Category Archive: 5.) Alhambra Investments

Inflation Fairy Tale: Why It’s Deflation We Should Worry About (w/ Steven Van Metre & Jeff Snider)

Is inflation on the horizon? Should bank reserve balances stored with the Federal Reserve count as "money"? According to Jeffrey Snider, head of global research at Alhambra Investment Partners, and Steven Van Metre, macro fund manager and founder of Portfolio Shield, the answer to these questions is a resounding "no." Drawing upon a data ranging from Treasury auction sales to Eurodollar futures curves, van Metre and Snider...

Read More »

Read More »

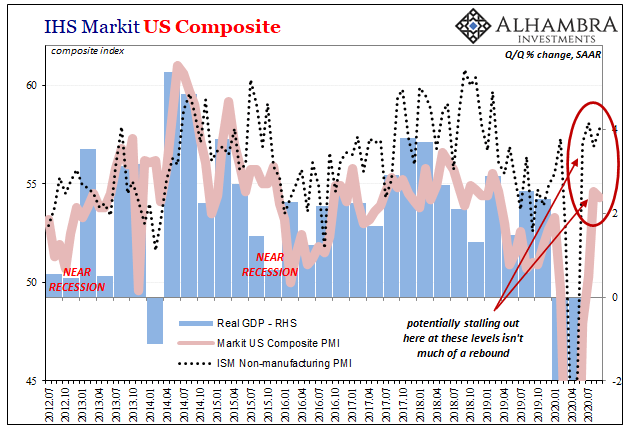

Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

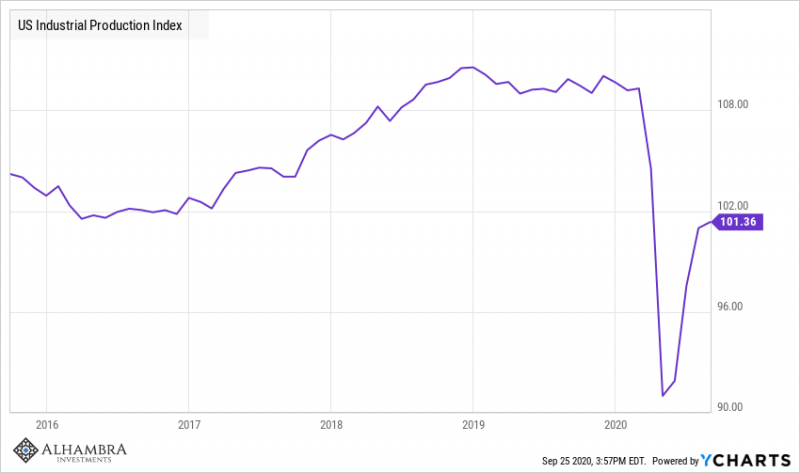

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too.

Read More »

Read More »

