Category Archive: 5.) Alhambra Investments

(Almost) Everything Sold Off Today

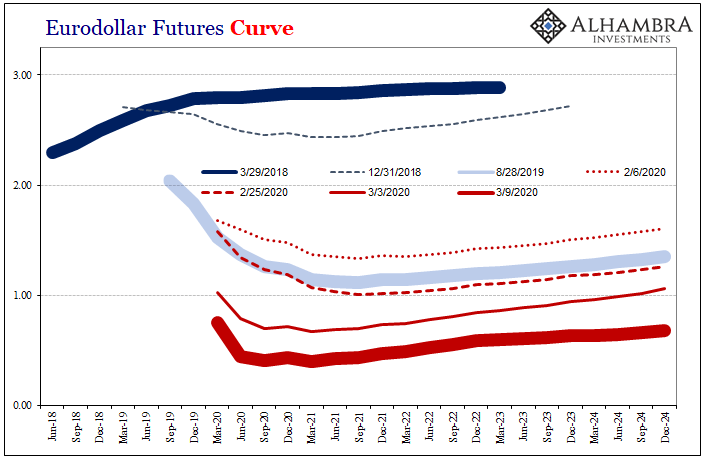

The eurodollar curve’s latest twist exposes what’s behind the long end. To recap: big down day in stocks which, for the first time in a while, wasn’t accompanied by massive buying in longer maturity UST’s. Instead, these were sold, too. Rumors of parity funds liquidating were all over the place, which is consistent with this curve behavior.

Read More »

Read More »

Low Rates As Chaos, Not ‘Stimulus’

Basic recession economics says that when you end up with too much of some commodity, too much inventory that you can’t otherwise sell, you have to cut the price in order to move it. Discounting is a feature of those times. What about a monetary panic? This might sound weird, but same thing.

Read More »

Read More »

Is this the Beginning of a Recession?

As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn.

Read More »

Read More »

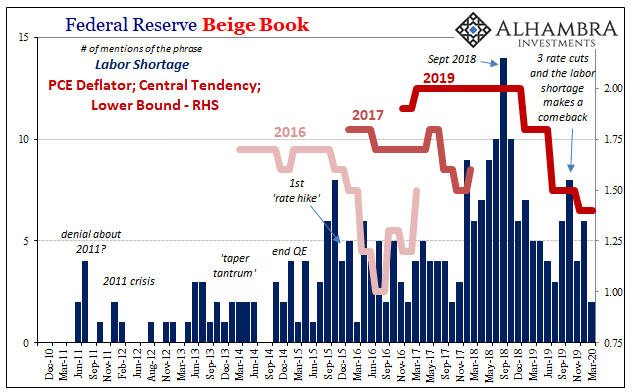

Like Repo, The Labor Lie

The Federal Reserve has been trying to propagate two big lies about the economy. Actually, it’s three but the third is really a combination of the first two. To start with, monetary authorities have been claiming that growing liquidity problems were the result of either “too many” Treasuries (haven’t heard that one in a while) or the combination of otherwise benign technical factors.

Read More »

Read More »

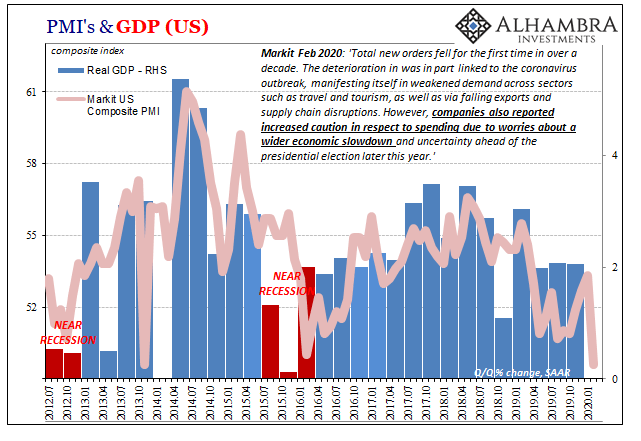

Take Your Pick of PMI’s Today, But It’s Not Really An Either/Or

Take your pick, apparently. On the one hand, IHS Markit confirmed its flash estimate for the US economy during February. Late last month the group had reported a sobering guess for current conditions. According to its surveys of both manufacturers and service sector companies, the system stumbled badly last month, the composite PMI tumbling to 49.6 from 53.3 in January.

Read More »

Read More »

The Greenspan Moon Cult

Taking another look at what I wrote about repo and the latest developments yesterday, it may be worthwhile to spend some additional time on the “why” as it pertains to so much determined official blindness, an unshakeable devotion to otherwise easily explained lunar events.

Read More »

Read More »

A Day For Rate Cuts

Well, that wasn’t he had in mind. The whole point of a rate cut, any rate cut let alone an emergency fifty, is to signal especially the stock market that the Fed is in the business of…something. The public has been led, by and large, to assume that something good happens when the Fed Chair shows up on TV.

