Category Archive: 5.) The United States

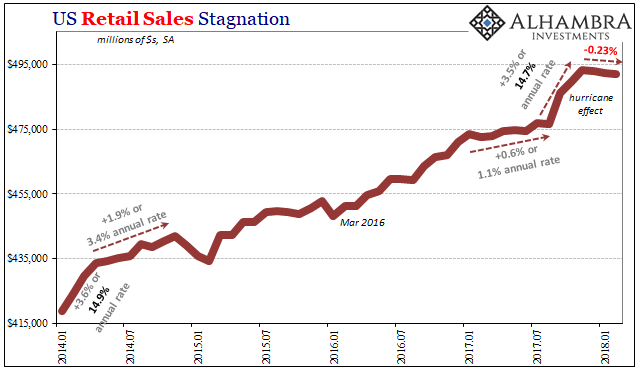

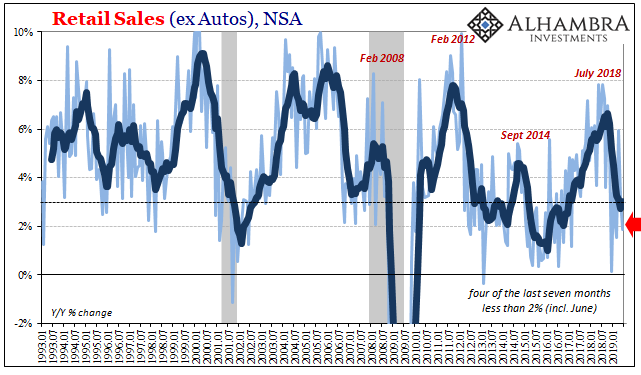

The Retail Sales Shortage

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months.

Read More »

Read More »

