Category Archive: 5.) Emerging Markets

Emerging Markets: What has Changed

Hong Kong Chief Executive Leung Chun-ying said he won’t seek a second term. Korea’s parliament voted 234-56 to impeach President Park. Czech National Bank raised the possibility of negative rates to help manage the currency. A Brazilian Supreme Court justice removed Senate chief Renan Calheiros from his post, but was later overturned by the full court. Brazil central bank signaled a possibly quicker easing cycle.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

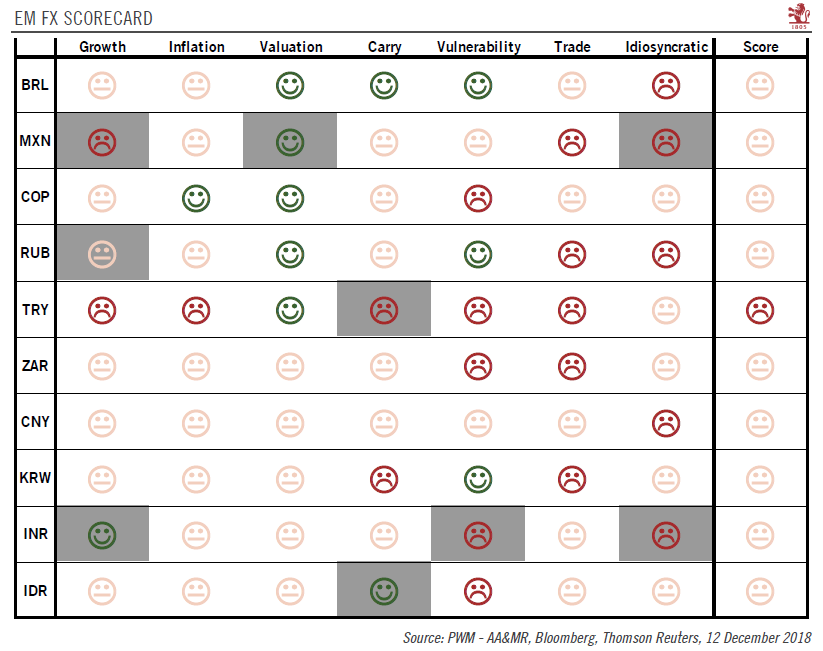

EM remains a mixed bag. Despite the negative connotations of a rising US rate environment, EM gathered an element of stability last week as the dollar consolidated its recent gains. Rising commodity prices are also helping EM at the margin, with RUB and COP amongst the best last week on higher oil and CLP on higher copper.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended last week on a somewhat firmer note, though we note divergences remain in place. For the week, ZAR and KRW performed the best while TRY and BRL were the worst. US jobs data Friday will draw some attention, though a December Fed rate hike is pretty much fully priced in.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine President Duterte will reportedly ask central bank. Governor Tetangco to stay on for a third term. South Africa’s government has proposed a national minimum wage. Fitch moved the outlook on South Africa’s BBB- from stable to negative. Turkey’s central bank surprised markets with a 50 bp hike in its benchmark repo rate to 8.0%. Political risk in Brazil is rising as President Temer’s top aide was implicated in an influence peddling...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended the week on a soft note, as higher US rates continue to take a toll. EM policymakers are getting more concerned about currency weakness, with Brazil, Malaysia, Korea, India, and Indonesia all taking action to help support their currencies. If the EM sell-off continues as we expect, more EM central banks are likely to act to slow the moves.

Read More »

Read More »

Emerging Markets: What has Changed

Malaysia appears to have enacted a subtle change in FX policy. Turkey cut foreign currency reserve requirements in an effort to increase the supply of foreign exchange. Brazil’s central bank suspended the sale of reverse currency swaps and started selling new regular swaps (equivalent to selling USD). Colombia reached a new peace agreement with FARC rebels. Mexico's central bank hiked cash rates by 50 bp.

Read More »

Read More »

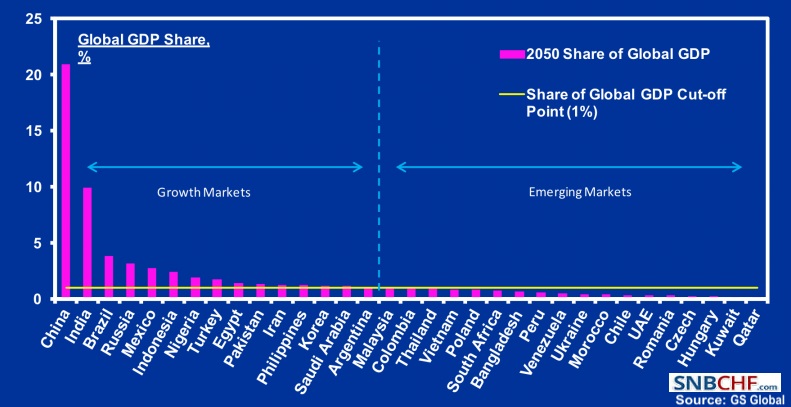

Are Emerging Markets Still “A Thing”?