Read More »

Read More »

Jeff Snider Part 2/2 (Repo Mkt/Eurodollar Expert) Rebel Capitalist Show Ep. 19

Jeff Snider reveals insights ?YOU CAN'T AFFORD TO MISS! ?This interview with Jeff Snider is so packed with knowledge bombs we had to turn it into 2 parts! This is PART 2 of 2, and trust me, it will blow your mind! As always, The Rebel Capitalist show helps YOU learn more about Macro, Investing, Entrepreneurship AND Personal Freedom. Jeff and I discuss how money is actually created and how US dollars (Eurodollars) have been created, outside the...

Read More »

Read More »

Jeff Snider (Repo Mkt/Eurodollar Expert) Rebel Capitalist Show Ep. 19 Part 1 of 2

Jeff Snider reveals insights ?YOU CAN'T AFFORD TO MISS! ?This interview with Jeff Snider is so packed with knowledge bombs we had to turn it into 2 parts! This is PART 1 of 2, and trust me, it will blow your mind! As always, The Rebel Capitalist show helps YOU learn more about Macro, Investing, Entrepreneurship AND Personal Freedom. Jeff and I discuss how money is actually created and how US dollars (Eurodollars) have been created, outside the...

Read More »

Read More »

Economy: Curved Again

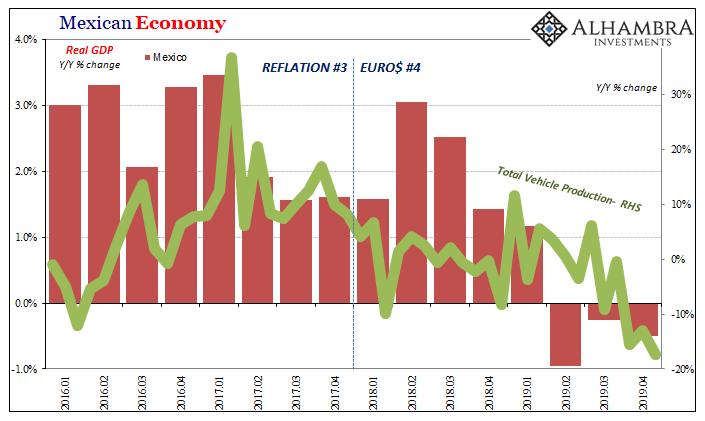

Earlier today, Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) confirmed the country’s economy is in recession. Updating its estimate for Q4 GDP, year-over-year output declined by 0.5% rather than -0.3% as first thought. On a quarterly basis, GDP was down for the second consecutive quarter which mainstream convention treats as a technical recession.

Read More »

Read More »

All-Stars #94 Jeff Snider: The slowdown started before the Coronavirus hit the tape!

Please visit our website https://www.macrovoices.com to register your free account to gain access to supporting materials.

Jeff Snider Chartbook: http://bit.ly/2T1IZbB

Read More »

Read More »

Schaetze To That

When Mario Draghi sat down for his scheduled press conference on April 4, 2012, it was a key moment and he knew it. The ECB had finished up the second of its “massive” LTRO auctions only weeks before. Draghi was still relatively new to the job, having taken over for Jean-Claude Trichet the prior November amidst substantial turmoil.

Read More »

Read More »

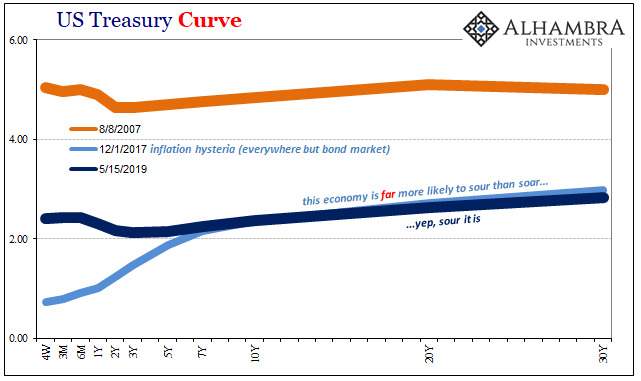

Was It A Midpoint And Did We Already Pass Through It?

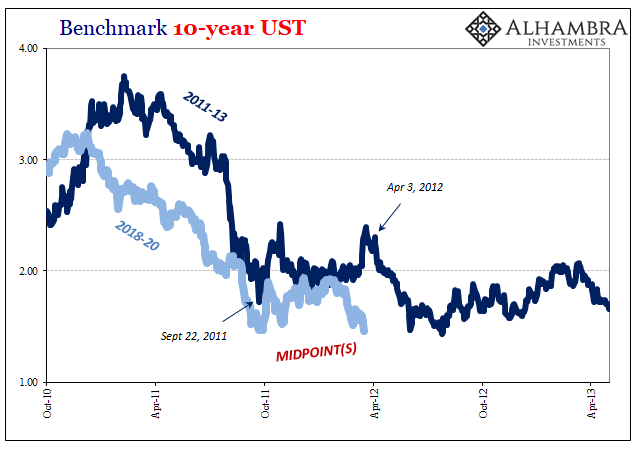

We certainly don’t have a crystal ball at the ready, and we can’t predict the future. The best we might hope is to entertain reasonable probabilities for it oftentimes derived from how we see the past. Which is just what statistics and econometrics attempt. Except, wherein they go wrong we don’t have to make their mistakes.