Meanwhile, Outside Today’s DC

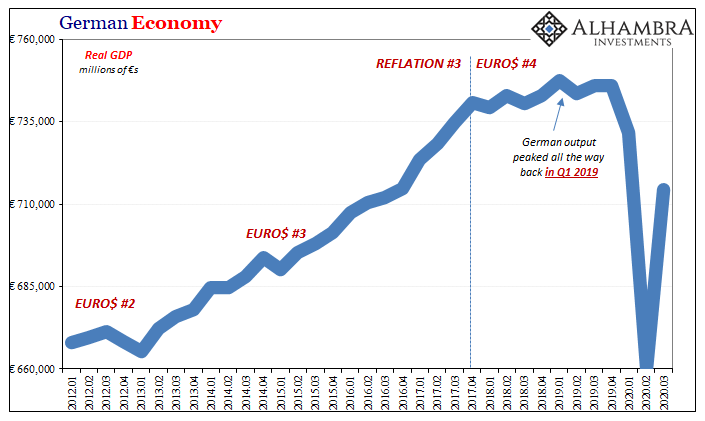

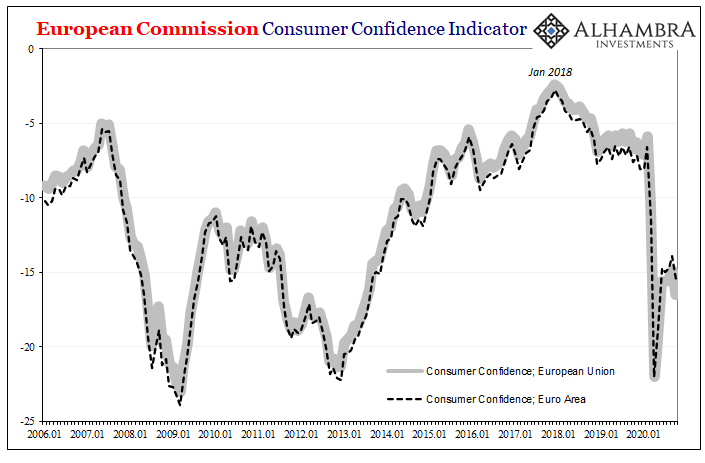

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

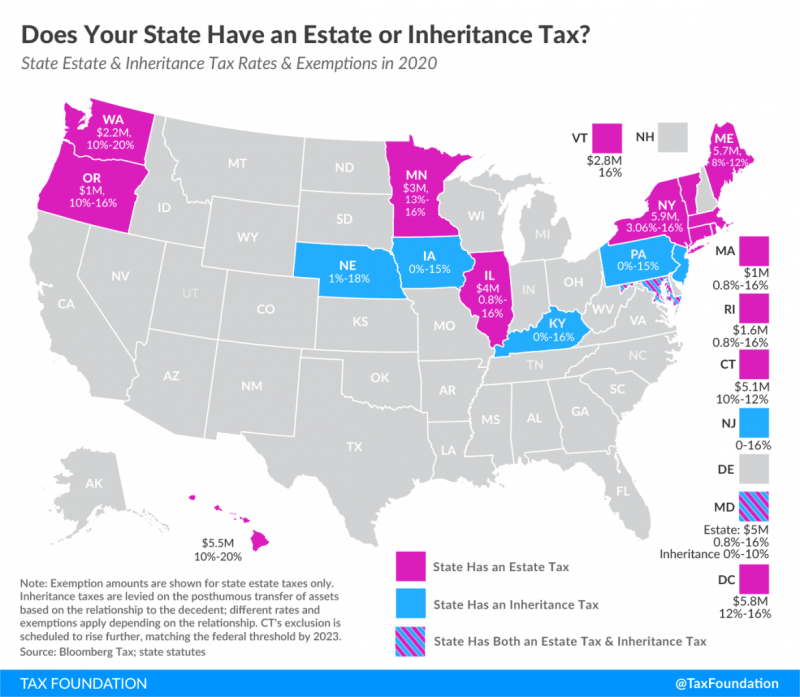

17 States that Charge Estate or Inheritance Taxes

Death tax, inheritance tax, estate tax—call it what you will, they all mean that some government entity wants to put its hand in your pocket or your heirs’ pockets, after your demise.

Read More »

Read More »

What’s Going On, And Why Late August?

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

Read More »

Read More »

Charitable Remainder Trusts

Alhambra's' Bob Williams describes Charitable Remainder Trusts and how they can be used as a planning tool to create a win-win for you and charities.

Read More »

Read More »

Yep, There’s A New ‘V’ In Town And The Locals…Don’t Seem To Much Care For It

They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage.

Read More »

Read More »

Consumer Confidence Indicator: Anesthesia

Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom.

Read More »

Read More »

5 Estate Planning Myths That Can Derail Your Estate Plan

You spend a lifetime earning, saving, acquiring. But the old adage is true—you can’t take it with you. So, what do you do with your assets when you’re gone? How do you want them distributed? That’s where a good estate plan comes in.

Read More »

Read More »

A Deflationary Mindset That Isnt In Our Minds: Jeff Snider

The timing could not have been worse, though in the grand scheme of things it is just perfect. It was barely two weeks ago when Jay Powell was announcing what he and others were claiming was a huge, massive deal. No longer a specific inflation target, but one that would be averaged high against low.

Read More »

Read More »

Inflation Conditions Absent, Someone Call Jay

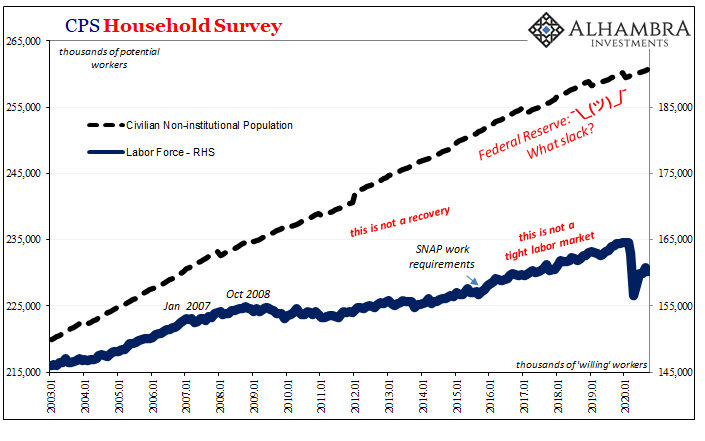

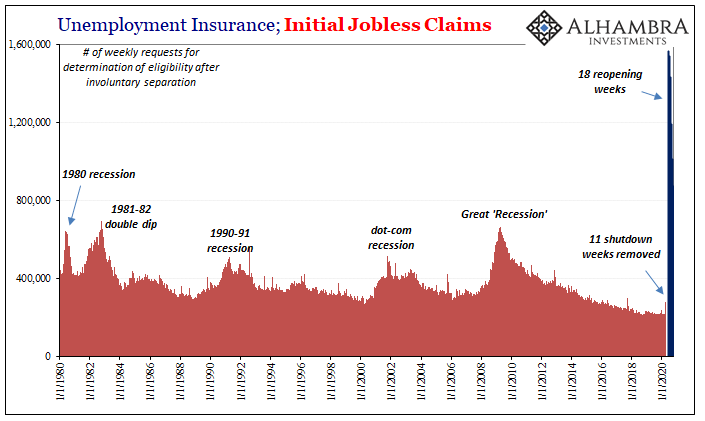

Wednesday, October 7, 2020 5:45 AM EDT Not just payroll data, either. The JOLTS data also keeps backing up this idea of a slowdown forming in the trajectory of both the CES and CPS series. More and more it looks like the economy is running out of momentum well short of the finish line.

