Category Archive: 9a.) Real Investment Advice

Stagnation Is Lulling The Fed To Sleep

The JOLTs data released on Wednesday paint a picture of labor market stagnation. The graph below shows that the number of job openings has fallen to levels similar to those right before the pandemic. While the number of openings seems somewhat stable, layoffs are slowly increasing, while new hires are near a 15-year low. Similarly, …

Read More »

Read More »

New Year’s Resolutions For 2026 – Investor Version

Every January, it happens like clockwork: you drive by gym parking lots that look like a Taylor Swift concert. Go to the store, and the salad aisles are ransacked like there’s a lettuce shortage, and half of your coworkers suddenly start quoting Warren Buffett while buying stock in companies they can’t spell. You got it, …

Read More »

Read More »

1-8-26 Markets Don’t Need a Crash to Go Down in 2026

Markets don’t need a crash to go down in 2026—valuation compression alone can do the damage.

In this Short video, Michael Lebowitz and I discuss why stretched multiples, normal volatility, and rotation risk matter more than bullish forecasts.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-8-26 2026 Market Forecasts: Why Wall Street Gets It Wrong

Lance Roberts & Michael Lebowitz explain why year-ahead market forecasts are largely an exercise in false precision. Instead of offering a price target with zero confidence, we walk through the key forces that are likely to shape markets in 2026—including stretched valuations, liquidity injections disguised as “reserve management,” the Federal Reserve leadership transition, midterm elections, fiscal uncertainty, AI-driven capital spending,...

Read More »

Read More »

Fed Challenges: Bill Dudley’s Take On 2026

Bill Dudley, a respected economist and President of the New York Fed during the Financial Crisis, penned a Bloomberg editorial outlining six challenges facing the Fed in 2026. Given his deep background in economics and intimate knowledge of the Fed, it's worth providing a brief summary of his views. Independence is at the top of …

Read More »

Read More »

Understanding Inflation Impact On Investments

How Inflation Affects Your Investments & Ways to Protect Against It Inflation has a sneaky talent; it rarely arrives with fireworks. It shows up in the small stuff first. A higher grocery bill. A pricier dinner out. A “wait, when did flights get this expensive?” moment. Then, if it sticks around, it starts changing the …

Read More »

Read More »

1-7-25 Live Chat Q&A – Ask Us Anything!

Markets are hitting all-time highs, earnings expectations are rising, and investors are navigating everything from oil prices to Roth conversions. Lance Roberts & Danny Ratliff take live viewer questions and explore the themes investors are most focused on right now.

Topics discussed include why earnings may be the primary market driver this year, what recent all-time highs signal for forward returns, and how capital flows are shifting across...

Read More »

Read More »

1-7-26 Let’s Talk About Venezuela, Oil Prices & Energy Stocks

Energy stocks $XLE are running ahead of oil fundamentals, and that gap won’t last forever.

In this Short video, Lance Roberts explains how Venezuela, supply risk, and slowing demand could push #crudeoil prices lower and force energy stocks to catch up.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

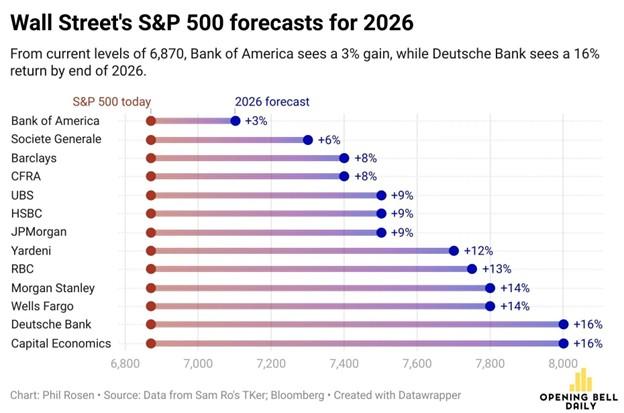

2026 Forecast: Tis The Season For Wild Guesses

It's that time of year when every Wall Street analyst posts their forecast for where the S&P 500 will close at the end of 2026. This year, as in every other, Wall Street expects the S&P 500 to post positive returns. As shown below, Bank of America is the most cautious, with a 3% gain, … Continue reading »