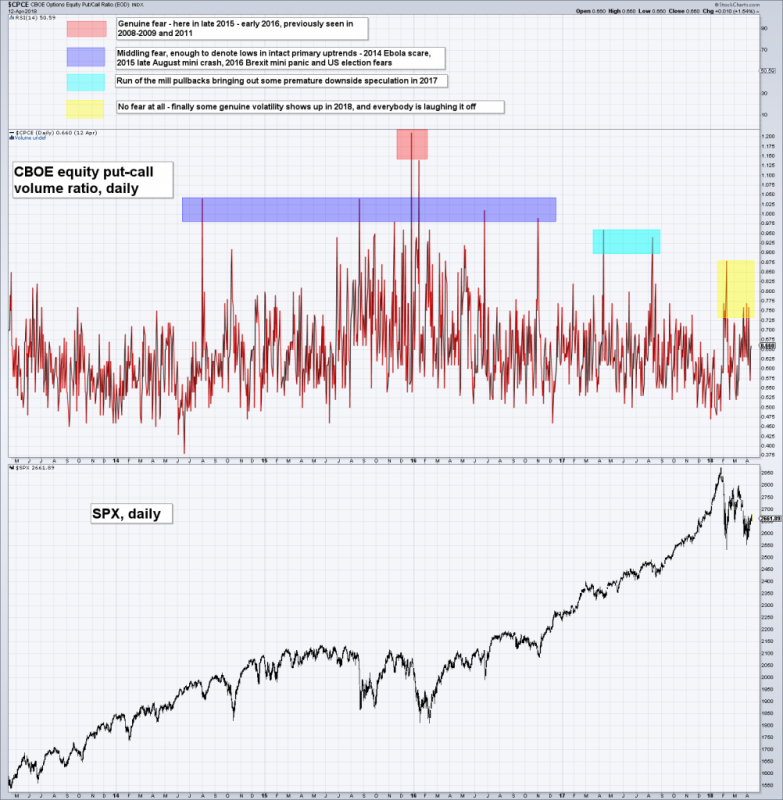

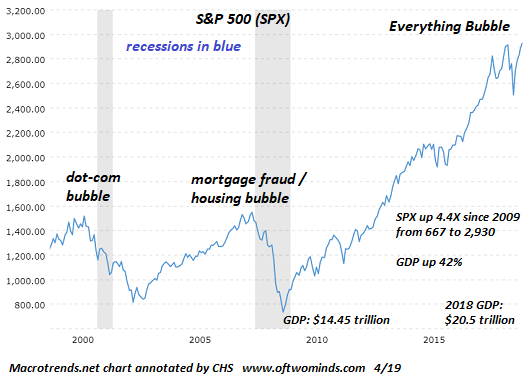

US Stock Market: Happy Days Are Here Again? Not so Fast…

Obviously, assorted crash analogs have by now gone out of the window – we already noted that the market was late if it was to continue to mimic them, as the decline would have had to accelerate in the last week of March to remain in compliance with the “official time table”. Of course crashes are always very low probability events – but there are occasions when they have a higher probability than otherwise, and we will certainly point those out...

Read More »

Read More »

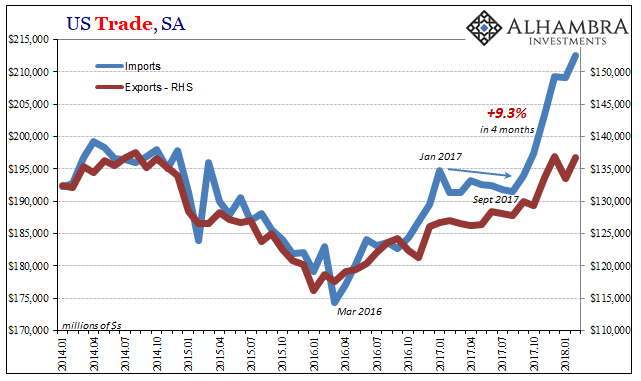

US Imports Don’t Quite Match Chinese Exports

In early 2015, a contract dispute between dockworkers’ unions and 29 ports on the West Coast of the US escalated into what was a slowdown strike. Cargoes piled up especially at some of the largest facilities like those in Oakland, LA, and Long Beach, threatening substantial economic costs far and away from just those directly involved. Each side predictably blamed the other for it.

Read More »

Read More »

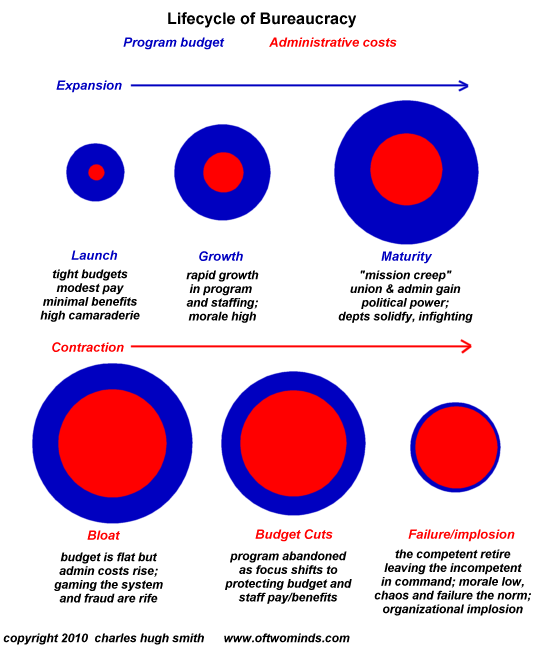

Why Systems Fail

Since failing systems are incapable of structural reform, collapse is the only way forward. Systems fail for a wide range of reasons, but I'd like to focus on two that are easy to understand but hard to pin down. Systems are accretions of structures and modifications laid down over time.Each layer adds complexity which is viewed at the time as a solution. This benefits insiders, as their job security arises from the need to manage the added...

