Category Archive: 5.) Charles Hugh Smith

Charles Hugh Smith on the Social, Financial and Economic Implications of the Coronavirus!

Charles Hugh Smith on the Social, Financial and Economic Implications of the Coronavirus! http://financialrepressionauthority.com/2020/04/01/the-roundtable-insight-charles-hugh-smith-on-the-social-financial-and-economic-implications-of-the-coronavirus/

Read More »

Read More »

The End of Globalization & Financialization Leads To A New Monetary System – Charles Hugh Smith

Thanks for watching this RTD Q&A ft. Charles Hugh Smith. Share your thoughts in the comment section below. Subscribe & click the ? icon to be notified of the next livestream. Consider becoming a supporter of the RTD Channel. All gifts add up to make a difference. Thanks RTD Patreon (Monthly Support): https://www.patreon.com/rtd RTD Donation …

Read More »

Read More »

The New (Forced) Frugality

There are only two ways to survive a decline in income and net worth: slash expenses or default on debt. In post-World War II America, the cultural zeitgeist viewed frugality as a choice: permanent economic growth and federal anti-poverty programs steadily reduced the number of people in deep economic hardship (i.e. forced frugality) and raised the living standards of those in hardship to the point that the majority of households could choose to be...

Read More »

Read More »

The Pandemic Is Accelerating the Breakdown That Began a Decade Ago

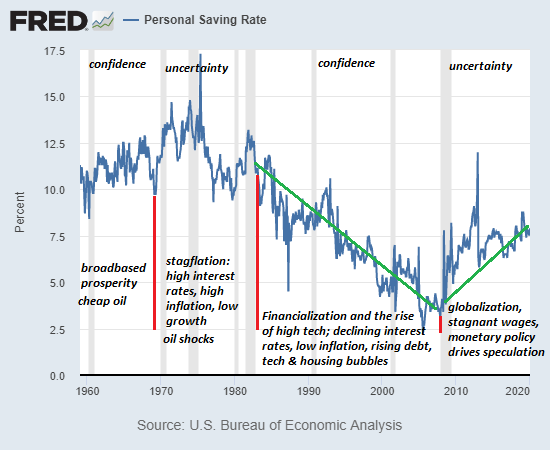

The feedback loop has reversed: by saving more, people will spend, borrow and speculate less, draining the fuel from any broadbased expansion. In eras of confidence and certainty, people save less and spend more freely.

Read More »

Read More »

Helicopter Money: Short-Term Relief Won’t Cure our Financial Disease

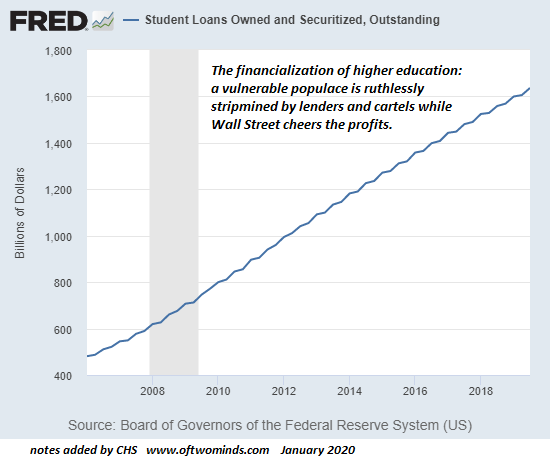

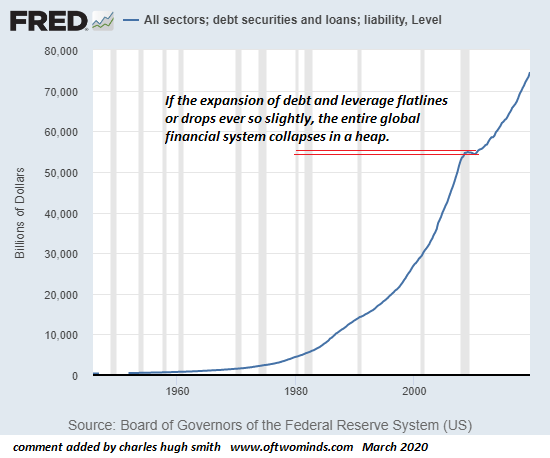

The collateral supporting the global mountain of debt is crumbling as speculative bubbles deflate. A great many freebies are being tossed in the Helicopter Money basket. That households experiencing declines in income need immediate support is obvious, as is the need to throw credit lifelines to small businesses.

