Category Archive: 5.) The United States

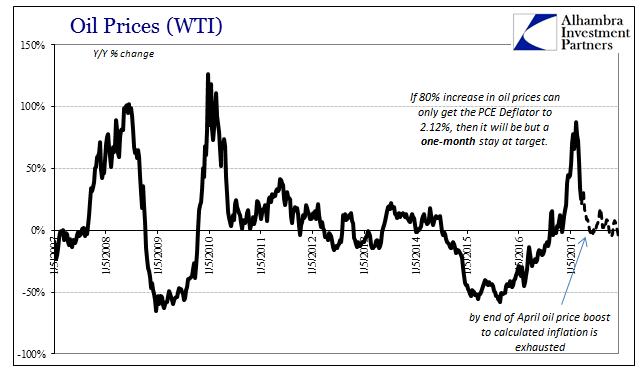

The Power of Oil

For the first time in 57 months, a span of nearly five years, the Fed’s preferred metric for US consumer price inflation reached the central bank’s explicit 2% target level. The PCE Deflator index was 2.12% higher in February 2017 than February 2016. Though rhetoric surrounding this result is often heated, the actual indicated inflation is decidedly not despite breaking above for once.

Read More »

Read More »

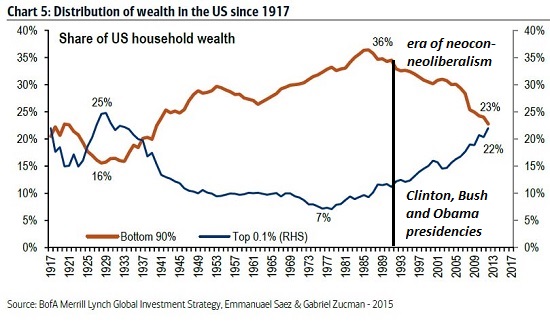

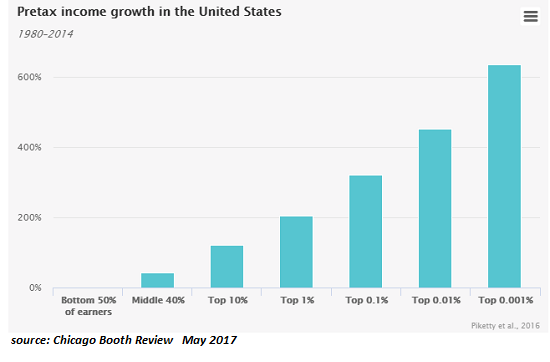

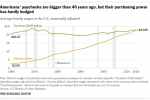

Do the Roots of Rising Inequality Go All the Way Back to the 1980s?

Unless we change the fundamental structure of the economy so that actually producing goods and services and hiring people is more profitable than playing financial games with phantom assets, the end-game of financialization is financial collapse. I presented this chart of rising wealth inequality a number of times over the past year. Do you notice something peculiar about the inflection points in the 1980s?

Read More »

Read More »

Ending The Fed’s Drug Problem

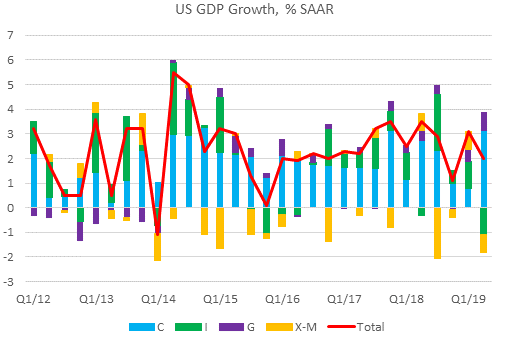

Gross Domestic Product was revised slightly higher for Q4 2016, which is to say it wasn’t meaningfully different. At 2.05842%, real GDP projects output growing for one quarter close to its projected potential, a less than desirable result. It is fashionable of late to discuss 2% or 2.1% as if these are good numbers consistent with a healthy economy.

