Category Archive: 6a.) Gold Standard

Silver Eagles

We have ALL the eagles you need! ? Dates as far back as the original 1986 Silver Eagle are available to order, or simply choose from our random dates for a lower premium! ?

ORDER YOURS! https://www.moneymetals.com/search?q=silver+eagle

#coincollector #coinpusher #silvereagle #silver #coin#special #financialfreedom #beyourownbank #silverstacking #preciousmetals #investment #money #metals #moneymetals #silverbug #fyp #american #usmint #eagle

?...

Read More »

Read More »

Silver Institute Forecasts $30 Silver on 2024 Demand of 1.2 Billion Oz (Michael Pento Interview)

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

Silver Institute Forecasts $30 Silver on 2024 Demand of 1.2 Billion Ounces

As speculative fervor fuels price spikes in technology stocks and cryptocurrencies, gold continues to quietly hold its major support level. Also, don’t miss a must-hear interview with Michael Pento of Pento Portfolio Strategies.

Read the Full Transcript Here:...

Read More »

Read More »

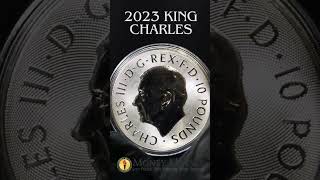

Royal Arms

Celebrating the unity of the monarchy of the United Kingdom, the 10-oz Royal Arms of Great Britain! ✨ ? Only a limited number available, so call to order!

➡️800.800.1865⬅️

See more specials HERE: https://www.moneymetals.com/buy/specials?page=2

#coincollector #coinpusher #new #silver #round #special #financialfreedom #beyourownbank #silverstacking #preciousmetals #investment #money #metals #moneymetals #silverbug #fyp #greatbritian #royalmint

?...

Read More »

Read More »

Between a Rock and a Hard Place: Money Metals’ Midweek Memo

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

The Federal Reserve is between a rock and a hard place.

It needs to cut interest rates because this debt-riddled economy can’t function in a high-rate environment. But it can’t plausibly cut rates with price inflation still far above its target. As Mike Maharrey explains in this episode of Money Metals’ Midweek Memo, the Fed is damned if it does and damned if it doesn’t....

Read More »

Read More »

Heart Charm

LAST CHANCE to gift before Valentines! ? At a lower premium and higher purity than retail jewelry, give the gift of INVESTING! ✨

ORDER HERE: https://www.moneymetals.com/gold-charm-heart-3-7-grams-9999-pure/670

#jewelry #goldjewelry #valentine #giftideas #bullion #goldbug #gold #investing #money #metals #moneymetals #preciousmetals

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Platinum Jewelry

PLATINUM Investment Jewelry - The PERFECT Valentines gift! ? At a lower premium and higher purity than retail jewelry, give the gift of INVESTING! ✨

ORDER YOURS ➡ https://www.moneymetals.com/buy/platinum/platinum-jewelry

#jewelry #platinum #valentine #giftideas #bullion #foryou #investing #money #metals #moneymetals #preciousmetals

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Federal Reserve & Banks on High Alert for Bank Runs

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

With state legislatures now in session, there’s a ton of activity with respect to precious metals sales taxes, income taxes, and much more. And a special interview with Money Metals CEO Stefan Gleason… covering all the latest developments on the sound money battlefront.

Read the full Transcript Here:...

Read More »

Read More »

Silver Buffalos

LOW COST SILVER! ✨Our Buffalo rounds are an excellent way to invest your dollars to silver. ?

Check out ALL of our buffalo design silver ➡ https://www.moneymetals.com/buy/silver/rounds/buffalo-silver-rounds

#buffalo #round #silver #silverstacking #bar #coin #money #metals #moneymetals #investment #financialfreedom #beyourownbank

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬...

Read More »

Read More »

Good News Is Bad News! Money Metals’ Midweek Memo

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

We live in a strange world where good economic news is perceived as bad, and bad economic news is good. In this episode of Midweek Money Metals’ Memo, host Mike Maharrey provides some examples of this strange phenomenon, and then explains why this is going on. It all boils down to the market’s addiction to the drug of easy money. Along the way, Mike talks about the January...

Read More »

Read More »

STARTER KIT

Want to protect yourself against inflation? ? Have no idea how??Our STARTER KIT is loaded with information, and 4oz of pure silver to sell at your demand when spot is just right. ?

Have questions? Hop on our website for more info, or speak to a specialist! We're here for you, rather you're a first timer, or a life-long silver investor. ?

GET YOURS ➡️ moneymetals.com/go

#silver #coin #coincollector #inflation #fyp #starter #beginner #special...