Read More »

Read More »

Minerals, Russia, China & Iran: More On Venezuela

Yesterday’s Commentary discussed the potential impact of regime change in Venezuela on the energy sector. Today, we extend the analysis and examine other reasons for the invasion. The following theories are based on a Substack commentary from Tracy Shucart, an economist and resources trader. For starters, Tracy makes it clear that oil is not the …

Read More »

Read More »

1-6-26 The Most Dangerous Risk Is The One No One Sees

Markets don’t crash on risks everyone is watching—they’re already priced in and hedged.

In this Short video, Lance Roberts explains why the real danger is an unexpected shock that forces earnings lower and triggers a rapid repricing of valuations.

📺Full episode: -Z7mJI

Catch Lance daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-6-26 Financial Nihilism vs. Financial Planning

More investors—especially Millennials and Gen Z—are treating markets like a casino. Not because they’re reckless, but because the traditional path to financial security feels broken.

Lance Roberts & Jonathan Penn break down Financial Nihilism vs. Financial Planning: why speculative behavior is rising, and what still works when confidence in long-term investing erodes. Options trading, crypto, meme assets, and betting apps offer fast outcomes...

Read More »

Read More »

Tax-Efficient Investing Strategies

Tax‑Efficient Investing: Keep More of What You Earn Growing wealth is only part of the story. Keeping it, especially after taxes, is where strategy makes the biggest difference. For high-net-worth investors, tax drag can be a persistent leak in performance, especially when taxable income and capital gains stack up inside the wrong accounts. Tax-efficient investing …

Read More »

Read More »

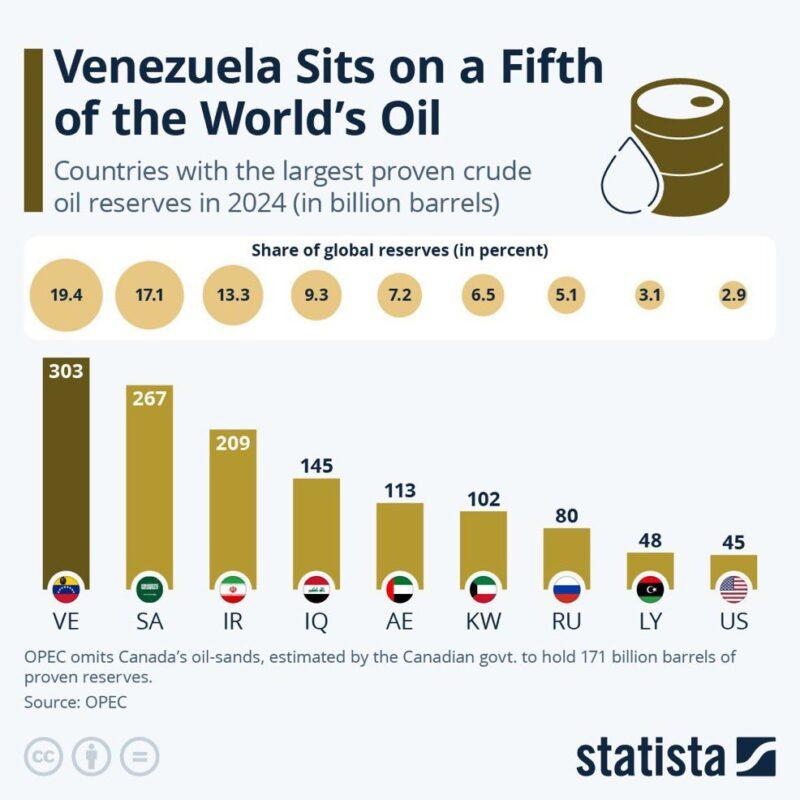

Venezuela Leads Energy Stocks Out Of The Gate In 2026

Venezuela holds 20% of the world's proven oil reserves. Not only are they the largest, but as shown in the Statista graphic below, they hold approximately seven times that of the United States. Despite its large reserves, Venezuela has fallen well short of its ability to supply the world. US sanctions and the significant deterioration …

Read More »

Read More »

1-5-26 Don’t Just Bet on Upside — Prepare for Any Outcome

The outlook for 2026 hinges on how valuations and economic growth play out.