Read More »

Read More »

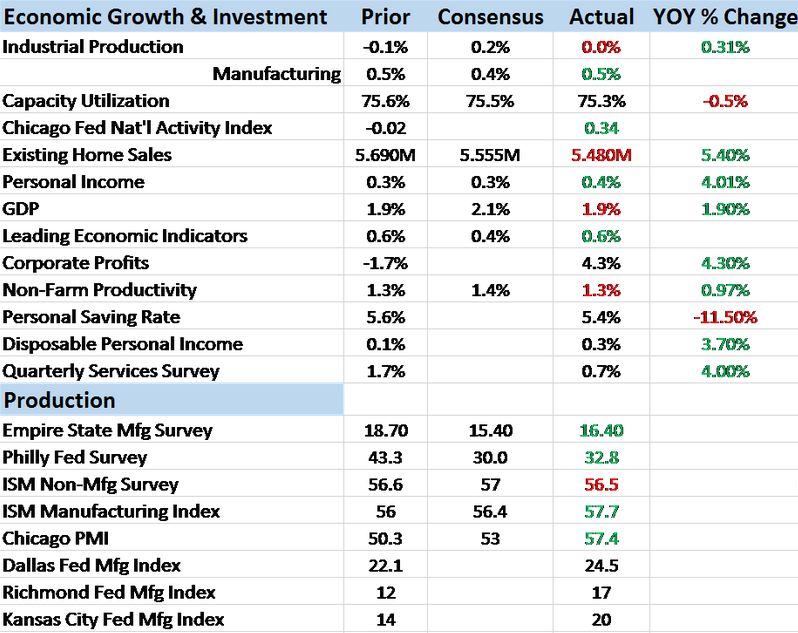

Bi-Weekly Economic Review

The Fed did, as expected, hike rates at their last meeting. And interestingly, interest rates have done nothing but fall since that day. As I predicted in the last BWER, Greenspan’s conundrum is making a comeback. The Fed can do whatever it wants with Fed funds – heck, barely anyone is using it anyway – but they can’t control what the market does with long term rates.

Read More »

Read More »

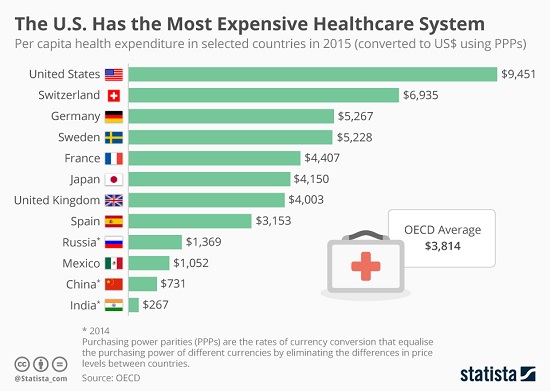

Forget ObamaCare, RyanCare, and any Future ReformCare-the Healthcare System Is Completely Broken

It's time to start planning for what we'll do when the current healthcare system implodes. As with many other complex, opaque systems in the U.S., only those toiling in the murky depths of the healthcare system know just how broken the entire system is.

Read More »

Read More »

