Category Archive: 5.) Charles Hugh Smith

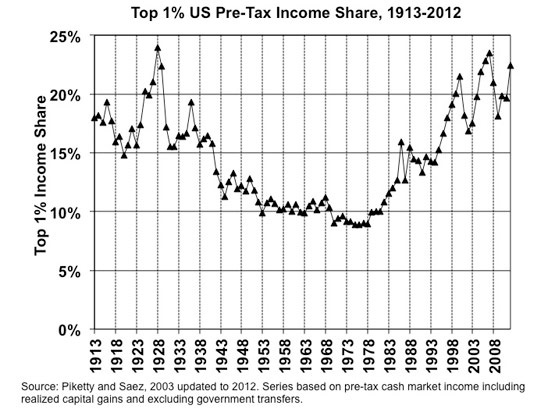

Charles Hugh Smith On Inequalities And The Distortions Caused By Central Bank Policies

FRA is joined by Charles Hugh Smith in discussing income inequality as a result of central bank policies Charles Hugh Smith is a contributing editor to PeakProsperity.com and the proprietor of the popular blog OfTwoMinds.com. He is the author of numerous books, including Why Everything Is Falling Apart: An Unconventional Guide To Investing In Troubled …

Read More »

Read More »

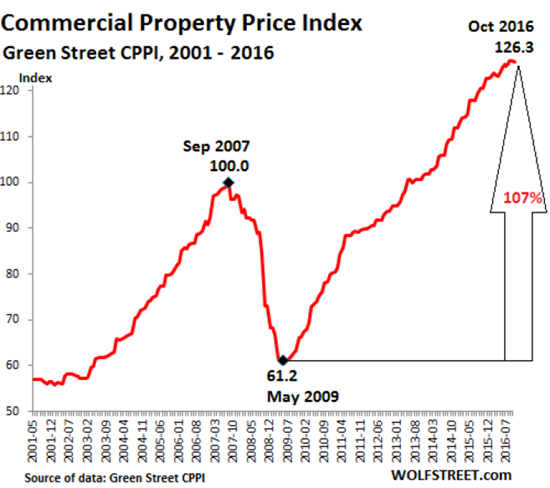

The Next Domino to Fall: Commercial Real Estate

Just as generals prepare to fight the last war, central banks prepare to battle the last financial crisis--which in the present context means a big-bank liquidity meltdown like the one that nearly toppled thr global financial system in 2008-09.

Read More »

Read More »

Are Central Banks Losing Control?

If you want a central banker to choke on his croissant, read him this quote from socio-historian Immanuel Wallerstein: "Countries (have lost the ability) to control what happens to them in the ongoing life of the modern world-system."

Read More »

Read More »

Interview Questions For Charles Hugh Smith Exclusive March 2017

Interview Questions For Charles Hugh Smith Exclusive March 2017, Interview Questions For Charles Hugh Smith Exclusive March 2017

Read More »

Read More »

MACRO ANALYTICS – 03 03 17 – Is Retail CRE The Next Financial Implosion? – w/Charles Hugh Smith

ABSTRACT: https://matasii.com/is-retail-commercial-real-estate-the-next-financial-implosion/

Read More »

Read More »

Why Is the Cost of Living so Unaffordable?

