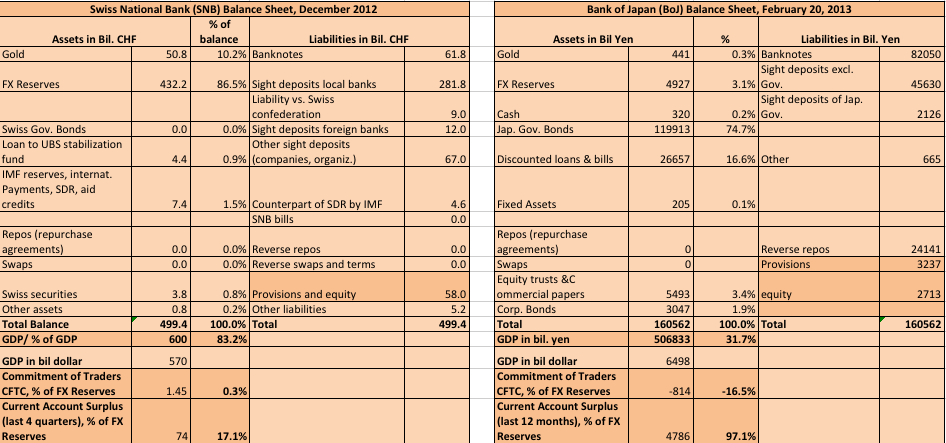

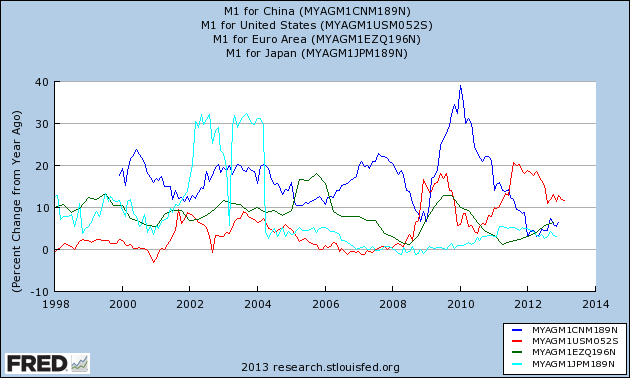

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and both safe-havens like the CHF, gold or the Japanese …

Read More »