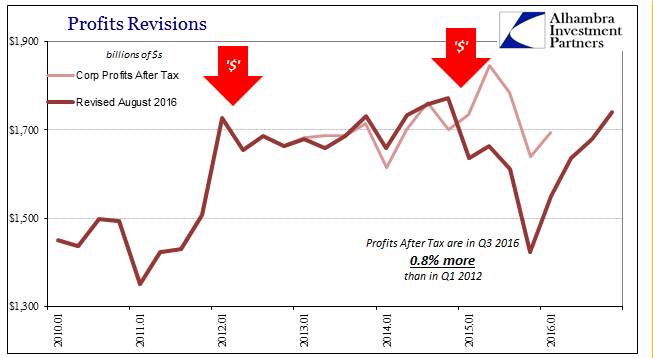

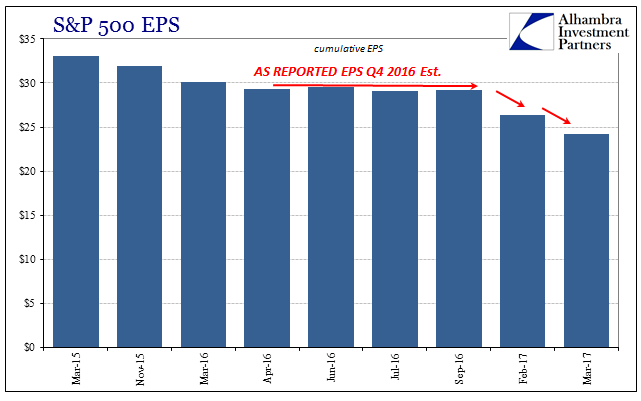

The Inverse of Keynes

With nearly all of the S&P 500 companies having reported their Q4 numbers, we can safely claim that it was a very bad earnings season. It may seem incredulous to categorize the quarter that way given that EPS growth (as reported) was +29%, but even that rate tells us something significant about how there is, actually, a relationship between economy and at least corporate profits.

Read More »

Read More »

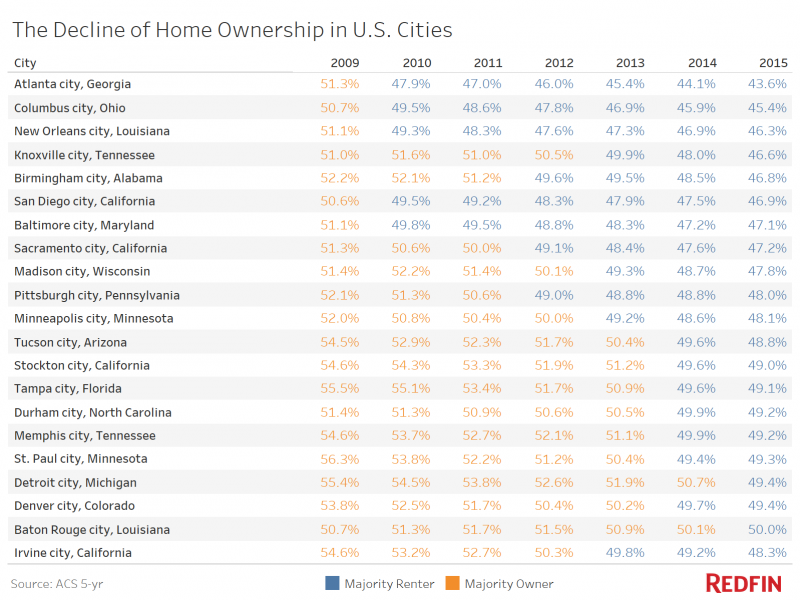

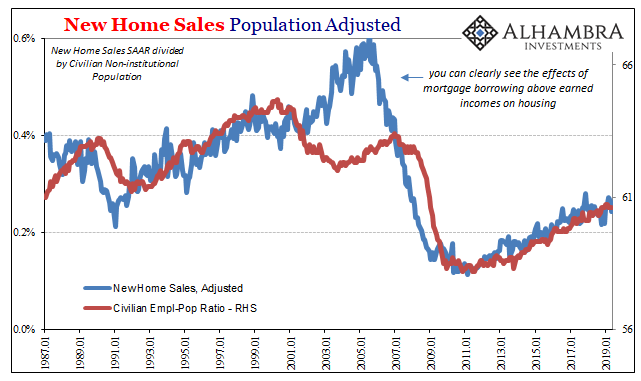

Renters Now Rule Half of U.S. Cities

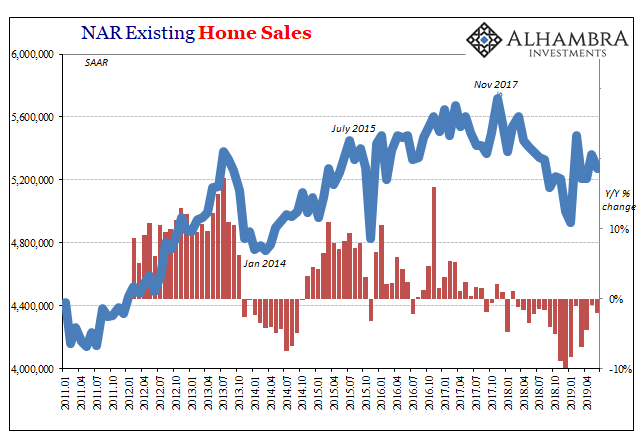

The American Dream increasingly involves a lease, not a mortgage. Detroit was once known as a city where a working-class family could afford to own a home. Now it’s a city of renters. Just 49 percent of Motor City households were homeowners in 2015, down from 55 percent in 2009 and the lowest percentage in more than 50 years.