Read More »

Read More »

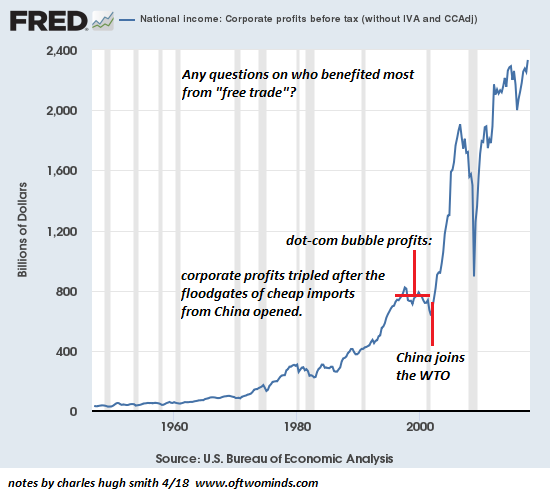

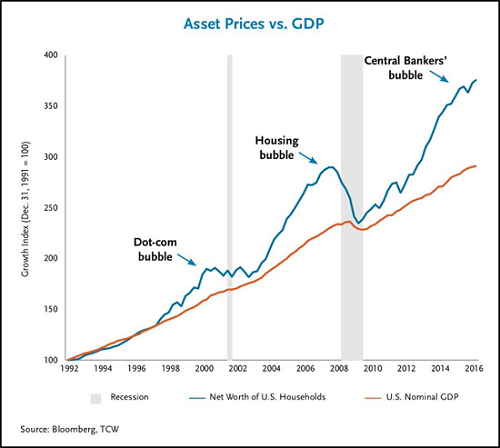

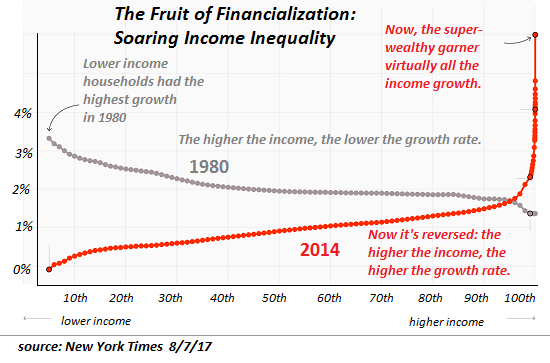

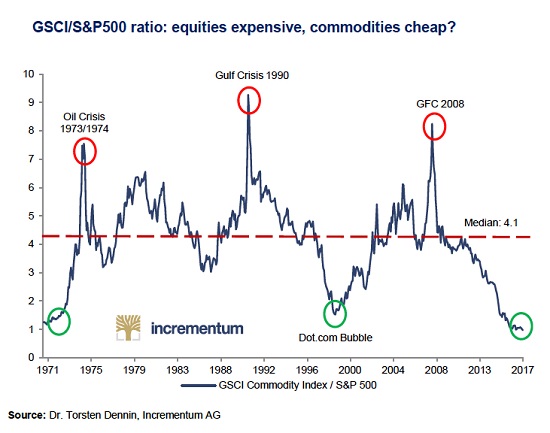

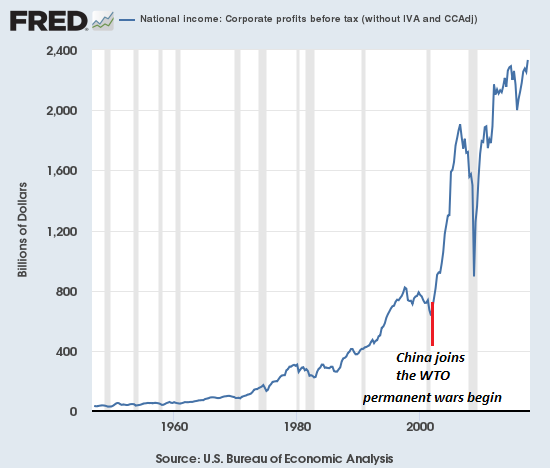

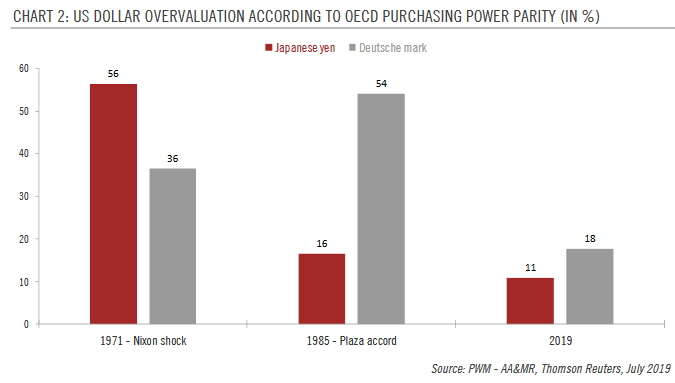

Were Trade Wars Inevitable?

