Category Archive: 4) FX Trends

The USD moves higher and retraces some of the week’s declines

Fed's Waller spoke to inflation remaining too high with more hikes needed ("hikes" as in more than 1 more hike). That has given the USD a boost in early NY trading. The 2 year is up 10 basis points. The 10 year is up 6 basis points.

In this technical report, I take a look at the EURUSD, USDJPY, GBPUSD and the USDCAD and outline the levels in play and show/explain why.

Read More »

Read More »

Hawkish ECB Comments Boost Risk of a 50 bp Hike Next Month

Overview: The 0.5% decline in US March producer

prices pushed on the door opened by the softer-than-expected CPI on Wednesday.

The Fed funds futures market sees the year end rate to a 4.33%, while still

pricing in a nearly 70% chance of a hike on May 3 to 5.25%. The dollar tumbled

to new lows for the year against the euro, sterling, and Swiss franc. The

Dollar Index made a new low for the year today, a few hundredths of an index

point below the low...

Read More »

Read More »

BREAKOUT. The PPI and claims data send the USD lower.What next?

BREAKOUT!

The USD is breaking to new lows vs the EUR and GBP for the year, and the USDCAD is breaking below its 200 day MA for the first time since August 2022. For the USDJPY, it is making a break below its 200 hour MA. So lots of breaks technically for the major currency pairs.

Learn about it, and what's next in the morning forex technical report.

- EURUSD 2:18

- USDJPY 4:42

- GBPUSD 5:56

- USDCAD 7:12

Read More »

Read More »

US Dollar Slumps and China Surprises with Twice the Expected Trade Surplus

Overview: The market took US short-term rates and

the dollar lower after the CPI data, which was largely in line with

expectations. On the one hand, the odds of a quarter-point hike next month

increased slightly (73.6% vs. 71.6%) to 5.25%, but it reinforced that sense

that it is last hike and that the Fed will unwind this hike and more before the

end of the year. The year-end implied policy rate fell by about six basis points to

4.33%. The dollar...

Read More »

Read More »

US CPI sends the USD lower. What next for some of the major currency pairs

The USD moved lower after the US CPI data. The CPI showed a headline increase of 0.1% for the headline and 0.4% for the core. The Shelter costs continue to elevate the core measure (accounts for 1/3 of CPI data). It increased by 0.6%. Traders and analysts continue to look for lower shelter costs to start to kick in.

Nevertheless, the numbers has lowered yields and pushed up stock prices. The USD has moved lower.

In this video, I take a...

Read More »

Read More »

US CPI is Unlikely to Tell Us Anything We Don’t Already Know

Overview: Today's highlight is the March US

CPI, and while everyone is talking about it, it is unlikely to tell us anything

we do not already know. Headline price pressures are easing but the core rate

is sticky, and despite comments from the Chicago Fed president about the need

for patience, the odds of a hike next month have crept up. Understanding the

Fed's reaction function, it seems clear that for most officials, inflation is

remains too high...

Read More »

Read More »

USDCHF falls to a swing area support target and stalls. What next?

Can the sellers keep control in the USDCHF?

A day after buyers pushed the USDCHF higher and above the 200 hour MA - and failed - sellers have take control today and pushed the price of the pair back to where the price has found support buyers going back to last week's trading. Can the buyers now push the price back higher? Or will the sellers remain in control and push the pair even lower?

IN this video, I explain the levels in play TODAY as...

Read More »

Read More »

The EURUSD and the GBPUSD move back toward the 100/200 hour MAs

The USDJPY is trading back below its 100 day MA. What next?

In the morning Forex technical report, I take a look at the EURUSD, USDJPY and the GBPUSD. Both the EURUSD and GBPUSD or higher, but have backtracked lower and tests the 100 and 200 are moving average areas. For the USDJPY, it had a shot above its 100 day moving average both yesterday and into today's trading, but has failed and trades below the level. Can the sellers stay below that...

Read More »

Read More »

Greenback Pares Yesterday’s Gains

Overview: As the long-holiday ends, risk appetites

have returned. Equities and yields are mostly higher. The dollar is seeing

yesterday's gains pared. Yesterday's setback in the yen helped lift Japanese

stocks, with the Nikkei advancing 1%. Several other markets in the region also

gained more than 1%, including Australia and South Korea. China's CSI was an

exception. It slipped fractionally. Europe's Stoxx 600 is up nearly 0.6%

through the European...