Read More »

Read More »

It Just Isn’t Enough

The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state.

Read More »

Read More »

Is There Enough?

It’s just not fast enough. And with the labor market spitting out numbers across a broad economic cross-section that look increasingly tired suggesting an economy running out of momentum, there’s the added urgency of time.

Read More »

Read More »

Who’s Negative? The Marginal American Worker

The BLS’s payroll report draws most of the mainstream attention, with the exception of the unemployment rate (especially these days). The government designates the former as the Current Employment Statistics (CES) series, and it intends to measure factors like payrolls (obviously), wages, and earnings from the perspective of the employers, or establishments.

Read More »

Read More »

Monthly Macro Monitor – September (VIDEO)

Alhambra CEO Joe Calhoun and Alhambra's Bob Williams look at data from the past month and discuss what it means for the economy.

Read More »

Read More »

Why Aren’t Bond Yields Flyin’ Upward? Bidin’ Bond Time Trumps Jay

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground.And so it was also in...

Read More »

Read More »

Lyn Alden/Jeff Snider (QE, Deflation, Inflation, Dollar, Eurodollar System, Future US Economy)

The Rebel Capitalist show helps YOU learn more about Macro, Investing, Entrepreneurship AND Personal Freedom.

Want to take your investing to the next level? Check out my new online investing forum!! I've partnered with Lyn Alden and Chris MacIntosh to bring you the best investment tool on the internet...Rebel Capitalist Pro. Check out our special offer at https://www.GeorgeGammon.com/pro

For more content that'll help you build wealth...

Want to take your investing to the next level? Check out my new online investing forum!! I've partnered with Lyn Alden and Chris MacIntosh to bring you the best investment tool on the internet...Rebel Capitalist Pro. Check out our special offer at https://www.GeorgeGammon.com/pro

For more content that'll help you build wealth...

Read More »

Want to take your investing to the next level? Check out my new online investing forum!! I've partnered with Lyn Alden and Chris MacIntosh to bring you the best investment tool on the internet...Rebel Capitalist Pro. Check out our special offer at https://www.GeorgeGammon.com/pro

For more content that'll help you build wealth...

Want to take your investing to the next level? Check out my new online investing forum!! I've partnered with Lyn Alden and Chris MacIntosh to bring you the best investment tool on the internet...Rebel Capitalist Pro. Check out our special offer at https://www.GeorgeGammon.com/pro

For more content that'll help you build wealth... Read More »

What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying.

Read More »

Read More »

Monthly Macro Monitor – September 2020

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end.

Read More »

Read More »

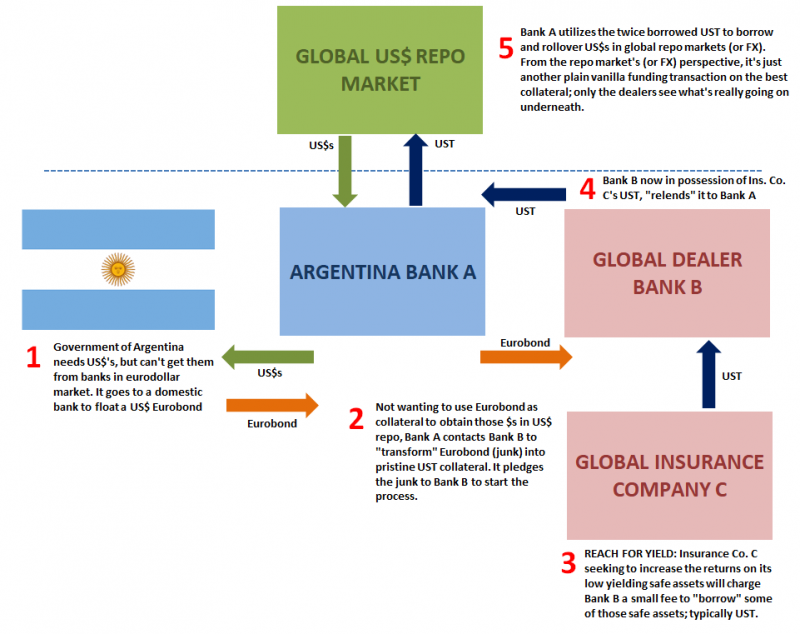

Jeff Snider’s Eurodollars and Lacy Hunt’s monetary policy in 10 Minutes

I've been watching videos from Jeff Snider, Lacy Hunt, Steve Van Meter and Brent Johnson for months and I've slowly built up a mental framework for what they are talking about.

Read More »

Read More »