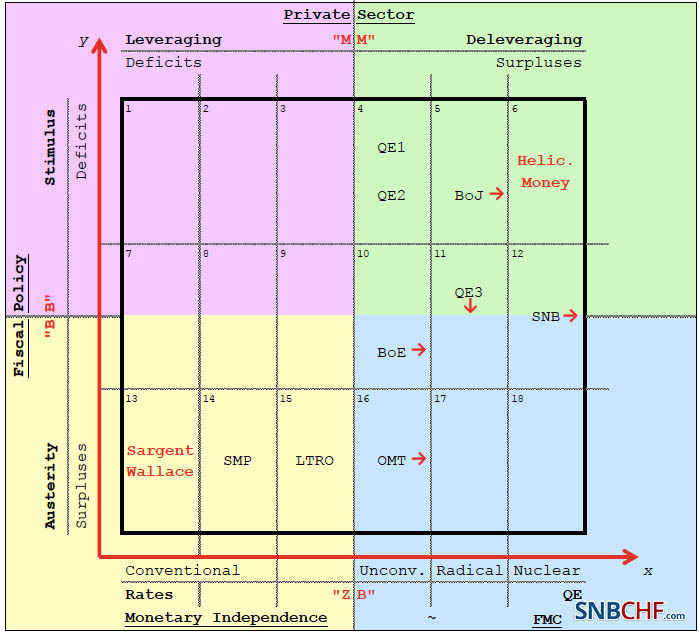

Category Archive: 8d.) Monetary Policy

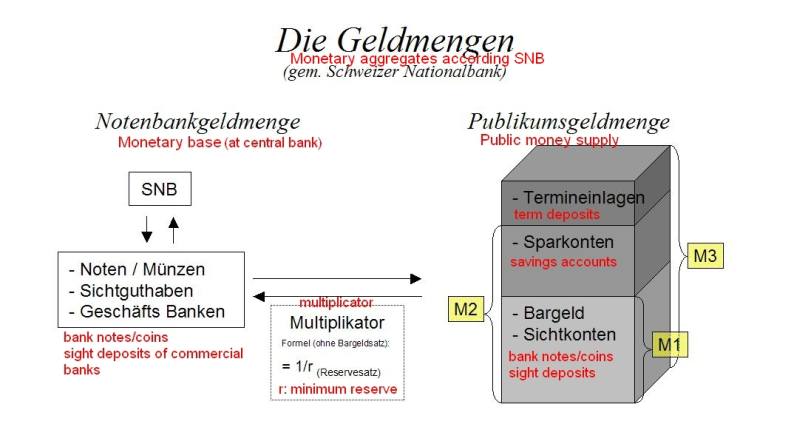

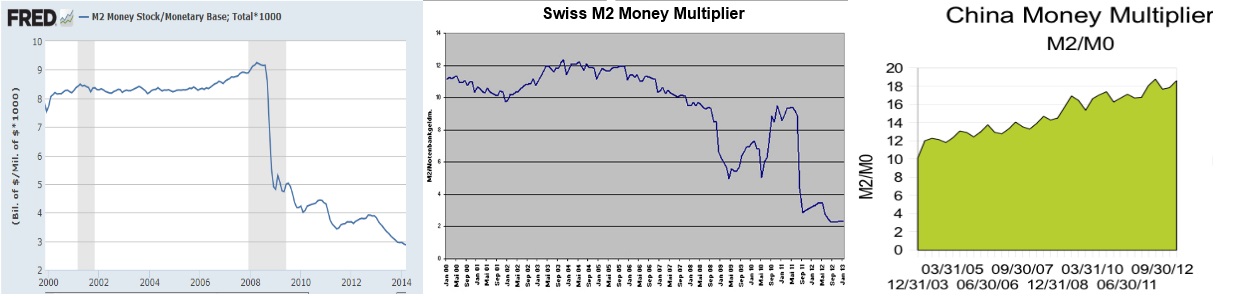

Why negative interest rates are contractionary, the base money confusion

From FT Alphaville: Excess reserves do not mean banks are not lending, and enforcing negative rates may do more harm than good because it is ultimately contractionary rather than expansionary.

Read More »

Read More »