Were trade wars inevitable? The answer is yes, due to the imbalances and distortions generated by financialization and central bank stimulus. Gordon Long and I peel the trade-war onion in a new video program, Were Trade Wars Inevitable?

Read More »

Read More »

Playing for All the Marbles

Global Plunge Protection Teams must be ordering take-out food; every night is a long one now. The current stocks/bonds game is for all the marbles, by which I mean the status quo now depends on valuations and interest rates remaining near their current levels for the system to function.

Read More »

Read More »

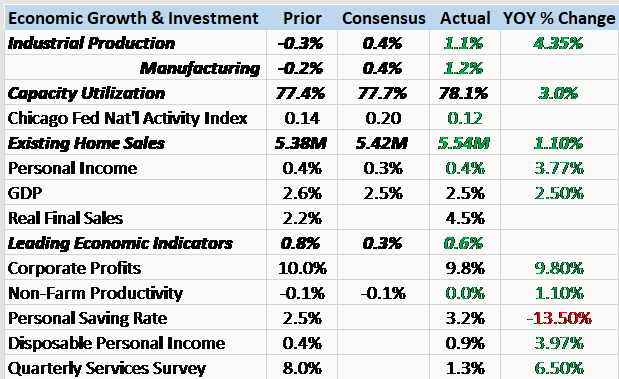

Bi-Weekly Economic Review

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for April 01, 2018.

Read More »

Read More »

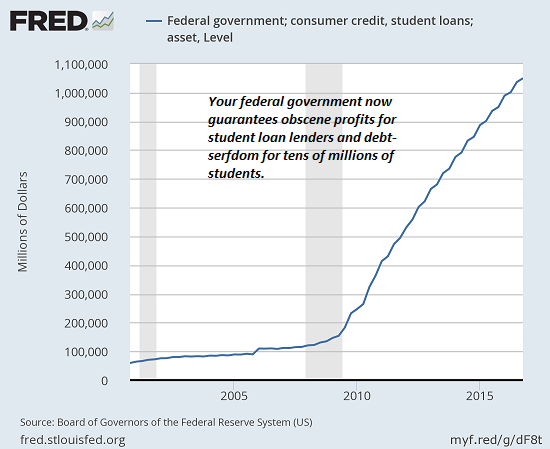

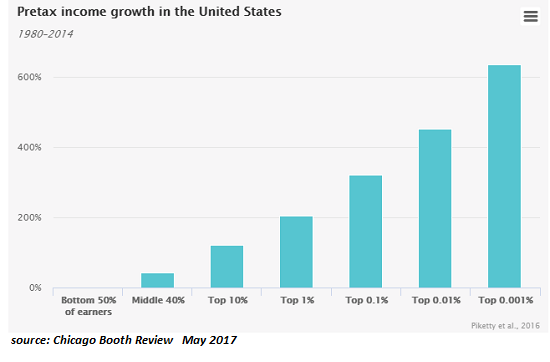

The Problem with a State-Cartel Economy: Prices Rise, Wages Don’t

The vise will tighten until something breaks. It could be the currency, it could be the political status quo, it could be the credit/debt system--or all three. The problem with an economy dominated by state-enforced cartels and quasi-monopolies is that prices rise (since cartels can push higher costs onto the consumer) but wages don't (since cartels can either dominate local labor markets or engage in global wage arbitrage: offshore jobs, move to...

Read More »

Read More »

What If All the Cheap Stuff Goes Away?

