Category Archive: 4) FX Trends

What did the volatility from the FOMC decision do to the technicals in the USDJPY?

This video outlines the technicals in play for the USDJPY and explains why the levels in play are SO IMPORTANT.

Read More »

Read More »

NZDUSD trades to new 2024 lows today and maintains a bearish bias. What shift the bias?

A technical look at the NZDUSD as we head toward the US Fed decision at 2 PM ET. What levels are in play? What would shift the bias back to the upside? What key targets loom on more downside momentum today?

Read More »

Read More »

AUDUSD traders stall the rise today against a key MA and keep the sellers in control

The technical roadmap for the AUDUSD ahead of the Fed rate decision is explained in full.

Read More »

Read More »

USDCAD bounces higher today but finds sellers near swing area resistance. What next?

It is Fed Day. What technical levels are in play for the USDCAD through the FOMC rate decision

Read More »

Read More »

USDCHF extends above key retracement target. Trades at highest since November 14

The price of the USDCHF moves above its 61.8% retracement at 0.88957.. What is driving the pair technically.

Read More »

Read More »

Dollar Extends Gains Against the Yen but Broadly Firmer Ahead of the FOMC

Overview: The US dollar remains bid ahead of the outcome of today's

FOMC meeting. No change in policy is expected, but the forward guidance, partly

delivered in the updated projections, is the focus. In the last iteration

(December), the Fed "dot" was for three rate cuts this year. Japanese

markets were closed for a national holiday today but dollar's gains against the

yen have been extended and the greenback is nearing the peak seen in...

Read More »

Read More »

Navigating US OIL PRICE trends | Market Outlook with Exness

Curious about the recent behavior of the US oil price? You're not alone. Many traders are keeping a keen eye on the US oil price chart, trying to decipher where the US oil market is heading next. Something interesting is brewing this week with US oil trading. Could there be a lucrative opportunity as the price potentially dips to the $76 mark and then aims for a retest at $78?

Is it time to consider trading US oil?

In this Market Outlook with...

Read More »

Read More »

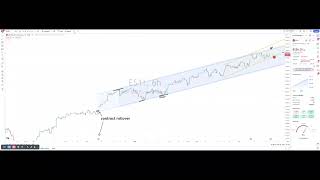

WTI Crude Oil Technical Analysis – Watch what happens at this key resistance zone

#crudeoil #futures #technicalanalysis

In this video you will learn about the latest fundamental developments for WTI Crude Oil. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:40 Technical Analysis with Optimal Entries.

2:13 Upcoming Economic Data....

Read More »

Read More »

Kickstart your FX trading for March 19 w/ a technical look at the EURUSD, USDJPY and GBPUSD

The USD is higher but the 3 major currency pairs have reached target levels and is seeing some stall. What next?

Read More »

Read More »

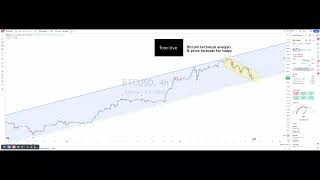

Bitcoin technical analysis, heading for a possible bounce at 61k to 62k

Bitcoin Technical Analysis: Anticipating a Bounce at $61k-$62k ?➡️?

Delve into our technical analysis as we explore Bitcoin's current trajectory, supported by a logical interpretation of market trends and patterns. This video shares an in-depth look at the potential for a bounce in Bitcoin's value, targeting the $61,000 to $62,000 range. Our speculation is grounded in technical analysis, offering a reasoned perspective on what might lie ahead for...

Read More »

Read More »

Greenback Surges after BOJ Hikes and Ends YCC and RBA Delivers a Dovish Hold

The US dollar is surging today against most of the G10 currencies, and although the intraday momentum is stretched ahead of start of the North American session, there may be little incentive to resist before the end of the FOMC meeting tomorrow.

Read More »

Read More »

USDJPY Technical Analysis – What’s next after the BoJ hike?

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:57 Technical Analysis with Optimal Entries.

3:22 Upcoming Economic Data....

Read More »

Read More »