Category Archive: 6a.) Ronan Manly (Bullionstar)

New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil

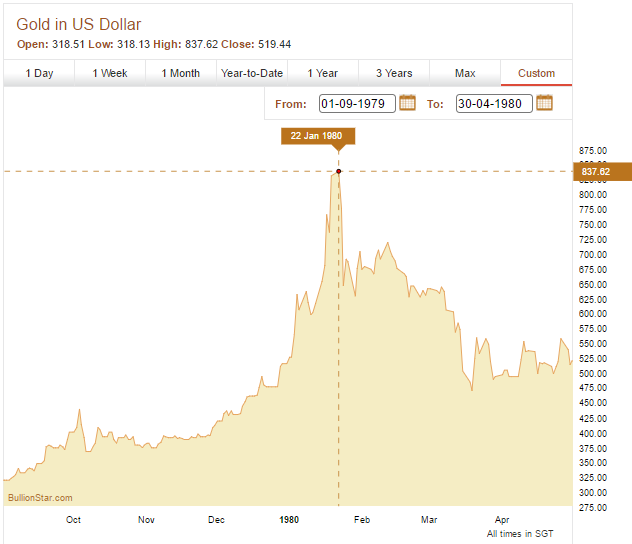

This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland.

Read More »

Read More »

New Gold Pool at the BIS Basle, Switzerland: Part 1

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.”

Read More »

Read More »

Death Spiral for the LBMA Gold and Silver auctions?

In a bizarre series of events that have had limited coverage but which are sure to have far-reaching consequences for benchmark pricing in the precious metals markets, the LBMA Gold Price and LBMA Silver Price auctions both experienced embarrassing trading glitches over consecutive trading days on Monday 10 April and Tuesday 11 April. At the outset, its worth remembering that both of these London-based benchmarks are Regulated Benchmarks, regulated...

Read More »

Read More »

Who Owns the Public Gold: States or Central Banks?

It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states?

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

Central Banks & Governments and their gold coin holdings

While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves.

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »