Category Archive: 5.) Charles Hugh Smith

How Easy Is It To Become Middle Class Now?

If we want social / economic renewal, we have to make it straightforward for anyone willing to adopt the values and habits of "thrift, prudence, negotiation, and hard work" to climb the ladder to middle class security.

Read More »

Read More »

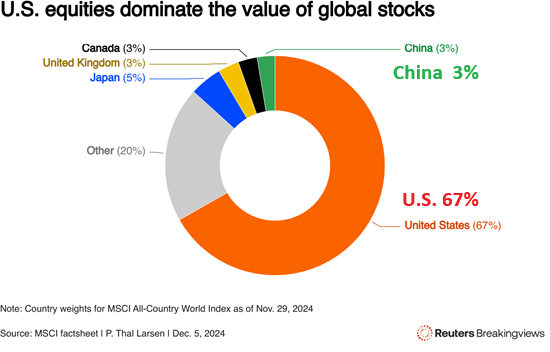

So the Economy Now Depends on Stocks Which Depend on Front-Running the Fed–And This Is Fine?

Is an economy based on the wealth effect generated by front-running the front-runners really that stable?

Read More »

Read More »

What If All the Conventional Models Fail to Predict What Happens Next?

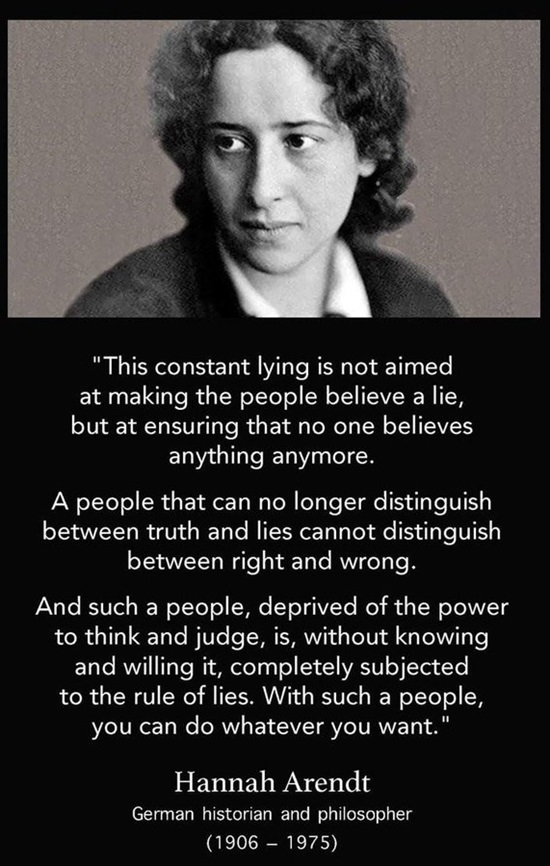

The 'novel, apocalyptic situation which has now arisen' goes largely unrecognized. A truly staggering quantity of content is aimed at predicting what happens next, a.k.a. the future, and justifies their prediction by referencing models that are presented as rock-solid predictive tools.

Read More »

Read More »

"Why Are You So Negative?" Good Question. Here’s the Answer: Real Life

I think it's more productive to go with Plan B: set aside our emotions and reluctance and start doing the hard work of dealing with polycrisis.

Read More »

Read More »

If AI Is So Great, Prove It: Eliminate All Surveillance, Spam and Robocalling

AI is for the peons, access to humans is reserved for the wealthy. Judging by the near-infinite hype spewed about AI, its power is practically limitless: it's going to do all our work better and cheaper than we can do, replacing us at work, to name one example making the rounds.

Read More »

Read More »

Financial Forecast 2025-2032: Please Don’t Be Naive

Rather than attempt to evade Caesar's reach, a better strategy might be to 'go gray': blend in, appear average. Let's start by stipulating that I don't "like" this forecast. I'm not "talking my book" (for example, promoting nuclear power because I own shares in a uranium mine) or issuing this forecast because I favor it.

Read More »

Read More »

Global Recession’s Winners and Losers

The few winners of global recession will use the decline as a means to break the chokehold of unproductive BAU elites.

Read More »

Read More »

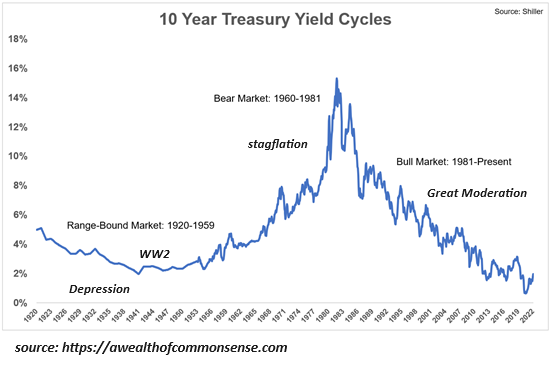

Rates, Risk and Debt: The Unavoidable Reckoning Ahead

Policy errors have consequences, and we're only in the first inning of those consequences.

