Category Archive: 5.) The United States

The Implicit Desperation of China’s “Social Credit” System

Other governments are keenly interested in following China's lead. I've been pondering the excellent 1964 history of the Southern Song Dynasty's capital of Hangzhou, Daily Life in China on the Eve of the Mongol Invasion, 1250-1276 by Jacques Gernet, in light of the Chinese government's unprecedented "Social Credit Score" system, which I addressed in Kafka's Nightmare Emerges: China's "Social Credit Score".

Read More »

Read More »

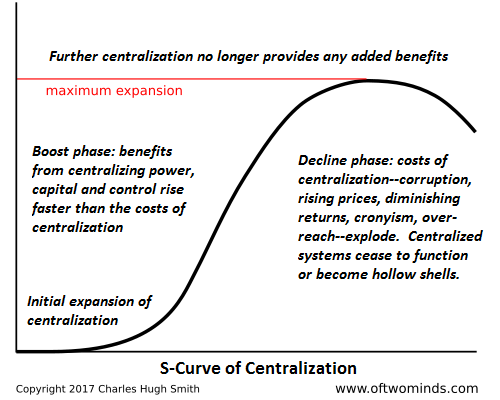

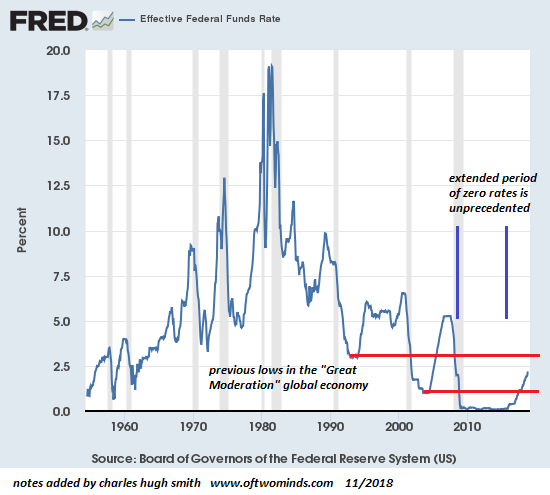

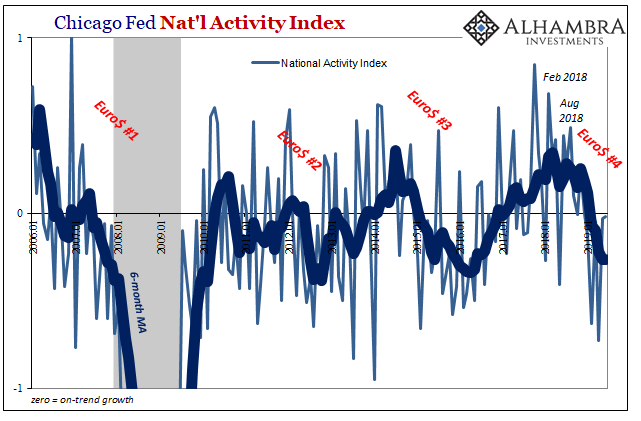

Understanding the Global Recession of 2019

Isn't it obvious that repeating the policies of 2009 won't be enough to save the system from a long-delayed reset? 2019 is shaping up to be the year in which all the policies that worked in the past will no longer work. As we all know, the Global Financial Meltdown / recession of 2008-09 was halted by the coordinated policies of the major central banks, which lowered interest rates to near-zero, bought trillions of dollars of bonds and iffy assets...

Read More »

Read More »