Read More »

Read More »

Goldback State Bundles

NEVER LET YOUR DOLLAR DEVALUE AGAIN ? with Goldbacks! ? Get one of each goldback denomination from each available state.

Order yours today! ➡️ moneymetals.com/buy/gold

#new #gold #goldback #special #financialfreedom #beyourownbank #goldstacking #preciousmetals #investment #money #metals #moneymetals #goldbug #coincollector #coinpusher #fyp

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube...

Read More »

Read More »

SPECIAL on 5oz Bars

5oz Silver Bars are on ✨ SPECIAL ✨

Get this low premium for a LIMITED TIME!

Order yours today! ➡️ moneymetals.com/buy/silver

#coincollector #coinpusher #new #silver #bars #special #financialfreedom #beyourownbank #silverstacking #preciousmetals #investment #money #metals #moneymetals #silverbug #fyp

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★...

Read More »

Read More »

Gold INVESTMENT Jewelry

Investment Jewelry - The PERFECT Valentines gift! ? At a lower premium and higher purity than retail jewelry, give the gift of INVESTING! ✨

ORDER HERE: https://www.moneymetals.com/buy/gold/gold-jewelry

#jewelry #goldjewelry #valentine #giftideas #bullion #goldbug #gold #investing #money #metals #moneymetals #preciousmetals

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW...

Read More »

Read More »

New Hints of Election-Year Market Interventions & Turmoil

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

After a sluggish January for precious metals, gold and silver markets saw a rally during the first day of February trading, only to see it reverse here today on the 2nd day of the month, after a strong U.S. jobs report, to continue the lackluster performance we’ve seen in early 2024.

Read the Full Transcript Here:...

Read More »

Read More »

PURE Silver Bullets

A bullet represents the power to uphold justice, stop a threat, and protect your life and property. Arm yourself with Money Metals Exchange PURE Silver Bullets! Choose from 1/2, 1, 2, 5, and 10 ounces, depending on your caliber of choice.

ORDER YOURS: moneymetals.com/buy/silver/bullets

#bullet #ammo #gun #silver #pure #silverstacking #collection #money #metals #moneymetals #america #bullion #caliber

? SUBSCRIBE TO MONEY METALS EXCHANGE ON...

Read More »

Read More »

1.5oz Australian Blue Whale

!!NEW!! ✨ 1.5oz Blue Whale Silver Coins ? ? Own this 2022 Austrailian Coin with the worlds largest animal at just $12.99 over melt.

SEE MORE: moneymetals.com/buy/specials

#bluewhale #silver #austrailian #silverstacking #numismatics #coincollector #coinpusher #special #new #fyp #money #metals #moneymetals #preciousmetals

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY...

Read More »

Read More »

They Break It! You Buy It: Money Metals Midweek Memo

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

The government and the Federal Reserve broke the economy and we have to buy it!

Things may seem OK on the surface, but the economy is sliding toward a crisis. It's just a matter of time.

In this episode of the Money Metals' Midweek Memo, host Mike Maharrey explains how and when the government and the Fed broke the economy, and talks about one sector where the damage...

Read More »

Read More »

Top 5 Investment Coins

Trying to start stacking? Do you want #financialfreedom ? These are the top 5 Coins for Investment! ?

Check out these and more at https://www.moneymetals.com/guides/best-silver-coins-to-buy

#beyourownbank #investment #silver #preciousmetals #coin #coinpusher #bullion #money #moneymetals #fyp #nomoreexcuses

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS...

Read More »

Read More »

Mixed Goldbacks

NEW!!! Have you gotten any goldbacks? ? Start off your gold backed currency collection with our mixed bundle.

Order online: https://www.moneymetals.com/1-goldback-mixed-bundle-11000th-troy-oz-9999-gold-backed-bills-one-per-state-5-total/1002

#silverstacking #gold #goldback #newhampshire #southdakota #nevada #wyoming #utah #billsbillsbills #money #moneymetals #preciousmetals #mytype #fyp #financialfreedom #beyourownbank

? SUBSCRIBE TO MONEY...

Read More »

Read More »

Year of The Dragon

2024 is YEAR OF THE DRAGON ? We have Silver, Gold, Platinum, and even Sterling Silver statues. How cool are these?? ?

Start stacking your dragons by calling, or ordering online! https://www.moneymetals.com/search?q=dragon

FREE SHIPPING on orders $199+

#dragon #yearofthedragon #2024 #silver #goldbug #silverstacking #silverbug #numismatic #bullionstacking #collection #coincollecting #coin #statue #sterlingsilver #thursdaymotivation #money #metals...

Read More »

Read More »