Category Archive: 9a) Buy and Hold

Trumps Puzzle

We are big fans of Sunday crossword puzzles, which tend to be bigger and more challenging than the weekday format. Adding to their allure, most Sunday puzzles have a clever theme, typically three or four clues whose answers stretch across the puzzle. Solving the theme often makes a complex puzzle a little easier. Like a … Continue reading »

Read More »

Read More »

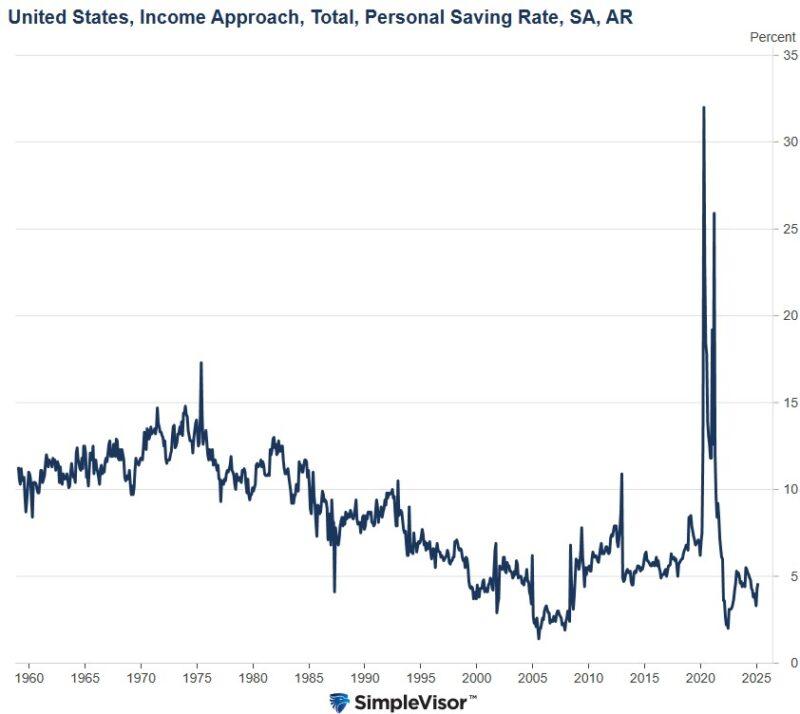

Personal Savings: An Unpolitical Sentiment Gauge

Yesterday's Commentary discussed the vast divergence in the economic sentiment of Democrats versus Republicans. In the piece, we wrote: "Democrats think today’s economic outlook is worse than during the peak of Covid and the financial crisis of 2008. Sentiment is tricky to convert into an economic forecast. Sometimes, sentiment is bad, but consumers continue to …

Read More »

Read More »

Tagesgeld und Girokonto bei der gleichen Bank?!

Was ist schlauer: Tagesgeld und Girokonto bei einer Bank eröffnen oder doch lieber auf zwei verschiedene Banken aufteilen? Hier findest Du es heraus.

#Finanztip

Read More »

Read More »

Understanding Market Trends: The Power of Buyers and Sellers

Understanding market trends: More buyers drive prices up, more sellers bring them down. Learn how futures impact gold prices! 📈💰 #MarketInsights

Watch the entire show here: https://cstu.io/25b2ab

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Real Madrid schreibt Geschichte: eine Milliarde Umsatz! ️ #realmadrid #shorts

Real Madrid schreibt Geschichte: eine Milliarde Umsatz! ⚽️ #realmadrid #shorts

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔 Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen...

Read More »

Read More »

Userfrage: Wohin Auswandern und Gesellschaftszyklen

Immer mehr zur Leistung bereite Bürger Deutschlands fassen den Entschluss auszuwandern. Ein Zuseher schreibt mir und will wissen, ob sein Plan eine gute Idee sei. Doch welche #Länder bzw. #Regionen auf der Welt versprechen sich besser zu entwickeln an wir? Es gibt eine Gesellschaftstheorie der Sozialwissenschaftler Strauss und Howe aus den USA, die einen beim Finden der #Entscheidung unterstützt.

-

✘ Werbung:

Mein Buch Katastrophenzyklen ►...

