Category Archive: 6a.) Monetary Metals

The Future of Gold and Money: Jeff Deist, James Dale Davidson, Keith Weiner Roundtable

2020-09-22

by Keith Weiner

In this roundtable discussion, David Gornoski, host of A Neighbor's Choice radio show, is joined by Mises Institute’s Jeff Deist, Keith Weiner of Monetary Metals, and James Dale Davidson, author of The Sovereign Individual. Together, they discuss the history and future of gold as an investment asset for the average Joe, general misconceptions about gold, the fiat money system, how to make gold become money.

Read More »

Read More »

Battle of the Scapegoats, Keith Weiner on GDP, Inflation

2020-09-10

by Keith Weiner

David Gornoski hosts A Neighbor's Choice LIVE 4-6pm EST. Comment below or call in at 727 587 1040.

Read More »

Read More »

The Dollar Cancer and the Gold Cure with Keith Weiner Part One

2020-09-04

by Keith Weiner

In this far reaching interview i speak to Keith Weiner, CEO and Founder of Monetary Metals about fiat currency and why it is bound to fail.

The history of money and credit and the decline of dollar purchasing power

Money versus credit and why you need to understand the current issues

What the implications are for modern society

If people want to take their marbles home what does that look like?

Warren Buffet's investment into gold.

Do you...

Read More »

Read More »

Veteran Ben Adams on Endless Wars, Keith Weiner Takes on Keynes

2020-09-02

by Keith Weiner

David Gornoski hosts A Neighbor's Choice LIVE 4-6pm EST. Comment below or call in at 727 587 1040.

Read More »

Read More »

Keith Weiner, CEO, Monetary Metals

2020-09-02

by Keith Weiner

What is money? How has it worked in the past and how will it work in the digital economy?

Read More »

Read More »

Dr. Yu on Self Charging Batteries, Keith Weiner on the Fed

2020-08-28

by Keith Weiner

David Gornoski hosts A Neighbor's Choice LIVE 4-6pm EST. Comment below or call in at 727 587 1040.

Read More »

Read More »

Warren Buffett Shorts The Economy, 18 August

It must be Monday, because the price of silver skyrocketed. From $26.10, it shot up to $27.50, or +5.4%. The last time we wrote about silver was after its crash to $25. Silver is now priced 10% above that low point.

Read More »

Read More »

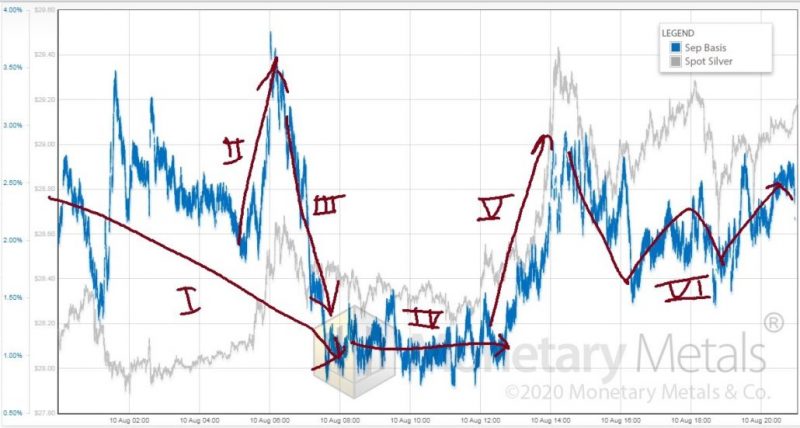

Silver Supply & Demand Still Strong at $29, 11 Aug

And, *bam!* Just like that, silver sells for $29. It seems so simple, so obvious, so black-and-white. Seeing the price chart in recent weeks, you wouldn’t know that silver speculators have been waiting for this moment since March, 2013 (when silver crossed the $29 line to the downside, and has not looked back until now).

Read More »

Read More »

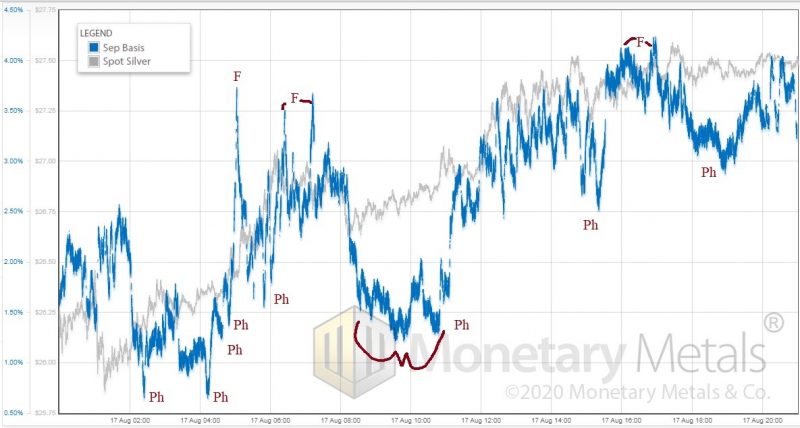

Silver Explodes—But Why?