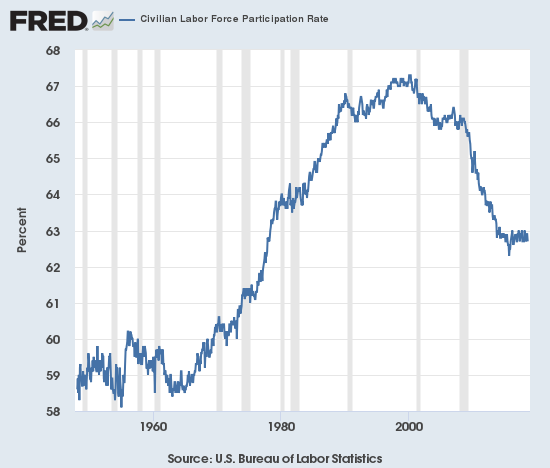

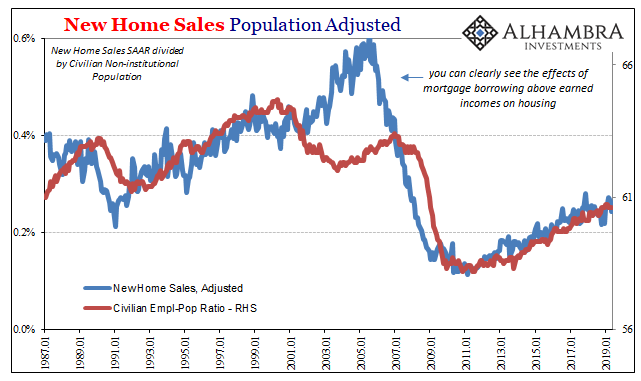

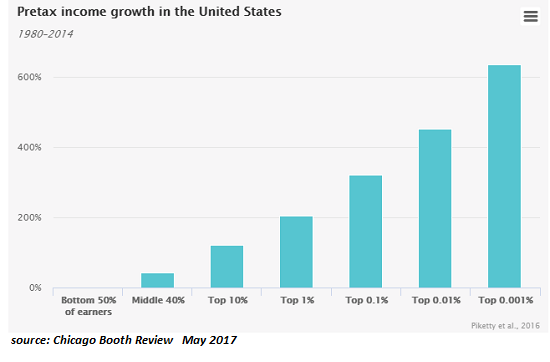

Why Are so Few Americans Able to Get Ahead?

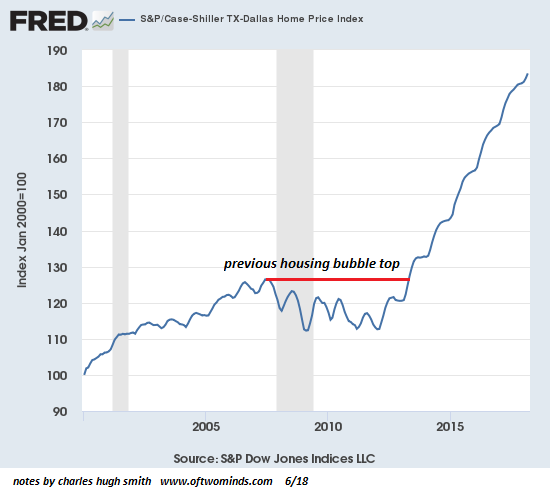

Our entire economy is characterized by cartel rentier skims, central-bank goosed asset bubbles and stagnating earned income for the bottom 90%. Despite the rah-rah about the "ownership society" and the best economy ever, the sobering reality is very few Americans are able to get ahead, i.e. build real financial security via meaningful, secure assets which can be passed on to their children.

Read More »

Read More »

Is This “The Most Important Election of our Lives” or Just Another Distraction?

The problem isn't polarization; the problem is neither flavor of the status quo is actually solving any of the nation's most pressing system problems. As I write this at 5 pm (Left Coast) November 6, the election results are unknown. While various media are trumpeting this as "the most important election of our lives," the less eyeball-catching, emotion-triggering reality is this election is nothing but another distraction.

Read More »

Read More »

Turn Off, Tune Out, Drop Out

An unknown but likely staggeringly large percentage of small business owners in the U.S. are an inch away from calling it quits and closing shop. Timothy Leary famously coined the definitive 60s counterculture phrase, "Turn on, tune in, drop out" in 1966. (According to Wikipedia, In a 1988 interview with Neil Strauss, Leary said the slogan was "given to him" by Marshall McLuhan during a lunch in New York City.)

Read More »

Read More »