Read More »

Read More »

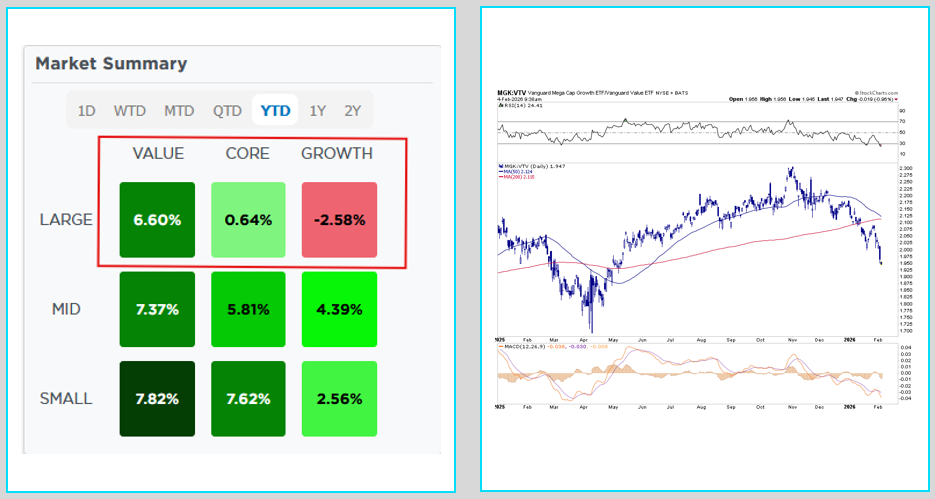

4-1-25 Failure At The 200-DMA – Correction Continues

Investors must remember that we're coming off two years of exceptional market returns, and that market corrections must be viewed in their proper context...and expected. Lance discusses the positive and negative impact of Mag-7 stocks on markets due to their weighting; meanwhile, the First Quarter has ended with institutional buyers acting in the final minutes of Monday's trading day, boosting stocks to a less than 1% gain at the close. Markets...

Read More »

Read More »

Ist eine Reiserücktrittsversicherung sinnvoll? ️🩹 #versicherungen

Ist eine Reiserücktrittsversicherung sinnvoll? ❤️🩹 #versicherungen

🎥 10 sinnlose Versicherungen, die Geldverschwendung sind!:

_IRKg?si=yOYz-kmuTVTlOHQY

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔...

Read More »

Read More »

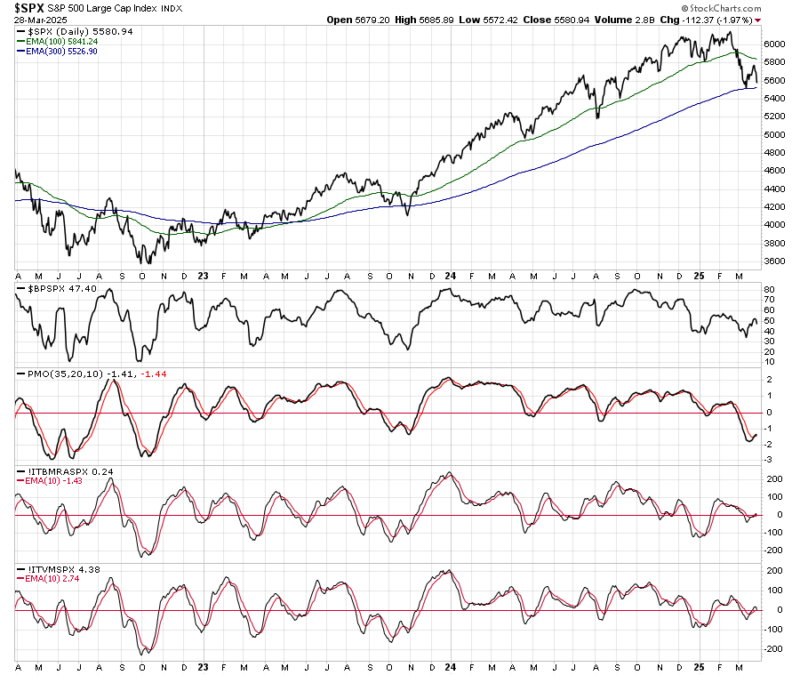

Failure At The 200-DMA

In last week's post, "Is the correction over?" we wrote about the potential for a rally back to the 200-DMA. However, the failure of that test increased short-term concerns. As we noted in that post, there were early indications of buyers returning to the market. To wit: "The chart below has four subpanels. The first … Continue reading...