Read More »

Read More »

The Deep State’s Dominant Narratives and Authority Are Crumbling

This is why the Deep State is fracturing: its narratives no longer align with the evidence. As this chart from Google Trends illustrates, interest in the Deep State has increased dramatically in 2017. The term/topic has clearly moved from the specialist realm to the mainstream. I've been writing about the Deep State, and specifically, the fractures in the Deep State, for years.

Read More »

Read More »

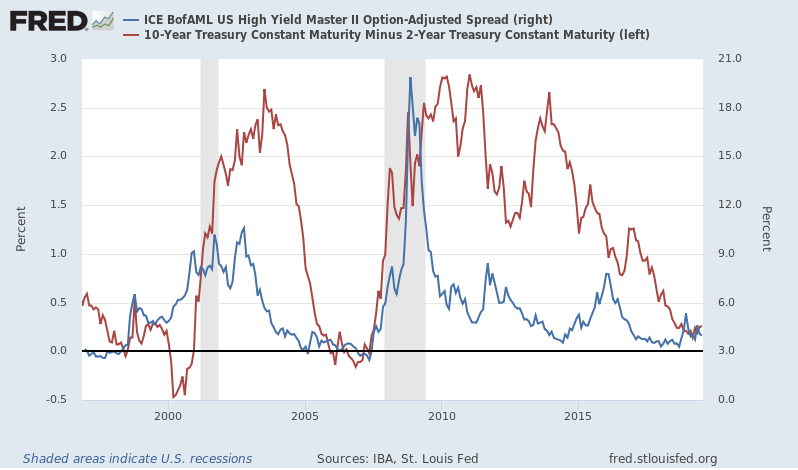

All In The Curves

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December.

Read More »

Read More »

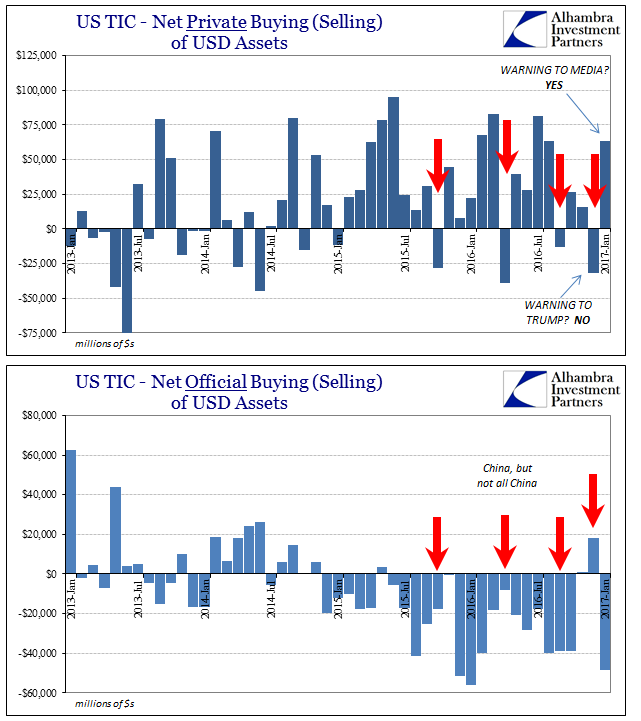

TIC Analysis of Selling

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of...

Read More »

Read More »

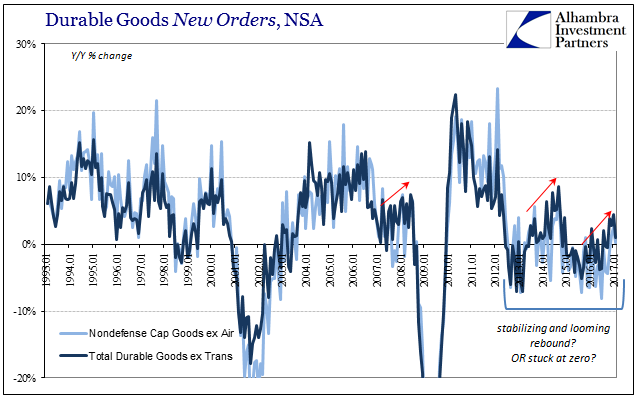

Durable Goods After Leap Year

New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version.