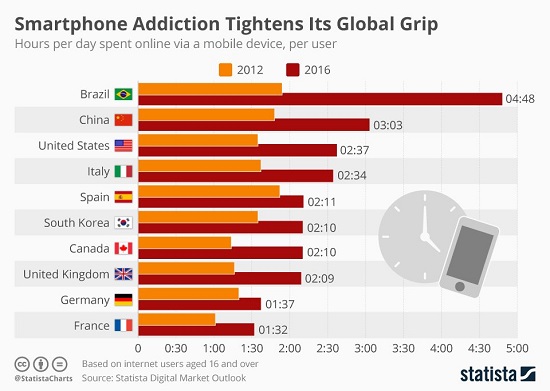

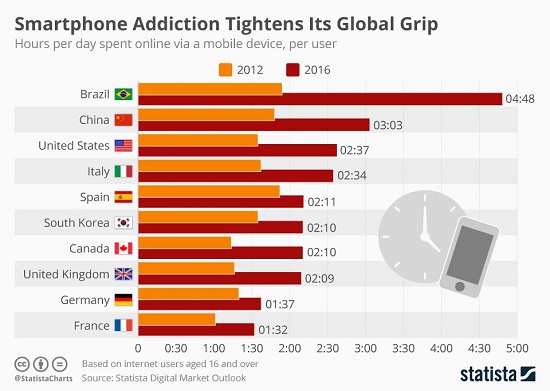

What’s Behind the Erosion of Civil Society?

Rebuilding social capital and social connectedness is not something that can be done by governments or corporations. As the mid-term elections are widely viewed as a referendum of sorts, let's set aside politics and ask, what's behind the erosion of our civil society? That civil society in the U.S. and elsewhere is fraying is self-evident.

Read More »

Read More »

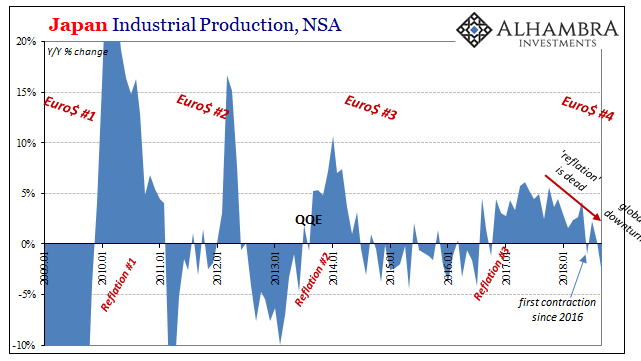

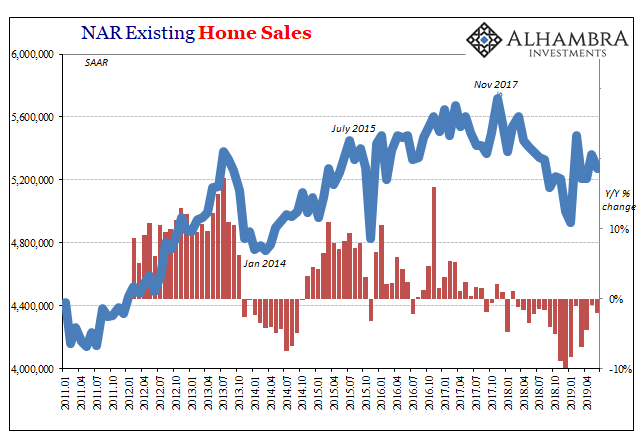

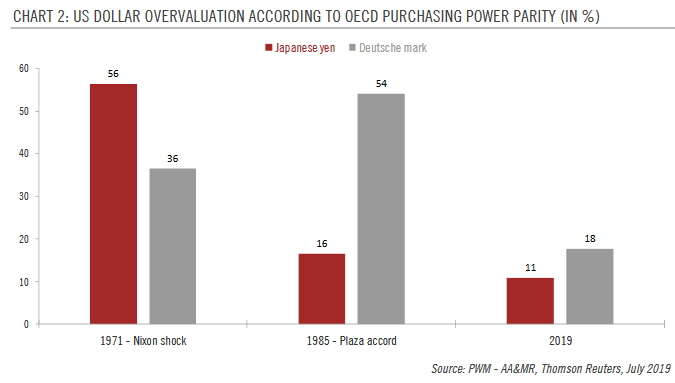

China Now Japan; China and Japan

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc.

Read More »

Read More »

Bloomberg Interview with Jeffrey Snider

Why Eurodollars Might Be Key to the Market Sell-Off (Podcast). There’s a huge market out there that doesn’t get much attention: Eurodollars. These have nothing to do with the euro-dollar exchange rate. Instead, eurodollars are U.S. dollar-denominated deposits at foreign banks and overseas branches of American banks.

