Category Archive: 5.) Charles Hugh Smith

Where the Rubber Meets the Road

Longtime correspondent Paul B. suggested I re-publish three essays that have renewed relevance. This is the second essay, from July 2008. Thank you, Paul, for the suggestion. I received this timely inquiry from astute reader Paul B.: I'm interested in # 1, while you seem to take into account 300 million people in your writings--would you comment on rubber-meets-the-road impacts and proactive actions we can take to help shield ourselves (and our...

Read More »

Read More »

Wrenching And Immediate Jobs Problem, Just As Consumer Prices Must Rise

Charles Hugh Smith joins us to discuss the economic reality on Main Street, totally disconnected from Wall Street. From the abrupt loss of jobs, to a consumer that’s nowhere to be found and inflation ready to run rampant, here’s robust discussion about these unprecedented, dark times… Some of the questions that developed during today’s discussion: …

Read More »

Read More »

The Art of Survival, Taoism and the Warring States

Longtime correspondent Paul B. suggested I re-publish three essays that have renewed relevance. This is the first essay, from June 2008. Thank you, Paul, for the suggestion. I'm not trying to be difficult, but I can't help cutting against the grain on topics like surviving the coming bad times when my experience runs counter to the standard received wisdom.

Read More »

Read More »

MACRO ANALYTICS – 04-30-20 – MAIN STREET Shock!

31 Minutes with 24 Supporting Slides If you enjoyed this video you will find the following integrating newsletters of value. They expand on the video content with associated security charts: VIDEO NEWSLETTER-1 https://conta.cc/2AdDiQQ – 05-08-20 – Focus: MONOLINES & MUNI’S VIDEO NEWSLETTER-2 https://conta.cc/3cywcom – 05-10-20 – Focus: Commercial REITS Notification Sign-Up for Free Video Newsletter …...

Read More »

Read More »

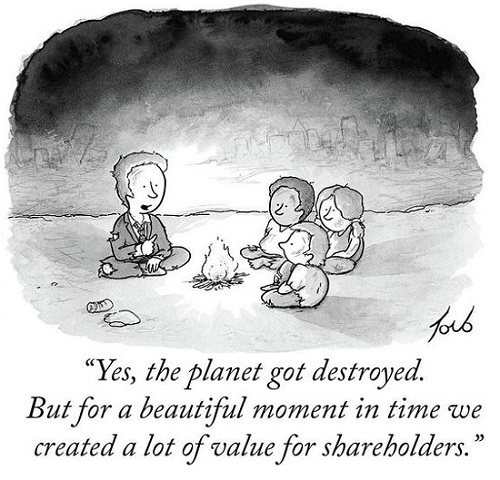

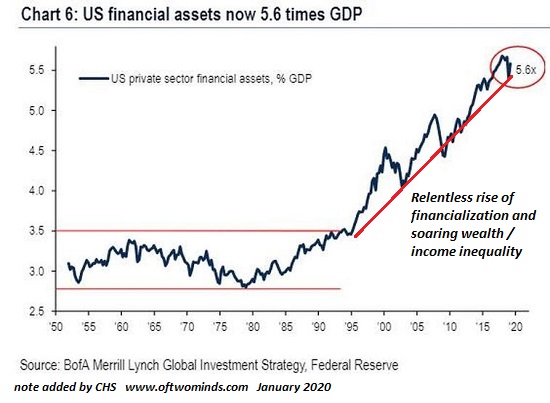

Why Assets Will Crash

This is how it happens that boats that were once worth tens of thousands of dollars are set adrift by owners who can no longer afford to pay slip fees. The increasing concentration of the ownership of wealth/assets in the top 10% has an under-appreciated consequence: when only the top 10% can afford to buy assets, that unleashes an almost karmic payback for the narrowing of ownership, a.k.a. soaring wealth and income inequality: assets crash.

Read More »

Read More »

Charles Hugh Smith on how COVID 19 will affect Jobs and the Economy

http://financialrepressionauthority.com/2020/05/01/the-roundtable-insight-charles-hugh-smith-on-how-covid-19-will-affect-jobs-and-the-economy/

Read More »

Read More »

With Superfluous Demand in Free-Fall, What’s the Upside of Re-Opening a Small Business?

