Category Archive: 5.) Charles Hugh Smith

Deep State to Powell: Stop Goosing Stocks Higher Or You’ll Re-Elect Trump

Come on, Jay, you can always goose stocks back to new highs after the election. Indulge me for a moment in some backroom speculation. It's absurdly obvious that the unelected, permanent, ever-expanding National Security State, a.k.a the Deep State, and its Democratic Party allies have been attempting to torpedo Donald Trump since the 2016 election took them by surprise. (Imagine doing everything that worked so well in the past and failing at the...

Read More »

Read More »

Charles Hugh Smith: This Event Has Revealed The Failures Of Government & Central Banks

https://rebrand.ly/gunstorage Charles Hugh Smith: This Event Has Revealed The Failures Of Government & Central Banks Mac SlavoJune 1st, 2020SHTFplan. com Central banking and centralized planning has failed. This “event,” also well-known as a scamdemic, or plandemic, has proven that the government always fails, and to give them another chance is simply ludicrous. Charles Hugh …

Read More »

Read More »

Global Crisis: the Convergence of Marx, Kafka, Orwell and Huxley

The global crisis is not merely economic; it is the result of profound financial, sociological and political trends described by Marx, Kafka, Orwell and Huxley. The unfolding global crisis is best understood as the convergence of the dynamics described by Marx, Kafka, Orwell and Huxley.

Read More »

Read More »