Read More »

Read More »

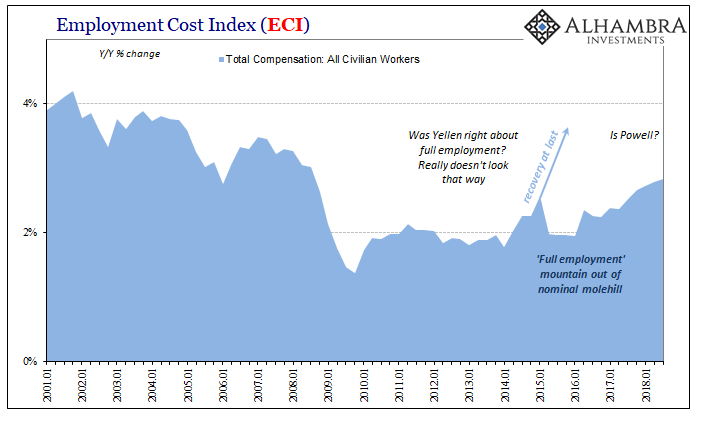

Another ‘Highest In Ten Years’

Upon the precipice of the Great “Recession”, US workers were cushioned to some extent by what economists call sticky wages. Before the Great Depression, as well as during it, companies would attempt to deal with looming economic contraction by cutting pay rates before workers.

Read More »

Read More »

Why Is Social Media So Toxic?

The desire to improve our social standing is natural. What's unnatural is the toxicity of doing so through social media. It seems self-evident that the divisiveness that characterizes this juncture of American history is manifesting profound social and economic disorders that have little to do with politics. In this context, social media isn't the source of the fire, it's more like the gasoline that's being tossed on top of the dry timber.

Read More »

Read More »

Globalization Has Hollowed Out Rural America

What do we make of an economy in which a handful of bubblicious urban areas are magnets for jobs and capital while rural communities have been hollowed out? The short answer is that this progression of urbanization has been one of the core dynamics of civilization for thousands of years: opportunities are greater in cities, and so people move from rural areas with few opportunities to cities with greater opportunities.

Read More »

Read More »

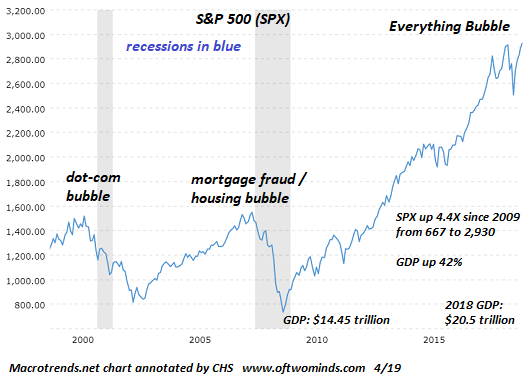

What’s the Real Meaning of the Stock Market Swoon?

Economy has reached peak earnings so there's no fundamentals-driven upside left. Bond yields are now high enough to dampen enthusiasm for inherently risky stocks. Central banks curtailing / ending their quantitative easing programs have reduced liquidity in the financial system. US markets are catching up to the rest of the world's market slump.

Read More »

Read More »

No Such Thing As An 80 percent Boom

Many attribute the saying “a rising tide lifts all boats” to President John Kennedy. He may have been the man who brought it into the mainstream but as his former speechwriter Ted Sorenson long ago admitted it didn’t originate from his or the President’s imagination. Instead, according to Sorenson, it was a phrase borrowed from the New England Chamber of Commerce or some such.

Read More »

Read More »