Read More »

Read More »

The Extended Holiday Makes for Subdued Price Action

Overview: The holiday continues. In the Asia Pacific

region, Hong Kong, Australia, and New Zealand, and the Philippines markets were

closed. The regional bourses advanced but China. European markets remain

closed. US equity futures are narrowly mixed. The 10-year US Treasury yield is

off nearly three basis points to about 3.36%. The dollar is trading quietly

mostly within ranges seen before the weekend. It is slightly softer against

most of the...

Read More »

Read More »

Bullish S&P 500 E-mini Futures: Technical Analysis Reveals 4170+ Price Surge! Don’t Miss Out

Good Friday hinted that we are going up. The demonstrated technical analysis hints support more up for ES.

Trade at your own risk and visit ForexLive.com for additional views.

See possible updates within the comment section at

https://www.forexlive.com/technical-analysis/bullish-sp-500-e-mini-futures-technical-analysis-reveals-4170-price-forecast/

Read More »

Read More »

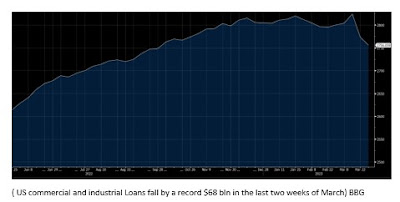

US and Chinese Inflation Highlight the Week Ahead, While the Bank of Canada Stands Pat

Bank

shares rose in Japan and Europe for the second consecutive week, but the KBW US

bank index fell nearly 2% after increasing 4.6% in the last week of March. Emergency borrowing from the Fed remains elevated ($149 bln vs. $153 bln). Bank lending has fallen sharply (~$105 bln) in the two weeks through March 29. This appears to be a record two-week decline. Commercial and industrial loans had fallen a little in the first two months of the year...

Read More »

Read More »

Good Friday

Overview: Activity throughout the capital markets remains

light as most financial centers in Europe are closed for the Easter celebration.

Hong Kong, Australia, New Zealand, and Indian markets were closed as well. Still,

most of the equity markets in Asia Pacific advanced, led by South Korea's

Kospi's nearly 1.3% advance. The market responded favorably to news that

Samsung would cut its production of memory chips and shrugged off its smaller

than...

Read More »

Read More »

SPX technical analysis: Anticipating 4200 next

S&P 500 index is holding well and at the bring of breaking out of the bull flag. I am targeting 4200.

Visit ForexLive.com for additional views.

Updates may be published in the comments section here:

https://www.forexlive.com/technical-analysis/spx-technical-analysis-im-bullish-with-a-4200-target/

Read More »

Read More »

VIDEO: Initial claims data readjustments from seasonals influencing the major currencies

The US initial jobless claims seasonal adjustments mainly due to volatility of covid data (still living that nightmare), sent that series to the upside and change the trend of jobs since mid-January from strong to getting weaker.

There markets reacted to that data.

In this video I explain the early moves in yields and then in some of the major currency pairs including the EURUSD, USDJPY and the GBPUSD.

Read More »

Read More »

Fragile Calm Casts a Pall over the Capital Markets

Overview: There is a fragile calm in the capital

markets today ahead of the long holiday weekend for many. The poor US economic

data yesterday and third consecutive decline in the KBW bank index weighed on

risk sentiment. Most of the large bourses in the Asia Pacific region fell, with

Hong Kong and India notable exceptions. In Japan, the Topix bank index fell

1.1% after a 1.9% decline yesterday and is now lower on the week. Europe's

Stoxx 600 is...

Read More »

Read More »

AUDUSD rebounds off lows but retracement stalls near resistance

The AUDUSD fell sharply today but has seen a bounce with the USD selling. The price trades between short term support and resistance. What does that look like? What's next? Those questions are answered in this trading video.

Read More »

Read More »

VIDEO: USDCAD tries to end 7-day slide, but technical resistance keeps a lid on the pair

The USDCAD has rebounded today and tries to break a 7 day slide. The correction higher, however, has run into some short term resistance that puts a lid on the pair.

In this video, I step through the daily and hourly charts of the pair and show in detail what levels are in play. It is important as a trader to understand the "whys". This video explains so you can replicate the ideas in your trading going forward.

Read More »

Read More »

What technical levels are driving the EURUSD, USDJPY and GBPUSD today?

The EURUSD, GBPUSD and USDJPY made breaks yesterday and revisited those break levels today. What key technical levels are driving those three major trading pairs today and why?

Read More »

Read More »