Category Archive: 9a) Buy and Hold

AI Productivity, Employment and UBI

A funny thing about bull markets is that investors develop a very short memory about the previous bear market. Such is why cycles repeat throughout history as lessons must be learned and relearned. The post AI Productivity, Employment and UBI appeared first on RIA.

Read More »

Read More »

Kannst Du bald eine Million Euro steuerfrei erben?

Die SPD will einen neuen Freibetrag bei der Erbschaftsteuer einführen: Demnach sollst Du bis zu 1.000.000 € steuerfrei erben dürfen – 900.000 € aus Deiner Familie, 100.000 € von Dritten.

Aktuell liegt der Freibetrag für Kinder bei 400.000 € alle 10 Jahre. Eltern könnten auch jetzt schon Steuern sparen – durch Schenkung alle 10 Jahre. Aber: Das klappt nur, wenn man früh genug plant.

🏠 Ansonsten liegen Erb:innen mit einem Einfamilienhaus in vielen...

Read More »

Read More »

1-19-26 The Metric that Matters – The Michael Green Interview

What really matters for markets in 2026—and why are most forecasts focused on the wrong metrics?

Lance Roberts visits with Simplify Portfolio Manager & Chief Investment Strategist, Michael Green, CFA, to examine the structural changes inside today’s markets that are reshaping price discovery, volatility, and risk. From the rise of passive investing and ETF dominance to the growing disconnect between fundamentals and flows, the mechanics of how...

Read More »

Read More »

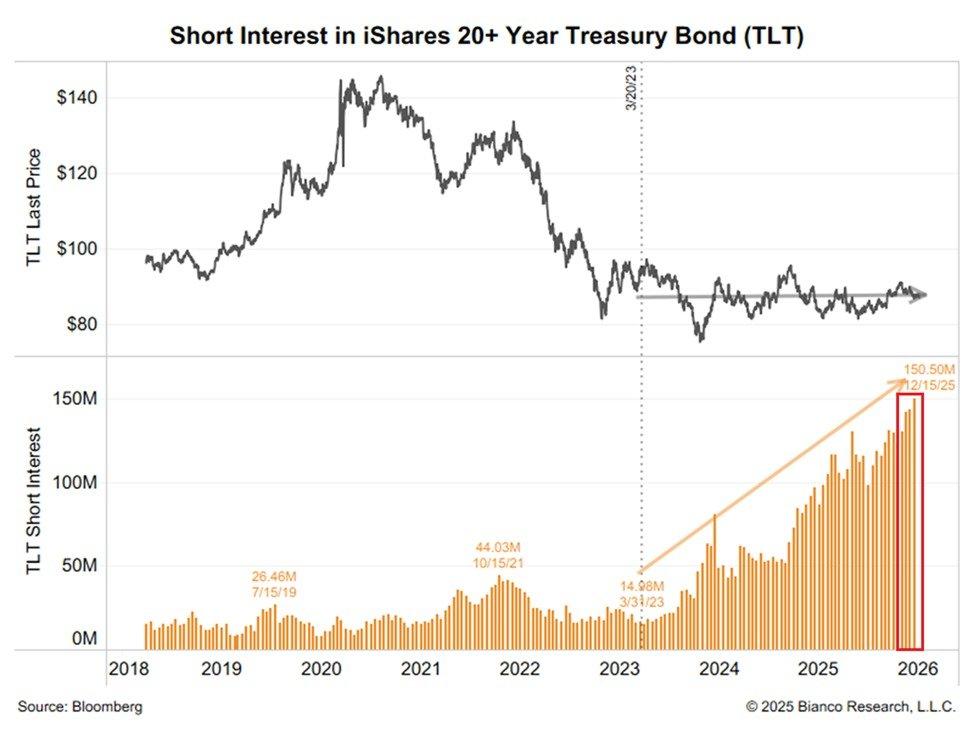

1-15-26 Why Growth-Driven Inflation Threatens the Rate-Cut Thesis

Markets may be mispricing the Fed by betting too aggressively on rate cuts in 2026.

In this Short video, Michael Lebowitz and I discuss why growth-driven inflation could return and derail the rate-cut thesis that’s fueling the current rally.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Deal oder kein Deal: Studium abbrechen fürs Business

Die ehrliche Antwort: kommt drauf an. 😅

Manche Studien sind ein Asset.