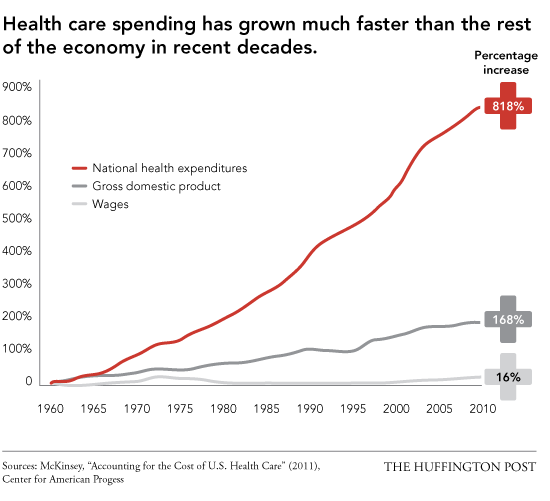

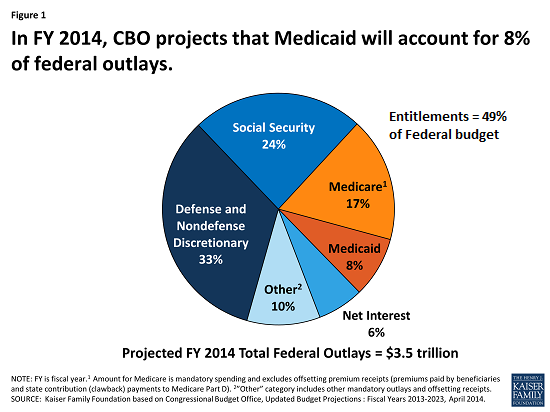

Strip away the centralized power that protects and funds cartels, and prices would plummet. The mainstream narrative is "the problem is low wages." Actually, the problem is the soaring cost of living. If essentials such as healthcare, housing, higher education and government services were as cheap as they once were, a wage of $10 or $12 an hour would be more than enough to maintain a decent everyday life.

Read More »

Read More »

Virtue-Signaling the Decline of the Empire

Virtue-signaling doesn't signal virtue--it signals decline and collapse. There are many reasons why Imperial Rome declined, but two primary causes that get relatively little attention are moral decay and soaring wealth inequality. The two are of course intimately connected: once the morals of the ruling Elites degrade, the status quo seeks to mask its self-serving rot behind high-minded "virtue-signaling" appeals to past glories and cost-free...

Read More »

Read More »

There’s a Difference: Fake News and Junk News

The mainstream media continues peddling its "fake news" narrative like a desperate pusher whose junkies are dying from his toxic dope. It's slowly dawning on the media-consuming public that the MSM is the primary purveyor of "fake news"-- self-referential narratives that support a blatantly slanted agenda with unsupported accusations and suitably anonymous sources.

Read More »

Read More »

The Problem with Gold-Backed Currencies

Any currency is only truly "backed by gold" if it is convertible to gold. There is something intuitively appealing about the idea of a gold-backed currency --money backed by the tangible value of gold, i.e. "the gold standard." Instead of intrinsically worthless paper money (fiat currency), gold-backed money would have real, enduring value-it would be "hard currency", i.e. sound money, because it would be convertible to gold itself.

Read More »

Read More »

The Criminalization of Financial Independence

Just as the "war on drugs" criminalized and destroyed large swaths of African-American and Latino communities, the "war on cash" will further criminalize the few remaining avenues to financial independence and freedom. The introduction of "entitlement" welfare in the 1960s generated a toxic dependency on the state that institutionalized worklessness, a one-two punch that undermined marriage and family in America's working class of all ethnicities.

Read More »

Read More »

This Is How the Status Quo Unravels: As the Pie Shrinks, Everybody Demands Their Piece Should Get Bigger

The politics of the past 70 years was all about horsetrading who got what share of the growing pie: the "pie" being cheap energy, government revenues and consumption, sales and profits. Horsetrading over a growing pie is basically fun. There's always a little increase left for the losers, so there is a reason for everyone to cooperate in a broad political consensus.

