Category Archive: 9a) Buy and Hold

Multimillionär packt aus: Was dir niemand über das Auswandern sagt!

In den sozialen Medien wird Auswandern oft als der ultimative Ausweg präsentiert – Dubai, Bali, Costa Rica, Nord-Zypern, Paraguay... aber wie realistisch ist das wirklich?

In diesem Video nimmt Gerald Hörhan den aktuellen Auswanderungshype genauer unter die Lupe:

-Was kostet es wirklich, auszuwandern?

-Welche Herausforderungen erwarten dich – beruflich, rechtlich und familiär?

-Warum viele Menschen den Aufwand und die Risiken unterschätzen.

Ob...

Read More »

Read More »

Elster Online: Steuererklärung für 2024 Schritt-für-Schritt selber machen! | Mein Elster Portal 2025

Steuererklärung mit Elster Online Portal einfach erklärt!

Zum Steuersoftware-Vergleich: ►► https://www.finanzfluss.de/vergleich/steuerprogramm/ ?

Unser Steuersoftware Testsieger: ►► https://link.finanzfluss.de/go/wiso-steuererklaerung *?

ℹ️ Weitere Infos zum Video:

Mit Elster kannst du kostenlos deine Steuererklärung erstellen. Markus geht mit euch die wichtigsten Anlagen für Nichtselbstständige durch.

• Steuersoftware Vergleich:...

Read More »

Read More »

BKK firmus: Günstigste Krankenkasse Deutschlands – Wo ist der Haken?

Krankenkassenvergleich 01/2025 - Finde die beste GKV

HKK* ► https://www.finanztip.de/link/hkk-gkv-text-youtube/yt_Pl_el2L_naM

TK* ► https://www.finanztip.de/link/tk-gkv-text-youtube/yt_Pl_el2L_naM

BKK Firmus* ► https://www.finanztip.de/link/bkkfirmus-gkv-text-youtube/yt_Pl_el2L_naM

Audi BKK* ► https://www.finanztip.de/link/audibkk-gkv-text-youtube/yt_Pl_el2L_naM

Energie-BKK* ►...

Read More »

Read More »

3 Dinge, die Du an Deinem ETF falsch einschätzt

Wärst Du bei diesen 3 Dingen auch falsch gelegen? Schreib's uns in die Kommentare.

#Finanztip

Read More »

Read More »

Understanding Inflation: The Role of Supply and Demand in the Economy

Supply and demand drive inflation, but slowing economic growth is the solution. An interesting conundrum! #EconomyTalks #Inflation #SupplyDemand

Watch the entire show here: https://cstu.io/dd3cf6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

“Drill, baby, drill” – aber keiner macht mit? ? #trump #biden #shorts

"Drill, baby, drill" – aber keiner macht mit? ? #trump #biden #shorts

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen...

Read More »

Read More »

Investieren junge Menschen schlauer?

Junge Menschen investieren anders. Worin die Unterschiede liegen, das zeigen wir Dir hier.

#Finanztip

Read More »

Read More »

Magnesium Deficiency Is SILENTLY Wrecking Your Health! Fix It NOW! – Dr. Nicole Srednicki

In this episode of "Ultra Healthy Now”, Dr. Nicole Srednicki, founder of Ultra Healthy Human, explores the critical role of magnesium in health. She highlights that 75% of Americans are deficient in magnesium, leading to issues like migraines and insomnia. Dr. Srednicki discusses various forms of magnesium supplements, their specific benefits, and how to choose the right one. She also emphasizes dietary sources and the importance of testing...

Read More »

Read More »

Quick Market Rotations: Favorable Shifts Happen Fast!

Ever wonder why certain markets suddenly surge? ? Rotations happen fast in the financial world! ? Stay on top of your portfolio and risk management! #FinanceTips #MarketInsights ??

Watch the entire show here: https://cstu.io/d9c943

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Die reichen werden reicher. Das ist kein Geheimnis… ? #superreich

Die reichen werden reicher. Das ist kein Geheimnis... ? #superreich

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir...

Read More »

Read More »

Fleiß lohnt sich im Leben | Weiterbildung | Remotearbeit | Work-Life-Balance

Lohnt sich Fleiß im Leben? Oder wird man nur #ausgenutzt? Lohnt es sich, sich weiterzubilden oder bremst der #Sozialismus einen in #Zukunft mehr und mehr aus?

-

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Abschiedsbrief KFZ-Ingenieur ► -A

-

00:00 Einführung und Ankündigung der Themen

01:14 Danksagung...

Read More »

Read More »

2-7-25 Taking the No-buy Challenge

TIring of overconsumption and desirous of paying off debt, more and more Americans are participating in the "no buy 2025" trend to reduce spending. Rich and Jonathan discuss strategies for improving household budgets, Money Saving Tips and Frugal Living Hacks, with Financial Discipline Strategies and Spending Freeze Guidance, plus tax traps to avoid as a result of the Social Security Fairness Act, and the challenges from inherited IRA's....

