Category Archive: 5.) Alhambra Investments

Why Aren’t Bond Yields Flyin’ Upward? Bidin’ Bond Time Trumps Jay

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground.And so it was also in...

Read More »

Read More »

Lyn Alden/Jeff Snider (QE, Deflation, Inflation, Dollar, Eurodollar System, Future US Economy)

The Rebel Capitalist show helps YOU learn more about Macro, Investing, Entrepreneurship AND Personal Freedom.

✅ Want to take your investing to the next level? Check out my new online investing forum!! I've partnered with Lyn Alden and Chris MacIntosh to bring you the best investment tool on the internet...Rebel Capitalist Pro. Check out our special offer at https://www.GeorgeGammon.com/pro

For more content that'll help you build wealth...

Read More »

Read More »

What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying.

Read More »

Read More »

Monthly Macro Monitor – September 2020

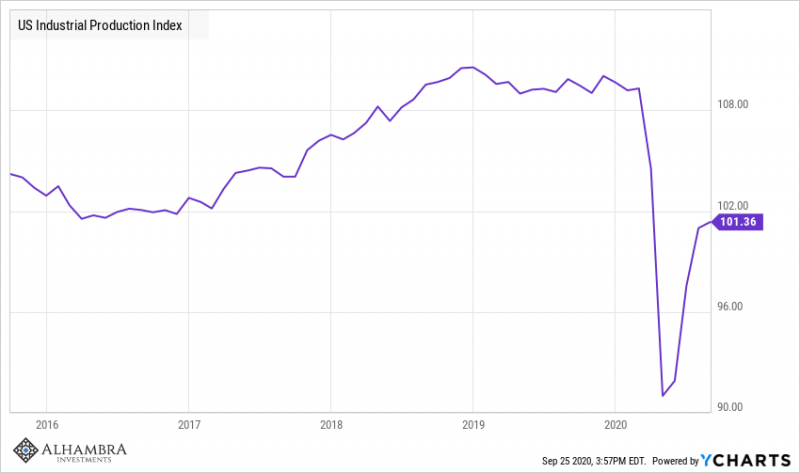

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end.

Read More »

Read More »

Jeff Snider’s Eurodollars and Lacy Hunt’s monetary policy in 10 Minutes

I've been watching videos from Jeff Snider, Lacy Hunt, Steve Van Meter and Brent Johnson for months and I've slowly built up a mental framework for what they are talking about.

Read More »

Read More »

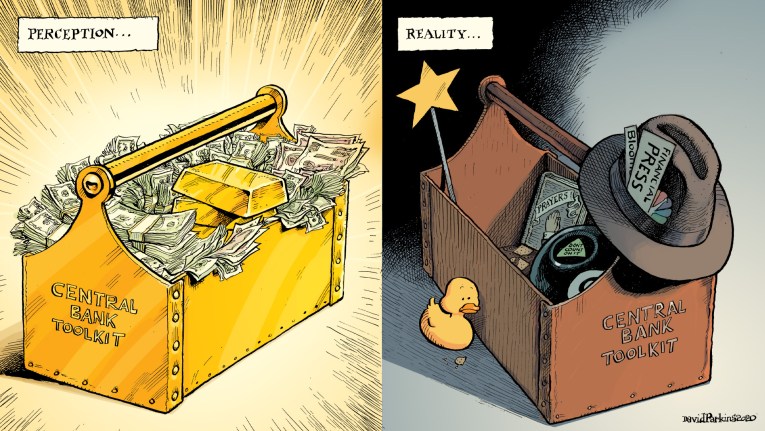

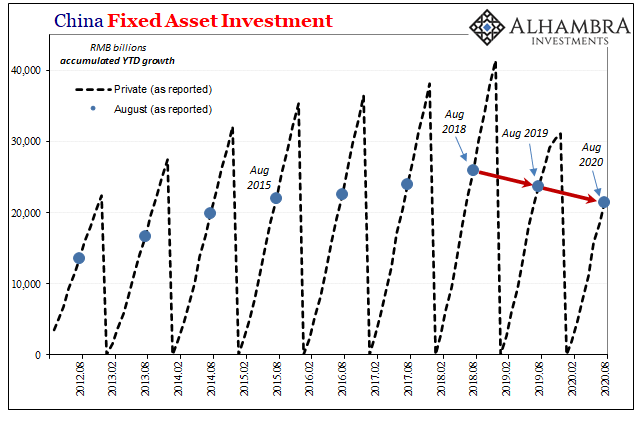

28 Brent Johnson and Jeff Snider (also ‘George Gobel’)

Brent Johnson, CEO of Santiago Capital, joins Jeff Snider to discuss central banks, public relations, modern monetary theory, politically-directed investment and whether the future ahead is a bright or dark one. Also, brown shoes.

