Category Archive: 5.) Alhambra Investments

There Was Never A Need To Translate ‘Weimar’ Into Japanese

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates.No, stupid, declared Milton Friedman.

Read More »

Read More »

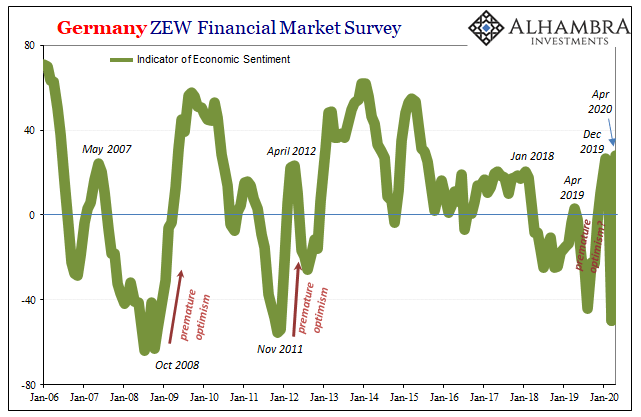

The global economy doesn’t care about the ECB (nor any central bank)

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.”They did it – and it didn’t take.Lagarde’s outreach was simply an act of admitting reality.

Read More »

Read More »

A Big One For The Big “D”

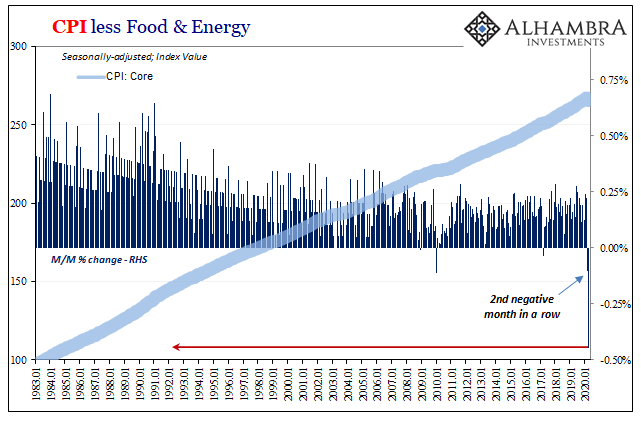

From a monetary policy perspective, smooth is what you are aiming for. What central bankers want in this age of expectations management is for a little bit of steady inflation. Why not zero? Because, they decided, policymakers need some margin of error. Since there is no money in monetary policy, it takes time for oblique “stimulus” signals to feed into the psychology of markets and the economy.

Read More »

Read More »

Everyone Knows The Gov’t Wants A ‘Controlled’ Weimar

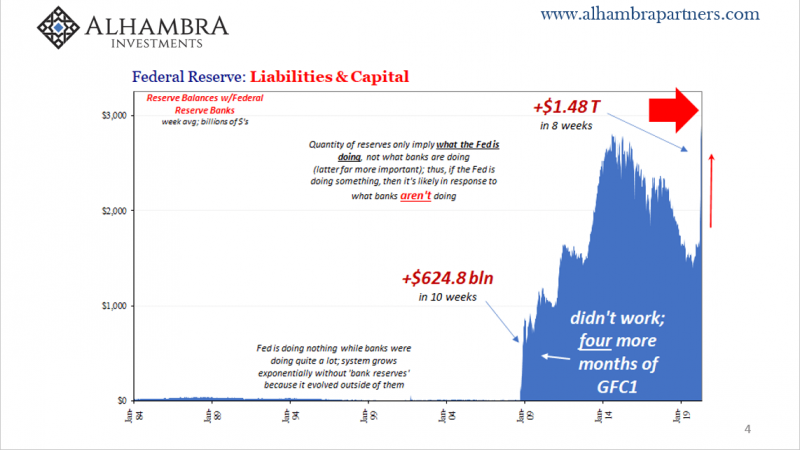

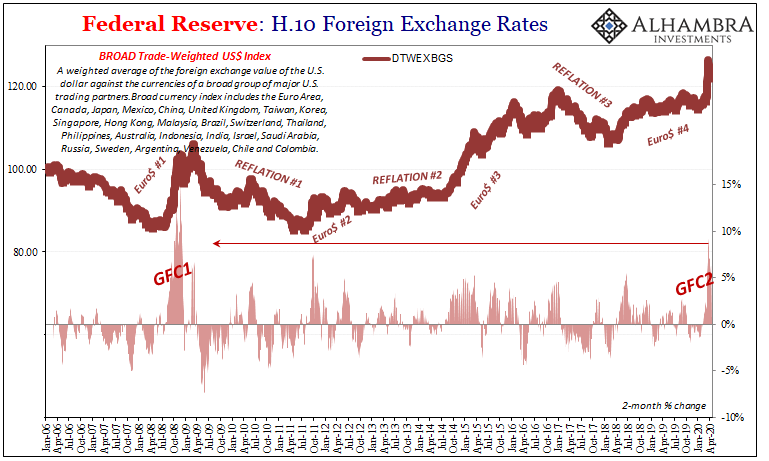

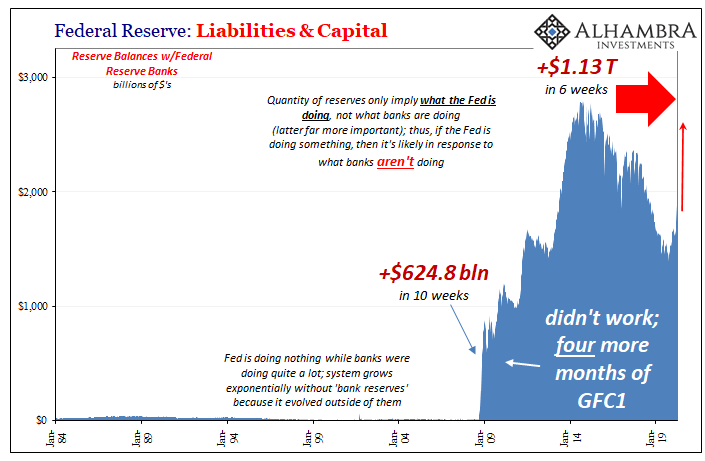

There are two parts behind the inflation mongering. The first, noted yesterday, is the Fed’s balance sheet, particularly its supposedly monetary remainder called bank reserves. The central bank is busy doing something, a whole bunch of something, therefore how can it possibly turn out to be anything other than inflationary?The answer: the Federal Reserve is not a central bank, not really.