Andere sind einfach nur Zeitverschwendung mit Titel.

Schreib in die Kommentare:

👉 Was studierst du?

👉 Welches Business hast du (oder planst du)?

Ich sag dir ehrlich, ob durchziehen, abbrechen oder parallel aufbauen schlauer ist.

Sehr individuell und genau deshalb spannend.

#investmentpunk

#mindset

#business

Read More »

Read More »

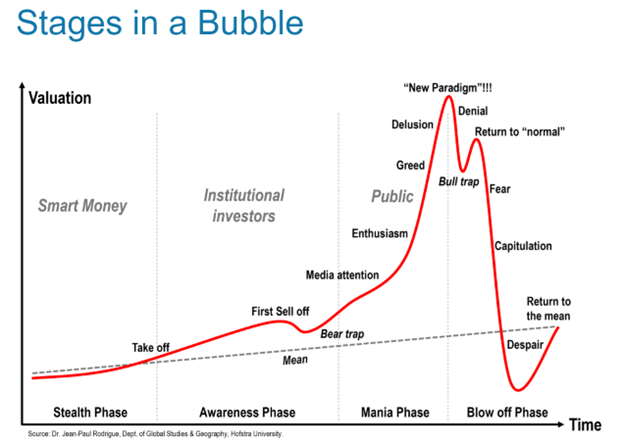

1-15-26 Silver’s Surge: Bubble or Fundamentals?

Can we classify Silver as a microbubble?

Lance Roberts & Michael Lebowitz take a disciplined, valuation-driven look at silver through the lens of post-2020 micro-bubble cycles.

#SilverMarket #PreciousMetals #MarketBubbles #InvestorRisk #MacroInvesting

Read More »

Read More »

All-In Glomumbo oder Silberminen?

All-In Glomumbo oder Silberminen? 🙃

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!...

Read More »

Read More »

Luxury Slump Bankrupts Saks Fifth Avenue

“With the debt payment looming, time ran out.” That succinct summary ended a Wall Street Journal article titled: Saks Global Files for Bankruptcy, Undone by Debt and a Luxury Slump. A year ago, Saks Fifth Avenue’s parent company purchased its […] The post Luxury Slump Bankrupts Saks Fifth Avenue appeared first on RIA.

Read More »

Read More »

EU vs. USA – Klein aber oho!

EU vs. USA - Klein aber oho! 🌍🌎

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel #rendite #finanzbildung #ökonomie...

Read More »

Read More »

Wird 2026 ein Krypto-Jahr?

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_DuL743rDg5E

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_DuL743rDg5E

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_DuL743rDg5E

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_DuL743rDg5E

Trade...

Read More »

Read More »

1-14-26 Why “Just Hold Forever” Isn’t a Good Strategy

The market isn’t about to crash, but it is pressing against a rare, long-term resistance zone at historically high valuations. That raises the risk of lower future returns and periodic corrections.

In this Short video, Lance Roberts discussed why ignoring valuation and mean reversion can leave long-term investors short of their goals.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Deal oder kein Deal: Krypto als Notgroschen

Wenn im Ernstfall Konten eingefroren sind und du das Land verlassen musst,

bringen dir Immobilien gar nichts, wenn sie dir von der Regierung enteignet werden.

Krypto schon. Grenzenlos. Schnell. Zugriff von überall.

Aber Achtung:

👉 Volatilität!

Krypto ist ein Notgroschen für den Ausnahmefall, nicht für die Miete nächste Woche.

Absicherung heißt Optionen haben und Krypto ist eine davon.

#investmentpunk

#krypto

#finanziellefreiheit

Read More »

Read More »

Diese Krankenkassen-Leistungen gibt es nicht mehr (TROTZ höherem Zusatzbeitrag!)

Leistungen und Zusatzbeiträge der Krankenkassen 2026: 10 Kassen im Check!

Krankenkassenvergleich: Beste GKV finden ►► https://link.finanzfluss.de/r/gkv-yt-ff 🏆

Kostenloses Depot eröffnen (+25€ Bonus): ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=899&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

Finanzfluss Copilot: App für dein Vermögen ►►...

Read More »

Read More »

1-14-26 Q & A Wednesday – Your Money & Market Questions Answered

Lance Roberts & Danny Ratliff take your real-time questions directly from our YouTube live chat window, and break down today’s most important money, market, investing, and retirement topics.