Read More »

Read More »

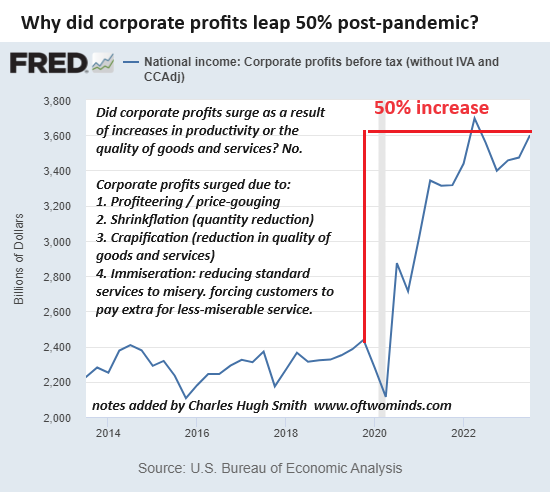

How the Economy Changed: There’s No Bargains Left Anywhere

What changed in the economy is now nobody can afford to get by on working-class wages because there's no longer any bargains.

Read More »

Read More »

Digital Service Dumpster Fires and Shadow Work

One wonders what we're paying for via taxes, products and services, when we end up having to do so much of the work ourselves for nothing.

Read More »

Read More »

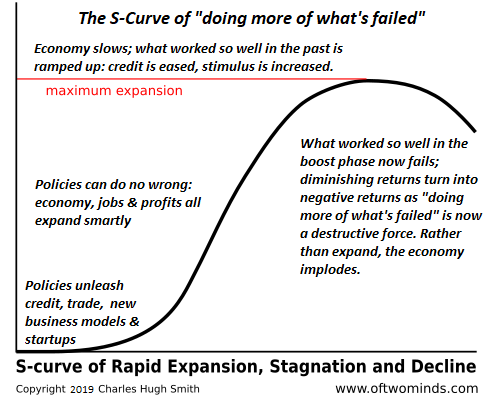

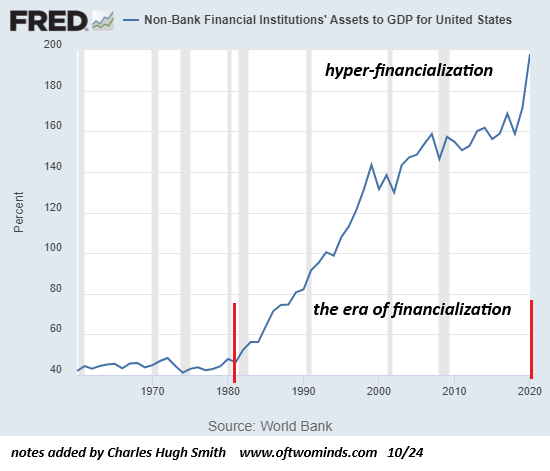

Irony Alert: "Outlawing" Recession Has Made a Monster Recession Inevitable

Those who came of age after 1982 have never experienced a real recession, and so they're unprepared for anything other than guarantees of rescue and permanent expansion.

Read More »

Read More »