In this Short video, I cover multiple $SPX year-end scenarios and explain why managing ranges matters more than betting on a single target.

📺Full episode: -Z7mJI

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-5-26 2026 Market Outlook: Bullish Momentum, Valuation Risks, and What Comes Next

Markets closed 2025 with strong gains, but the path forward into 2026 is far more nuanced than headline optimism suggests.

Lance Roberts reviews what drove 2025’s market performance, why the Santa Claus Rally failed, and how shifting inflation trends, Federal Reserve policy expectations, and valuation levels are shaping market outlooks for 2026.How can investors navigate the New Year with realistic expectations, disciplined risk management, and...

Read More »

Read More »

Precious Metals Aren’t Predicting Economic Collapse

In 2025, the prices of precious metals rose sharply, with silver prices recently surging past $80 per ounce. Of course, when precious metals rise, there is always the same group of commentators (mostly paid newsletter writers and physical metal dealers) to declare that a financial breakdown is underway. Articles like those published on ZeroHedge by …

Read More »

Read More »

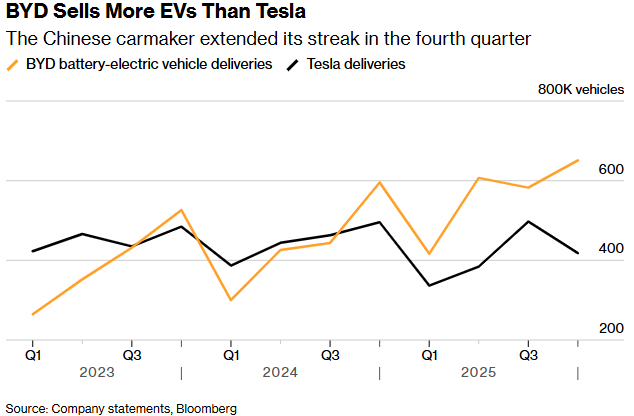

Tesla EV Deliveries Continue to Lag Global Rivals

Tesla EV deliveries totaled 1.64 million vehicles in 2025, leaving the company behind China’s BYD, which delivered more than 2.2 million EVs for the year. The result marks a second consecutive annual decline in Tesla EV deliveries, reinforcing the growing pressure on the company’s core automotive business. Fourth-quarter deliveries fell sharply year over year, underscoring …

Read More »

Read More »