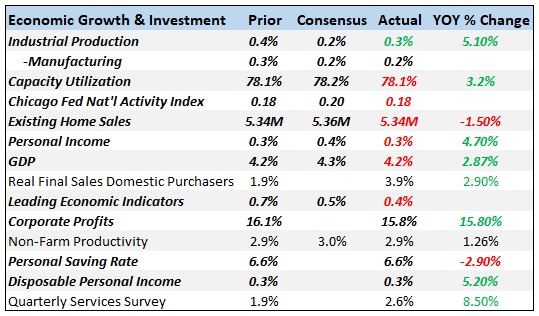

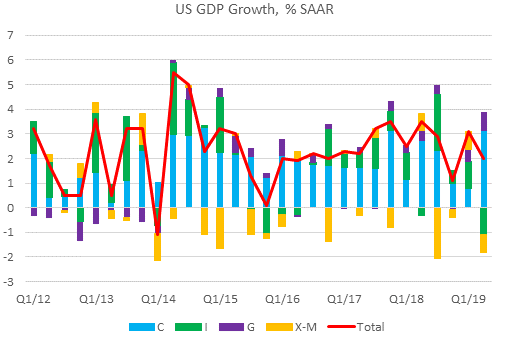

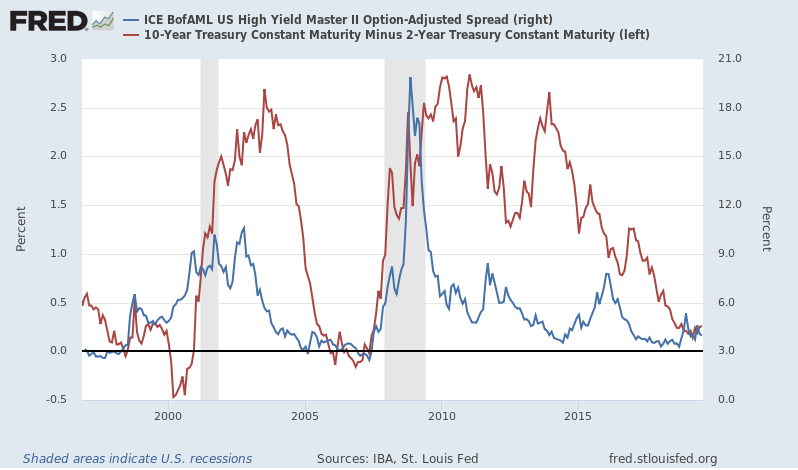

Monthly Macro Monitor – October 2018

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly.

Read More »

Read More »

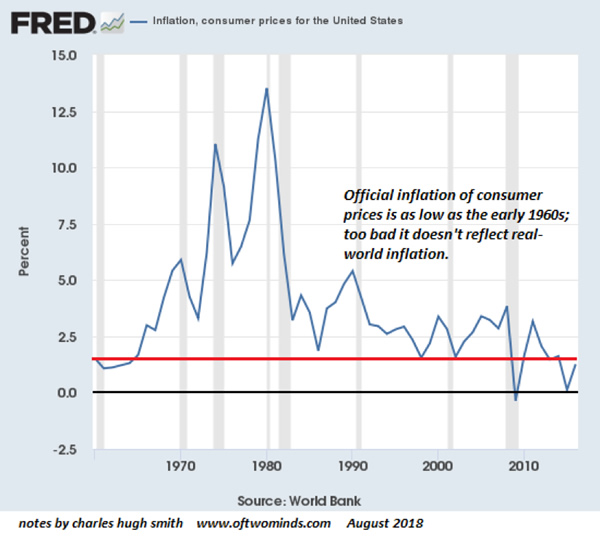

The Coming Inflation Threat

Falling asset inflation plus rising cost inflation equals stagflation. Inflation is a funny thing: we feel it virtually every day, but we’re told it doesn’t exist—the official inflation rate is around 2.5% over the past few years, a little higher when energy prices are going up and a little lower when energy prices are going down.

Read More »

Read More »

Mutiny, Class, Authority and Respect

Humiliation and fear of a catastrophic decline in status foment mutiny and rebellion. I recently finished The Bounty: The True Story of the Mutiny on the Bounty, a painstakingly researched history of the mutiny, but with a focus on how the story was shaped by influential families after the fact to save the life of one mutineer, Peter Haywood, and salvage the reputation of the leader, Fletcher Christian, via a carefully orchestrated character...

Read More »

Read More »

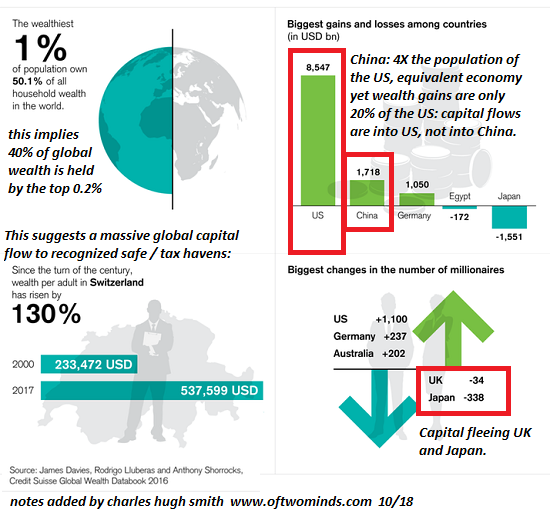

Is the Greatest Bull Market Ever Finally Ending? (Hint: Follow the Money)

The key here is the gains generated by owning US-denominated assets as the USD appreciates. Is the Greatest Bull Market Ever finally ending? One straightforward approach to is to follow the money, i.e. global capital flows: assets that attract positive global capital flows will continue rising if demand for the assets exceeds supply, and assets that are being liquidated as capital flees the asset class (i.e. negative capital flows) will decline in...

