Category Archive: 4) FX Trends

FX Daily, July 30: Greenback’s Bounce is Likely Short-Lived

A wave of profit-taking is seen through most of the capital markets today, with the exception of the bond market, where yields continue to trend lower. The US 10-year is now yielding 55 bp, a new low since early March, and the five-year yield set a new record low near 23 bp. European yields are 2-4 bp lower.

Read More »

Read More »

FX Daily, July 29: Greenback Slips Ahead of the FOMC

Global equity markets are stabilizing today, and the dollar is once again on its back foot. Chinese markets led a mixed regional performance with a 2%-3% gain, while South Korea and Hong Kong markets also advancing. The strength of the yen appears to weigh on Japanese shares.

Read More »

Read More »

FX Daily, July 28: Dollar Bounces, Gold Slips, while Equities Hold Their Own

The main development in the capital markets today is the firmer dollar against nearly all the major and emerging market currencies. Among the majors, the New Zealand dollar and Swedish krona are the heaviest (~-0.4%), while the Swiss franc and yen are marginally lower.

Read More »

Read More »

FX Daily, July 27: Dollar Slide Continues, while Gold Soars

The US dollar's dramatic sell-off continues. It is off against nearly all currencies. Among the majors, the Swedish krona and Japanese yen are leading the money, and the euro surged through $1.17. Emerging market currencies are fully participating, with the JP Morgan Emerging Market Currency Index posting its fifth gain in six sessions.

Read More »

Read More »

Cool Video: Gold and the Dollar

I have been talking with Neils Christensen, editor at Kitco news, for several years about the dollar, gold, and my read of the capital markets more broadly. We had a chance to discuss recent developments yesterday. I began my career at a small newswire, and Kitco reminds me of it.

Read More »

Read More »

FX Daily, July 24: Strong PMIs Have Limited Impact as Profit-Taking Hits Equities

US stocks stumbled yesterday, and the S&P 500 nearly gave back the week's gains with its roughly 1.25% loss, the largest of the month. The NASDAQ 100 fell to two-week lows. Slower cloud growth at Microsoft and a delay in the next generation of chips at Intel were among the drags.

Read More »

Read More »

FX Daily, July 23: Powerful Momentum is Still Evident in the Foreign Exchange Market

The powerful momentum moves in the capital markets continues unabated by escalating US-China tensions and continued spread of the virus. Asia Pacific equities were mixed. Tokyo was closed for a holiday, but several other large markets in the region, like China, South Korea, and Taiwan markets slipped lower, while Hong Kong, Australia, and India advanced.

Read More »

Read More »

FX Daily, July 22: Pang of Uncertainty Spurs Profit-Taking

The optimism among investors appears to have evaporated in the face of new US-Chinese tensions, possible delays in the next US fiscal stimulus, and new record virus infections in Australia and Hong Kong. US stocks had pared early gains yesterday, and the high-flying NASDAQ finished lower after setting new record highs.

Read More »

Read More »

FX Daily, July 21: Europe and Tech Lift Risk Appetites

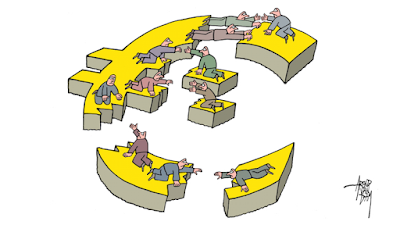

Overview: The continued domination of the tech sector and Europe's tentative agreement are lifting equities and risk assets more generally today. Australia and Hong Kong's 2.3%-2.5% rally led Asia Pacific markets. The Dow Jones Stoxx 600 is higher for a third session and above its 200-day moving average for the first time since February.

Read More »

Read More »

FX Daily, July 20: Markets Yawn, Deal or No Deal

Overview: While there are signs that Europe has reached a compromise on the grant/loan issue, the spillover into the markets is quite limited. China, with Shanghai's 3.1% gain, led a few markets in the Asia Pacific region higher, including Japan and India. Most markets were lower, and Europe's Dow Jones Stoxx 600 is a fractionally firmer, recovering from initial losses.

