Category Archive: 4) FX Trends

USDCHF trades to new session lows. Looks toward 38.2% of the move up from the March low

The 38.2% of the move up from March low comes in at 0.9034. The 100 hour MA stalled the rally in the European session.

Read More »

Read More »

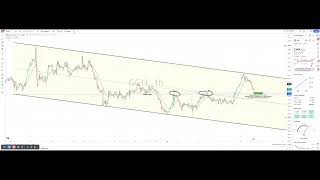

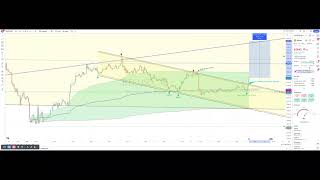

Gold futures technical analysis. I am waiting to go Long on Gold at 2337.5 to 2341.5

Next buy zone 2337.5 - 2341.5

targeting a reversal potential in the area of

Yesterday's VAH, Yesterday's VWAP 1st upper std dev.

Daily EMA20 2333 so stop below that.

Trade at your own risk.

Visit www.ForexLive.com for additional views.

Read More »

Read More »

Consolidative Tone to Start the Week

Overview: The new week has begun off quietly. The

dollar is in narrow ranges against the G10 currencies, +/- 0.15% as the North

American market prepares to open. The Dollar Index is trading inside the narrow

pre-weekend range. With softer US CPI, retail sales, and industrial production

due this week, we have a downside bias for the greenback. Most emerging market

currencies are firmer. A few Asian currencies, including the Chinese yuan and...

Read More »

Read More »

EURUSD Technical Analysis – The US CPI will likely set the trend for the rest of the month

#eurusd #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the EURUSD pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:44 Technical Analysis with Optimal Entries.

1:41 Upcoming Economic Data....

Read More »

Read More »

Bitcoin is breaking out up, here’s what you can do.

Watch the key price levels as junctions. Visit www.ForexLive.com for additional views. Trade bitcoin at your own risk.

Read More »

Read More »

2-for-1: A technical look at the AUDUSD and NZDUSD as the USD gets bid

The two currency pairs are testing support at their respective 100 hour MAs. Can sellers break below the MA level?

Read More »

Read More »

Kickstart the FX trading day for April 10 w/a look at the EURUSD, USDJPY and GBPUSD.

In addition, I take a quick look at the USDCAD after the stronger-than-expected Canadian jobs report

Read More »

Read More »

USDJPY Technical Analysis – The buyers remain in control

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:01 Technical Analysis with Optimal Entries.

1:55 Upcoming Economic Data....

Read More »

Read More »

Gold Technical Analysis – Waiting for a catalyst to trigger the next big move

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:46 Technical Analysis with Optimal Entries.

1:48 Upcoming Economic Data....

Read More »

Read More »

What is the technical roadmap for the GBPUSD through the BOE interest rate decision.

The BOE decision is tomorrow. What levels will help guide the pair through either a more bullish run or a more bearish run. Look for the break.

Read More »

Read More »

USDJPY buyers are keeping control at least in the short and medium term. Stay above 155.00

The 155.00 level in the USDJPY will be eyed by buyers looking for more upside momentum going forward.

Read More »

Read More »

AUDUSD continues its move lower into retracement support, but below key 100D MA.

The battle lines are drawn by traders with the 100 day MA above and the broken 38.2% retracement below

Read More »

Read More »

USDCAD rotates back lower in the early NA session and looks to test support target support.

The 1.37159 to 1.3727 in the USDCAD is support. Will the buyers come in to stall the fall?

Read More »

Read More »