0:00 - INTRO

0:19 - Big Banks' Earnings & Trading Revenue

4:00 - Markets Decline off All-time Highs

9:05 - Fun with Charts - Understanding Market Dynamics

16:17 - Contributing to Roth in Retirement?

20:27 - SimpleVisor Alerts

21:10 - Determining...

Read More »

Read More »

Folgen des schwachen Dollars für deutsche Anleger 🇺🇸

Folgen des schwachen Dollars für deutsche Anleger 🇺🇸

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel #rendite #finanzbildung...

Read More »

Read More »

The Silver Surge: Micro Bubble Or Reasonable Valuation?

Silver has been on a tear, rising fourfold in the last few years. The price is driven by the narrative of dollar debasement. Furthermore, there are indications that limited supply, along with growing industrial demand for silver, warrants higher prices. As we have stated in recent articles (Debasement, What It Is And Isn’t & Dollar …

Read More »

Read More »

Transportation Stocks Are At Odds With Truck Sales

Yesterday’s Commentary noted the recent strength in transportation stocks. For example, the transportation ETF (XTN) has outperformed the S&P 500 by more than 9% over the last 25 trading days. The leading stocks within the ETF over this period include. ARCB (trucking), MATX (shipping), WERN (freight shipping), and FedEx (shipping). Some of the recent gains …

Read More »

Read More »

Was schiebst Du vor dir her?

Was schiebst Du gerade vor Dir her? 👀

💡 Tagesgeld wechseln, Kleiderschrank ausmisten oder endlich mal die Steuer machen – manche Aufgaben ziehen sich wie Kaugummi durchs Leben.

🧠 Du kannst zwei Wege gehen:

1️⃣ Rechne aus, was es Dir bringt. 100 € mehr Zinsen im Jahr? Klingt gut – aber oft nicht motivierend genug.

2️⃣ Oder: Mach’s, um wieder Ruhe im Kopf zu haben. Diese „Ich müsste mal...“-Gedanken kosten Energie. Und die kannst Du Dir sparen.

📅...

Read More »

Read More »

Heute startet HBO Max in Deutschland Wirst du ein Abo abschließen?

Heute startet HBO Max in Deutschland 🍿 Wirst du ein Abo abschließen?

🎯 Seit 2015 möchten wir dich dabei unterstützen, Verantwortung für deine Finanzen zu übernehmen und eigene, fundierte Entscheidungen zu treffen.

🔔 Folge uns, um keine wertvollen Tipps mehr zu verpassen!

#finanzen #aktie #aktien #etf #etfs #geld #wirtschaft #börse #sparen #anlegen #investieren #investments #finanzmarkt #finanzenverstehen #geldanlage #fonds #börsenhandel #rendite...

Read More »

Read More »

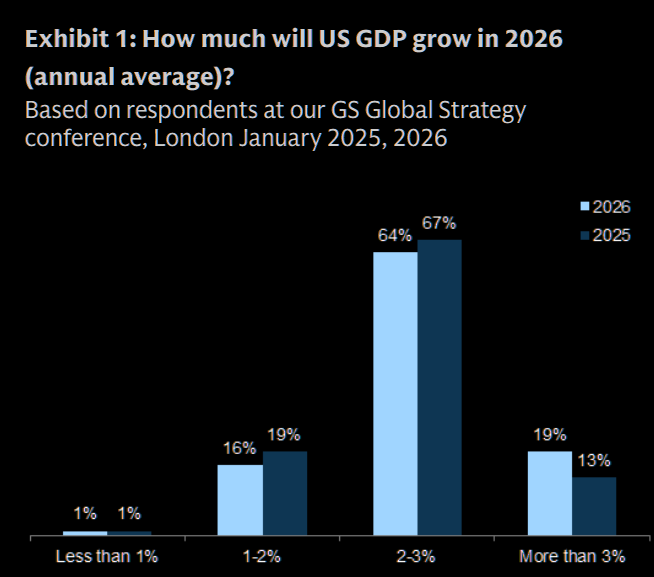

1-13-26 The Reflation Trade Explained

Markets are priced for a perfect reflation outcome after three years of big gains. Everyone expects strong growth, falling inflation, and rate cuts at the same time.

In this Short video, Lance Roberts argues why these expectations may be setting investors up for disappointment.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »