Category Archive: 9a.) Real Investment Advice

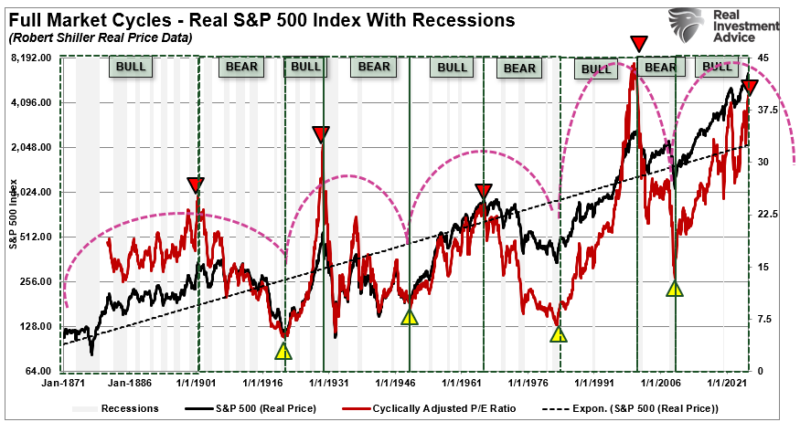

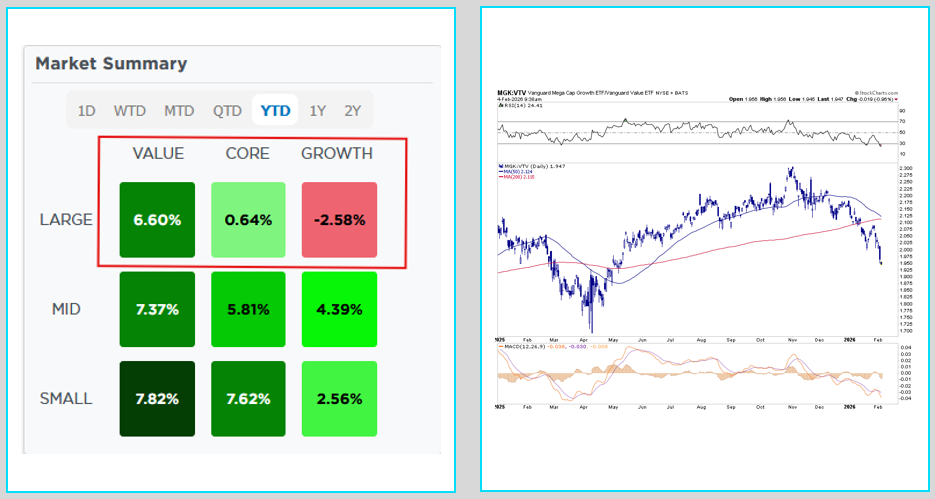

Full Market Cycles: Half Bull and Half Bear

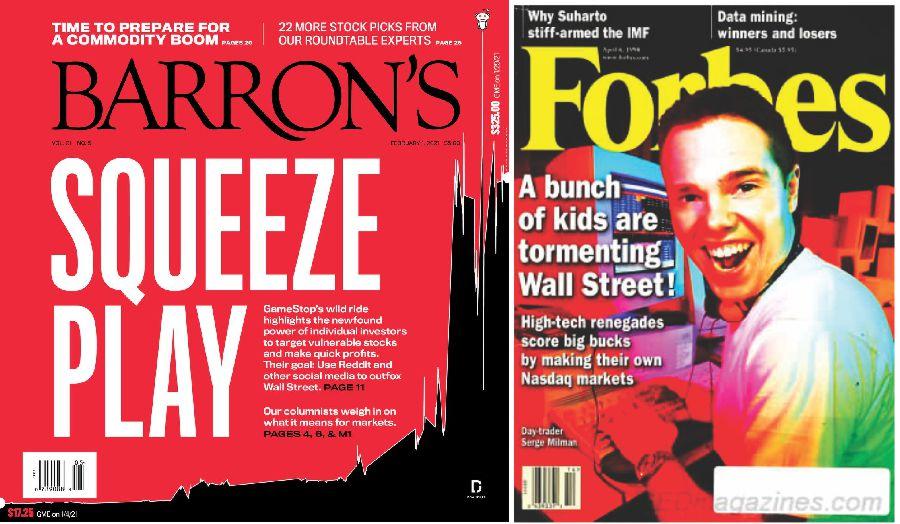

Last week, we discussed the importance of "math" as it relates to valuations and noted the importance of understanding "full market cycles." To wit: "The math on forward return expectations, given current valuation levels, does not hold up. The assumption that valuations can fall without the price of the markets being negatively impacted is also grossly flawed. …

Read More »

Read More »

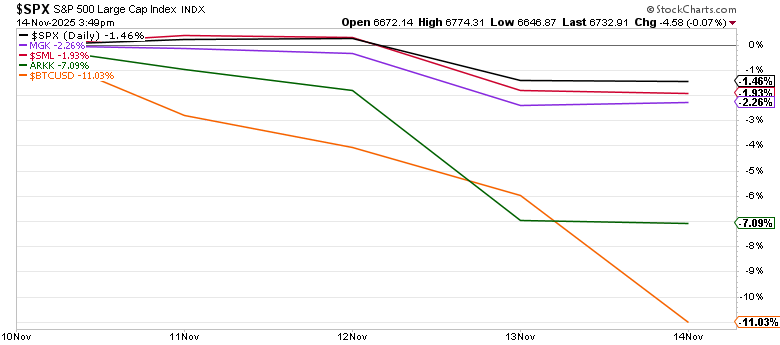

Is Strategy Dragging Bitcoin Down?

Bitcoin is up 2% year to date, but the share price of the world's largest holder of Bitcoin, Strategy (MSTR - formerly MicroStrategy), is down about 30% year to date. As we have noted in the past, Strategy is a Bitcoin holding company, a leveraged alternative to holding Bitcoin. Its original business, enterprise analytics software, …

Read More »

Read More »

11-15-25 Why The Fed Is Easing Into Strength — And What It Means For Markets

The Fed is preparing to cut rates just as an AI-driven boom accelerates.

In this short video, MIchael Lebowitz and I discuss why easing into strength is unusual, how it could stoke inflation, and what it means for the next phase of market growth.

📺Full episode: https://www.youtube.com/watch?v=-YZaHtreohI

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

EBITDA And The Warnings Of Charlie Munger

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

12-2-25 Dollar Power, AI, & The New Financial Order

In this episode, Lance Roberts sits down with Brent Johnson, CEO of Santiago Capital, to break down what’s really happening with the U.S. dollar, the global monetary system, and why AI is accelerating a geopolitical and economic power shift.

If you're looking for big-picture insights on the future of the dollar, geopolitics, AI-driven capital flows, and where long-term investing tailwinds are forming—this is a must-watch.

#BrentJohnson #USDollar...

Read More »

Read More »

11-14-25 Open Enrollment Traps to Avoid This Year

11-14-25 Open Enrollment Traps to Avoid This Year

Open Enrollment season is here—and it’s one of the most overlooked financial opportunities employees have all year. In this episode, we break down the biggest mistakes people make when reviewing their employer benefits and how to approach your plan as if you were a brand-new hire.

Richard Rosso & Jonathan McCarty tackle the smart way to choose health insurance, whether young workers really...

Read More »

Read More »

11-13-25 Everyone Thinks AI Is the Bubble — But the Real One Is the Fed

For over a decade, the Fed’s endless liquidity has fueled moral hazard—pushing investors to buy every dip and keeping valuations inflated.

In this short video, @michaellebowitz and I discuss why the real bubble isn’t AI—it’s the Fed’s never-ending backstop.

📺Full episode: https://www.youtube.com/watch?v=-YZaHtreohI

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

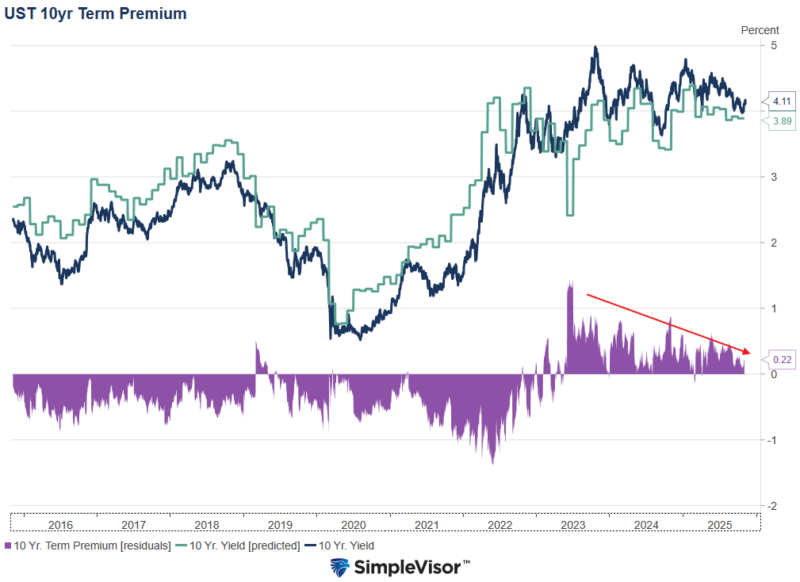

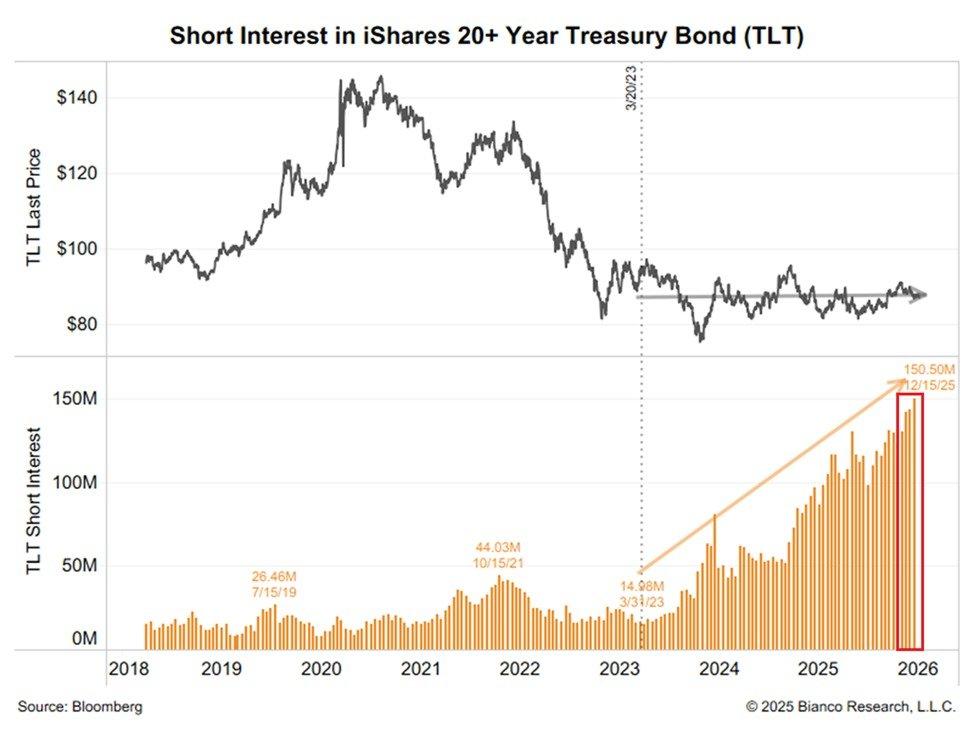

The Bearish Bond Narrative Fades

Not that long ago, bond yields were rising as concerns over deficits, inflation, and a series of bad Treasury auctions were paraded through the media. We bring this to your attention as the Ten-year Treasury auction on Wednesday was on the weaker side, yet the bond market reaction was minimal. Additionally, government deficits are just …

Read More »

Read More »

Economic Reacceleration: A Contrarian View

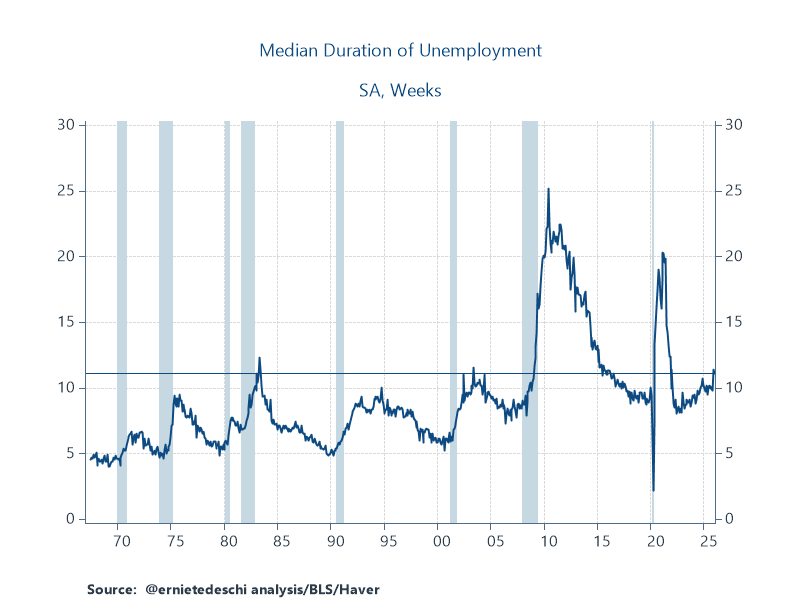

Over the past two weeks, we’ve addressed a persistent question: if the data signals weakness, why hasn’t the recession arrived? In "Slowdown Signals: Are Leading Indicators Flashing Red?" we examined the cracks forming beneath the economy's surface. From deteriorating leading indicators to credit stress and cooling employment metrics, the evidence supported a cautious stance. In …

Read More »

Read More »

11-13-25 A Daily Dose Of Charts & Graphs

In this short video, I cover the end of the 43-day US government shutdown, renewed dip-buying from both retail and institutions, and #Bitcoin drawdown closely mirroring its February correction.

I also touch on widening performance gaps among the top tech stocks — with rotation opportunities emerging from $AAPL and $AMZN into $META — all in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch me daily on The Real...

Read More »

Read More »

11-13-25 QE Is Coming: Why Fed Liquidity Now Runs the Entire Market

The scent of QE is back.

With overnight funding markets flashing early stress and NY Fed President John Williams hinting at “gradual asset purchases,” it’s clear: the liquidity cycle is turning again.

But the real question is why markets have become so dependent on the Fed in the first place.

Lance Roberts & Michael Lebowitz break down how the 2008 financial crisis fundamentally rewired market plumbing, sidelined private liquidity providers,...

Read More »

Read More »

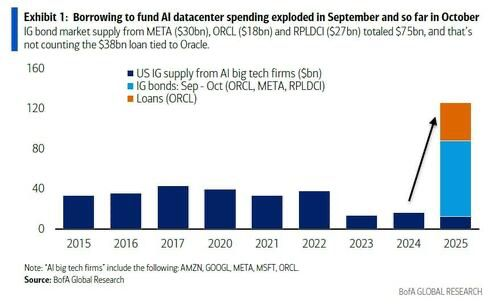

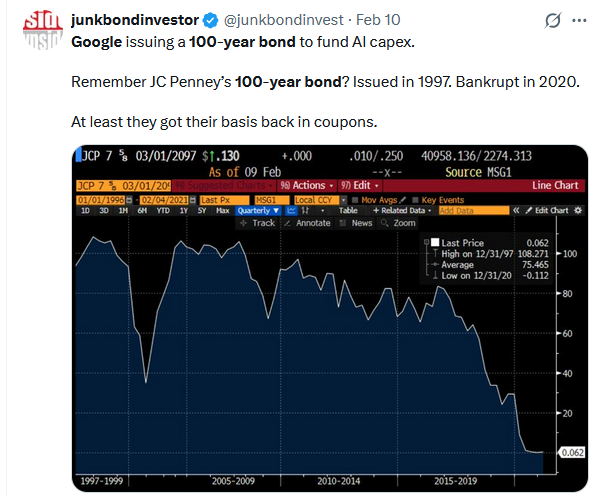

Data Center Debt: Can Oracle Hang With The Big Boys?

Meta and Google recently borrowed a combined $55 billion in the corporate bond market. As we share below, this debt represents a new source of funding for data center expansion. Further, as shown in orange, Oracle tapped the private market for loans to secure the capital needed to sustain AI innovation and the related data … Continue...

Read More »

Read More »

11-25-25 The System Is Broken – Garrett Baldwin Interview

Lance Roberts sits down with Garrett Baldwin to dissect how the financial system became structurally distorted — from the Fed’s collateral-driven era after 2008 to the unchecked rise of passive investing and liquidity engineering.

Other key topics include:

The illusion of value through asset-price debasement

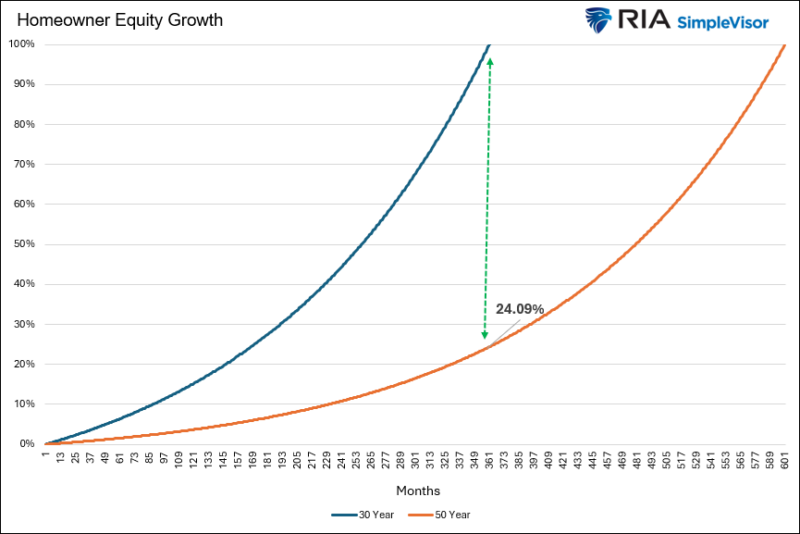

The 50-year mortgage folly and real housing affordability

CATH ETFs and the birth of speculative flows

How ETFs and repo markets reshaped...

Read More »

Read More »

11-12-25 December Rate Cut Back in Play

Soft jobs data and falling rents point to weaker inflation ahead, setting the stage for a potential Fed rate cut in December.

In this short video, I explain why this slowdown may be exactly what the market needs to keep the rally alive.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-12-25 A Daily Dose Of Charts & Graphs

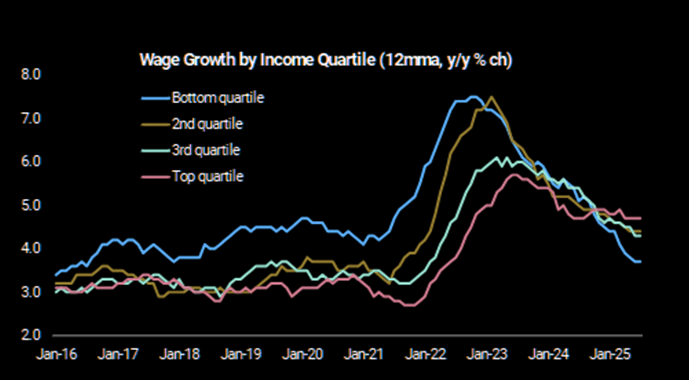

In this short video, I cover the return of risk appetite, falling rents signaling disinflation, and the $5–$7T AI data-center buildout.

I also touch on $AAPL push into robotics and the massive power and funding needs driving the next tech super-cycle — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-12-25 How to Spend Without Regret: Strategies for Enjoying Retirement

Most retirement advice focuses on saving and not running out of money — but few talk about how to spend confidently once you’ve achieved financial independence.

Lance Roberts & Danny Ratliff show how to shift from saving mode to living mode without fear or guilt:

Why it’s okay to enjoy what you’ve earned

How to enjoy your wealth without overspending

The emotional side of leaving the “accumulation” mindset

Practical withdrawal and income...

Read More »

Read More »

QE Is Coming: The 2008 Roots Of Fed Dominance

Here we go again. The overnight funding markets are showing signs of stress, and the scent of QE is in the air. Per New York Fed President John Williams: Based on recent sustained repo market pressures and other growing signs of reserves moving from abundant to ample, I expect that it will not be long … Continue reading »

Read More »

Read More »

50 Year Mortgages: Pros And Cons

President Trump proposed, with the full support of Federal Housing Director Bill Pulte, that homeowners be allowed to take out 50-year mortgages. The goal is to make housing more affordable, especially for younger generations who lack real estate equity and face high home prices and elevated mortgage rates. Read more about the sad state of …

Read More »

Read More »

11-11-25 A Daily Dose Of Charts & Graphs

In this short video, I cover the record $1.2T in U.S. buybacks, flat profit margins outside tech, and Europe’s lagging data capacity.

I also touch on tightening liquidity, rising debt-fueled AI investment, and echoes of the 1990s boom that point to hidden risks beneath the surface — everything you need in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch me daily on The Real Investment Show:...

Read More »

Read More »

An Economic Data Flood Is Coming: Does It Matter?

Buckle Up! With the end of the government shutdown and the return to work of government employees comes a flood of economic data. Below is a list of old economic data that should be released over the coming weeks: The list goes on. But, of more importance is whether or not the markets will care … Continue reading »

Read More »

Read More »