Since superfluous demand was the core driver of most consumer spending, and that demand is in free-fall, what's the upside of re-opening? The mainstream view assumes everyone will be gripped by an absolutely rabid desire to return to their pre-pandemic frenzy of borrowing and spending and consuming, the more the better.

Read More »

Read More »

The Crash Has Only Just Begun

Everything, including a rational, connected-to-reality, effective financial system, is on back-order and unlikely to ship any time soon. While the stock market euphorically front-runs the Fed and a V-shaped recovery, the reality is the crash has only just begun.

Read More »

Read More »

AxisOfEasy Salon #1: Hypernormalisation, Legitimacy and Simulacrum

The first episode in the AxisOfEasy Salon and Interviews series with the AoE Contributors: Charles Hugh Smith, Jesse Hirsh and Mark E. Jeftovic.

Read More »

Read More »

AxisOfEasy Salon #1: Hypernormalisation, Legitimacy and Simulacrum

The first episode in the AxisOfEasy Salon and Interviews series with the AoE Contributors: Charles Hugh Smith, Jesse Hirsh and Mark E. Jeftovic.

Read More »

Read More »

Overcapacity / Oversupply Everywhere: Massive Deflation Ahead

The price of a great many assets will crash, out of proportion to the decline in demand. Oil is the poster child of the forces driving massive deflation: overcapacity / oversupply and a collapse in demand. Overcapacity / oversupply and a collapse in demand are not limited to the crude oil market; rather, they are the dominant realities in the global economy.

Read More »

Read More »

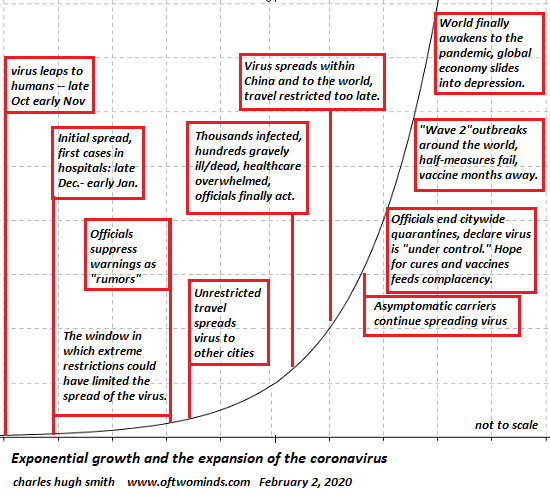

Between a Rock and a Hard Place: Pandemic and Growth

There is no way authorities can limit the coronavirus and restore global growth and debt expansion to December 2019 levels. Authorities around the world are between a rock and a hard place: they need policies that both limit the spread of the coronavirus and allow their economies to "open for business." The two demands are inherently incompatible, and so neither one can be fulfilled.

Read More »

Read More »

There’s No Going Back, We Can Only Go Forward

What I see is a global collapse of intangible capital that is invisible to most people. It's only natural that the conventional expectation is a return to the pre-pandemic world is just a matter of time. Whether it's three months or six months or 18 months, "the good old days" will return just as if we turned back the clock.

Read More »

Read More »

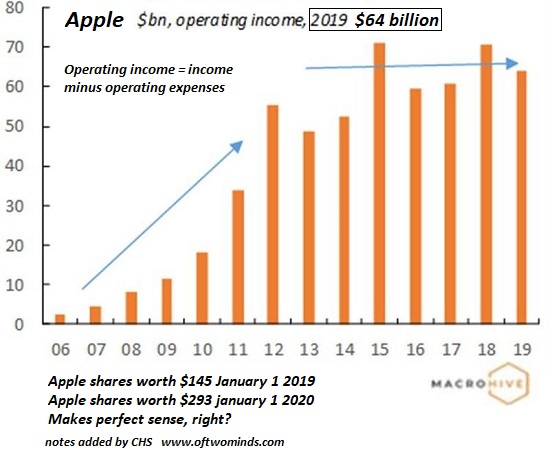

Buy The Tumor, Sell the News

The fictitious valuation of the stock market will eventually re-connect with reality in a violent decline. No, buy the tumor, sell the news (tm) is not a typo: the stock market is a lethal tumor in our economy and society.

Read More »

Read More »

The World Has Changed More Than We Know

Put another way: eras end. While the mainstream media understandably focuses on the here and now of the pandemic, some commentators are looking at the long-term consequences. Here is a small sampling: While each of these essays offers a different perspective, let's focus on the last two: Ugo Bardi's essay on Hyperspecialization and the technological responses described in the MIT Technology Review essay.