Read More »

Read More »

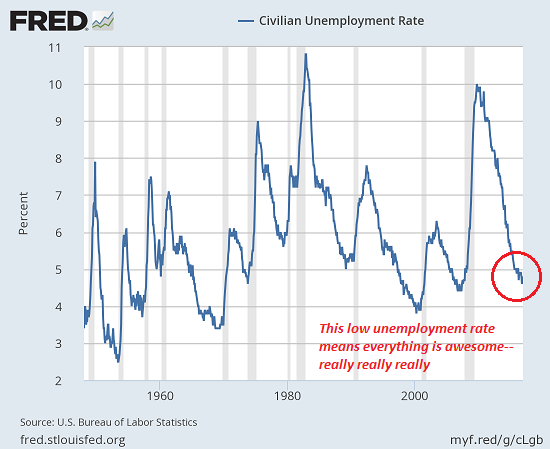

Want to Bring Back Jobs? It’s Impossible Unless We Fix these Four Things

It's your choice, America--you can keep your cartels and the captured government that enables and protects them, or you can fix what's broken and unaffordable. If there is any goal that might attract support from across the political spectrum, it's creating more fulltime jobs in the U.S. But this laudable goal is dead-on-arrival (DOA) unless we first fix these four things. Why is job growth stagnating? Many point to automation, and yes, that is a...

Read More »

Read More »

The Colonization of Local-Business Main Street by Corporate America

This is what our mode of production optimizes: ugliness, debt-serfdom, and servitude to politically dominant corporations.

Read More »

Read More »

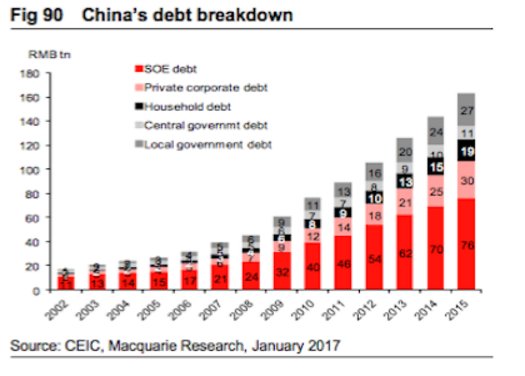

The Central Banks Pull Back: Now It’s Up to Fiscal Policy to “Save the World”

Another problem is the rise of social discord, for reasons that extend beyond the reach of tax reductions and increased infrastructure spending. Have you noticed that the breathless anticipation of the next central bank "save" has diminished? Remember when the financial media was in a tizzy of excitement, speculating on what new central bank expansion would send the global markets higher in paroxysms of risk-on joy?

Read More »

Read More »

Expropriation and Impoverishment: “Capitalist” Greece and “Socialist” Venezuela

Yesterday I noted that not all assets will make it through the inevitable financial re-set. ( Which Assets Are Most Likely to Survive the Inevitable "System Re-Set"?) Those that are easy to expropriate will be expropriated, and those assets vulnerable to soaring taxes, inflation and currency devaluation will also be hollowed out.

Read More »

Read More »

Which Assets Are Most Likely to Survive the Inevitable “System Re-Set”?

Your skills, knowledge and and social capital will emerge unscathed on the other side of the re-set wormhole. Your financial assets held in centrally controlled institutions will not. Longtime correspondent C.A. recently asked a question every American household should be asking: which assets are most likely to survive the "system re-set" that is now inevitable?

Read More »

Read More »