Read More »

Read More »

The System Will Not Return to “Normal,” and That’s Good; We Can Do Better

Essential home lockdown reading. The pandemic is revealing to all what many of us have known for a long time: the status quo was designed to fail and so its failure was not just predictable but inevitable. We've propped up a dysfunctional, wasteful and unsustainable system by pouring trillions of dollars in borrowed money down a multitude of ratholes to avoid a reckoning and a re-set.

Read More »

Read More »

Charles Hugh Smith warns of Global Collapse⚠️ Market is Broken with Banking System

For the full transcript go to: https://www.financialanalysis.tv #Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver #Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill …

Read More »

Read More »

The Global Repricing of Assets Can’t Be Stopped

All bubbles pop, period. The financial elites are pushing a narrative that asset prices, sales and profits will all return to January 2020 levels as soon as the Covid-19 pandemic fades. Get real, baby. Nothing is going back to January 2020 levels. Rather than the "V-shaped recovery" expected by Goldman Sachs et al., the crash in asset prices will eventually gather momentum.

Read More »

Read More »

Charles Hugh Smith – Why Are Things Falling Apart?

Charles Hugh Smith, author/proprietor of OfTwoMinds.com explains the self-inflicted pathology that threatens the West’s financial comfort and the liberties we have enjoyed for generations.

Read More »

Read More »

Covid-19 Helicopter Money: Go Big Now or Go Home

This is why it's imperative to go big now, and make plans to sustain the most vulnerable households and small employers not for two weeks but for six months--or however long proves necessary. That governments around the world will be forced to distribute "helicopter money" to keep their people fed and housed and their economies from imploding is already a given.

Read More »

Read More »

The Covid-19 Dominoes Fall: The World Is Insolvent

Subtract their immense debts and they have negative net worth, and therefore the market value of their stock is zero. To understand why the financial dominoes toppled by the Covid-19 pandemic lead to global insolvency, let's start with a household example. The point of this exercise is to distinguish between the market value of assets and net worth, which is what's left after debts are subtracted from the market value of assets.

Read More »

Read More »

Goodbye to All That: The Demise of Globalization and Imperial Pretensions

The decline phase of the S-Curve is just beginning. Globalization and Imperial Pretensions have been decaying for years; now the tide has turned definitively against them. The Covid-19 pandemic didn't cause the demise of globalization and Imperial Pretensions; it merely pushed the rickety structures over the edge.

Read More »

Read More »

And Then Came the Lawsuits: Pandemic in a Litigious Society

This is the upside of hyper-litigiousness: prevention is prioritized as the most effective means of limiting future liability. Never mind prevention or vaccines; the big question is "who can we sue after this blows over to rake in millions of dollars?" Yes, this is pathetic, tragic, perverse and evil, but that's reality in a hyper-litigious society like the U.S.

Read More »

Read More »

CHARLES HUGH SMITH Italian Top 3 in the Pandemic Deaths Surge 57% THIS GOES DEEP !

CHARLES HUGH SMITH- Italian- Top 3 in the Pandemic. Deaths Surge 57%. THIS GOES DEEP ! CHARLES HUGH SMITH- Italian- Top 3 in the Pandemic. Deaths Surge 57%. THIS GOES DEEP ! CHARLES HUGH SMITH- Italian- Top 3 in the Pandemic. Deaths Surge 57%. THIS GOES DEEP ! https://youtu.be/TPSmBmHLP5E

Read More »

Read More »

CHARLES HUGH SMITH: Italian- Top 3 in the Pandemic. Deaths Surge 57%. THIS GOES DEEP !