Read More »

Read More »

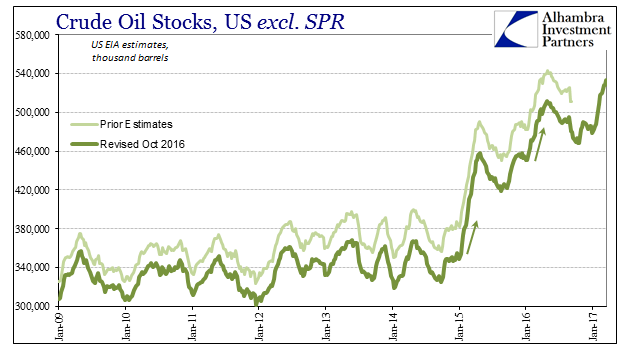

Economics Through The Economics of Oil

The last time oil inventory grew at anywhere close to this pace was during each of the last two selloffs, the first in late 2014/early 2015 and the second following about a year after. Those events were relatively easy to explain in terms of both price and fundamentals, though the mainstream managed to screw it up anyway (“supply glut”).

Read More »

Read More »

Was There Ever A ‘Skills Mismatch’? Notable Differences In Job Openings Suggest No

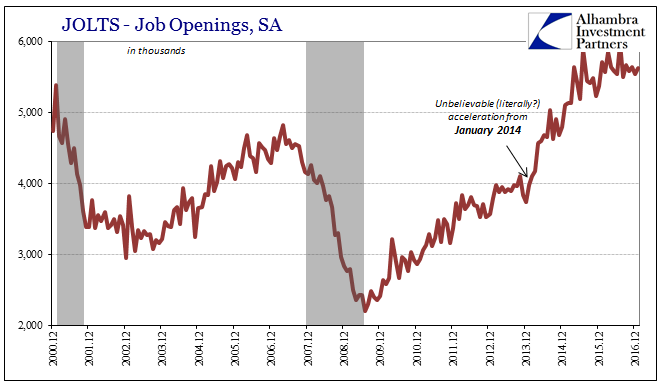

Perhaps the most encouraging data produced by the BLS has been within its JOLTS figures, those of Job Openings. It is one data series that policymakers watch closely and one which they purportedly value more than most. While the unemployment and participation rates can be caught up in structural labor issues (heroin and retirees), Job Openings are related to the demand for labor rather than the complications on the labor supply side.

Read More »

Read More »

Solutions Abound–on the Local Level

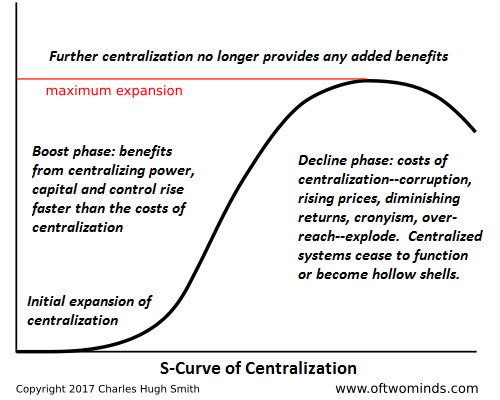

Rather than bemoan the inevitable failure of centralized "fixes," let's turn our attention and efforts to the real solutions: decentralized, networked, localized.Those looking for centralized solutions to healthcare, jobs and other "macro-problems" will suffer inevitable disappointment. The era in which further centralization provided the "solution" has passed: additional centralization (Medicare for All, No Child Left Behind, federal job training,...

Read More »

Read More »

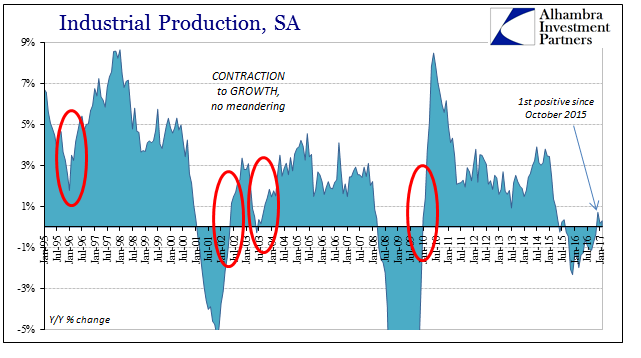

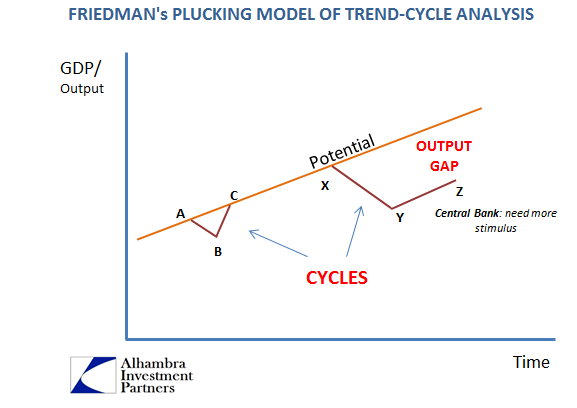

Industrial Symmetry

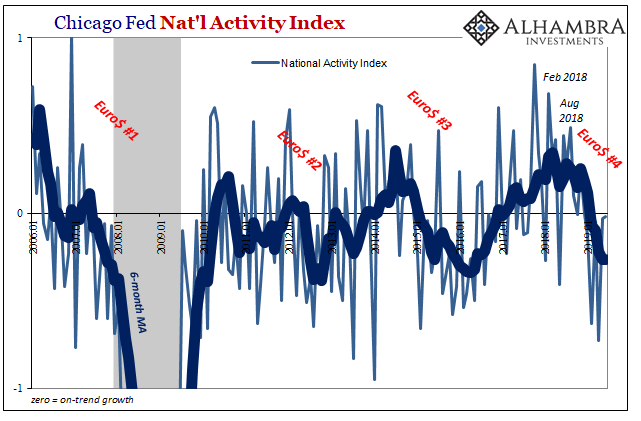

There has always been something like Newton’s third law observed in the business cycles of the US and other developed economies. In what is, or was, essentially symmetry, there had been until 2008 considerable correlation between the size, scope, and speed of any recovery and its antecedent downturn, or even slowdown. The relationship was so striking that it moved Milton Friedman to finally publish in 1993 his plucking model theory he had first...

Read More »

Read More »

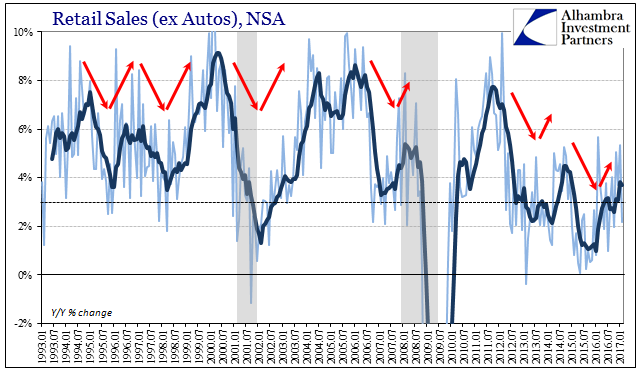

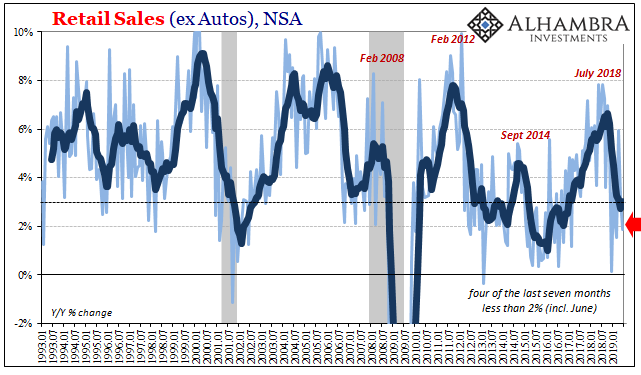

Retail Sales: Extra Day Likely, no Meaningful Difference

Retail sales comparisons were for February 2017 skewed by the extra day in February 2016. With the leap year February 29th a part of the base effect, the estimated growth rates (NSA) for this February are to some degree better than they appear. Seasonally-adjusted retail sales were in the latest estimates essentially flat when compared to the prior month (January). That leaves too much guesswork to draw any hard conclusions.

