Category Archive: 6a.) Gold Standard

Central Banks Fuel Gold Rally While Western Investors Sit Out

Don’t miss our exclusive interview with Philip Newman, managing director of Metals Focus (https://www.metalsfocus.com/) . Money Metals’ Mike Maharrey and Philip break down the silver supply deficit as well as where the demand for silver is coming from.

| Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan

Read More »

Read More »

Slow Cooking in a Microwave World: Reading Beyond the Economic Headlines

We live in a microwave world. But the economy is roasting in a slow cooker.

In this episode of the Midweek Memo, host Mike Maharrey talks about modern news media and the struggle to make sense of a slowly unfolding economy in a world where headlines drive decision-making. Along the way, he maps out some of the fundamentals he sees underlying today's economy. He goes on to talk about Federal Reserve Chairman Jerome Powell's Jackson Hole speech...

Read More »

Read More »

Pre COVID-19 Spot Prices VS TODAY!

SPOT PRICE ✅ Pre COVID-19 vs NOW!

As of yesterday morning, we’re seeing almost double the cost of gold and silver as we did in 2019 ‼️ Check out how Silver and Gold were priced just FIVE YEARS AGO! ?

With COVID stimulus and inflation since the pandemic, gold continues to soar to all-time highs. Stay up to date by following our newsletter and listening to our weekly podcast!

https://www.moneymetals.com/news

#inflation #finanialfreedom...

Read More »

Read More »

Job Creation Numbers Way Overstated; Corrupt Gold-Dealer Blows Up

Economist Daniel Lacalle, professor of Global Economy at IE Business School in Madrid, offers his well-studied insights on the state of global inflation, how that inflation has become the accepted policy by central planners around the world, and gives us one of the best explanations about how governments benefit from this and use it to stay in power and control the masses. | Do you own precious metals you would rather not sell, but need access to...

Read More »

Read More »

Inflation Is on Purpose!

Everybody seems to think the Federal Reserve just about has price inflation under control. As Money Metals' Midweek Memo host Mike Maharrey explains, it doesn't. And it won't. That's because price inflation is the Fed's stated policy. He also talks about the recent record-breaking run for gold and why this bull likely still has legs.

Read More »

Read More »

Gold Eyes Huge Breakout as Politicians Seek Big Rate Cut

Frank Holmes joins Mike Maharrey for a wonderful conversation on gold, Bitcoin and how the recent market turmoil has caused weak hands to give up gold and crypto. | Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan

Read More »

Read More »

Three Dumb Ideas That Won’t Go Away

There are a lot of dumb ideas out there, especially when it comes to economics and investing. In this episode of the Money Metals' Midweek Memo, host Mike Maharrey covers some dumb things that grabbed his attention this week including the notion that gold is "a useless metal," Kamala Harris's plan to deal with inflation, and minting a $1-trillion coin to deal with the national debt.

Read More »

Read More »

Wall Street Lets Out Sigh of Relief, Uncertainties Persist

Exclusive interview with Dr. Peter Earle -- Senior Economist at the American Institute of Economic Research. Join Money Metals' Mike Maharrey and Dr. Earle as they dive into the health of the U.S. economy, the lack of quality jobs that have been created, and the fallacy of the supposed soft landing. Mike and Peter also discuss how the recent wave of inflation has driven many out there, especially young people, to turn to gold and silver as a...

Read More »

Read More »

Market Madness! Overreaction or Premonition?

There was complete panic as stock markets melted down on Monday, but on Tuesday, it was as if everything was fine. So, was it just an overreaction to a few isolated factors? Or was it a premonition? On this episode of the Money Metals' Midweek Memo, host Mike Maharrey dissects the big selloff in both stocks and gold. What caused it? What happened to gold being a safe haven? And what can we expect next from the Federal Reserve?

Read More »

Read More »

Stocks Are Getting Slammed as Gold Remains Buoyant

This week we interviewed Michael Pento of Pento Portfolio Strategies. Michael covers a range of topics, including the evisceration of the middle class, the unsustainable debt levels and debt servicing costs we’ve reached in this country and how he – as an investment advisor – looks at markets and aims to capitalize on all of the market chaos. | Do you own precious metals you would rather not sell, but need access to cash? Get Started...

Read More »

Read More »

Inflation Fight! Don’t Miss the Main Event!

Will the Fed signal interest rate cuts with the July FOMC meeting? That's the question on everybody's mind. But interest rates are really a sideshow in this Fed drama. The real action is on the Fed balance sheet.

