Category Archive: 5.) Alhambra Investments

Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

From Silver Blaze by Arthur Conan Doyle, 1892

Read More »

Read More »

Rate Hikes Are Working

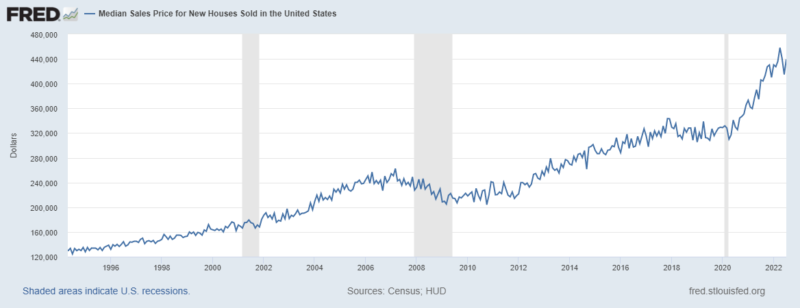

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%.

Read More »

Read More »

The Economy Improved In July

The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7.

Read More »

Read More »

Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine.

Read More »

Read More »

Tips for Buying a Medicare Supplement Policy

The clock is ticking and it gets louder the closer you get to the magic age of 65. That’s when you sign up for Medicare. But there’s more than one way to receive Medicare coverage. There are Medicare Advantage plans, sometimes referred to as all-in-one plans, because they provide medical coverage and can also provide benefits for vision, dental, hearing, and prescriptions.

Read More »

Read More »

Another Historic Social Security Cost of Living Increase is on the Way

It’s almost time for the Social Security Administration to break out pencil and calculator to find out how much more it costs to live this year than it did last, and then decide how much of a raise Social Security beneficiaries will get in 2023. For 2022, the Social Security Cost of Living Adjustment (COLA) was 5.9%, the largest increase since 1982.

Read More »

Read More »

Fed Official: Inverted curve means Fed is awesome [Ep. 269, Eurodollar University]

James Bullard, St. Louis Fed chief, says the yield curve is twisted by the inflation surge, and may not be a recession message. Indeed, markets are twisting it because they have confidence the central bank will get control of consumer prices.

Read More »

Read More »

Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong.

Read More »

Read More »

In 1982 the Fed missed an opportunity; it still haunts us [Ep. 267, Eurodollar University]

On May 20, 1982 the Fed held an emergency conference call for which transcripts are missing (on purpose? by accident?) to solve the "Drysdale Problem". They 'solved' it by focusing on the trees and ignoring the forest.

Read More »

Read More »

Ask Bob: Is Maxing Out Your 401k A Good Investment Decision?

Since the beginning of 401(k) plans in 1978, people have considered it to be the quintessential retirement plan—you get to save money before taxes and in most cases, the company puts money into your account, too. What could be better than that? But now, 44 years later, it’s time to take a broader look at 401(k)s that considers taxes on 401(k) distributions.

Read More »

Read More »

Yield Curve Inversion ‘Infection’ Spreading [Ep. 263, Eurodollar University]

The US Treasury yield curve continues to spread and has reached the 52-week bill. The Fed is being told by the market it will be CUTTING rates, soon.

Read More »

Read More »

Own These Assets To Survive The Bear Market

Hot inflation is crashing corporate profits, as consumer spending falls and the Fed's rate hikes make the cost of capital more expensive. As a result, stocks remain under pressure and bond default risks grow.

Read More »

Read More »

Why Are Foreigners Happy with Bond ‘Losses’? [Ep. 262, Eurodollar University]

Foreign institutions have been merrily losing money on US Treasury holdings for years, buying high and selling low - are they insane? No, their investment behavior reveals that these bonds are used for managing risk, global systemic risk.

Read More »

Read More »

Weekly Market Pulse: There Is No Certainty In Investing

Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record.

Read More »

Read More »

4 Social Security Changes to Expect in 2023

Looking into a crystal ball and prognosticating the future is always a risky endeavor, but when it comes to Social Security and the year 2023 there are 4 things that have a high probability of happening.

Read More »

Read More »

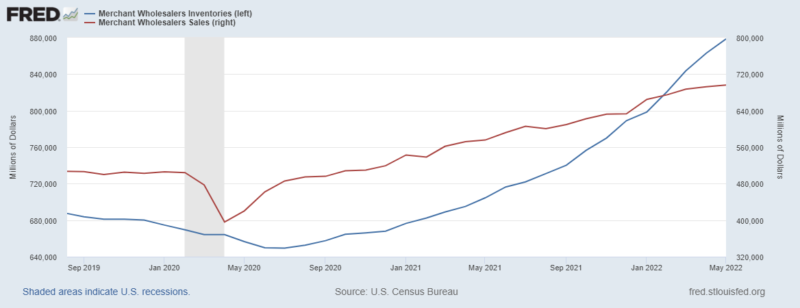

The Economist Reviews Pandemic Goods Boom 2020-22 [Eurodollar University, Ep. 261]

The Economist recounts how the pandemic led to a goods-consumption-boom and whether post-pandemic economics means normalization, or a services boom or a recession.

Read More »

Read More »

The Economist Notes UK’s Economy was Maimed 15 Years Ago [Eurodollar University, Ep. 260]

The Economist admits to, warns of and draws attention to Britain's 15-year economic depression, labeling it a "slow-burning crisis", "long-standing", "stagnation nation" and "a chronic disease". There are many devastating socioeconomic, geopolitical consequences. It's not just Britain, it's the world.

Read More »

Read More »

Weekly Market Pulse: A Most Unusual Economy

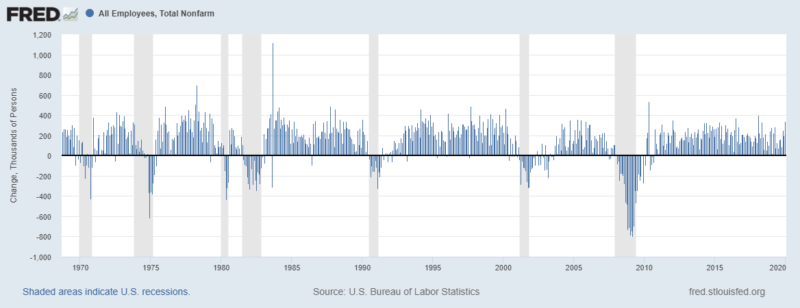

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy.

Read More »

Read More »

MacroVoices #331 Jeff Snider: The Eurodollar Curve Says Deflation Not Inflation

MacroVoices Erik Townsend and Patrick Ceresna welcome Jeff Snider to the show. Jeff says that monetary inflation is NOT the cause of out-of-control consumer prices, and he doesn’t see stagflation as a big risk.

Read More »

Read More »

The Market Is Playing Tug of War With the Fed

On the eve of one of the most consequential Jobs Fridays maybe ever, Jeffrey Snider says markets reflect an ongoing struggle between central bankers and investors. The former believe they must continue on their rate-hiking path.

Read More »

Read More »