Read More »

Read More »

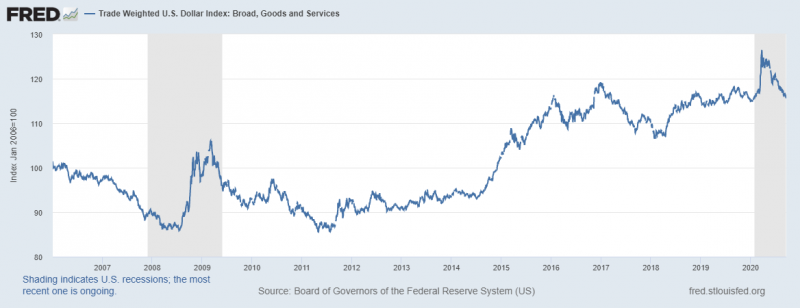

Uh Oh, The Dollar Has Caught A Bid

Anyone who follows Alhambra knows that we keep an eye on the dollar. It is a very important part of our process of identifying the economic environment. A rising dollar, when combined with a falling rate of growth, can be a lethal combination. That was the situation in March and of course during the financial crisis of 2008.

Read More »

Read More »

Jeff Snider: What happens if Dollar LOSES RESERVE STATUS? (RCS Ep75)

Topics: What would happen to the US economy long term if the Dollar is no longer the global reserve currency? US privilege/burden since Bretton Woods. Euro dollar system: what’s wrong with it? Hypothetically, how would it have been better/more sustainable?

Read More »

Read More »

If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

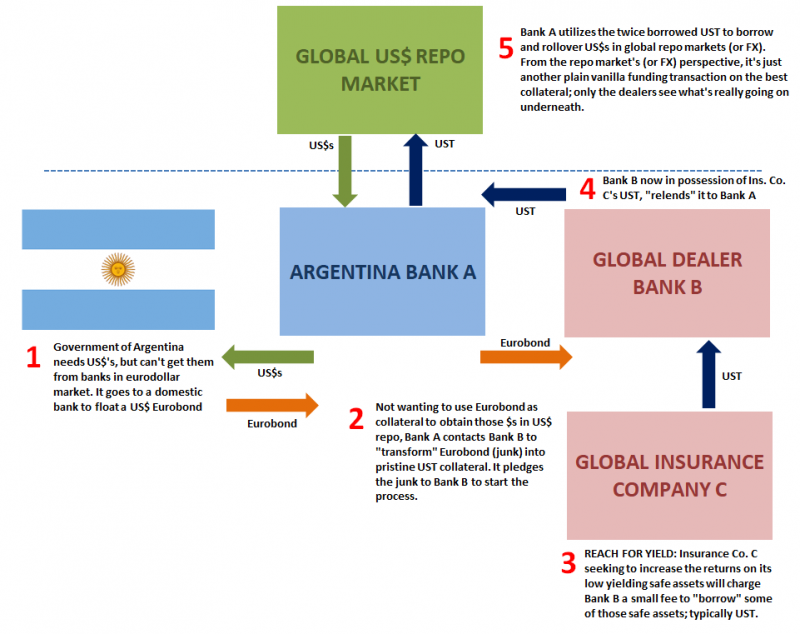

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets.

Read More »

Read More »

27.3 US Retail Sales and Industrial Production in AUG

What do the latest figures tell us about the world's most important consumer? Jeff Snider reviews retail sales, industrial production and asks what is it that is missing from our post 2007-08 economy that precludes robust recovery.

Read More »

Read More »

Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday.

Read More »

Read More »

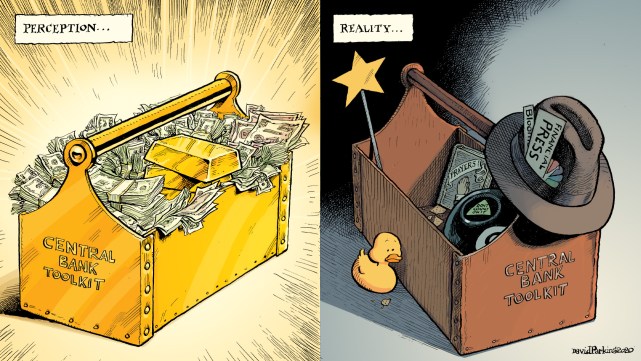

12 States That Keep Retirement Dollars in Your Pocket

“Will I outlive my money?” That’s one of the biggest concerns for most retirees. There’s the high cost of medical care, which gets more expensive all the time. There’s inflation, which raises the cost of goods and services, eating into your retirement budget.