Read More »

Read More »

What Will The Post-Coronavirus World Look Like? (Martenson, Rubino, Smith & Taggart)

If covid-19 is indeed hastening the permanent disruption of the status quo, what will life in a post-coronavirus world look like? This prognosticating session builds on last week’s Economic Shockwaves roundtable: https://www.peakprosperity.com/economic-shockwaves/ This time, John Rubino, Charles Hugh Smith and Adam Taggart — also joined by Chris Martenson this time — discuss the myriad ways …

Read More »

Read More »

If Lockdown Is a Needless Over-Reaction, Then Why Did China Lockdown Half its Economy?

Recall that the initial deaths and related costs are only the first-order effects; policy makers have to consider the second-order effects. Everyone who reckons that the lockdown is needless and more destructive than the pandemic that triggered it has to answer this question: then why did China lockdown half its economy?

Read More »

Read More »

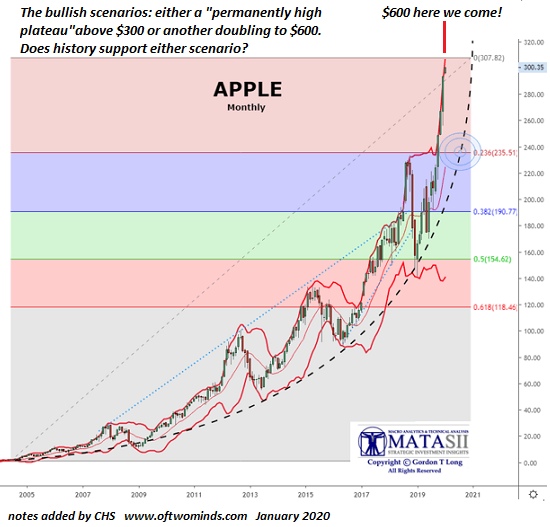

When Bulls Are Over-Anxious to Catch the Rocketship Higher, This Isn’t the Bottom

Everyone with any position in today's market will be able to say they lived through a real Bear Market. In the echo chamber of a Bull Market, there's always a reason to get bullish: the consumer is spending, housing is strong, the Fed has our back, multiples are expanding, earnings are higher, stock buybacks will push valuations up, and so on, in an essentially endless parade of self-referential reasons to buy, buy, buy and ride the rocketship...

Read More »

Read More »

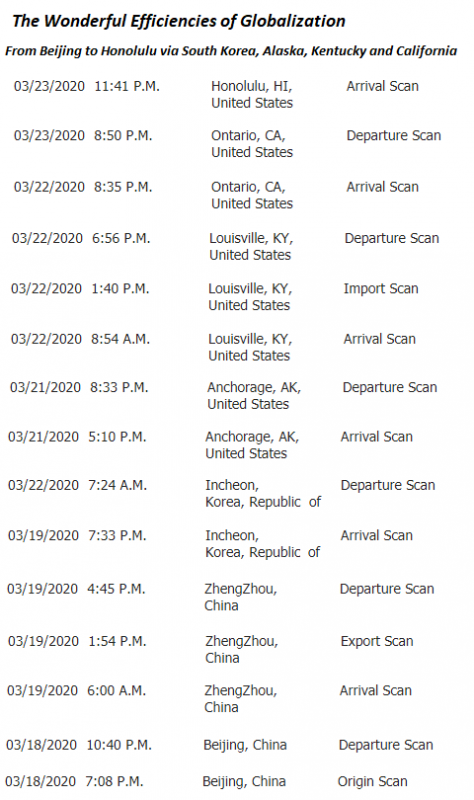

The Wonderful Insanity of Globalization

So here's an April Fools congrats to globalization's many fools. The tradition here at Of Two Minds is to make use of April Fool's Day for a bit of parody or satire, but I'm breaking with tradition and presenting something that is all too real but borders on parody: the wonderful insanity of globalization.

Read More »

Read More »

Gadfly Public Interview: Charles Hugh Smith – Of Two Minds Blog

Start your FREE 30-day subscription today https://thegadfly.vhx.tv/ Visit and support Charles with his work: https://www.oftwominds.com/blog.html

Read More »

Read More »