What Lies Ahead: Destabilizing Social Stratification

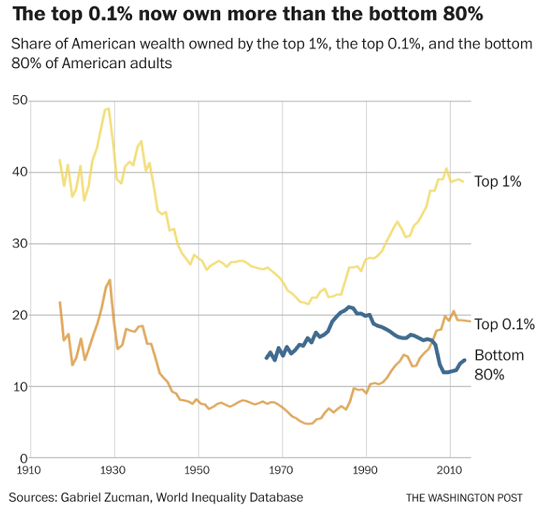

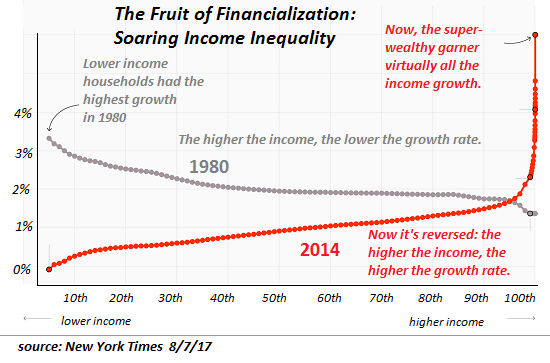

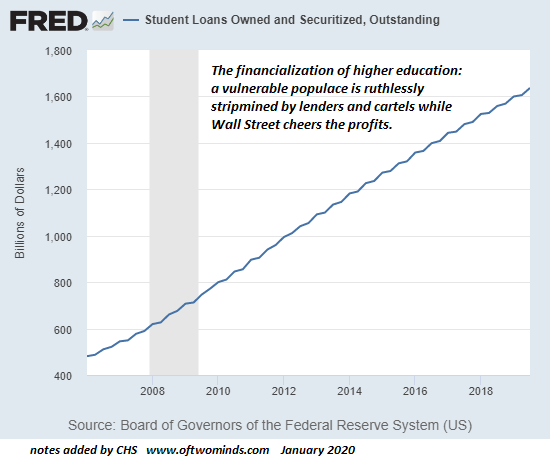

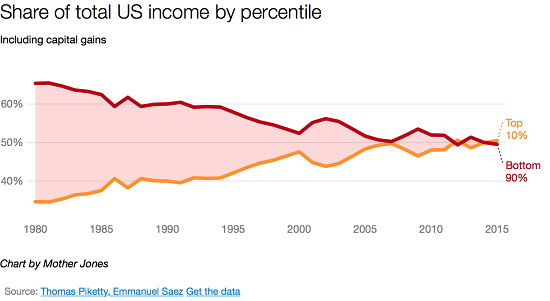

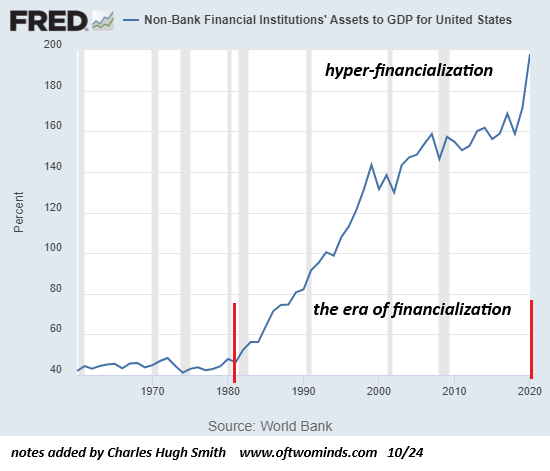

The bill for extreme wealth/income inequality is now overdue, and the penalties for ignoring the bill will be as extreme as the inequality. Our socio-economic-political system--let's call it the status quo--has been hollowed out by extremes of wealth/power inequality driven by financialization and globalization, which have enriched the top 5% and left everyone else behind.

Read More »

Read More »

When Institutions Fail, Fragmentation and Decentralization Become Solutions

That which has failed is unsustainable, no matter how many trillions the Federal Reserve tosses against the tides of history.

Read More »

Read More »

CHARLES HUGH SMITH – Made, Spend and Stay ın The Local Economy

SUBSCRIBE For The Latest Issues About ; can economy grow forever, how indian economy can grow, can the economy ever recover, can the economy recover after covid, how did economy start, how do economy works #DEEP STATE #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH …

Read More »

Read More »

The Post-Covid Economy Will Be Very Different From the Pre-Pandemic Bubble Economy

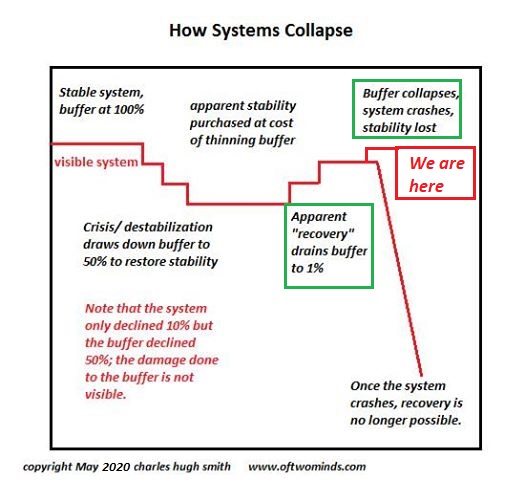

As the old models break down, opportunities for new models will arise. Unstable, unsustainable systems can lull observers into a comfy complacency as instability increases beneath a thin veneer of apparent stability. That's the systemic story of the past 20 years: all the extremes that were needed to maintain the veneer of stability have increased the instability building beneath the complacent confidence.

Read More »

Read More »

We’re Living the Founding Fathers’ Nightmare: America Is Corrupt to the Core

Our ruling elites, devoid of leadership, are little more than the scum of self-interested, greedy grifters who rose to the top of America's foul-smelling stew of corruption. The Founding Fathers were wary of institutional threats to liberty and the citizenry's sovereignty, which included centralized concentrations of power (monarchy, central banks, federal agencies, etc.) and the tyranny of corruption unleashed by small-minded, self-interested,...

Read More »

Read More »

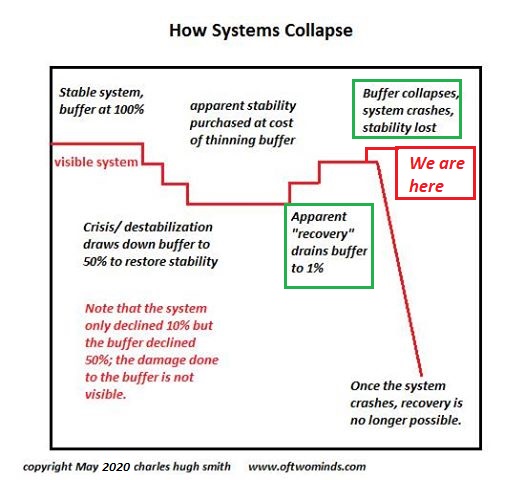

This Is How Systems Collapse

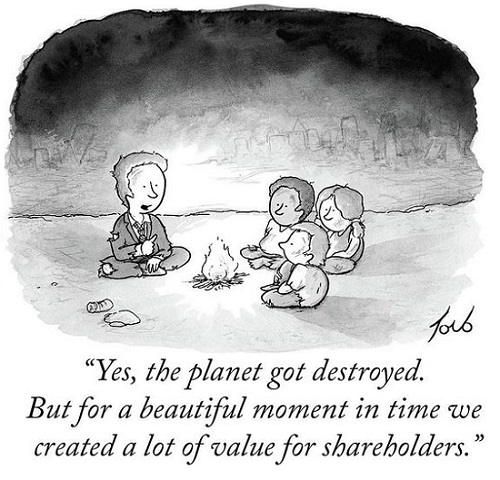

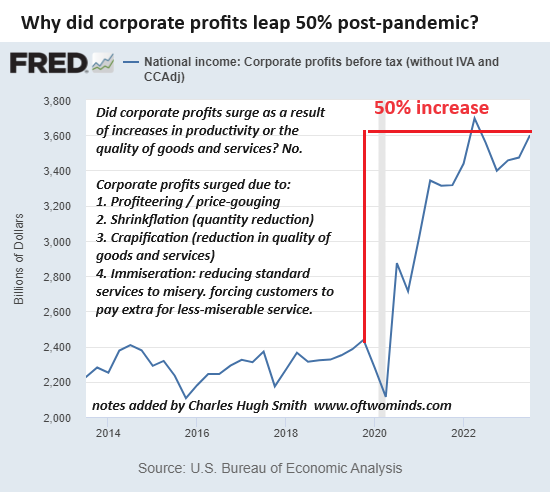

Flooding the financial system with "free money" only restores the illusion of stability. I updated my How Systems Collapse graphic from 2018 with a "we are here" line to indicate our current precarious position just before the waterfall: For those who would argue we're nowhere near collapse, consider that over 20% of the Federal Reserve's $2 trillion spew of free money went directly into the pockets of America's billionaires.

Read More »

Read More »

CHARLES HUGH SMITH – That System Is Completely And Incredibly Unfair

SUBSCRIBE For The Latest Issues About ; #DEEP STATE #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ For More Info; https://www.youtube.com/channel/UCjG4MtXKu6a9MFNYUK0WcZA/videos?view_as=subscriber

Read More »

Read More »

The Event Has RevealedThe Structural Fragilities Of America,The [CB] Model Failed:Charles Hugh Smith

Prepare Today And SAVE $100 Off A Full 4-WEEK SUPPLY My Patriot Supply http://preparewithx22.com Today’s Guest: Charles Hugh Smith Todays Interview: Todays interview is with Charles Hugh Smith, Charles talks cv-19 in Hawaii and how the island is handling it. The discussion then branches off into centralization, the [CB] and how the people have the …

Read More »

Read More »

Charles Hugh Smith on Meeting the Challenges of the “New Normal” World

Charles Hugh Smith on Meeting the Challenges of the “New Normal” World http://financialrepressionauthority.com/2020/05/27/the-roundtable-insight-charles-hugh-smith-on-meeting-the-challenges-of-the-new-normal-world/

Read More »

Read More »

