Category Archive: 4) FX Trends

Friday Surprises: Tokyo Inflation on the Upside, France and Spain on the Downside, Stronger UK Retail Sales

Overview: The US dollar, which struggled yesterday, is trading higher against most currencies today. The Japanese yen an exception among the G10 currencies. The higher-than-expected March Tokyo CPI had little impact on BOJ expectations, the pullback in the US 10-year yield, around seven basis points from yesterday's high, has helped underpin the yen. The UK reported stronger than expected retail sales and its first trade surplus, excluding precious...

Read More »

Read More »

USDJPY Technical Analysis – The JPY gets a boost from higher Tokyo CPI data

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:55 Technical Analysis with Optimal Entries.

1:56 Upcoming Catalysts...

Read More »

Read More »

What’s really priced in for April 2 tariffs

Adam Button from Forexlive.com talks with BNNBloomberg about the state of play around April 2 tariffs, what markets are pricing in and what he expects.

Read More »

Read More »

Markets Hold Collective Breath as US Offensive Launched

Overview: Many participants were focused on next week's US "reciprocal tariffs" when yesterday, it announced a 25% tariff on imported cars, effective April 3. Fully assembled vehicles are the first target, but by May 3, major parts, such as engines, transmissions, powertrain components and electrical systems will be included. The tariffs on Mexico and Canada will be adjusted based on the share of domestic content. A White House official...

Read More »

Read More »

Gold Technical Analysis – Renewed tariffs fears boost the precious metal

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:33 Technical Analysis with Optimal Entries.ù

1:39 Upcoming Catalysts...

Read More »

Read More »

The USD is higher vs the 3 major currencies – the EUR, JPY and GBP – to start the US day

What are the technicals and fundamentals that are moving the markets at the start of the US session?

Read More »

Read More »

Softer CPI Weighs on Sterling, Ahead of Budget Statement

Overview: Uncertainty over next week's US tariff announcement continues weigh on markets and undermines near-term conviction. The dollar is mostly consolidating against the G10 currencies. Sterling is the heaviest, off about 0.3% after a soft CPI report and ahead of the Spring Budget Statement. The dollar bloc and Norwegian krone are the strongest. Among emerging market currencies, the Mexican peso roughly 0.25% loss puts it at the bottom of the...

Read More »

Read More »

USDJPY Technical Analysis – Focus on the “Liberation Day”

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:53 Technical Analysis with Optimal Entries.

1:51 Upcoming Catalysts...

Read More »

Read More »

FX Market Calm on the Surface, Angst Below

Overview: The US dollar is consolidating its recent gains against the G10 currencies in quiet and relatively uneventful turnover. There continue to be mixed signals about the US tariffs threatened for next week. President Trump himself said that auto tariffs were coming soon as in days, while suggesting that there may be "a lot" of carve-outs from the reciprocal tariffs. EU's trade representative Sefcovic is meeting with US Commerce...

Read More »

Read More »

The Possibility that the US is Toning Down its April 2 Tariff Threat Helps Lift Equities

Overview: Investors are finding some comfort in a signal from some senior US official that toned down the double-barrel threat of reciprocal and sectoral tariffs on April 2. The focus is said to be on the former, with some exemptions. Although the administration is two-months old, there have been many conflicting signals and there still is much uncertainty. After last week's gains, the greenback has begun the new week mostly softer against the G10...

Read More »

Read More »

Week Ahead: Is the Dollar Bottoming?

After falling steadily since from the end of Q3 24 through the first part of January, the dollar stabilized last week, despite the dovish market takeaway from the Federal Reserve. The median projection for growth was shaved while the inflation project was raised. Still, despite the Atlanta Fed's GDP Now tracking a contraction here in Q1, few are that pessimistic. None of the 58 economists in Bloomberg's survey see a contraction, and only one...

Read More »

Read More »

March Madness? The Dollar is Closing in on its Best Week this Month

Overview: The dollar's down trend, which began at least a week before President Trump's second inauguration stalled this week, and preliminary technical signs suggest a bottom may be in the process of forming. The uncertainty over US reciprocal and sector tariff announcement on April 2 is boosting uncertainty among policymakers, investors, and businesses. The greenback is mostly firmer today and near the week's best levels against most of the...

Read More »

Read More »

Dollar Comes Back Bid

Overview: The Federal Reserve's projections show a little more inflation and a little less growth this year and next, but the median projection showed, as it did in December, two rate cuts this year. This, coupled with the reduction of the balance sheet unwind of Treasury holdings (QT) gave a dovish cast to the FOMC outcome, though the dispersion of forecasts showed upside risks to inflation, and even the two rate cuts anticipated was a closer...

Read More »

Read More »

Fed: When Words are Actions

Overview: Often it is said that what the Fed does is more important than what it says. But this is not so today. There is little doubt that the Fed continues to remain on hold but it will updates its forecasts, and Chair Powell will likely reiterate his recent assessment that the economy is in a position that allows the central bank to be patient and wait for clearer signals of the impact of the administration's policies. The Summary of Economic...

Read More »

Read More »

Europe Leads Dollar Drop, Unwinding Last Year’s Record Purchases of US Equities

Overview: The greenback remains under pressure and fell to new lows for the move against the euro, sterling, and the Norwegian krone. It is softer against nearly all the G10 currencies but the Japanese yen, where more disappointing data were reported and polls showed support for Prime Minister Ishiba plunged following his admission of doling out JPY100k (~$672) to 15 first-term LDP members of parliament. It makes for a poor backdrop for the upper...

Read More »

Read More »

USDJPY Technical Analysis – Eyes on the BoJ and FOMC decisions

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

Read More »

Read More »

AUDUSD makes a break above the 100 day MA. Can the buyers keep the momentum going?

Staying above the 100 day moving average at 0.63535 is the best case scenario for the buyers now.

Read More »

Read More »

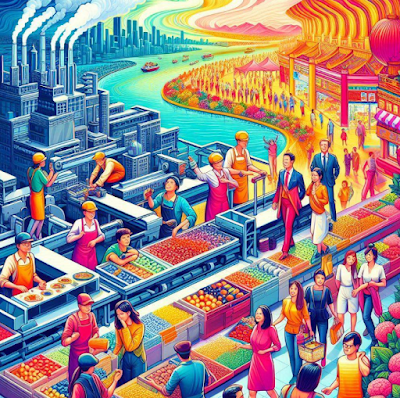

China Underwhelms, PBOC sets Dollar Fix Lower, Bessent’s Lack of Concern Weighs on US Stocks, and More US Tariffs Coming

Overview: The US dollar begins the new week quietly. The week features five G10 central bank meetings, and real sector data that may show the US economy is resilient despite the Atlanta's Fed's pessimism (which will be updated today). President Trump renewed his warning that reciprocal and sectoral tariffs will be announced on April 2. The greenback is trading with a mostly softer but consolidative bias today. Emerging market currencies are mixed,...

Read More »

Read More »