Read More »

Read More »

We All Know Who’s On First, But What’s On Second?

It wasn’t entirely unexpected, though when it was announced it was still quite a lot to take in. On September 1, 2005, the Bureau of Economic Analysis (BEA) reported that the nation’s personal savings rate had turned negative during the month of July. The press release announcing the number, in trying to explain the result was reduced instead to a tautology, “The negative personal saving reflects personal outlays that exceed disposable personal...

Read More »

Read More »

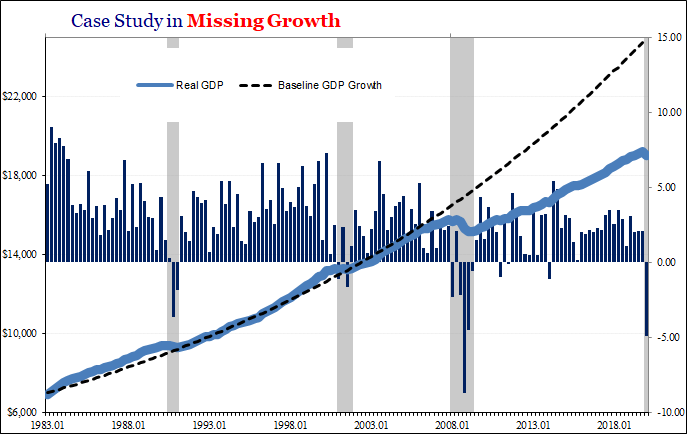

GDP + GFC = Fragile

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation.

Read More »

Read More »

COT Black: No Love For Super-Secret Models

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust.

Read More »

Read More »

Unbounded Conversations Episode 7 – Jeffrey Snider

Alhambra Investments CIO Jeffrey Snider joins Zach & Jack for the seventh installment of Unbounded Conversations to discuss shadow money and its effects on the global economy.

The Unbounded Conversations video series features discussions between Unbounded Managing Partner Zach Resnick, Principals Dave Mullen-Muhr & Jack Laskey, & various guests building businesses on Bitcoin. In this series they discuss the possibilities of what...

Read More »

Read More »

All-Stars #103 Jeff Snider: The Myth of Central Bank Market Support (and liquidity)

Download chartbook: https://bit.ly/2YcW0lo

Alhambra Investments YouTube channel: https://bit.ly/2yU8Lqo

Please visit our website https://www.macrovoices.com to register your free account.

Read More »

Read More »

Follow-Up Question and Answer Session on Repos with Jeff Snider-April 28, 2020

FuturesTrader71 meets with Jeff Snider, head of Global Research at Alhambra Investment Partners to review follow up questions from the Repo market webinar held on April 15, 2020.

Read More »

Read More »

The Puppet Show Is Powerful

I never said it wasn’t powerful. What I continue to show is that it doesn’t work. Ben Bernanke kept his job because despite the carnage, in times of turmoil people are willing to give anyone a second chance. And if the turmoil never ends, so much the luckier – for him.

Read More »

Read More »

Jeff Snider 2: the FED’s main tool since 2008 is psychology

Jeff Snider was talking today about what the FED is capable of doing. How the FED bureaucracy works. How they buy things. When the system broke. And what the FED is actually doing. May surprise you.

Read More »

Read More »

Jeff Snider (Macro/Repo/Eurodollar NINJA!) Rebel Capitalist Show Ep. 41!

Jeff Snider reveals insights ?YOU CAN'T AFFORD TO MISS! ?This interview with Jeff Snider is absolutely packed with knowledge bombs!! Jeff and I discuss ALL TODAYS HOT TOPICS, how the unemployment rate can be deceiving and if you look at the clues in the bond market and the oil market you can get a better idea of where the stock market is headed. Jeff is truly in a league of his own and he shares an incredible amount of his wisdom and knowledge...

Read More »

Read More »

The Fallen Kings & The Bond Throne of Collateral

There is no schadenfreude at times like these, no time to dance on anyone’s grave. Victory laps are a luxury that only central bankers take – always prematurely. The world already coming apart because of GFC1, what comes next with GFC2 and then whatever follows it? Another “bond king” has thrown in the towel.

Read More »

Read More »

Jeff Snider: the world banking EuroDollar system Jedi

Shadow Banking. Go look up Jeff Snider. This is not an advertisement. He's just the best resource for learning about the world banking system, called the EuroDollar system. He has Twitter, and EuroDollar University videos on YouTube.

Read More »

Read More »

An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »

The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

Read More »

Read More »

All About The Repo Markets with Jeff Snider – April 15, 2020

Jeff Snider, Head of Global Research at Alhambra Investment Partners, takes the time with us to discuss what the Repo market is, how this market is used and why the Repo market can cause large moves in equities markets and across many assets.

Join our list to be informed of future high-quality events such as this one: http://eepurl.com/drE6vH

Read More »

Read More »

The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations.If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility.

Read More »

Read More »

The Real Diseased Body

Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter?For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work.

Read More »

Read More »