap

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen und...

Read More »

Read More »

Revolut Konto mit Zinsen, Unterkonten, Depot, Krypto: Lohnt sich die App? | Revolut Bank Erfahrungen

Revolut Bank: Erfahrungen mit Konto, Kreditkarte, Zinsen und App!

Revolut Konto (+20€ Prämie): ►► https://link.finanzfluss.de/go/revolut-20 *?

Aktionsbedingungen: Tätige innerhalb eines Monats nach Eröffnung deines Kontos Einkäufe von mindestens 20€, um die Prämie zu erhalten.

Zu den Vergleichen:

• Girokonto-Vergleich: https://www.finanzfluss.de/vergleich/girokonto/

• Depot-Vergleich: https://www.finanzfluss.de/vergleich/depot/

•...

Read More »

Read More »

Banker-Portfolio: US-Fokus zu hoch? ?

? Solltest du dein Portfolio vor dem nächsten Crash absichern?

? Ein Banker Mitte 40 möchte seine Investments weiter absichern und fragt sich, ob es sinnvoll ist, seine ETF-Strategie zu überdenken. Ist es wirklich notwendig, sich vor einem Börsenabschwung zu schützen, oder kosten die Maßnahmen am Ende mehr, als sie bringen? Bleib bis zum Schluss, um die Antworten zu erfahren.

Read More »

Read More »

Understanding the Market as a Living Organism

Ever thought of the market as a living organism of a million minds? ?? Trading futures, stocks, options - it's all just a big bet that moves prices! #finance #trading

Watch the entire show here: https://cstu.io/201d33

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Presidential Election Cometh

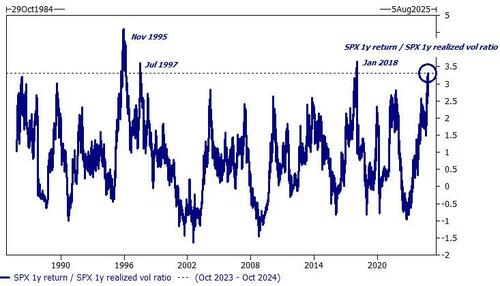

Inside This Week's Bull Bear Report One The Greatest Risk-Adjusted Returns...Ever Last week, we discussed the break of the rising wedge pattern. "Unsurprisingly, the market stumbled a bit this past week, breaking the "rising wedge" pattern to the downside. However, the market continues to find buyers at the 20-DMA as portfolio managers are unwilling to …

Read More »

Read More »

Diese Amex Funktion verdoppelt deine Punkte!

Mit Amex Punkten kannst du mehr machen, als du denkst. Ob für Reisen oder Payback – erfahre, wie du das Maximum herausholen kannst ?

Read More »

Read More »

Is California’s Energy Plan Failing? The Truth Exposed – Mike Mauceli

In this episode of The Energy Show with REI Energy, host Mike Mauceli discusses the challenges facing California's oil and gas industry with Alessandra Manasco, Government Affairs and Regulatory Director of California Fuels and Convenience Alliance. They explore the effects of California's policies on energy conservation, the closure of refineries, and the push towards electric vehicles. Alessandra highlights the economic and environmental...

Read More »

Read More »

Bitcoin hat seit einigen Tagen erneut die 70.000-Dollar-Marke überschritten… #bitcoin

Bitcoin hat seit einigen Tagen erneut die 70.000-Dollar-Marke überschritten... ? #bitcoin

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen?...

Read More »

Read More »