Read More »

Read More »

Liberation Day: A Bullish Scenario

Stocks are hitting the skids as April 2nd, or Liberation Day, quickly approaches. Investors are rightfully scared that tariffs announced on Liberation Day will be crippling to the economy and harm corporate earnings. Based on recent comments from Donald Trump, that is a logical concern. However, what if Trump is playing with emotions to make …

Read More »

Read More »

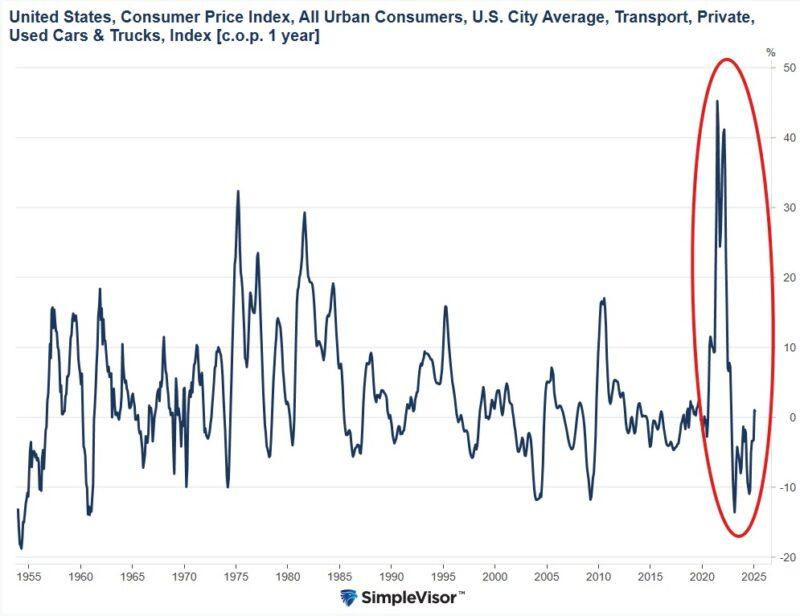

So viel Geld sparst Du jetzt beim Kauf von Gebrauchtwagen in Deutschland

Wie viel hast Du für Dein aktuelles Auto ausgegeben? Schreib's uns in die Kommentare.

#Finanztip

Read More »

Read More »

Mastering Buy Low, Sell High: Essential Tips for Investors

Learn to take profits and buy declines! Investing tip: Sell high and buy low. Don't miss the buy signal for Bitcoin at 80,000! 💰📈 #Investing101

Watch the entire show here: https://cstu.io/6f035d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

3-29-25 Savvy Social Security Planning

Much has been reported and speculated about the recently passed Social Security Fairness Act. In this episode of Candid Coffee, Richard Rosso and Danny Ratliff discuss what the repeal of WEP and GPO mean for you; understanding Social Security Spousal Benefits and survivor benefits; and rethinking retirement planning with an income boost from Social Security. They take a clear-eyed look at the Social Security Fairness Act, Windfall Elimination...

Read More »

Read More »

STEUERERHÖHUNG – #141 Tariffs mit Thomas + 25% auf alles (+ Soli)

Diese Steuererhöhungen stehen auf dem Plan! 🧮 #steuern

Ausschnitt aus Episode #141: Tariffs mit Thomas + 25% auf alles (+ Soli)

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen....

Read More »

Read More »

3-31-25 Sellable Rally Or “Buy The Dip”?

There are no discernable signs of economic stress...yet, bu tconsumers are concerned about wages and job security. The question begging to be asked: When is the Fed going to step in (Fed purview: Employment and price stability...AND by extension, consumer confidence). How will markets react to Liberation Day (4/2)? Corporate buy backs will resume 3rd week of April. Markets pulled back on Friday (mimicking four similar pull backs last year.) Make no...

Read More »

Read More »

Ist eine Reisegepäckversicherung sinnvoll? ️🩹 #versicherungen

Ist eine Reisegepäckversicherung sinnvoll? ❤️🩹 #versicherungen

🎥 10 sinnlose Versicherungen, die Geldverschwendung sind!:

_IRKg?si=yOYz-kmuTVTlOHQY

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

🔔...

Read More »

Read More »

Are Used Car Prices Set To Soar Again?

It wasn’t that long ago that used car prices were soaring as the production of new cars was crimped due to Covid-related supply line shortages. Since then, used car prices have stabilized as the supply lines have healed. However, like many goods, prices haven't retreated to pre-pandemic levels. As we wrote in yesterday's Commentary, the …

Read More »

Read More »

Why Letting Big Banks Go Bankrupt Won’t Destroy the Economy

Letting big banks go bankrupt during the financial crisis could have been a better move! Find out why in this eye-opening video. 💰 #Finance #Economy

Watch the entire show here: https://cstu.io/4ea134

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Ist eine Krankenhaustagegeldversicherung sinnvoll? ️🩹 #versicherungen

Ist eine Krankenhaustagegeldversicherung sinnvoll? ❤️🩹 #versicherungen

🎥 10 sinnlose Versicherungen, die Geldverschwendung sind!:

_IRKg?si=yOYz-kmuTVTlOHQY

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum...

Read More »

Read More »