Read More »

Read More »

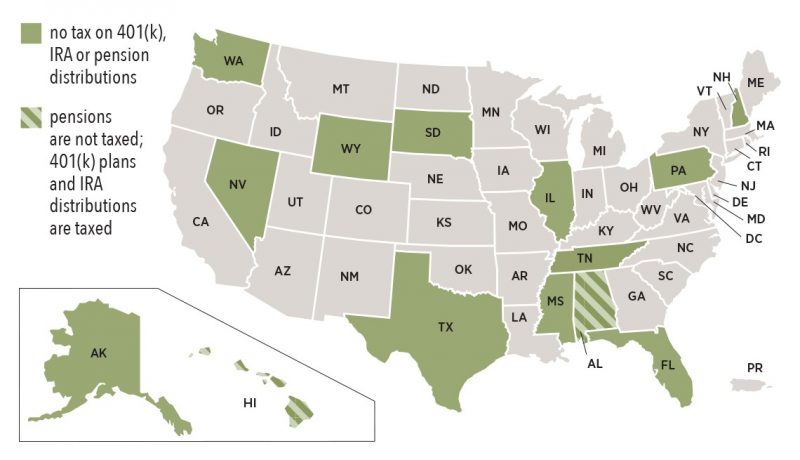

China’s Hole Puzzle

One day short of one year ago, on September 16, 2019, China’s National Bureau of Statistics (NBS) reported its updated monthly estimates for the Big 3 accounts. Industrial Production (IP) is a closely-watched indicator as it is relatively decent proxy for the entire goods economy around the world. Retail Sales in the post-Euro$ #2 context give us a sense of the Chinese economy’s persistent struggle to try to “rebalance” without the pre-2008 boost...

Read More »

Read More »

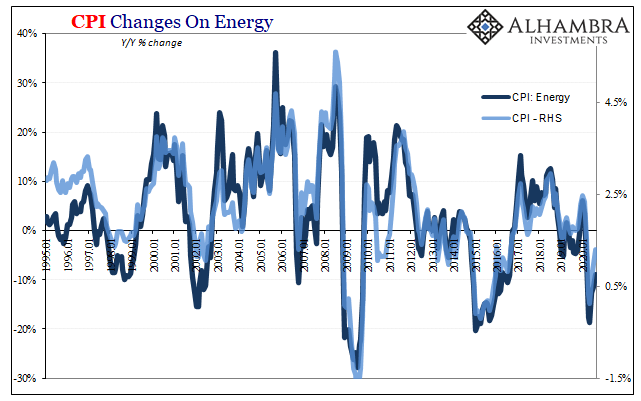

Inflation Karma

There is no oil in the CPI’s consumer basket, yet oil prices largely determine the rate by which overall consumer prices are increasing (or not). WTI sets the baseline which then becomes the price of motor fuel (gasoline) becoming the energy segment. As energy goes, so do headline CPI measurements.

Read More »

Read More »

Re-recession Not Required

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates?Not for nothing, every couple years when we do those (record low yields) that’s what “they”...

Read More »

Read More »

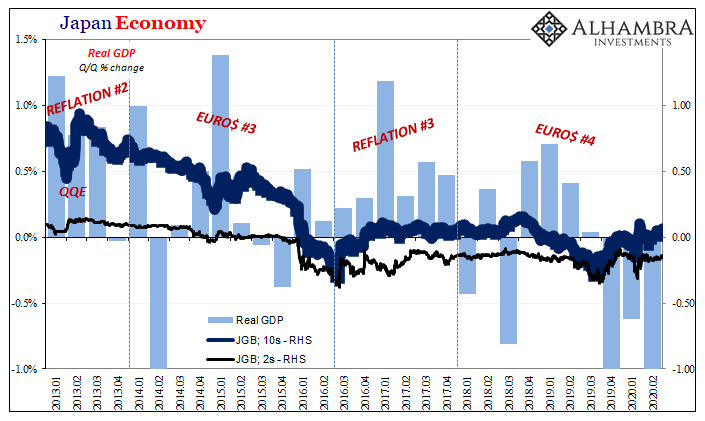

Bottleneck In Japanese

Japan’s yen is backward, at least so far as its trading direction may be concerned. This is all the more confusing especially over the past few months when this rising yen has actually been aiding the dollar crash narrative while in reality moving the opposite way from how the dollar system would be behaving if it was really happening.

Read More »

Read More »

Monthly Market Monitor – August 2020

Many of the weak dollar trends I noted in June’s update have moderated – even as the dollar has weakened further. US stocks surged over the last month, with growth indices leaving their value counterparts in the dust…again.

Read More »

Read More »

Jeff Snider talks INFLATION, DEFLATION

?? Subscribe here for more : ?http://www.youtube.com/channel/UCZIFOCfVxLJexAKnSb2TWXg?sub_confirmation=1

?? Support! ;) http://www.ko-fi.com/aminray

#fed #reserve #trade #economy #dollar #bloomberg #neworldorder #finance #bitcoin

Jeff Snider talks INFLATION, DEFLATION

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 24, Part 2: Peering Behind The (Unemployment Rate) Curtain

———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Apple: https://apple.co/3czMcWN

iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Castbox: https://bit.ly/3fJR5xQ

Breaker: https://bit.ly/2CpHAFO

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

SoundCloud: https://bit.ly/3l0yFfK...

Read More »

Read More »