Read More »

Read More »

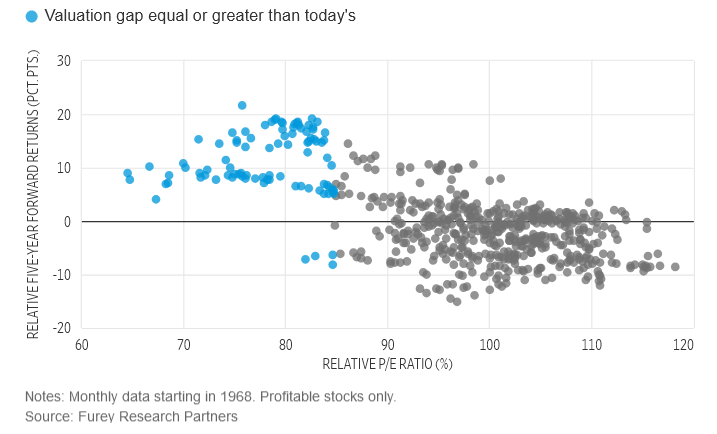

Small Cap Stocks Are Offering Outsized Returns

The Wall Street Journal published an interesting article For Small Cap Stocks, Look Past The Trump Trade. It is worth sharing the article's premise and the potential pitfalls in the analysis as quite a few articles seem to be popping up recently touting small-cap stocks. Let's start with the scatter plot below, courtesy of Fuery …

Read More »

Read More »

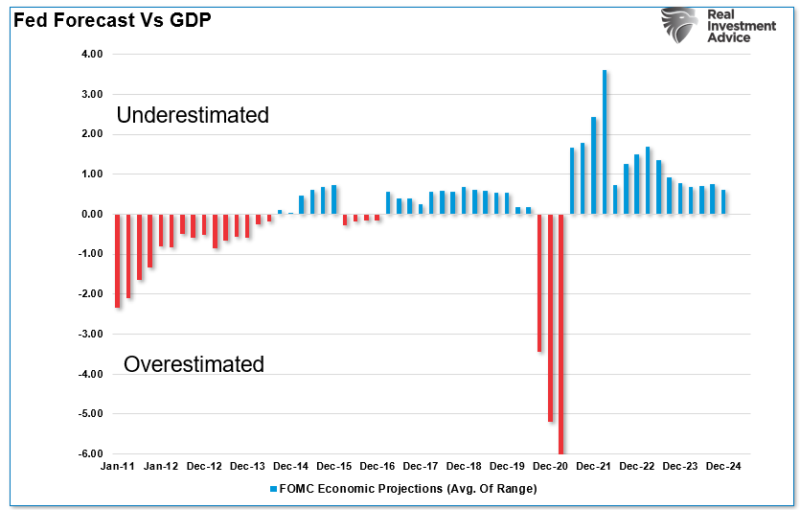

Forecasting Error Puts Fed On Wrong Side Again

The Federal Reserve's record of forecasting has frequently led it to respond too late to changes in economic and financial conditions. In the most recent FOMC meeting, the Federal Reserve changed its statement to support a pause in the current interest rate-cutting cycle. As noted by Forbes: "The policy-setting Federal Open Market Committee agreed unanimously …

Read More »

Read More »

Warum wir ING und Comdirect nicht empfehlen

Vielleicht ist Dir schon aufgefallen, dass die ING und Comdirect aus unseren Empfehlungen für Girokonten rausgefallen sind. Woran das liegt, das erfährst Du in unserer GGE Folge zu den besten Girokonten 2025.

#Finanztip

Read More »

Read More »

Real Estate CRISIS or OPPORTUNITY? The Truth About 2025! – Tom Wheelwright, Bronson Hill

Join Tom Wheelwright as he explores what we can expect in real estate in 2025 with multi-family real estate expert, Bronson Hill.

Bronson Hill is the founder and CEO of Bronson Equity and has raised over $20M for real estate investment. He is a general partner in over $150M worth of real estate around the US. Bronson is an authority on apartment investing and is continually putting out new content to help educate investors and help them achieve...

Read More »

Read More »

Avoid Emotional Trading: Key to Better Long-Term Returns

Emotional trading leads to mistakes & selling bottoms. Turn off, let the market digest. Don't follow the herd. Timing is key. #StockMarketTips

Watch the entire show here: https://cstu.io/9193b9

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Tax Loophole That Saves Real Estate Investors THOUSANDS! – Jaren Sustar, Ryan Bakke

? Get Your Free Copy of "How to Buy Your First Investment Property" - https://bit.ly/3NJLquO

Most people think paying high taxes is just part of making good money—but what if you could legally reduce (or even eliminate) your tax bill? In this episode of the Rich Dad Real Estate Show, I sit down with Ryan Bakke, a CPA and real estate investor who has helped 600+ investors maximize their wealth while paying less to the IRS.

Ryan reveals...

Read More »

Read More »