In this episode of the Money Metals' Midweek Memo, host Mike Maharrey explains what's going on with the balance sheet, why it matters, and what it tells us about the likely trajectory of price inflation and the economy. He also touches...

Read More »

Read More »

Periodic Table 1oz Silver Bar

✨ NEW ✨ One oz silver Periodic Table bars! ? Merge scientific fascination with investment value the size of a business card! A visually striking and educational addition to any precious metals collection. ?

ORDER HERE: https://www.moneymetals.com/periodic-table-silver-card-1-troy-ounce-999-pure/1388

#periodictable #science #silver #bar #bullion #silverstacking #coincollection #coin #money #metals #moneymetals #financialfreedom #beyourownbank...

Read More »

Read More »

Market Volatility, Political Drama Increases Uncertainty As Metals Fall

This week, join us for a conversation with Money Metals CEO Stefan Gleason. Stefan reveals some juicy details of Money Metals’ new, much larger depository which just opened in Idaho. This state-of-the-art precious metals storage facility is actually twice the size of Fort Knox! You’ll also hear some insider info on just what’s happening in the retail bullion market right now, the sound money movement, and much more. | Do you own precious metals...

Read More »

Read More »

Silver Prices Have Pulled Back Sharply! #shorts

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

? Silver Alert: Prices have dropped over $3 in the past week, with another dollar decline today, now below $28 per ounce. Gold is also seeing a reduction. Lower premiums and precious metals prices are creating a prime entry point for investors. ?

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER...

Read More »

Read More »

You Don’t Know What You Don’t Know!

You don't know what you don't know.

And that can be a big problem if you're an investor or a central planner.

In this episode of the Money Metals' Midweek Memo, host Mike Maharrey talks about the "knowledge problem" and explains why it, along with hubris, is the Achilles heel of central planning. He applies this truth specifically to Federal Reserve monetary policy with the help of an interesting history lesson.

Read More »

Read More »

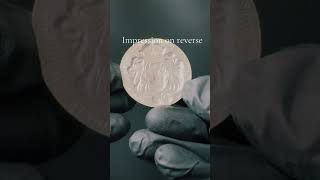

Scottsdale 2oz Silver Rounds

Scottsdale 2oz Silver Rounds! With the Scottsdale Mint iconic, beautifully detailed lion design, these satisfyingly stackable rounds are a MUST HAVE!

Call or go online to order!

800.800.1865

https://www.moneymetals.com/2-oz-scottsdale-stacker.../1161

#scottsdalemint #scottsdale #lion #silver #round #coin #silverbug #silverstacker #beyourownbank #financialfreedom #fyp #bullion

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤...

Read More »

Read More »

Political and Economic Turmoil Suddenly Surging

This week, Ed Steer of the Gold and Silver Digest joins the show for a conversation and a deep dive into the suppression that’s some believe is occurring in the paper silver market, how much longer it’s likely to last, who Ed believes is responsible for it, and what it will take for trading in the physical metal itself to finally overwhelm the paper market, leading to true price discovery. | Do you own precious metals you would rather not sell, but...

Read More »

Read More »

Jerome Powell Speaketh and Gold Records Fall!

Gold hit a new all-time high Tuesday after Jerome Powell gave some indications that the Federal Reserve is getting closer to actually cutting rates.

In this episode of the Money Metals' Midweek Memo, host Mike Maharrey analyzes the record-breaking rally, and puts Powell's comments and rate cut mania into context. He also touches on market reaction to the Trump assassination attempt.

Read More »

Read More »

Colorized Patriotic Silver Bars

✨ NEW ✨ Patriotic Flag and Bald Eagle silver bars IN STOCK! ?? Beautifully designed, colorized silver from the prestigious @Scottsdale Mint ORDER YOURS!

ORDER HERE: https://www.moneymetals.com/patriotic-bald-eagle-silver-bar-1-troy-ounce-999-pure/1353

https://www.moneymetals.com/liberty-flag-silver-bar-1-troy-ounce-999-pure/1352

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Get Ready for Lower Interest Rates as Fed Loses Its Nerve

This week we interview the Silver Guru, and hear his take on the current market conditions, why we should be skeptical of the inflation numbers the government is feeding us, a breakdown of the gold to silver ratio and what to expect in the metals during the second half of 2024. | Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan

Read More »

Read More »