Nothing stays the same in dynamic systems, and it's inevitable that the current glut of low costs / cheap stuff will give way to scarcities that cannot be filled at current low prices. One of the books I just finished reading is The Fate of Rome: Climate, Disease, and the End of an Empire.

Read More »

Read More »

15 Years of War: To Whose Benefit?

As for Iraq, the implicit gain was supposed to be access to Iraqi oil. Setting aside the 12 years of "no fly zone" air combat operations above Iraq from 1991 to 2003, the U.S. has been at war for almost 17 years in Afghanistan and 15 years in Iraq. (If the word "war" is too upsetting, then substitute "continuing combat operations".)

Read More »

Read More »

Bi-Weekly Economic Review: Embrace The Uncertainty

There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s going...

Read More »

Read More »

Decrypting the Appointment of John Bolton

So perhaps the dominant wing of the Deep State is finally willing to cut a deal with Trump. To many observers, the appointment of John Bolton as national security advisor is the functional equivalent of appointing the Anti-Christ--or maybe worse. Indeed, these observers would, when comparing the two, find grudging favor with the Anti-Christ.

Read More »

Read More »

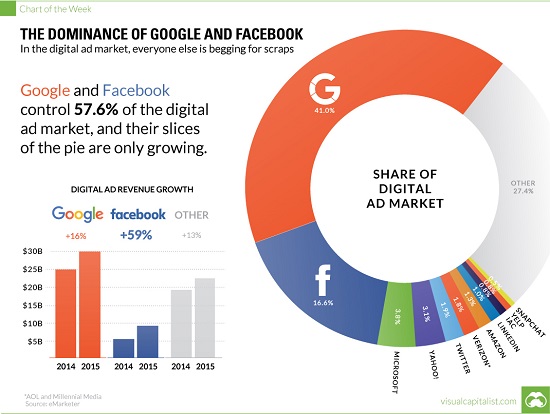

Should Facebook and Google Pay Users When They Sell Data Collected from Users?

Let's imagine a model in which the marketers of data distribute some of their immense profits to the users who created and thus "own" the data being sold for a premium. It's not exactly news that Facebook, Google and other "free" services reap billions of dollars in profits by selling data mined/collected from their millions of users. As we know, If you're not paying for it, you're not the customer; you're the product being sold, also phrased as if...

Read More »

Read More »

Solutions Only Arise Outside the Status Quo

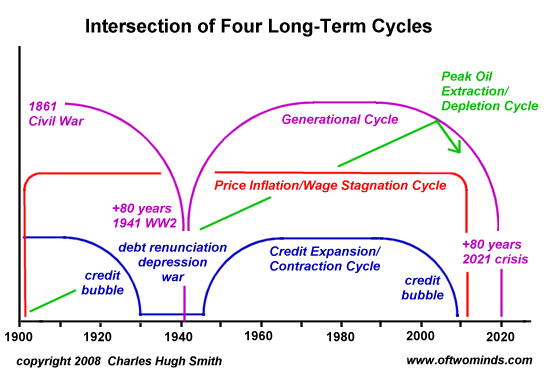

Solutions are only possible outside these ossified, self-serving centralized hierarchies. Correspondent Dan F. asked me to reprint some posts on solutions to the systemic problems I've outlined for years, most recently in How Much Longer Can We Get Away With It? and Checking In on the Four Intersecting Cycles. I appreciate the request, because it's all too easy to dwell on what's broken rather than on the difficult task of fixing what's broken.

Read More »

Read More »

Is Profit-Maximizing Data-Mining Undermining Democracy?

As many of you know, oftwominds.com was falsely labeled propaganda by the propaganda operation known as ProporNot back in 2016. The Washington Post saw fit to promote ProporNot's propaganda operation because it aligned with the newspaper's view that any site that wasn't pro-status quo was propaganda; the possibility of reasoned dissent has vanished into a void of warring accusations of propaganda and "fake news" --which is of course propaganda in...