Read More »

Read More »

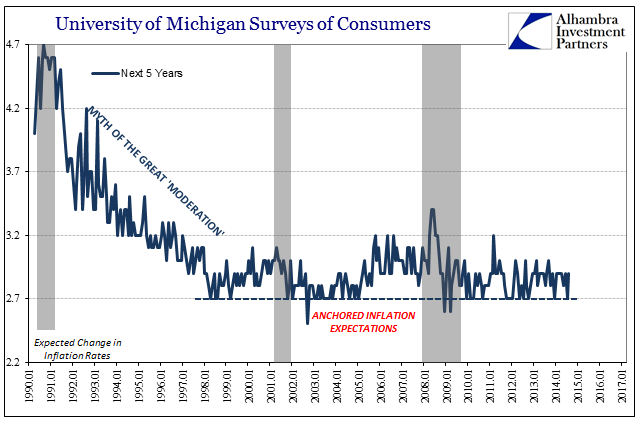

Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate.

Read More »

Read More »

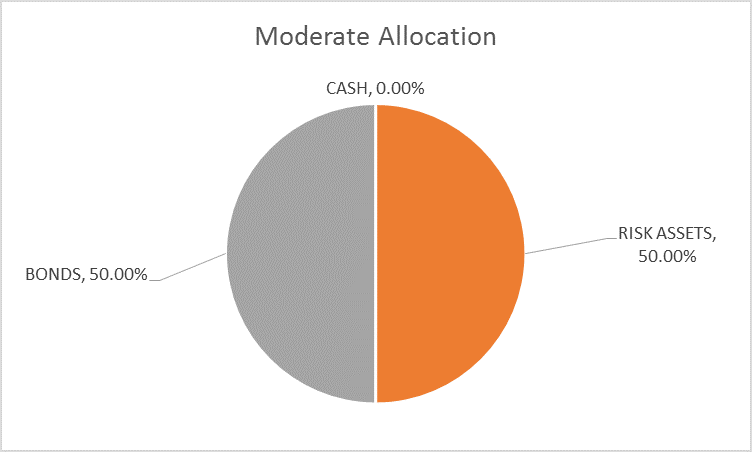

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle.

Read More »

Read More »

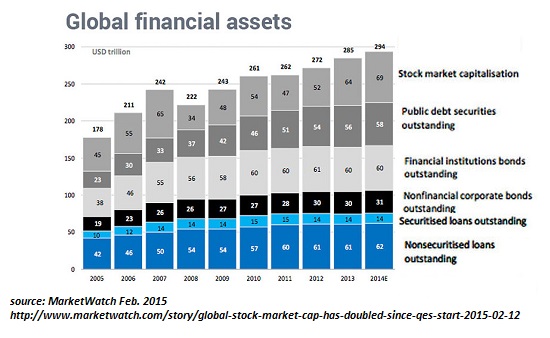

Now That Everyone’s Been Pushed into Risky Assets…

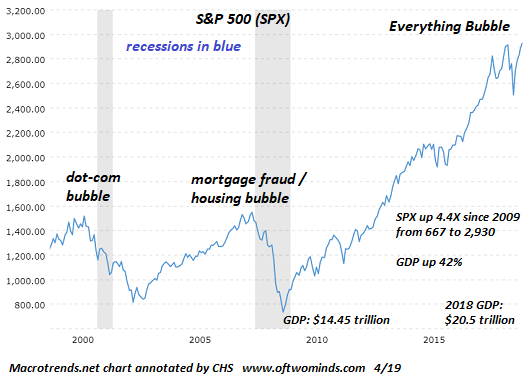

If we had to summarize what's happened in eight years of "recovery," we could start with this: everyone's been pushed into risky assets while being told risk has been transformed from something to avoid (by buying risk-off assets) to something you chase to score essentially guaranteed gains (by buying risk-on assets).

Read More »

Read More »

Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them.

Read More »

Read More »