Category Archive: 4) FX Trends

EURUSD buyers making a break for it… Price moves above the 38.2% retracement

The 38.2% retracement of the move down from the December high comes in at 1.0864. Stay above is more bullish

Read More »

Read More »

USDCAD finds willing sellers versus the high from last week and backs off.

Although there are willing sellers against the eye from last week, the price remains above its 100-day moving average and 50% midpoint of the move down from the November 2023 high. Buyers and sellers battle it out.

Read More »

Read More »

Kickstart the FX day for March 5 with a technical look at the EURUSD, USDJPY and GBPUSD

The market is quiet to start the US session for March 5. What are the technical bias, the risk and the targets for the major currency pairs.

Read More »

Read More »

Forex Becalmed with the Greenback Mostly Firmer in Narrow Ranges

(Business trip will interrupt the commentary over the next few days. Check out the March monthly here. Back with the Week Ahead on March 9. May have some comments on X @marcmakingsense.) Overview: Outside of the Australian and New Zealand

dollars, which are off by 0.20%-0.25%, the other G10 currencies are little

changed and mostly softer in narrow ranges. A firm Tokyo CPI, mostly on base

effects and softer rates helped keep the US dollar below...

Read More »

Read More »

Stock market technical analysis update for 05 Feb, 2024

Check out https://www.forexlive.com/technical-analysis/stock-market-technical-analysis-es1-at-5140-watching-5170-and-then-watch-out-20240304/

Read More »

Read More »

USDJPY Technical Analysis

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:20 Technical Analysis with Optimal Entries.

2:56 Upcoming Economic Data....

Read More »

Read More »

EURUSD trades up to the 38.2%, and finds sellers

The buyers Iin the EURUSD are making a play but can they get the price above the 38.2% and stay above?

Read More »

Read More »

USDCAD stays above the 100 day MA at 1.3544. Stay above is more bullish this week

The 100-day MA and the 50% of move down from the November high is the barometer for the buyers and sellers this week.

Read More »

Read More »

USDCHF reverses higher despite higher Swiss CPI data today. What next technically?

The USDCHF is back above the 200-day MA at 0.88354. That level will be the short term barometer for buyers and sellers. Staying above is more bullish.

Read More »

Read More »

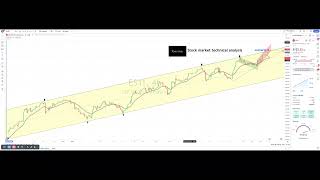

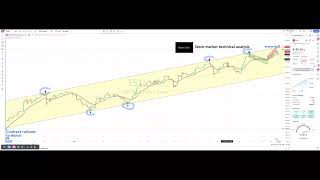

Stock market technical analysis, ES1 at 5140 ▲ watching 5170 and then watch out

?? S&P 500 Futures technical analysis and leading scenario, my opinion of area 5170... And then watch out for bears ???

See the video with the latest technical analysis of the S&P 500 futures, right here on ForexLive.com In this analysis, we view the market from the December contract to March, uncovering a simple channel and price movements and what they could mean for traders. ? Key Highlights of the stock maket technical analysis as...

Read More »

Read More »

Narrowly Mixed Dollar to Start the Big Week for Europe and North America

Overview: The dollar is narrowly mixed against the G10 currencies to begin the week that features a Bank of Canada and ECB meetings, US jobs data, Federal Reserve Chair Powell's two-day testimony before Congress, and US President Biden's State of the Union address.

Read More »

Read More »

Gold Technical Analysis – The price is at a key resistance zone

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:42 Technical Analysis with Optimal Entries.

2:09 Upcoming Economic Data....

Read More »

Read More »

March 2024 Monthly

Rarely are officials able to achieve the proverbial economic soft-landing when higher interest rates help cool price pressures without triggering a significant rise in unemployment or a contraction.

Read More »

Read More »

Ueda’s Comments Knock the Yen Back, while the Euro Flirts with $1.08

Overview: The US dollar is mixed today. The dollar-bloc currencies and the Scandis are enjoying a slightly firmer tone, while the euro and sterling are edging higher in European turnover.

Read More »

Read More »

EURUSD Technical Analysis – The price is at a key support zone

#eurusd #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the EURUSD pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:11 Technical Analysis with Optimal Entries.

2:24 Upcoming Economic Data....

Read More »

Read More »

The USDCAD moves lower and toward key support near 100 day MA and key swing area.

The 100 day MA comes in at 1.35457, and the 50% of the move down from the October high at 1.35378. That area is key support.

Read More »

Read More »