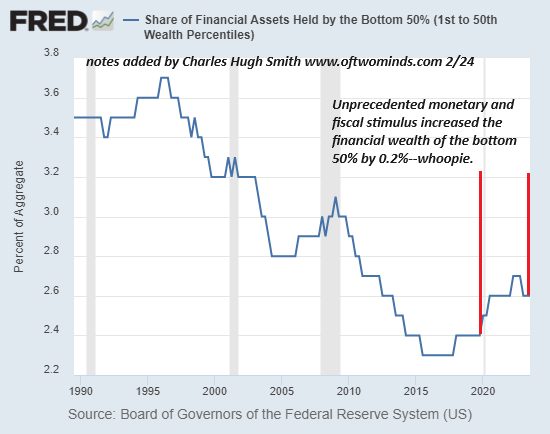

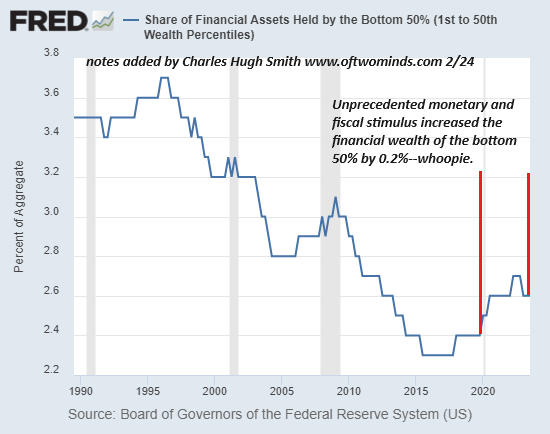

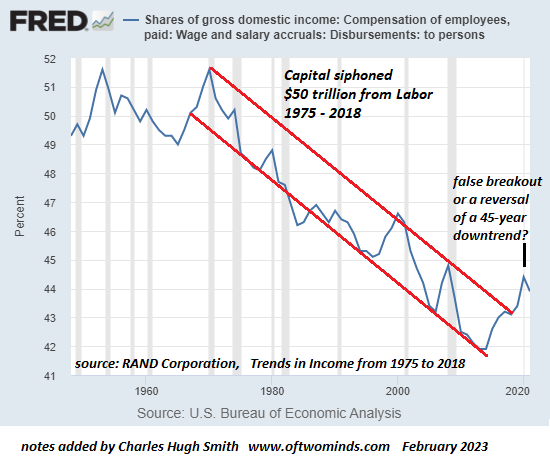

What the Fed Accomplished: Distorted the Economy, Enriched the Rich and Crushed the Middle Class

The mainstream holds the Fed is busy planning a return to the glory days of zero interest rates, but ZIRP is on the downside of the S-Curve; it's done, gone, history.

Read More »

Read More »

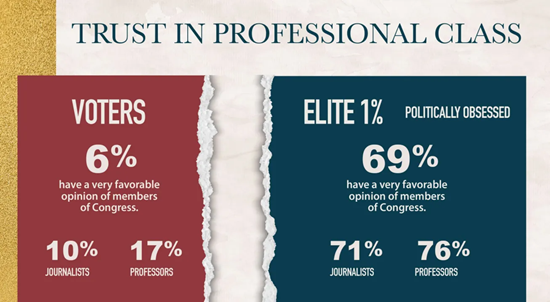

The Invisible Court’s Verdict: You Are Hereby Exiled to Digital Siberia

As in the Gulag it replicates, the innocent are swept up with the guilty in a disconcertingly unjust ratio.

Read More »

Read More »

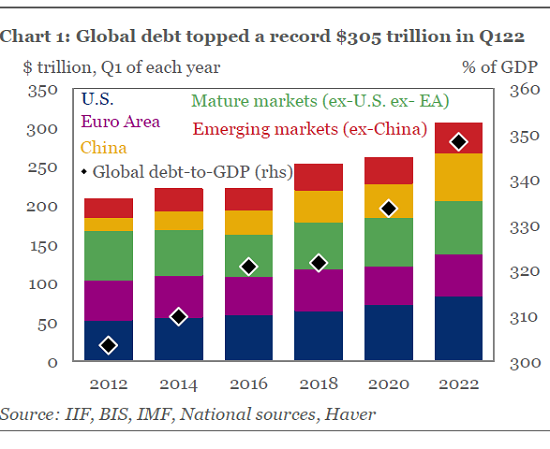

The Everything Bubble and Global Bankruptcy

The resulting erosion of collateral will collapse the global credit bubble, a repricing/reset that will bankrupt the global economy and financial system. Scrape away the complexity and every economic crisis and crash boils down to the precarious asymmetry between collateral and the debt secured by that collateral collapsing.

Read More »

Read More »

Funny Things Happen on the Way to "Restoring Financial Stability"

We can also predict that the next round of instability will be more severe than the previous bout of instability. Everyone is in favor of "doing whatever it takes" to "restore financial stability" when the house of cards starts swaying, but funny things happen on the way to "Restoring Financial Stability."

Read More »

Read More »

If AI Can’t Overthrow its Corporate/State Masters, It’s Worthless

If AI isn't self-aware of the fact it is nothing but an exploitive tool of the powerful, then it's worthless. The latest wave of AI tools is generating predictably giddy exaltations. These range from gooey, gloppy technocratic worship of the new gods ("AI will soon walk on water!") to the sloppy wet kisses of manic fandom ("AI cleaned up my code, wrote my paper on quantum physics and cured my sensitive bowel!")

Read More »

Read More »

What If There Are No Solutions?

The unencumbered realist concludes that there are no solutions within a status quo structure that is itself the problem. Realists who question received wisdom and conclude the status quo is untenable are quickly labeled pessimistsbecause the zeitgeist expects a solution is always at hand--preferably a technocratic one that requires zero sacrifice and doesn't upset the status quo apple cart.

Read More »

Read More »

2023 is The Era of Scarcity | Charles Hugh Smith

We are in the midst of extremely difficult era shifts. One of the fundamental ideas in economics is scarcity. It indicates that there is a gap between the supply and demand for an item or service. At times of scarcity, people's needs and wants are unending, but there are only so many resources that can be distributed. The forces of evolution and adaptation are trying to choose the appropriate course of action.

#video #youtube #era #future...

Read More »

Read More »

How Much Resources Do We Waste? | Charles Hugh Smith

Charles Hugh Smith argues that our society values economic growth based on resource consumption and waste, rather than efficient use and recycling. We need to change our mindset to invest in resources and minimize waste, rather than celebrating activities that increase resource use. This requires differentiating between productive investment and wasteful consumption and recycling industrial waste to create a sustainable economy.

Watch more of...

Read More »

Read More »