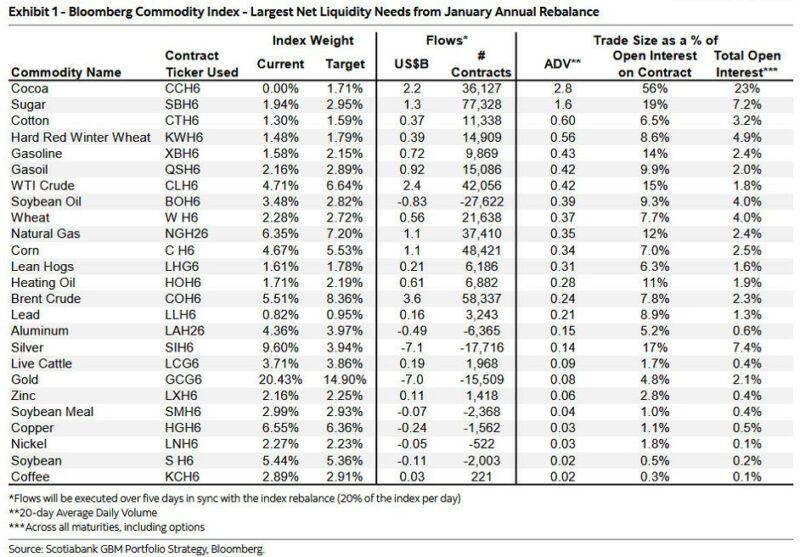

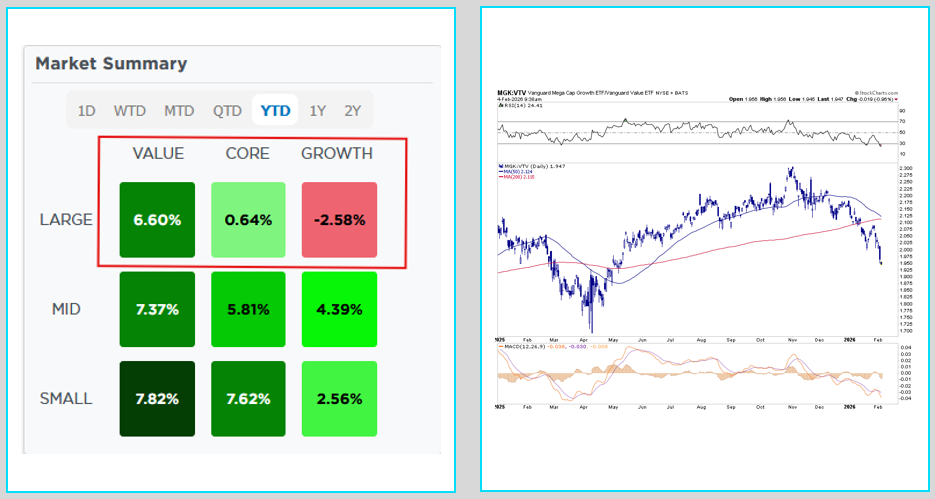

Market Outlook For 2026

🔎 At a Glance 💬 Don't Miss Our Upcoming "Live & In Person" Summit Our 2026 Summit is a limited-seating event, so secure your tickets now before they sell out. Topics Include: I look forward to seeing you there. 🏛️ Market Brief - Strong Year-End Returns Lead to Bullish Market Outlooks Let's start this week … Continue reading...

Read More »

Read More »

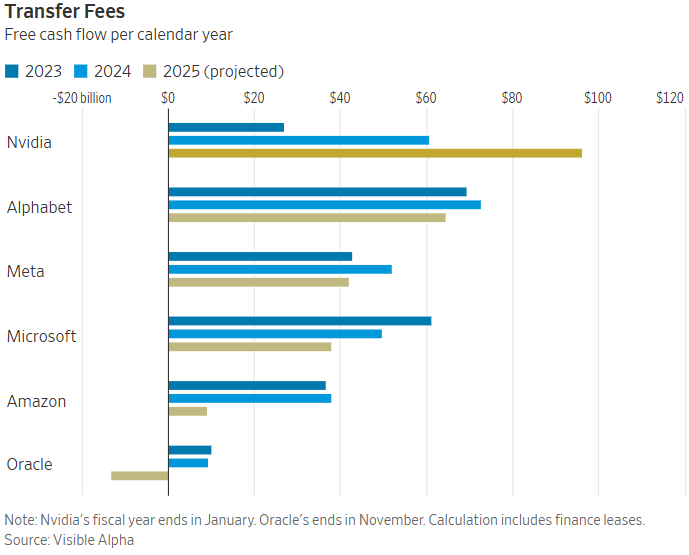

Nvidia’s Cash Strategy Reflects Regulatory Landscape

Nvidia’s explosive growth has created a new challenge: how to deploy an unprecedented amount of cash in a world where scale itself has become a regulatory constraint. The chart below, from The Wall Street Journal, illustrates Nvidia’s massive free cash flow growth. However, traditional uses of its cash, such as large acquisitions, are increasingly difficult …

Read More »

Read More »