For the full transcript go to: https://www.financialanalysis.tv #Financial News #Silver News #Gold #Bix Weir #RoadToRoota #Kyle Bass #Realist News #Greg Mannarino #Rob Kirby #Reluctant Preppers #The Next Newss #Maneco64 #Mike Maloney #Gold Silver #Eric Sprott #Jim Rickards #David Morgan #Peter Schiff #Max Keiser #Robert Kiyosaki #SilverDoctors #Jim Willie #Clif High #Ron Paul# Pastor Williams #Bill …

Read More »

Read More »

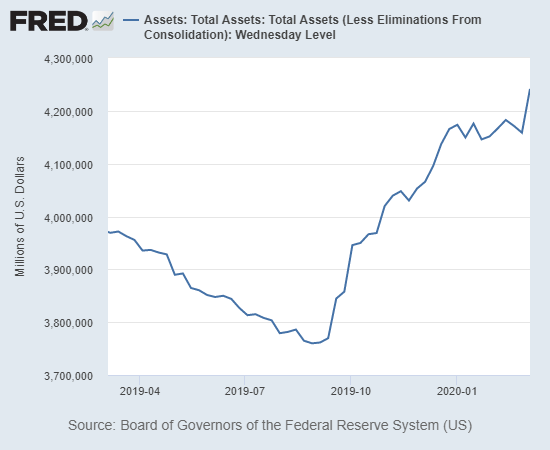

What the Fed Can Do: Print and Buy, Buy, Buy

Everyone with a pension fund or 401K invested in stocks better hope the Fed becomes the buyer of last resort, and soon. Much has been written about what the Federal Reserve cannot do: it can't stop the Covid-19 pandemic or reverse the economic damage unleashed by the pandemic.

Read More »

Read More »

CHARLES HUGH SMITH: Coronavirus, Italian Nightmare – THIS GOES DEEP!

EXCLUSIVE REPORTS ON PRESIDENT TRUMP AND THE WITCH HUNT! LP(S) – Maga LP(S) – Media LP(S) – Epic LP(S) – Election EDUCATE YOURSELF IMMEDIATELY: LP(S) – Enemy LP(S) – Dead LP(S) – Ratio PREPARE FOR THE BEAR MARKET: LP(S) – Bear Warren Buffett, Ray Dalio, Charlie Munger And Other Notable Billionaires Have All Focused On …

Read More »

Read More »

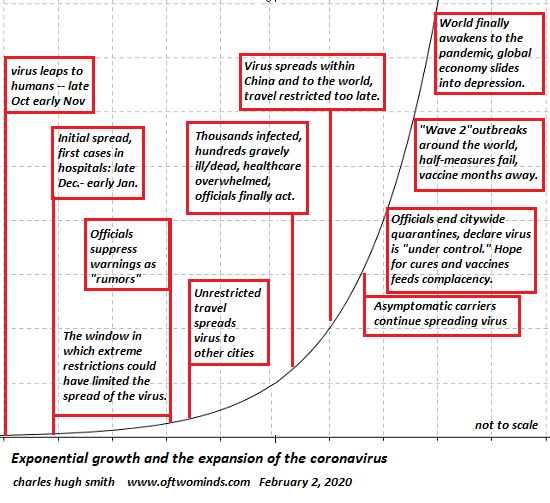

The Gathering Storm: Could Covid-19 Overwhelm Us in the Months Ahead?

Either the science is wrong and the complacent will be proven correct, or the science is correct and the complacent will be wrong. The present disconnect between the science of Covid-19 and the status quo's complacency is truly crazy-making, as we face a binary situation: either the science is correct and all the complacent are wrong, or the science is false and all the complacent are correct that the virus is no big deal and nothing to fret about.

Read More »

Read More »

Charles Hugh Smith EXCLUSIVE: Coronavirus PARALYZES Global Economy – RECESSION 100%!

EXCLUSIVE REPORTS ON PRESIDENT TRUMP AND THE WITCH HUNT! LP(S) – Maga LP(S) – Media LP(S) – Epic LP(S) – Election EDUCATE YOURSELF IMMEDIATELY: LP(S) – Enemy LP(S) – Dead LP(S) – Ratio PREPARE FOR THE BEAR MARKET: LP(S) – Bear Warren Buffett, Ray Dalio, Charlie Munger And Other Notable Billionaires Have All Focused On …

Read More »

Read More »