Category Archive: 5.) Emerging Markets

Emerging Markets: What has Changed

The IEA forecast that the surplus in global oil markets will last for longer than previously thought. Philippine President Duterte called for US troops to leave the southern island of Mindanao. Relations between Poland and the EU are deteriorating. Former head of Brazil’s lower house Eduardo Cunha was expelled and banned from public office for eight years. Brazil’s central bank cut the amount of daily reverse swap contracts sold to 5,000.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended last week on a soft note. Perhaps it was the North Korean nuclear test (see below). Perhaps it was disappointment in the ECB or rising Fed tightening odds. Whatever the trigger was, EM FX weakness persisted and appears likely to carry over into this week.

Read More »

Read More »

Emerging Markets: What has Changed

India has a new central bank head. North Korea detonated a nuclear device. The Turkish government may be eyeing the central bank for the next purge. Mexican Finance Minister Videgaray resigned. Incoming Mexican Finance Minister Meade announced new spending cuts.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note, as Fed tightening expectations ratcheted up.The December Fed funds futures contract has an implied yield of 0.5%,the highest since June 2. Note that on June 3, US rates plunged after the May jobs shocker (+38k). If the hawkish Fed storyline can be maintained, then EM will have trouble getting traction. This Friday’s jobs report for August will be key, with consensus at +185k vs. +255k in July.

Read More »

Read More »

Emerging Markets: What has Changed

Reserve Bank of India Deputy Governor Patel has been named to succeed Governor Rajan. Political risk is back in South Africa. The Colombian government and the FARC rebels have reached a final peace agreement. S&P cut the outlook on Mexico’s BBB+ rating from stable to negative.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note.Fed tightening expectations were buffeted first by hawkish Dudley comments and then by the more balanced FOMC minutes. On net, the markets adjusted the odds for tightening by year-end a little higher from the previous week, and stand at the highest odds since the Brexit vote. Yet despite the strong jobs data in June and July, odds of a move on September 21 or November 2 are still low, with the December 14 meeting...

Read More »

Read More »

Emerging Markets: What has Changed

China unveiled a second equity link that will allow foreign investors to buy local stocks with fewer restrictions. Saudi Arabia will allow qualified foreign investors to subscribe to local IPOs starting this January. South Africa’s two main opposition parties agreed to informally band together in local governments. The Brazilian central bank decreased the daily intervention amount to 10,000 reverse swap contracts from 15,000 before, just a week...

Read More »

Read More »

The Odds of a Global Food Crisis Are Rising

Given the current abundance of food globally, confidence in permanent food surpluses and low grain prices is high. Few worry that the present abundance of food could be temporary. But the global food supply is more fragile than we might think, despite historically low grain/agricultural commodity prices.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a soft note, despite the weaker than expected US retail sales report. Official concern about strong exchange rates is beginning to emerge. First it was Korea, then on Friday it was Brazil as acting President Temer said his country needs to maintain a balanced exchange rate, neither too weak nor too strong. We expect more pushback to emerge if the current

rally is extended. Still, the global liquidity outlook for now favors...

Read More »

Read More »

Emerging Markets: What has Changed

S&P upgraded Korea a notch to AA with a stable outlook. Voters passed the constitutional referendum in Thailand by a wide margin. The IMF and Egypt have reached a staff-level agreement on a 3-year $12 bln. loan program. Argentina’s central bank will begin using a new overnight rate to manage monetary policy. Political uncertainty has returned to Brazil.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note, despite the stronger than expected July jobs report. As we suspected, one strong US data point is not yet enough to derail the dovish Fed outlook. With the RBA and BOE cutting last week and the RBNZ expected to cut this week, the global liquidity backdrop remains supportive for EM and risk.

Read More »

Read More »

Emerging Markets: What has Changed

India’s upper house approved the creation of a Good and Services Tax (GST). The Polish government softened its stance on the proposed Swiss franc loan conversion plan. Support for South Africa’s ruling African. National Congress (ANC) appears to have fallen below 60% for the first time ever. Brazil’s Senate impeachment committee recommended putting President Rousseff on trial.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note, helped by the weaker than expected US Q2 GDP report as well as the small bounce in oil. With the RBA and BOE expected to ease this week, the global liquidity backdrop remains favorable for EM and “risk.” US jobs report Friday will be very important for EM going forward. We get our first glimpse of the Chinese economy for July with the PMI readings this week.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended the week on a soft note, as the dollar reasserted broad-based strength against most currencies. The FOMC meeting this week could see the Fed push back against the market’s dovish take on policy, in which case EM would be likely to remain under pressure.

Read More »

Read More »

Emerging Markets: What has Changed

The New York Times reported that the US is preparing to seize $1 bln in assets tied to 1MDB. S&P downgraded Turkey a notch to BB with a negative outlook, citing political uncertainty. Turkish President Erdogan declared a three-month state of emergency. The Nigerian Naira weakened above 300 per dollar for the first time. Brazil’s central bank signaled a longer wait until it cuts rates.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note, due in large part to the attempted coup in Turkey. Weakness in the lira spilled over into wider EM weakness in thin Friday afternoon market conditions. The situation in Turkey has calmed, and so EM may gain some limited traction this week. However, that calm will likely be very fragile and so we retain a defensive posture with regards to EM.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM and other risk assets rallied on Friday after the strong US jobs data. It appears that markets are pricing in a benign backdrop for risk near-term; that is, the US economy is recovering but not by enough to warrant an imminent Fed rate hike. The July 27 meeting seems unlikely, and so the next likely window would be September 21. Yet EM typically weakens in the run-up to FOMC meetings and so investors should be very careful about taking on too...

Read More »

Read More »

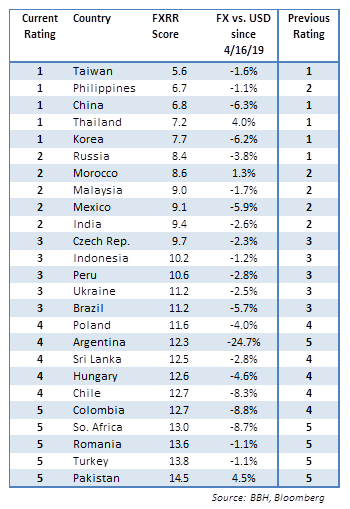

Emerging Markets: What has Changed

In the EM equity space as measured by MSCI, Hungary (+3.0%), UAE (+2.0%), and Qatar (+0.7%) have outperformed this week, while Mexico (-3.4%), South Africa (-2.1%), and Colombia (-1.7%) have underperformed. To put this in better context, MSCI EM fell -1.2% this week while MSCI DM fell -0.3%. In the EM local currency bond space, the Philippines (10-year yield -22 bp), Singapore (-12 bp), and Brazil (-11 bp) have outperformed this week, while Russia...

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM and risk recovered nicely from the Brexit turmoil last week. Yet we think markets are getting too carried away with the "low rates forever" theme and are likely underestimating the capability of the Fed to tighten before 2018. This Friday, the June jobs data could spark a shift in sentiment with a strong reading. Consensus is currently 175k jobs created, up from 38k in May.

Read More »

Read More »

Emerging Markets: What has Changed

Indonesia’s parliament approved a tax amnesty bill. Korea announced KRW20 trln ($17 bln) in fiscal stimulus. Czech President Zeman said a referendum on EU and NATO membership should be held Russia ended its tourism ban to Turkey. Brazil’s central bank is sending hawkish signals

Read More »

Read More »