The silver market witnessed another explosive day! At midnight (in London), the price of the metal was $26.90. By 9pm, it had rocketed up to $28.95, a gain of 7.6%. This is not normal.

Read More »

Read More »

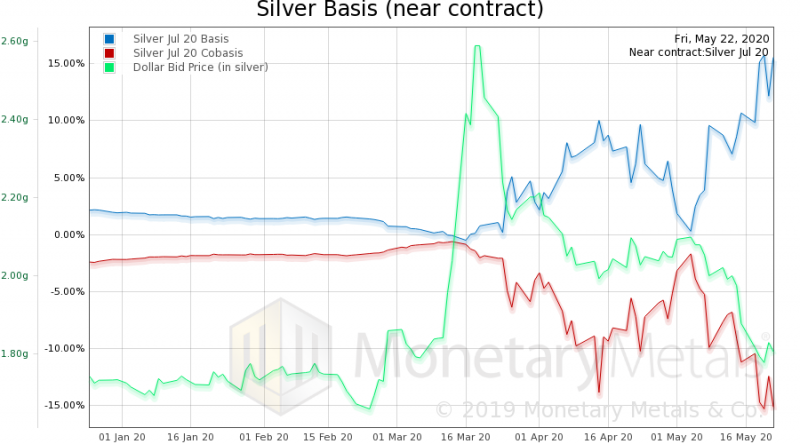

One of These Silver Days is Not Like the Other, 23 July

Yesterday, the price of silver spiked about 10%. We wrote that it was driven by: “…buying of physical metal.” And we added: “This is a pretty good signal that a bull market may be returning to silver. Let’s watch the basis and price action closely and see how it develops, before we join the pack…”

Read More »

Read More »

About that Spike in the Silver Price… 22 July

The price of silver has just spiked up about $2.00—that’s about 10%. All the usual suspects have been calling for silver to skyrocket. With some amusement, we have been watching ads from a guy known for savvy junior mining stock investments, who has been calling for gold to go up for a while.

Read More »

Read More »

Dear Bullion Banks, Please Come Back! Market Report

One of our colleagues recently wrote an open letter to Ted Butler. The point was that Monetary Metals gold leasing is a different kind of activity than what is called “gold leasing” in the institutional bullion market. We make it possible for gold owners to lease their metal to gold-using businesses, and thereby earn interest in gold.

Read More »

Read More »

The Simon-Ehrlich Bet Did Not Settle the Question

Are you familiar with the bet? Ehrlich wrote a book titled The Population Bomb. He held a pessimistic view of the future, in which population growth would outstrip resources (essentially the same as Thomas Malthus).

Read More »

Read More »

Defaults Are Coming, Market Report, 22 June

We are reading now about possible regulations for air travel. In brief: passengers might be forced to spend hours at the airport. Authorities will perform medical checks, including possibly needles to draw blood, no lounges, no food or drink on board the plane, masks required at all times, and even denied the use of a bathroom except by special permission.

Read More »

Read More »

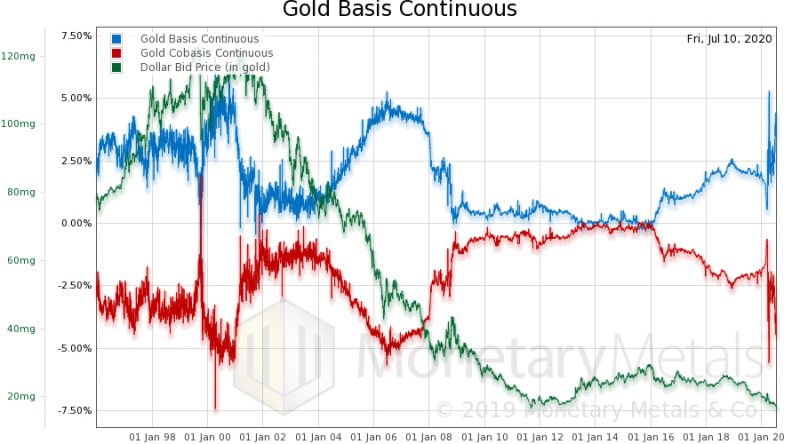

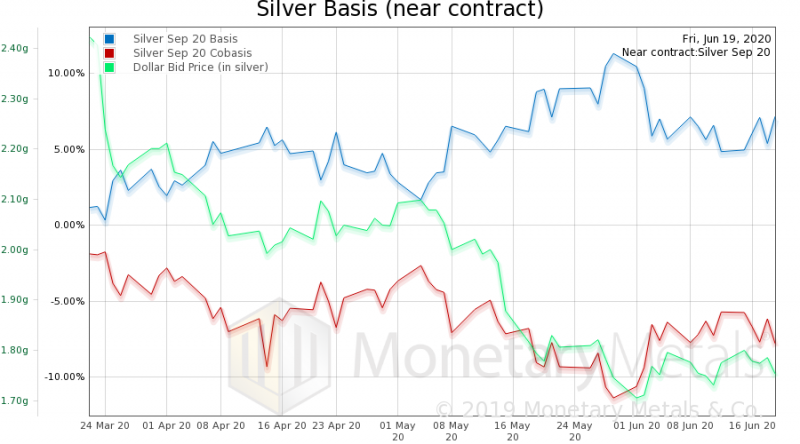

Growing Dollar Demand, Silver Weirdness, Market Report, 15 June

The Federal Reserve has become more aggressive again, after several years of acting docile. As you can see on this chart of the Fed’s balance sheet, it has very rapidly expanded from a baseline from (prior to) 2015 through 2018, of about $4.4 trillion. After which, it had attempted to taper, getting down to $3.8 trillion last summer. Then it was obliged to reverse itself well before responding to the COVID lockdown. Since then, its balance sheet...