Read More »

Read More »

FX Daily, July 17: Markets Limp into the Weekend

Chinese stocks stabilized after yesterday's sharp fall and most Asia Pacific equity markets, but Tokyo rose today. European shares are little changed, but the Dow Jones Stoxx 600 is still poised to hold on to modest gains for the third consecutive week.

Read More »

Read More »

FX Daily, July 16: Equities Slide and the Greenback Bounces After China’s GDP and Before the ECB

Overview: Profit-taking, perhaps spurred by disappointing retail sales figures, sent Chinese equity markets down by 4.5%-5.2% today, the most since early February. It appears to be triggering a broader setback in equities today. The Hang Seng fell 2%, and most other markets in the region were off less than 1%.

Read More »

Read More »

FX Daily, July 15: The Dollar Slumps and EU Court Rules in Favor of Apple

A recovery in US stocks yesterday, coupled with optimism over Moderna's vaccine, is providing new fodder for risk appetites today. Equities are being driven higher, and the dollar is under pressure. Most equity markets in Asia advanced. China and Taiwan were exceptions, and, in fact, the Shanghai Composite fell for the second consecutive session for the first time in a month.

Read More »

Read More »

Marc Chandler Marc to Market Follow Following .Bearish case for dollar thickens, but bulls are …

Marc Chandler Marc to Market Follow Following .Bearish case for dollar thickens, but bulls are tough to find

http://ntvforex.com/news/?id=3345e6 . 7 13 2020 11 08 49 AM .A surge in virus cases and record fatalities in several US states dampened the animal spirits at the end of last week. However, few seem emotionally or materially prepared to resist the official efforts to generate favorable financial conditions to facilitate an economic recovery....

Read More »

Read More »

Marc Chandler Marc to Market Follow Following .Risk appetites firm, but the greenback is mixed

Marc Chandler Marc to Market Follow Following .Risk appetites firm, but the greenback is mixed

http://ntvforex.com/news/?id=8ad403 . 7 13 2020 10 56 52 AM .Overview Equities began the week on a firm note in the Asia Pacific region. The Nikkei gained more than 2%, and the profit taking seen in China ahead of the weekend was a one day phenomenon. The Shanghai Composite rose 1.8%, and the Shenzhen Composite surged 3.5%. Taiwan and South Korea markets...

Read More »

Read More »

FX Daily, July 14: Turn Around Tuesday Began Yesterday

Overview: Turn around Tuesday began yesterday with a key reversal in the high-flying NASDAQ. It soared to new record highs before selling off and settling below the previous low. The S&P 500 saw new four-month highs and then sold-off and ended on its lows with a loss of nearly 1% on the session. Asia Pacific shares fell, led by declines in Hong Kong and India.

Read More »

Read More »

FX Daily, July 13: Risk Appetites Firm, but the Greenback is Mixed

Equities began the week on a firm note in the Asia Pacific region. The Nikkei gained more than 2%, and the profit-taking seen in China ahead of the weekend was a one-day phenomenon. The Shanghai Composite rose 1.8%, and the Shenzhen Composite surged 3.5%. Taiwan and South Korea markets also rallied more than 1%.

Read More »

Read More »

FX Daily, July 10: Surge in Coronavirus Spooks Investors as China Takes Profits

Record fatalities in a few US states, coupled with new travel restrictions in Italy and Australia, have given markets a pause ahead of the weekend. News that two state-backed funds in China took profits snapped the eight-day advance in Shanghai at the same time as there is an attempt to rein in the use of margin.

Read More »

Read More »

FX Daily, July 9: The Dollar is Sold through CNY7.0 as Chinese Equities Continue to Rally

Investors continue to clamor into risk assets. Led by Chinese shares, the MSCI Asia Pacific Index pushed higher for the third session this week to new five-month highs. Europe's Dow Jones Stoxx 600 is trying to snap a two-day decline with the help of better than expected revenues for its largest tech company.

Read More »

Read More »

FX Daily, July 8: Consolidation is the Flavor of the Day

The S&P 500's longest advance this year was stopped seemingly as concern that the flare-up in the virus will slow the recovery. The sell-off in airlines and hotels helped spur a broader bout of profit-taking. Most Asia Pacific bourses advanced, led by the continued rally in Hong Kong and China. Europe's Dow Jones Stoxx 600 is posting its first back-to-back decline in nearly a month.

Read More »

Read More »