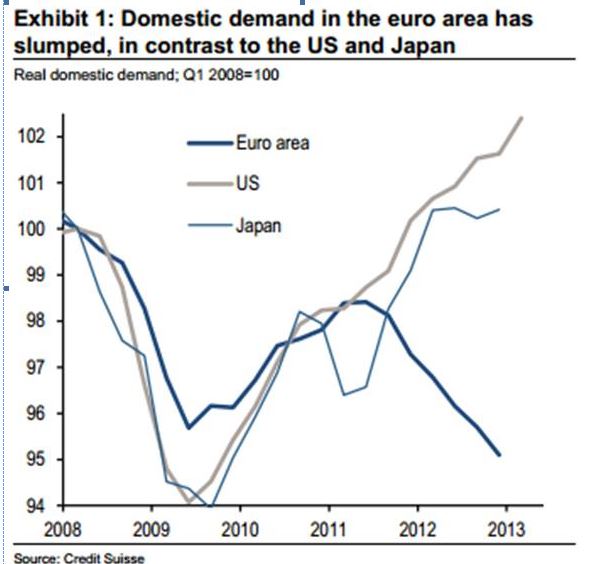

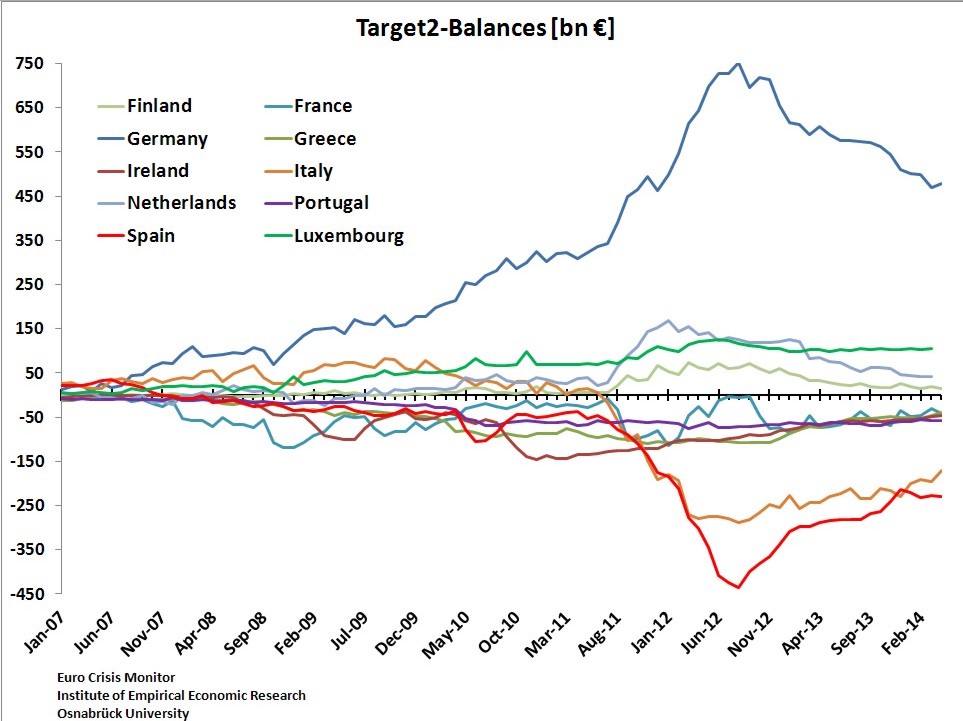

Balance of Payments Crisis: Did the Fed Cause the Euro Crisis with Excessive Monetary Easing?

The Fed's excessive monetary easing QE2 caused an inflationary period, that created a balance of payments crisis during which the Eurozone members were obliged to introduce excessive austerity measures.

Read More »

Read More »

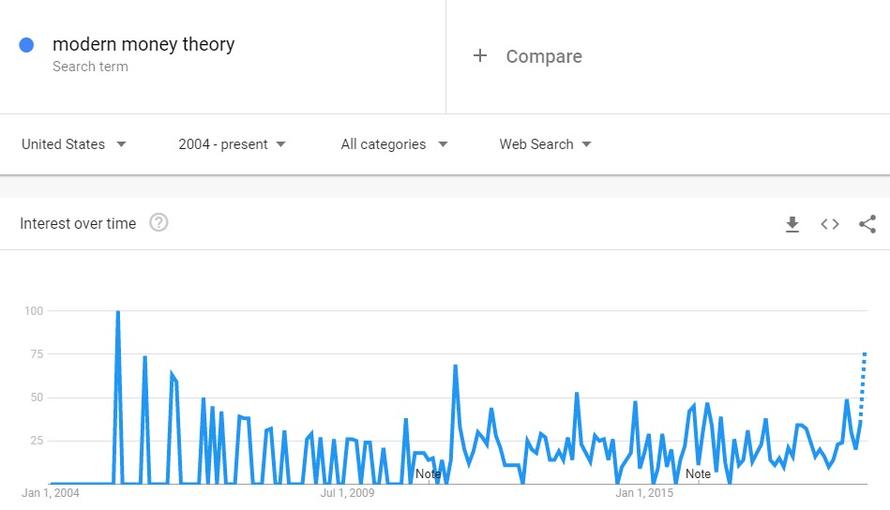

The Inflation Lie? Why and When Inflation Will Come Back

The so-called "inflation lie" : money printing does not create inflation. The cyclical slowing in emerging markets shows that it actually did cause inflation, just not in developed economies yet.

Read More »

Read More »

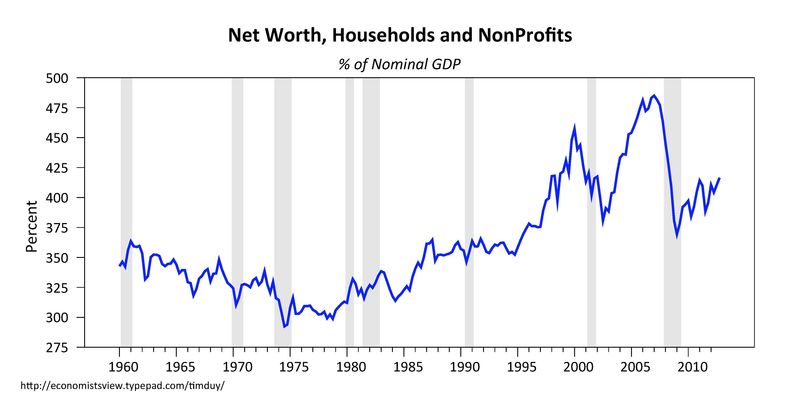

Are Asset Price Bubbles Needed to Make the US Economy Recover?

About the trade-off between economic recovery and financial stability In the recent post on gold prices, we maintained that the Fed will raise interest rates far later than most FOMC members admit. This would imply that the years of financial repression will continue and investors will push up asset prices, incl. gold, instead. Many libertarians …

Read More »

Read More »

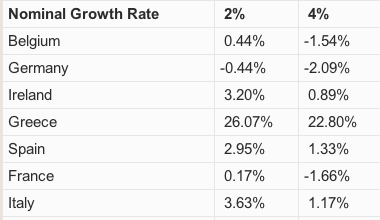

Which Primary Surpluses are needed for EU Members?

Primary surplus is the difference between government revenues and expenditures excl interest. Debt is reduced if rel. primary surplus is higher than debt multiplied by interest minus GDP growth.

Read More »

Read More »

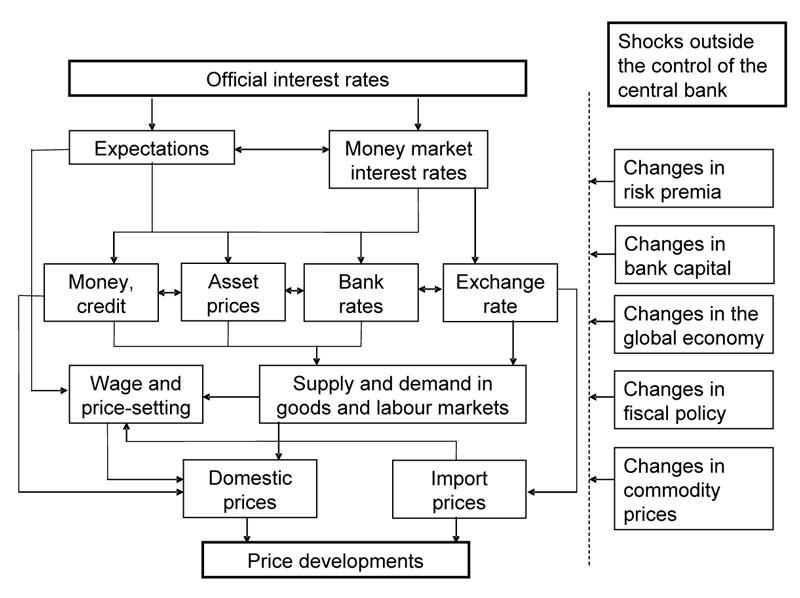

The Natural Rate of Interest/Taylor Rate

Central banks often want to follow two targets: low inflation and low unemployment. to achieve both criteria they look for a formula that incorporates both

Read More »

Read More »

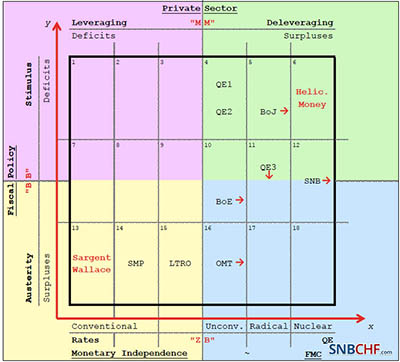

Quantitative Easing: The Fed Wants Americans to Continue Deficit Spending

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This usually pushes down the dollar and inflation hedges like the Swiss franc and …

Read More »

Read More »