Read More »

Read More »

Monetary Metals Provides Gold Loan to Sector Resources

The loan is denominated in gold with interest and principal paid in gold. Scottsdale, Ariz., June 9, 2020—Monetary Metals® announced today that it has loaned gold to Sector Resources Canada Ltd., a British Columbia based gold mining company. The private transaction was conducted off-market, and the interest rate and terms were not disclosed.

Read More »

Read More »

Interview with Keith Weiner on Theory of Interest Rates and Prices

2020-05-26

by Keith Weiner

The Theory of Interest and Prices https://monetary-metals.com/the-theory-of-interest-and-prices-in-paper-currency/

Read More »

Read More »

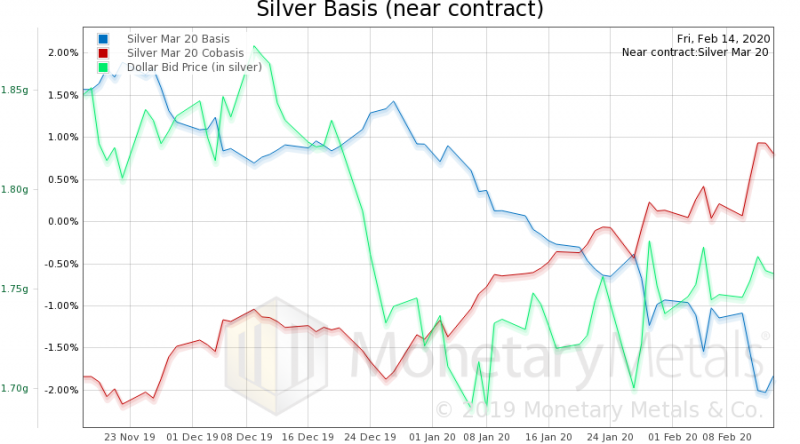

When Is a Capital Gain Capital Consumption? Market Report, 25 May

The price of gold dropped a few bucks this week, but the price of silver jumped about half a buck. The drumbeat for the gold bull market is well underway, and it is beginning now for silver. So let’s do a quick update on the supply and demand fundamentals.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

6 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito” -

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste! -

Entrepreneurship Beyond Politics: Mises Circle in Oklahoma City

-

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf! -

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani! -

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR -

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist

More from this category

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO22 Feb 2026

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!22 Feb 2026

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!21 Feb 2026

México en su PEOR año económico pero Sheinbaim presume “exito”

México en su PEOR año económico pero Sheinbaim presume “exito”21 Feb 2026

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!

Sachsen-Anhalt: Altparteien bilden Kartell gegen AfD und verhöhnen die Wähler aufs Schärfste!21 Feb 2026

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!

EIL: Nächster EDEKA Skandal kracht rein! “FCK AfD” Produkte im Verkauf!21 Feb 2026

New York im SCHOCK: Wütende Menge gegen Mamdani!

New York im SCHOCK: Wütende Menge gegen Mamdani!21 Feb 2026

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR

RUSIA OFRECE A ESTADOS UNIDOS VOLVER AL DÓLAR21 Feb 2026

What is America’s oldest constitutional debate? | The Economist

What is America’s oldest constitutional debate? | The Economist21 Feb 2026

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”!

Linnemann enthüllt SCHOCK-Wahrheit auf Parteitag: “Klingbeil ist SPD Kanzler”!21 Feb 2026

Optionshandel lernen: Warum du es einfach halten solltest

Optionshandel lernen: Warum du es einfach halten solltest21 Feb 2026

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen

Leben wir in einer Dystopie? #thorstenwittmann #finanzstrategien #finanzen21 Feb 2026

Cash für Medaillen

Cash für Medaillen21 Feb 2026

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby20 Feb 2026

El Tribunal Supremo HUNDE los aranceles de Trump… ¿o NO?

El Tribunal Supremo HUNDE los aranceles de Trump… ¿o NO?20 Feb 2026

Achtung: Elon Musk zerstört gerade Wikipedia!

Achtung: Elon Musk zerstört gerade Wikipedia!20 Feb 2026

1776 Patriot Silver Bars Are Selling Out

1776 Patriot Silver Bars Are Selling Out20 Feb 2026

Die Mittelschicht muss aufwachen!

Die Mittelschicht muss aufwachen!20 Feb 2026

Ray Dalio Shares His Secret for Longevity

Ray Dalio Shares His Secret for Longevity20 Feb 2026

2-20-26 This Market Is Chasing Themes, Not Valuations

2-20-26 This Market Is Chasing Themes, Not Valuations20 Feb 2026