Last week I jumped on a call with an old friend Thomas Hugger who I hadn't spoken with in months. I recorded the call for your enjoyment but first a quick bit of background to Thomas. Thomas is a Swiss fund manager living and working in Asian frontier markets such as Vietnam, Bangladesh, and Cambodia, which is a bit like taking a Rolls Royce through the Gobi desert if you think about it.

Read More »

Read More »

China Update

The evolving political situation in China is worth monitoring. China's trade surplus with the US has fallen this year. It has been roughly 20 years since China was formally labeled a currency manipulator. Trump has indicated he would do so.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM should trade firmer this week on news over the weekend that the FBI said its conclusion on Clinton’s emails remained unchanged. That should lift the cloud of suspicion that grew when the FBI said new emails had been uncovered. With risk appetite likely to rebound a bit, the Mexican peso should benefit the most as the week gets under way.

Read More »

Read More »

Emerging Market: Week Ahead Preview

EM ended the week on a soft note, as markets were taken off guard by news that the FBI was reopening its investigation of Hillary Clinton’s emails. Risk off trading hit MXN particularly hard. FOMC meeting this week should be a non-event, but markets are likely to remain volatile ahead of the November 8 elections in the US.

Read More »

Read More »

Emerging Markets: What has Changed

Chinese President Xi has strengthened his grip on power. Mozambique said it is in “debt distress” and hired advisors for a debt restructuring. South Africa revised its macro forecasts in the Finance Ministry’s Medium-Term Budget Program.Chile’s ruling center-left coalition lost municipal elections.In the EM equity space as measured by MSCI, Poland (+3.2%), Chile (+3.1%), and Hungary (+0.9%) have outperformed this week, while the Philippines...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX gained a little traction on Friday, but capped a week of steady losses. As the US election and FOMC meeting next month get closer, we believe markets and risk appetite will remain volatile. So far, September data from the US does not suggest any urgency to hike in November, and so we continue to believe that December is most likely for another hike.

Read More »

Read More »

Emerging Markets: What has Changed

Fitch upgraded Taiwan by a notch. Thailand has a new king. South Africa’s Finance Minister Gordhan has been summoned to appear in court to face charges. Brazil’s Congress voted to approve a constitutional amendment to freeze government spending in real terms for at least the next 10 years. Brazil’s Petrobras cut fuel prices and introduced a new pricing mechanism.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

Despite the weaker than expected US jobs report, the dollar remains firm and EM is ending the week on a soft note. The main culprit was higher US rates, with the 2-year yield moving up to 0.85% and is the highest since early June. Concerns about Brexit impact and as well the health of European banks remain ongoing and could weigh on risk sentiment this coming week. Lastly, oil may come under more pressure after Russia said it sees no deal with...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space as measured by MSCI, Brazil (+5.3%), Czech Republic (+4.4%), and Hungary (+3.0%) have outperformed this week, while Peru (-3.3%), UAE (-2.2%), and South Africa (-1.4%) have underperformed. To put this in better context, MSCI E...

Read More »

Read More »

Emerging Markets: What has Changed

Tensions between India and Pakistan are rising. The Philippine government ordered the suspension of three quarters of the nation’s mines. Czech central bank sounds more confident of the cap exit. Poland’s Finance Minister Szalamacha was sacked. Moody's downgraded Turkey one notch to Ba1 with a stable outlook. The Brazilian central bank's quarterly inflation report set the table for the easing cycle to start.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM initially benefitted from the FOMC decision, but softened into the weekend. One culprit was lower oil prices, as reports suggest an output deal is unlikely at the OPEC meeting this week in Algeria. But it wasn’t just EM, as the greenback closed firmer against the majors as well. We still believe that risk and EM should do fine over the next few weeks, as the Fed basically set a two-month window of steady rates.

Read More »

Read More »

Emerging Markets: What has Changed

In the EM local currency bond space, Brazil (10-year yield -36 bp), Turkey (-26 bp), and Hungary (-17 bp) have outperformed this week, while Ukraine (10-year yield +9 bp), Mexico (+2 bp), and China (flat) have underperformed.

Read More »

Read More »

Julius Baer CEO says Asia revenue may excede Europe’s in 5 years

Julius Baer Group Ltd. said Asia may overtake Europe as its biggest revenue-generating region, as the Swiss wealth manager steps up hiring in Hong Kong and Singapore. “In the next five years, Asia could be the biggest region for us if we grow at double-digit” rates, Chief Executive Officer Boris Collardi said Wednesday in an interview in Singapore. More than half of about 200 new bankers that Julius Baer plans to hire this year will be based in...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended the week on a soft note. Volatility is likely to remain high as markets are jittery and choppy ahead of the BOJ/FOMC meetings on Thursday. Dollar gains were broad-based last week, but EM certainly underperformed. China markets will reopen after a two-day holiday, but good news out of the mainland is doing little to help EM.

Read More »

Read More »