Category Archive: 9a) Buy and Hold

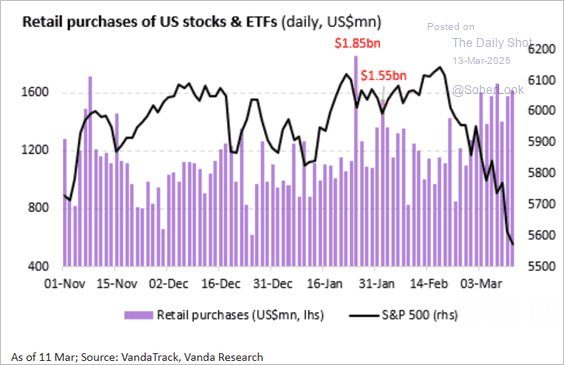

Retail Investor Buys The Dip Despite Bearish Sentiment

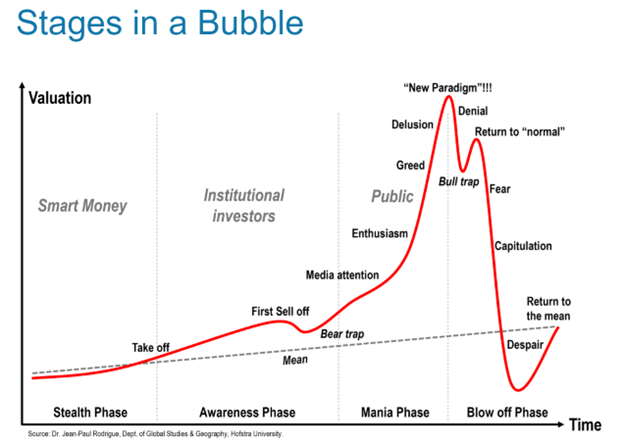

It has been an interesting correction. The average retail investor was "buying the dip" despite having an extremely bearish outlook. This is an interesting point because, as shown, the retail investor used to be considered a "contrarian indicator" as they were prone to be driven by emotional behaviors that led them to "buy high and sell low." …

Read More »

Read More »

VW weiß sicher am besten über VW Bescheid… #volkswagen

VW weiß sicher am besten über VW Bescheid... ? #volkswagen

?️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung zu übernehmen und eigene, fundierte, finanzielle Entscheidungen zu treffen....

Read More »

Read More »

Wie geht Altersvorsorge in Deinen 20ern? Wohlstand früh aufbauen

Zum Newsletter von Finanztip Schule ► https://www.finanztip.schule/anmeldung/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=0fY0i_oXDg0

🧡 Finanztip ist gemeinnützig. Jetzt Unterstützer werden: https://www.finanztip.de/unterstuetzer-youtube/?utm_source=youtube&utm_medium=videobeschreibung&utm_campaign=0fY0i_oXDg0&utm_content=content_unterstuetzer

In diesem Video spricht Saidi mit Sarah von der Finanztip Stiftung...

Read More »

Read More »

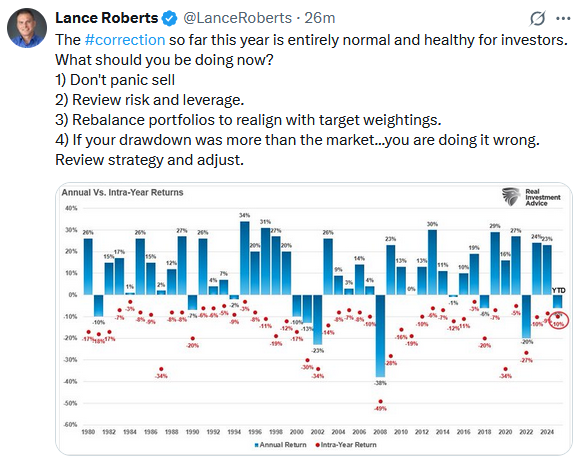

3-17-25 Recession Fears Emerge

Markets last week ripped through one of the fastest 10% corrections ever; that's what happens when markets are over bought. Media headlines whip investors into a frenzy with Recession talk, ignoring the fact that in order for a moving average to remain the average, markets must ebb and flow, above and below, in order to provide the average. The Government is shedding non-essential employees (which begs the question of why they were hired in the...

Read More »

Read More »

ETF-Fehler: Nicht mit dem Investieren beginnen #etf

ETF-Fehler: Nicht mit dem Investieren beginnen ? #etf

? 10 teure ETF-Fehler, die du vermeiden solltest! | Häufige ETF-Pannen von Anlegern:

?si=jun8zRArGp1u4LvA

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum...