Read More »

Read More »

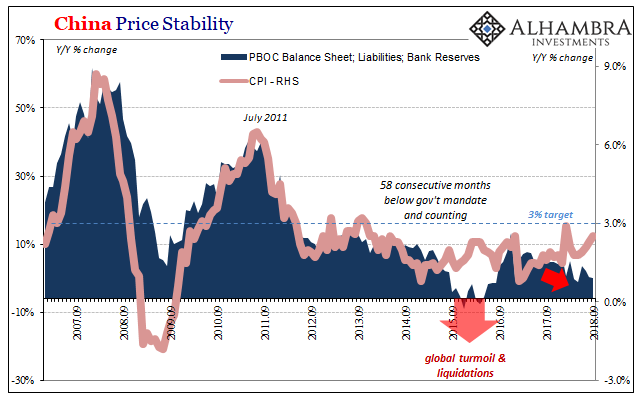

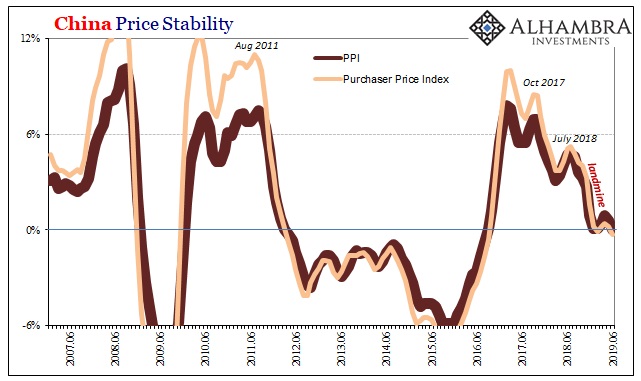

Raining On Chinese Prices

It was for a time a somewhat curious dilemma. When it rains it pours, they always say, and for China toward the end of 2015 it was a real cloudburst. The Chinese economy was slowing, dangerous deflation developing around an economy captured by an unseen anchor intent on causing havoc and destruction. At the same time, consumer prices were jumping where they could do the most harm.

Read More »

Read More »

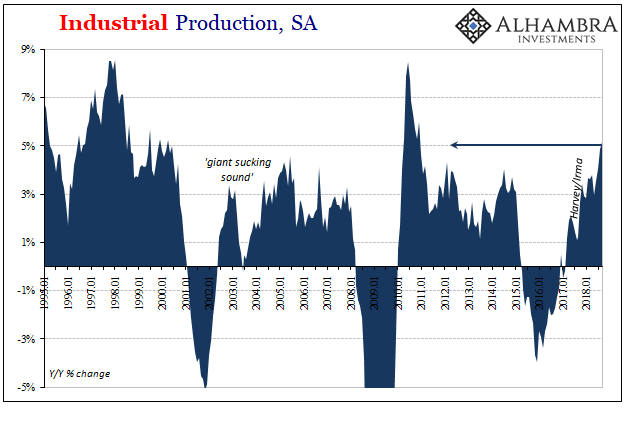

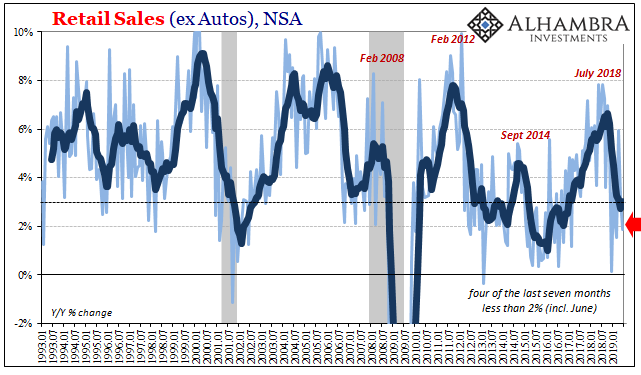

Just The One More Boom Month For IP

The calendar last month hadn’t yet run out on US Industrial Production as it had for US Retail Sales. The hurricane interruption of 2017 for industry unlike consumer spending extended into last September. Therefore, the base comparison for 2018 is against that artificial low. As such, US IP rose by 5.1% year-over-year last month. That’s the largest gain since 2010.

Read More »

Read More »