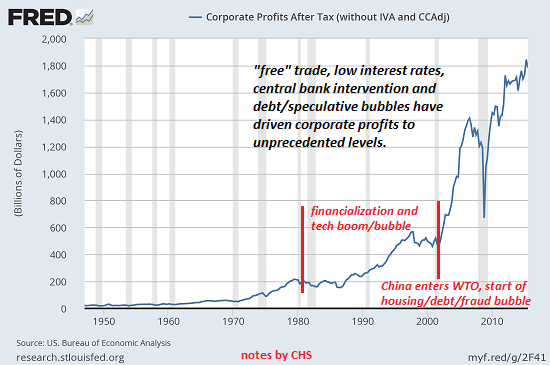

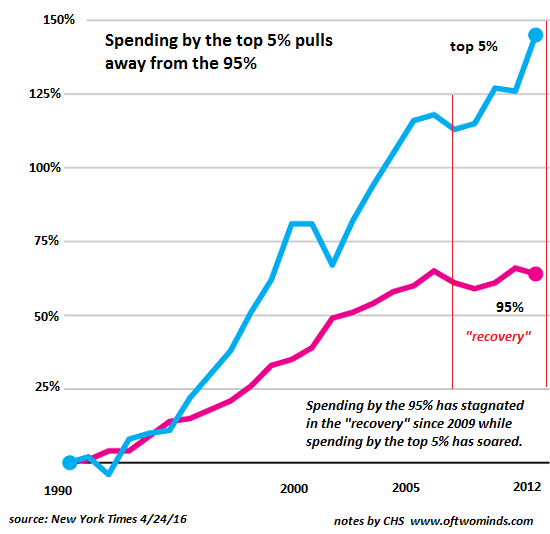

The Central Banks Face Unwelcome Realities: Their Policies Boosted Wealth Inequality, Failed to Generate “Growth”

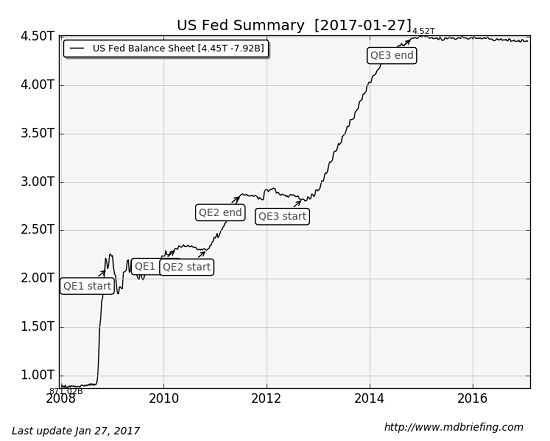

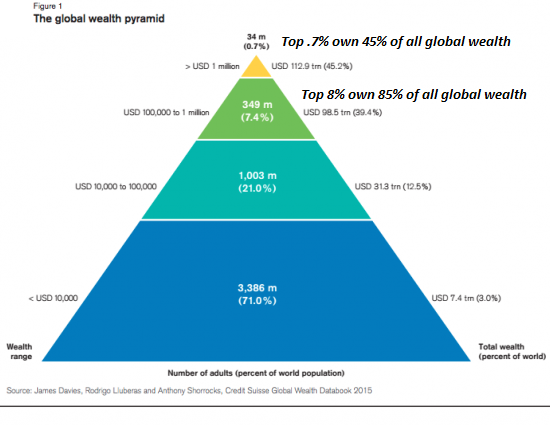

Rather than be seen to be further enriching the rich, I think central banks will start closing the "free money for financiers" spigots. Take a quick glance at these charts of the Federal Reserve balance sheet and bank credit in the U.S.

Read More »

Read More »

GoldSeek Radio – Feb 3, 2017 [CHARLES HUGH SMITH & JIM ROGERS] weekly

GoldSeek Radio’s Chris Waltzek talks to Charles Hugh Smith from Of Two Minds http://www.oftwominds.com/blog.html and to Famed investor Jim Rogers http://www.jimrogers.com/ http://www.goldseek.com/ http://radio.goldseek.com/

Read More »

Read More »

What Would a Labor-Centered Economy Look Like?

How about moving the power to create money from the apex of the pyramid down to its lowest level? Let's spend a moment deconstructing the word "capitalism." Note it contains the word Capital. So far so good. Obviously the key concept here is capital. So what is "capital"? It turns out there are multiple kinds of capital. The most familiar kinds are tangible: cash, orchards, factories, water rights, tools, and so on.

Read More »

Read More »

GSR interviews CHARLES HUGH SMITH – Feb 2, 2017 Nugget

GoldSeek Radio’s Chris Waltzek talks to Charles Hugh Smith from Of Two Minds http://www.oftwominds.com/blog.html http://www.goldseek.com/ http://radio.goldseek.com/

Read More »

Read More »