An Economy That Cannot Allow Stocks to Decline Is Too Fragile To Survive

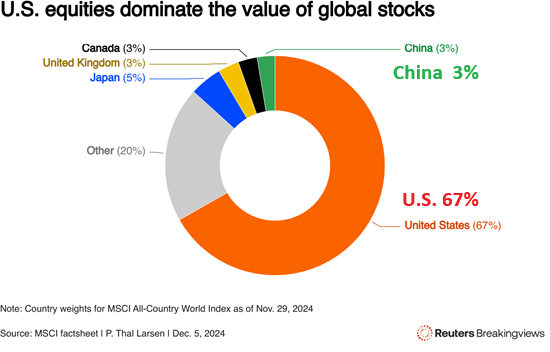

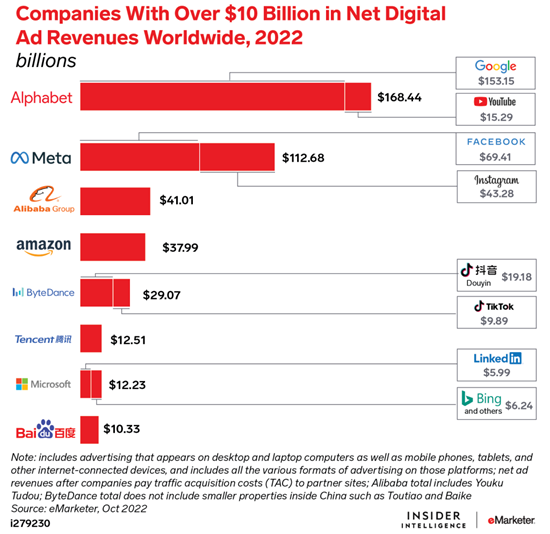

The fragile ice shelf of speculative bets and debt clinging to the mountainside is making strange creaking sounds-- will you listen or will you ignore it because 'the Fed has our back'? Feast your eyes on the chart below of the Nasdaq 100 stock market Index, which is dominated by the six FAAMNG (rhymes with "famine") stocks: Facebook, Apple, Amazon, Microsoft, Netflix and Google which now account for over 20% of the entire U.S. stock market's...

Read More »

Read More »

Re-Opening the Economy Won’t Fix What’s Broken

Re-opening a fragile, brittle, bankrupt, hopelessly perverse and corrupt "normal" won't fix what's broken. The stock market is in a frenzy of euphoria at the re-opening of the economy. Too bad the re-opening won't fix what's broken. As I've been noting recently, the real problem is the systemic fragility of the U.S. economy, which has lurched from one new extreme to the next to maintain a thin, brittle veneer of normalcy.

Read More »

Read More »

The Pandemic Gives Us Permission To Get What We Always Wanted

Dear Corporate America: maybe you remember the old Johnny Paycheck tune? Let me refresh your memory: take this job and shove it. Put yourself in the shoes of a single parent waiting tables in a working-class cafe with lousy tips, a worker stuck with high rent and a soul-deadening commute--one of the tens of millions of America's working poor who have seen their wages stagnate and their income becoming increasingly precarious / uncertain while the...

Read More »

Read More »

Consumer Spending Will Not Rebound–Here’s Why

Any economy that concentrates its wealth and income in the top tier is a fragile economy. There are two structural reasons why consumer spending will not rebound, no matter how open the economy may be. Virtually everyone who glances at headlines knows the global economy is lurching into either a deep recession or a full-blown depression, depending on the definitions one is using. Everyone also knows the stock market has roared back as if nothing...

Read More »

Read More »

The Collapse of Main Street and Local Tax Revenues Cannot Be Reversed

The core problem is the U.S. economy has been fully financialized, and so costs are unaffordable. To understand the long-term consequences of the pandemic on Main Street and local tax revenues, we need to consider first and second order effects. The immediate consequences of lockdowns and changes in consumer behavior are first-order effects: closures of Main Street, job losses, massive Federal Reserve bailouts of the top 0.1%, loan programs for...

Read More »

Read More »

The Way of the Tao Is Reversal

As Jackson Browne put it: Don't think it won't happen just because it hasn't happened yet. We can summarize all that will unfold in the next few years in one line: The way of the Tao is reversal. This is the opening line of Chapter 40 of Lao Tzu's 5,000-character commentary on the Tao, The Tao Te Ching. There are many translations of this slim volume, and for a variety of reasons I favor the 1975 translation by my old professor at the University of...

Read More »

Read More »

Surviving 2020 #3: Plans A, B and C

Readers ask for specific recommendations for successfully navigating the post-credit/speculative-bubble era and I try to do so while explaining the impossibility of the task. As the bogus prosperity economy built on exponential growth of debt implodes, we all seek ways to protect ourselves, our families and our worldly assets.

Read More »

Read More »