Read More »

Read More »

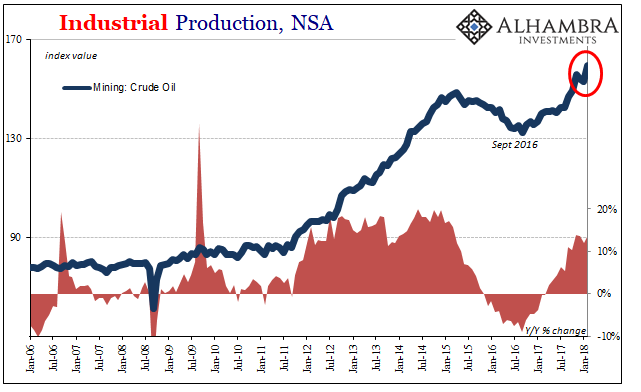

US Industry Experiences The Full 2014 Again in February

In February 2018, it was like old times for the US industrial sectors. Prior to the 2015-16 downturn, the otherwise moribund economy did produce two genuine booms. The first in the auto sector, the other in energy. Without them, who knows what the no-recovery recovery would have looked like. They were for the longest time the only bright spots.

Read More »

Read More »

Bi-Weekly Economic Review

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for March 15, 2018.

Read More »

Read More »

Checking In on the Four Intersecting Cycles

Correspondent James D. recently asked for an update on the four intersecting cycles I've been writing about for the past 10 years. Here's the chart I prepared back in 2008 of four long-term cycles: 1. Generational (political/social).2. Price inflation/wage stagnation (economic). 3. Credit/debt expansion/contraction (financial). 4. Relative affordability of energy (resources).

Read More »

Read More »

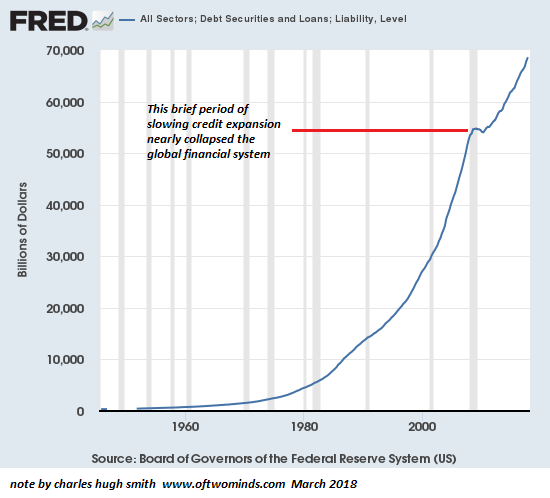

How Much Longer Can We Get Away With It?

Alas, fakery isn't actually a solution to fiscal/financial crisis.. This chart of "debt securities and loans"--i.e. total debt in the U.S. economy--is also a chart of the creation and distribution of new money, as the issuance of new debt is the mechanism in our financial system for creating (or "emitting" in economic jargon) new currency: when a bank issues a new home mortgage, for example, the loan amount is new currency created out of the...

Read More »

Read More »

Three Months Now of After-Harvey Retail Sales; or, The Boom Narrative Goes Boom

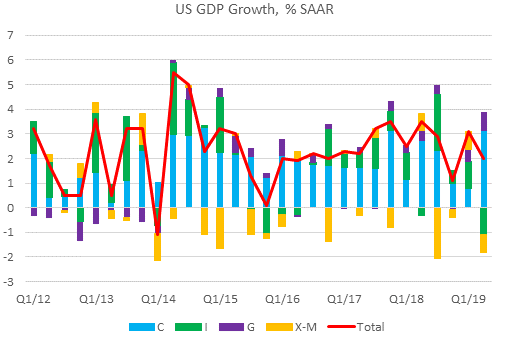

If indeed this inflation hysteria has passed, its peak was surely late January. Even the stock market liquidations that showed up at that time were classified under that narrative. The economy was so good, it was bad; the Fed would be forced by rapid economic acceleration to speed themselves up before that acceleration got out of hand in uncontrolled consumer price gains. On February 1, the Atlanta Fed’s GDPNow tracking model was moved up to...

Read More »

Read More »