Read More »

Read More »

Time Again For Triple Digit Dollar

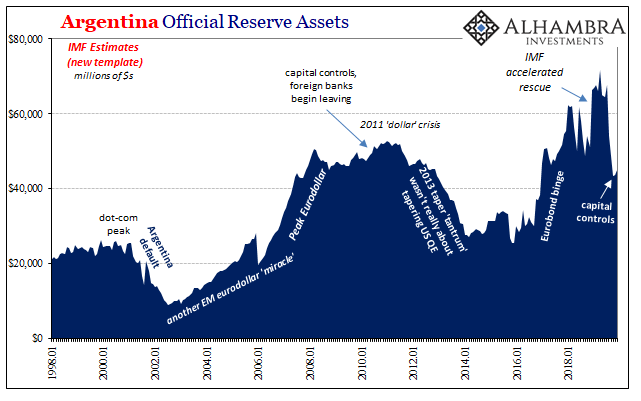

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig.

Read More »

Read More »

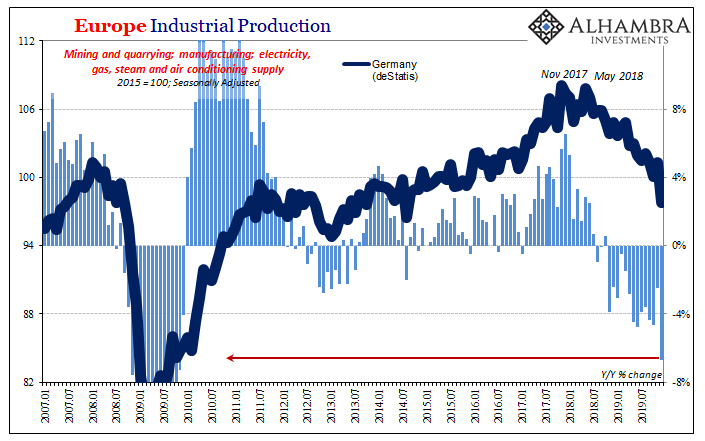

European Data: Much More In Store For Number Four

It’s just Germany. It’s just industry. The excuses pile up as long as the downturn. Over across the Atlantic the situation has only now become truly serious. The European part of this globally synchronized downturn is already two years long and just recently is it becoming too much for the catcalls to ignore. Central bankers are trying their best to, obviously, but the numbers just aren’t stacking up their way.

Read More »

Read More »

US Sales and Production Remain Virus-Free, But Still Aren’t Headwind-Free

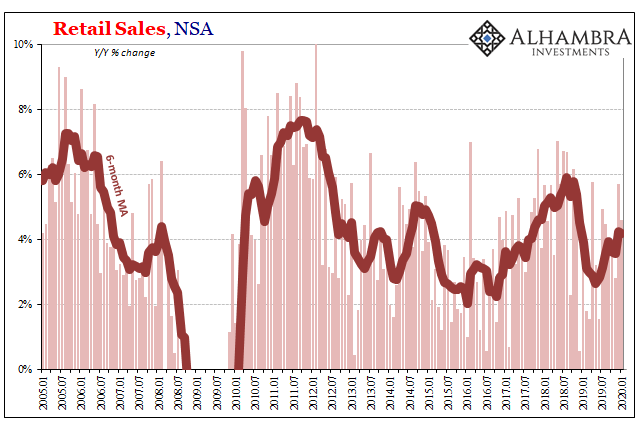

The lull in US consumer spending on goods has reached a fifth month. The annual comparisons aren’t good, yet they somewhat mask the more recent problems appearing in the figures. According to the Census Bureau, total retail sales in January rose 4.58% year-over-year (unadjusted). Not a good number, but better, seemingly, than early on in 2019 when the series was putting out 3s and 2s.

Read More »

Read More »

You Shouldn’t Miss The Cupom

I actually wanted to focus on this yesterday but confirmation wasn’t forthcoming until today. So, it ended up being a broader note on the dollar which only included some mention of Brazil in passing. Still a worthwhile couple of minutes.

Read More »

Read More »

As the Data Comes In, 2019 Really Did End Badly

The coronavirus began during December, but in its early stages no one knew a thing about it. It wasn’t until January 1 that health authorities in China closed the Huanan Seafood Wholesale Market after initially determining some wild animals sold there might have been the source of a pneumonia-like outbreak. On January 5, the Wuhan Municipal Health Commission issued a statement saying it wasn’t SARS or MERS, and that the spreading disease would be...

Read More »

Read More »

Two Years And Now It’s Getting Serious

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot.

Read More »

Read More »