Read More »

Read More »

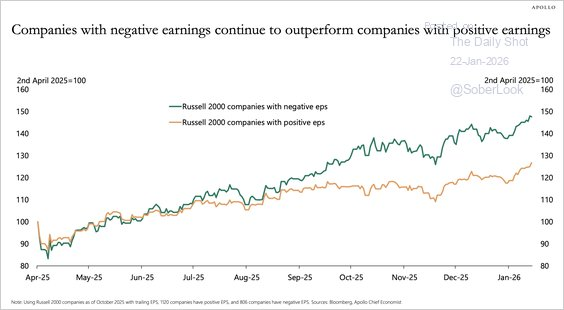

Investors Dismiss Fundamentals: Valuations Hold Little Weight in Modern Markets

Valuations haven't mattered. Fundamentals don't matter much due to the Momo chase. A whole generation of investors haven't seen this before. ? #Investing

Watch the entire show here: https://cstu.io/054b76

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How to Avoid Common Retirement Planning Mistakes That Could Cost You Thousands

Planning for retirement requires careful preparation and smart financial decisions. However, many retirees make critical errors that can drain their savings, reduce their income, and leave them financially vulnerable. Avoiding financial pitfalls is essential to ensuring a comfortable and stress-free retirement. Here’s a look at some of the most common retirement planning mistakes and how …

Read More »

Read More »

Orange Juice And Egg Prices Provide Welcome Relief

As we have mentioned numerous times, consumer sentiment greatly impacts economic activity. Accordingly, the price activity of particular goods can have an outsized influence on consumer inflation views. For example, orange juice and egg prices have been leading some consumers to have flashbacks of the recent high inflation. Based on the recent price trends of …

Read More »

Read More »

Staatsstreich in Deutschland? Wer hat Schuld?

Parteien wollen das #Grundgesetz für Giga-Schulden und #Aufrüstung ändern und brauchen dazu den alten, abgewählten Bundestag, weil der Neue keine 'passenden' Mehrheiten mehr hat. Warum hat das #Bundesverfassungsgericht den ersten Klagen nicht stattgegeben, obwohl der neue Bundestag den aktuellen Willen des Volkes spiegelt? Wer sitzt an den Schaltstellen der Macht und entscheidet, dass sich der neue Bundestag nicht konstituieren darf? Zum Abschluss...

Read More »

Read More »

Deutschland spart sich reich: Private Geldvermögen in Deutschland erreichte 2024 Rekordniveau #short

Deutschland spart sich reich: Das private Geldvermögen in Deutschland erreichte 2024 ein Rekordniveau!

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den...

Read More »

Read More »

Understanding How Valuations Impact Future Returns in Investments

Unpredictable market returns explained! ?? It's a rollercoaster - 10% up, 20% down, then back up! Who knows what the future holds? ? #investing101

Watch the entire show here: https://cstu.io/d25fe1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Rententrick Nr. 14: Privat vorsorgen #rente

Rententrick Nr. 14: Privat vorsorgen ?? #rente

? 14 legale Rententricks für mehr Geld / eine frühere Rente!:

&t=1s

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen...

Read More »

Read More »

63 Reise-Spartipps für den Urlaub! | Hacks für günstige Flüge, Hotels & mehr!

63 Sparhacks zum Geld sparen bei Flugtickets, Unterkunft, etc.!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=836&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Kreditkartenvergleich: https://www.finanzfluss.de/vergleich/kreditkarte/ ?

Finanzfluss Copilot: App für dein Vermögen ►► https://link.finanzfluss.de/r/copilot-app-yt ?

ℹ️ Weitere Infos zum...

Read More »

Read More »

Wie viel Immobilie kannst Du Dir leisten? Der richtige Preis für Dein Einkommen

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-text-youtube/yt_GWG7Zykf6Tc

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_GWG7Zykf6Tc

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_GWG7Zykf6Tc

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_GWG7Zykf6Tc

Justtrade* ►...

Read More »

Read More »

Rumdödeln bis 23 Uhr? Die Wahrheit über Arbeitszeiten im Consulting! ?

Rumdödeln bis 23 Uhr? Die Wahrheit über Arbeitszeiten im Consulting! ?

? Sebastian Klein ist Buchautor und Mitgründer von Blinkist. Durch seinen Exit bei Blinkist hat er zwar ein stattliches Vermögen erhalten, aber einen Großteil davon abgegeben. Heute spricht Sebastian über seine Zeit bei Boston Consulting und warum lange Arbeitsstunden nicht immer effizient genutzt werden.

Das komplette Interview in voller Länge, findest du auf unserem Youtube...

Read More »

Read More »

Understanding Market Downturns: What Shrinkage Reveals About Hidden Investment Mistakes

? Market insights: Don't rely on a bull market to cover mistakes. Plan your portfolio wisely for long-term success! ?? #InvestingTips #Finance

Watch the entire show here: https://cstu.io/38a112

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Rententrick Nr. 13: Rentenpunkte kaufen #rente

Rententrick Nr. 13: Rentenpunkte kaufen ?? #rente

? 14 legale Rententricks für mehr Geld / eine frühere Rente!:

&t=1s

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen...

Read More »

Read More »